The Middleby Corporation, Inc. (NASDAQ: MIDD; “Middleby” or the

“Company”), a leading worldwide manufacturer of equipment for the

commercial foodservice, food processing, and residential kitchen

industries, today announced that it has commenced a set of

strategic financing transactions, including an amendment to its

senior credit facility and the launch of a $550 million convertible

notes offering. The Company also expects to enter into a related

capped call hedge transaction, which will offset potential dilution

from the conversion feature of the notes.

“Consummation of these strategic transactions will enhance our

capital structure and provide greater financial flexibility as we

lead our business into the future. Most importantly, these actions

reinforce continued investment in our operating and strategic

initiatives supporting long-term growth objectives,” commented

Middleby Chief Executive Officer Tim Fitzgerald.

Overview of Credit Facility

Amendment

- The amended credit agreement will provide for a senior secured

credit facility in an aggregate principal amount of $3.1 billion,

consisting of (i) a $2.75 billion multi-currency revolving credit

facility and (ii) a $350 million term loan facility (after giving

effect to the $400 million prepayment upon effectiveness of the

amendment). The maturity date remains unchanged at January 31,

2025.

- The threshold leverage ratio restricting the incurrence of debt

has been increased to 5.50 to 1.00 from 4.00 to 1.00 through the

maturity of the facility.

- The borrowing cost under the senior credit facility remains

unchanged by the amendment at total net debt leverage ratios of

below 4.00 to 1.00. Pricing at newly established leverage tiers

above 4.00 times increase to a maximum of LIBOR plus 250 basis

points at the highest allowable borrowing levels.

- The amended credit agreement sets forth a secured net debt

leverage ratio of 3.50 to 1.00, with an initial elevated period

providing for a higher covenant of 4.50 to 1.00 times through March

2021 and 4.25 to 1.00 times through June 2021.

- At the end of the company’s fiscal second quarter, the

company’s net debt as defined under the credit facility amounted to

$1,786.7 million and the secured leverage ratio was 2.99 to 1.00.

On a pro-forma basis, after reflecting the anticipated repayment of

$400 million of the senior term loan upon effectiveness of the

amendment, the net debt under the senior credit facility would

amount to $1,386.7 million and the secured leverage ratio would

amount to 2.32.

- Borrowing availability under existing facilities after giving

effect to the contemplated transactions would amount to $1.4

billion.

The information in this press release is for informational

purposes only and shall not constitute, or form a part of, an offer

to sell or the solicitation of an offer to sell or the solicitation

of an offer to buy any securities.

About The Middleby Corporation

The Middleby Corporation is a global leader in the foodservice

equipment industry. Middleby develops, manufactures, markets and

services a broad line of equipment used in the commercial

foodservice, food processing, and residential kitchen equipment

industries. Middleby’s leading equipment brands serving the

commercial foodservice industry include Anets®, APW Wyott®, Bakers

Pride®, Beech®, BKI®, Blodgett®, Blodgett Combi®, Blodgett Range®,

Bloomfield®, Britannia®, Carter-Hoffmann®, Celfrost®, Concordia®,

CookTek®, Crown®, CTX®, Desmon®, Deutsche Beverage®, Doyon®,

Eswood®, EVO®, Firex®, Follett®, frifri®, Giga®, Globe®,

Goldstein®, Holman®, Houno®, IMC®, Induc®, Ink Kegs®, Jade®,

JoeTap®, Josper®, L2F®, Lang®, Lincat®, MagiKitch’n®, Market

Forge®, Marsal®, Middleby Marshall®, MPC®, Nieco®, Nu-Vu®,

PerfectFry®, Pitco®, QualServ®, RAM®, Southbend®, Ss Brewtech®,

Star®, Starline®, Sveba Dahlen®, Synesso®, Taylor®, Toastmaster®,

TurboChef®, Ultrafryer®, Varimixer®, Wells® and Wunder-Bar®.

Middleby’s leading equipment brands serving the food processing

industry include Alkar®, Armor Inox®, Auto-Bake®, Baker Thermal

Solutions®, Burford®, Cozzini®, CVP Systems®, Danfotech®, Deutsche

Process®, Drake®, Emico®, Glimek®, Hinds-Bock®, Maurer-Atmos®, MP

Equipment®, M-TEK®, Pacproinc®, RapidPak®, Scanico®, Spooner

Vicars®, Stewart Systems®, Thurne® and Ve.Ma.C.®. Middleby’s

leading equipment brands serving the residential kitchen industry

include AGA® Cookshop®, Brava®, EVO®, Fired Earth®, Heartland®, La

Cornue®, Leisure Sinks®, Lynx®, Marvel®, Mercury®, Rangemaster®,

Rayburn®, Redfyre®, Sedona®, Stanley®, TurboChef®, U-Line® and

Viking®.

Forward-Looking Statements

Statements in this press release or otherwise attributable to

the Company regarding the Company’s business which are not

historical facts are forward-looking statements including, among

other things, statements relating to Middleby’s intention to offer

the notes, the timing of the proposed offering, the proposed terms

of the offering and the intended use of the net proceeds from the

offering are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The Company

cautions investors that such statements are estimates of future

performance and are highly dependent upon a variety of important

factors that could cause actual results to differ materially from

such statements. Any forward-looking statement speaks only as of

the date hereof, and the Company does not undertake any obligation

to publicly update or review any forward-looking statement, whether

as a result of new information, future developments or otherwise,

except as required by law.

For a discussion of some of the risks and important factors that

could affect such forward-looking statements, see the sections

entitled “Forward Looking Statements” and “Risk Factors” in the

offering memorandum related to the offering, as well as the section

entitled “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” incorporated by reference in

the offering memorandum related to the offering from the Company’s

most recent annual and quarterly reports and other filings filed

with the U.S. Securities and Exchange Commission. New risks and

uncertainties emerge from time to time, and it is not possible for

the Company to predict or assess the impact of every factor that

may cause its actual results to differ from those contained in any

forward-looking statements. Forward-looking statements contained

herein speak only as of the date of this press release, and

Middleby expressly disclaims any obligation to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in Middleby’s expectations with regard

thereto or change in events, conditions or circumstances on which

any statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200817005631/en/

Investor and Public Relations: Darcy Bretz (847) 429-7756

dbretz@middleby.com

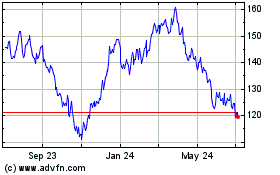

Middleby (NASDAQ:MIDD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Middleby (NASDAQ:MIDD)

Historical Stock Chart

From Apr 2023 to Apr 2024