FreightCar America, Inc. Reports Second Quarter 2020 Results

August 10 2020 - 7:00PM

FreightCar America, Inc. (NASDAQ: RAIL) today reported results for

the second quarter ended June 30, 2020.

Business Highlights

- Second quarter revenue of $17.5 million on deliveries of 100

railcars

- Second quarter net loss of $12.8 million, or $0.97 per

share

- Total cash, cash equivalents, restricted cash equivalents,

marketable securities and restricted certificates of deposit of

$52.4 million as of June 30, 2020

- Second quarter backlog totaled 1,839 railcars, with an

aggregate value of approximately $207 million

- Started production at Castaños, Mexico joint venture facility

in July

- Second half 2020 delivery outlook forecasted to range between

750 and 1,000 railcars

- Company continues to prioritize employee and community safety,

and is strictly adhering to pre-established health and safety

protocols including those necessary in response to the global

pandemic

“During the second quarter, FreightCar America

restarted two of the four production lines in Shoals, and managed

through the disruption brought on by the global COVID-19 pandemic.

I am very proud of how our team responded, as we focused equally on

health, safety and meeting customer expectations,” said Jim Meyer,

President and Chief Executive Officer of FreightCar America. “In

addition to these important undertakings, we continued to move

forward with our vision to become the highest quality and lowest

cost producer. In July, we started production at the new joint

venture plant in Castaños, Mexico along with preparation for the

certification process. We were able to hire an extremely

experienced workforce and are happy to welcome them to the

team.”

Meyer added, “The pandemic-related disruption

further contributed to a difficult demand environment across our

industry, which was already in the midst of a cyclical downtown.

This further challenged both railcar orders and production

scheduling during the second quarter. Of note, we had one

additional week of operational downtime in our Shoals facility in

the quarter as we halted production to protect the health and

safety of our workforce. And while the recovery pattern remains

opaque, we are encouraged by the recent improvement in order

inquiries for car types that we are well suited to build.”

Meyer concluded, “Our overall production ramped

well through July, giving us confidence in our forecast for second

half deliveries to range between 750 and 1,000 railcars. As we look

forward, we remain equally focused on preserving our liquidity

while also continuing to build the foundation for our future. We

believe we are taking the right steps to navigate both the cyclical

downturn and pandemic, while repositioning FreightCar America for

future success.”

Second Quarter Results

- Consolidated revenues were $17.5 million in the second quarter

of 2020, compared to $5.2 million in the first quarter of 2020 and

$73.6 million in the second quarter of 2019. The Company delivered

100 railcars in the second quarter of 2020, compared to 11 in the

first quarter of 2020 and 729 railcars in the second quarter of

2019.

- The Company had a backlog totaling 1,839 railcars on June 30,

2020, valued at approximately $207 million.

- Consolidated operating loss for the second quarter of 2020 was

$12.9 million, compared to an operating loss of $15.8 million for

the second quarter of 2019.

- Net loss attributable to FreightCar America, Inc. (“FCA”) in

the second quarter of 2020 was $12.8 million, or $0.97 per diluted

share, compared to a net loss attributable to FCA of $15.9 million,

or $1.26 per diluted share, in the second quarter of

2019.

Second Quarter 2020 Conference Call & Webcast

Information

The Company will host a conference call and live webcast on

Tuesday, August 11, 2020 at 11:00 a.m. (Eastern Daylight Time) to

discuss its second quarter 2020 financial results. Investors,

analysts, and members of the media interested in listening to the

live presentation are encouraged to join a webcast of the call,

available on the Company’s website at:

Event URL:

http://public.viavid.com/index.php?id=141184

Interested parties may also participate in the call by dialing

877-407-0789 or 201-689-8562 and should use confirmation number

13708161. Please dial in approximately 10 to 15 minutes prior

to the start time of the call to ensure your participation. An

audio replay of the conference call will be available beginning at

2:00 p.m. (Eastern Daylight Time) on August 11, 2020 until 11:59

p.m. (Eastern Daylight Time) on August 25, 2020. To access

the replay, please dial 844-512-2921 or 412-317-6671. The

replay pass code is 13708161. An audio replay of the call

will be available on the Company’s website within two days

following the earnings call.

About FreightCar America

FreightCar America, Inc. is a diversified manufacturer of

railroad freight cars, that also supplies railcar parts and leases

freight cars through its FreightCar America Leasing Company

subsidiaries. FreightCar America designs and builds high-quality

railcars, including open top hopper cars, covered hopper cars,

intermodal and non-intermodal flat cars, mill gondola cars, coil

steel cars, boxcars, coal cars, and also specializes in the

conversion of railcars for repurposed use. It is headquartered in

Chicago, Illinois and has facilities in the following locations:

Cherokee, Alabama; Castaños, Mexico; Johnstown, Pennsylvania; and

Shanghai, People’s Republic of China. More information about

FreightCar America is available on its website at

www.freightcaramerica.com.

Forward-Looking Statements

This press release may contain statements

relating to our expected financial performance and/or future

business prospects, events and plans that are “forward-looking

statements” as defined under the Private Securities Litigation

Reform Act of 1995. Forward-looking statements represent our

estimates and assumptions only as of the date of this press

release. Our actual results may differ materially from the results

described in or anticipated by our forward-looking statements due

to certain risks and uncertainties. These potential risks and

uncertainties include, among other things: risks relating to the

potential financial and operational impacts of the COVID-19

pandemic; the Shoals facility, including the facility not meeting

internal assumptions or expectations and unforeseen liabilities

from Navistar; the cyclical nature of our business; adverse

economic and market conditions; fluctuating costs of raw materials,

including steel and aluminum, and delays in the delivery of raw

materials; our ability to maintain relationships with our suppliers

of railcar components; our reliance upon a small number of

customers that represent a large percentage of our sales; the

variable purchase patterns of our customers and the timing of

completion, delivery and customer acceptance of orders; the highly

competitive nature of our industry; the risk of lack of acceptance

of our new railcar offerings by our customers; and other

competitive factors. We expressly disclaim any duty to provide

updates to any forward-looking statements made in this press

release, whether as a result of new information, future events or

otherwise.

FreightCar America, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| |

|

|

|

|

|

| |

June 30, 2020 |

|

December 31, 2019 |

| |

|

|

|

| Assets |

(in thousands, except for share and per share data) |

| Current assets |

|

|

|

|

|

|

Cash, cash equivalents and restricted cash equivalents |

$ |

48,540 |

|

|

$ |

66,257 |

|

|

Restricted certificates of deposit |

|

3,855 |

|

|

|

3,769 |

|

|

Accounts receivable, net |

|

6,789 |

|

|

|

6,991 |

|

|

Inventories, net |

|

47,116 |

|

|

|

25,092 |

|

|

Income tax receivable |

|

1,027 |

|

|

|

535 |

|

|

Other current assets |

|

14,265 |

|

|

|

7,035 |

|

| Total current assets |

|

121,592 |

|

|

|

109,679 |

|

| |

|

|

|

|

|

| Property, plant and equipment,

net |

|

39,469 |

|

|

|

38,564 |

|

| Railcars available for lease,

net |

|

38,393 |

|

|

|

38,900 |

|

| Right of use asset |

|

53,442 |

|

|

|

56,507 |

|

| Other long-term assets |

|

888 |

|

|

|

1,552 |

|

| Total assets |

$ |

253,784 |

|

|

$ |

245,202 |

|

| |

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts and contractual payables |

$ |

18,054 |

|

|

$ |

11,713 |

|

|

Accrued payroll and other employee costs |

|

306 |

|

|

|

1,389 |

|

|

Reserve for workers' compensation |

|

3,344 |

|

|

|

3,210 |

|

|

Accrued warranty |

|

7,903 |

|

|

|

8,388 |

|

|

Customer deposits |

|

33,012 |

|

|

|

5,123 |

|

|

Deferred income state and local incentives, current |

|

2,219 |

|

|

|

2,219 |

|

|

Lease liability, current |

|

15,063 |

|

|

|

14,960 |

|

|

Current portion of long-term debt |

|

13,950 |

|

|

|

- |

|

|

Other current liabilities |

|

5,626 |

|

|

|

2,428 |

|

| Total current liabilities |

|

99,477 |

|

|

|

49,430 |

|

| Long-term debt, net of current

portion |

|

6,250 |

|

|

|

10,200 |

|

| Accrued pension costs |

|

6,006 |

|

|

|

6,510 |

|

| Deferred income state and

local incentives, long-term |

|

3,612 |

|

|

|

4,722 |

|

| Lease liability,

long-term |

|

48,306 |

|

|

|

53,766 |

|

| Other long-term

liabilities |

|

2,833 |

|

|

|

3,420 |

|

| Total liabilities |

|

166,484 |

|

|

|

128,048 |

|

| |

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

Preferred stock |

|

- |

|

|

|

- |

|

|

Common stock |

|

136 |

|

|

|

127 |

|

|

Additional paid in capital |

|

83,318 |

|

|

|

83,027 |

|

|

Treasury stock, at cost |

|

(1,281 |

) |

|

|

(989 |

) |

|

Accumulated other comprehensive loss |

|

(10,499 |

) |

|

|

(10,780 |

) |

|

Retained earnings |

|

16,086 |

|

|

|

45,824 |

|

| Total FreightCar America

stockholders' equity |

|

87,760 |

|

|

|

117,209 |

|

| Noncontrolling interest in

JV |

|

(460 |

) |

|

|

(55 |

) |

| Total stockholders'

equity |

|

87,300 |

|

|

|

117,154 |

|

| Total liabilities and

stockholders’ equity |

$ |

253,784 |

|

|

$ |

245,202 |

|

| |

|

|

|

|

|

FreightCar America, Inc.

Condensed Consolidated Statements of

Operations(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In thousands, except for share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

$ |

17,458 |

|

|

$ |

73,661 |

|

|

$ |

22,655 |

|

|

$ |

144,369 |

|

| Cost of sales |

|

23,602 |

|

|

|

67,637 |

|

|

|

37,602 |

|

|

|

145,194 |

|

| Gross (loss) profit |

|

(6,144 |

) |

|

|

6,024 |

|

|

|

(14,947 |

) |

|

|

(825 |

) |

| Selling, general and

administrative expenses |

|

6,537 |

|

|

|

15,352 |

|

|

|

13,947 |

|

|

|

23,019 |

|

| Loss on sale of railcars

available for lease |

|

- |

|

|

|

5,196 |

|

|

|

- |

|

|

|

5,196 |

|

| Restructuring and impairment

charges |

|

267 |

|

|

|

1,319 |

|

|

|

1,147 |

|

|

|

1,319 |

|

| Operating loss |

|

(12,948 |

) |

|

|

(15,843 |

) |

|

|

(30,041 |

) |

|

|

(30,359 |

) |

| Interest expense and deferred

financing costs |

|

(167 |

) |

|

|

(115 |

) |

|

|

(463 |

) |

|

|

(151 |

) |

| Other income |

|

134 |

|

|

|

83 |

|

|

|

358 |

|

|

|

402 |

|

| Loss before income taxes |

|

(12,981 |

) |

|

|

(15,875 |

) |

|

|

(30,146 |

) |

|

|

(30,108 |

) |

| Income tax (benefit)

provision |

|

(1 |

) |

|

|

12 |

|

|

|

(3 |

) |

|

|

(189 |

) |

| Net loss |

|

(12,980 |

) |

|

|

(15,887 |

) |

|

|

(30,143 |

) |

|

|

(29,919 |

) |

|

Less: Net loss attributable to noncontrolling interest in JV |

|

(189 |

) |

|

|

- |

|

|

|

(405 |

) |

|

|

- |

|

| Net loss attributable to

FreightCar America |

$ |

(12,791 |

) |

|

$ |

(15,887 |

) |

|

$ |

(29,738 |

) |

|

$ |

(29,919 |

) |

| Net loss per common share

attributable to FreightCar America- basic and diluted |

$ |

(0.97 |

) |

|

$ |

(1.26 |

) |

|

$ |

(2.26 |

) |

|

$ |

(2.37 |

) |

| Weighted average common shares

outstanding – basic and diluted |

|

12,405,011 |

|

|

|

12,352,271 |

|

|

|

12,385,946 |

|

|

|

12,344,684 |

|

FreightCar America,

Inc.Segment

Data(Unaudited)

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Manufacturing |

$ |

15,129 |

|

|

$ |

70,817 |

|

|

$ |

18,069 |

|

|

$ |

138,412 |

|

| Corporate and

Other |

|

2,329 |

|

|

|

2,844 |

|

|

|

4,586 |

|

|

|

5,957 |

|

|

Consolidated revenues |

$ |

17,458 |

|

|

$ |

73,661 |

|

|

$ |

22,655 |

|

|

$ |

144,369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

loss: |

|

|

|

|

|

|

|

|

|

|

|

| Manufacturing |

$ |

(8,348 |

) |

|

$ |

(3,019 |

) |

|

$ |

(20,148 |

) |

|

$ |

(12,656 |

) |

| Corporate and

Other |

|

(4,600 |

) |

|

|

(12,824 |

) |

|

|

(9,893 |

) |

|

|

(17,703 |

) |

|

Consolidated operating loss |

|

(12,948 |

) |

|

|

(15,843 |

) |

|

|

(30,041 |

) |

|

|

(30,359 |

) |

FreightCar America,

Inc. Condensed Consolidated Statements of

Cash Flows (Unaudited)

| |

|

|

|

|

|

| |

|

Six Months Ended June 30, |

| |

2020 |

|

2019 |

| Cash flows from

operating activities |

|

(in thousands) |

| |

|

|

|

Net loss |

$ |

(30,143 |

) |

|

$ |

(29,919 |

) |

| Adjustments to reconcile net

loss to net cash flows used in operating activities: |

|

|

|

|

|

| Non-cash restructuring and

impairment charges |

|

352 |

|

|

|

1,319 |

|

|

Depreciation and amortization |

|

5,884 |

|

|

|

6,471 |

|

|

Change in inventory reserve |

|

5,052 |

|

|

|

(440 |

) |

|

Amortization expense - right-of-use leased assets |

|

3,065 |

|

|

|

5,662 |

|

|

Recognition of deferred income from state and local incentives |

|

(1,110 |

) |

|

|

(1,109 |

) |

|

Loss on sale of railcars available for lease |

|

- |

|

|

|

5,196 |

|

|

Stock-based compensation recognized |

|

17 |

|

|

|

274 |

|

|

Other non-cash items, net |

|

153 |

|

|

|

90 |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

|

|

Accounts receivable |

|

202 |

|

|

|

5,338 |

|

|

Inventories |

|

(27,076 |

) |

|

|

3,214 |

|

|

Other assets |

|

(7,188 |

) |

|

|

(2,307 |

) |

|

Accounts and contractual payables |

|

6,456 |

|

|

|

(4,890 |

) |

|

Accrued payroll and employee benefits |

|

(941 |

) |

|

|

910 |

|

|

Income taxes receivable/payable |

|

(13 |

) |

|

|

(197 |

) |

|

Accrued warranty |

|

(485 |

) |

|

|

(1,516 |

) |

|

Lease liability |

|

(5,391 |

) |

|

|

(9,091 |

) |

|

Customer deposits |

|

27,889 |

|

|

|

(1,719 |

) |

|

Other liabilities |

|

2,625 |

|

|

|

7,827 |

|

|

Accrued pension costs and accrued postretirement benefits |

|

(131 |

) |

|

|

(266 |

) |

|

Net cash flows used in operating activities |

|

(20,783 |

) |

|

|

(15,153 |

) |

| |

|

|

|

|

|

| Cash flows from

investing activities |

|

|

|

|

|

| |

|

|

|

|

|

| Purchase of restricted

certificates of deposit |

|

(3,855 |

) |

|

|

(1,117 |

) |

| Maturity of restricted

certificates of deposit |

|

3,769 |

|

|

|

4,400 |

|

| Purchase of securities held to

maturity |

|

- |

|

|

|

(1,986 |

) |

| Proceeds from maturity of

securities |

|

- |

|

|

|

20,025 |

|

| Purchase of property, plant

and equipment |

|

(7,009 |

) |

|

|

(2,034 |

) |

| Proceeds from sale of

property, plant and equipment and railcars available for lease |

|

170 |

|

|

|

11,442 |

|

|

Net cash flows (used in) provided by investing activities |

|

(6,925 |

) |

|

|

30,730 |

|

|

|

|

|

|

|

|

| Cash flows from

financing activities |

|

|

|

|

|

| |

|

|

|

|

|

| Proceeds from issuance of

long-term debt |

|

10,000 |

|

|

|

10,200 |

|

| Employee stock settlement |

|

(9 |

) |

|

|

(59 |

) |

| Deferred financing costs |

|

- |

|

|

|

(929 |

) |

|

Net cash flows provided by financing activities |

|

9,991 |

|

|

|

9,212 |

|

|

|

|

|

|

|

|

| Net (decrease) increase in

cash and cash equivalents |

|

(17,717 |

) |

|

|

24,789 |

|

| Cash, cash equivalents and

restricted cash equivalents at beginning of period |

|

66,257 |

|

|

|

45,070 |

|

| Cash, cash equivalents and

restricted cash equivalents at end of period |

$ |

48,540 |

|

|

$ |

69,859 |

|

|

INVESTOR & MEDIA CONTACT |

Joe Caminiti or Elizabeth Steckel |

| TELEPHONE |

312-445-2870 |

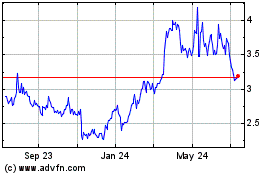

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Mar 2024 to Apr 2024

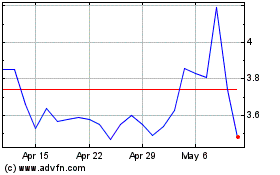

FreightCar America (NASDAQ:RAIL)

Historical Stock Chart

From Apr 2023 to Apr 2024