Cisco's 3Q Outlook Falls Short of Wall Street Targets

August 12 2020 - 4:53PM

Dow Jones News

By Maria Armental

Network-equipment giant Cisco Systems Inc. reported a 9% sales

decline in the most recent quarter, marking the first annual sales

decline in three years as the pandemic-driven economic shock takes

a toll on its core business of switches and routers.

This quarter, the San Jose, Calif.-based company expects to make

41 cents to 47 cents a share, or 69 cents to 71 cents a share as

adjusted, with revenue declining 9% to 11%.

Analysts surveyed by FactSet expected an adjusted profit of 75

cents a share with revenue falling about 7% to $12.23 billion.

Cisco, considered a proxy for corporate high-tech hardware

demand, has extended free offers and trials for its

videoconferencing-service Webex and security offerings as companies

moved to remote work during the pandemic. The offerings, company

officials said, could deliver a revenue boost in future

quarters.

More than half of its revenue now comes from software and

services, Chief Executive Chuck Robbins said in a statement.

"As we focus on the future, we are rebalancing our R&D

investments to focus on new areas so we can continue to offer

customers the best, most relevant technology in simpler, more

easily consumable ways," he said.

This month, it bought ThousandEyes Inc. to boost its network

performance and monitoring across enterprise and into the

cloud.

"If the pandemic response around the world has taught us

anything, it's the timeliness of bringing ThousandEyes and Cisco

technology together and providing it in the simplest possible way

to our users right now," Todd Nightingale, senior vice president

and general manager of Cisco's enterprise networking and cloud

business, said in a conference call in May to discuss the

acquisition.

Cisco didn't address its proposed acquisition of Acacia

Communications Inc. in the earnings release. The deal, which was

expected to close by the fourth quarter, awaited regulatory

approval in China.

Revenue from Acacia will be included in Cisco's infrastructure

platforms product category.

In the most recent quarter, ended July 25, revenue from that

business, which includes routers and switches, fell 16%, while

revenue from the applications business, which includes

videoconferencing, fell 9%.

The one bright spot again was the small but fast-growing

security segment, which posted a 10% revenue increase to $814

million.

Overall, revenue fell 9% to $12.15 billion.

Meanwhile, fourth-quarter profit rose 19% to $2.64 billion, or

62 cents a share. On an adjusted basis, profit fell to 80 cents a

share from 83 cents a year earlier.

Cisco had projected 57 cents to 62 cents a share in profit, or

72 cents to 74 cents a share as adjusted, with revenue declining

8.5% to 11.5%. Analysts expected 65 cents a share, or 74 cents as

adjusted, on $12.09 billion in revenue.

It ended the year at a profit of $11.21 billion on $49.30

billion in revenue, compared with a profit of $11.62 billion and

$51.90 billion in revenue a year earlier.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 12, 2020 16:38 ET (20:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

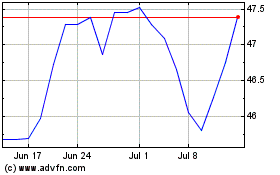

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cisco Systems (NASDAQ:CSCO)

Historical Stock Chart

From Apr 2023 to Apr 2024