Acquires Woodford portfolio of life science

assets for $282 million (£223.9 million); Recovered $185 million to

date in sales of certain acquired assets

Acacia Research Corporation (“we,” “us,” “our,” “Acacia” or “the

Company”) (Nasdaq: ACTG) today reported results for the three-month

period ended June 30, 2020.

Clifford Press, Chief Executive Officer, stated, “We announced

our first Approved Transaction, under our strategic alliance with

Starboard Value LP (“Starboard”), acquiring the former Woodford

portfolio of life science assets for $282 million from LF Equity

Income Fund. To date, we have recovered approximately $185 million

through the sale of securities of certain public companies in the

portfolio. Notably, the remaining positions include a 6% stake in

Oxford Nanopore and a 5% stake in Immunocore. In aggregate, our

sales to date and the potential of our remaining holdings represent

a strong path to increasing book value. This transaction

demonstrates our ability to navigate complex financial structures,

identifying and executing on opportunities, supported by our ready

access to capital.”

Mr. Press continued, “As of the end of the second quarter, the

market value of the remaining public securities in the portfolio

was approximately $50 million. The Woodford portfolio is a mix of

public and private company securities. Under GAAP, we assigned the

portfolio purchase price first to the public securities at market

value, and the residual value to the private company assets. We

will mark the public assets to market each quarter, and we will

adjust our carrying value in the private assets based on any

observed primary or secondary transactions in those companies’

shares or recognize any impairment.”

“During the quarter, we recognized $63 million of non-cash costs

associated with an increase in our derivative liability related to

our warrants and preferred, as our share price increased during the

quarter,” added Mr. Press. “This brings the aggregate value of

non-cash liability associated with these warrants and embedded

derivatives to a total of $95 million, or $1.93 per share. These

are non-cash items, and upon exercise or expiration, would be

eliminated and booked to equity. Our current book value at June 30

is $164.7 million, or $3.36 per share, as reduced by these

liabilities.”

Al Tobia, President and Chief Investment Officer, added, “To

fund the Woodford portfolio acquisition, we issued $115 million in

Senior Secured Notes to Starboard, convertible into shares of our

common stock at an exercise price of $3.65 per share if exchanged

with the Series B Warrants previously issued to Starboard. As we

noted at that time, we intend to offer stockholders the opportunity

to invest alongside Starboard. We currently intend to commence, as

soon as reasonably practicable, a Stockholder Offering (as defined

below) of up to $31.5 million of senior secured notes, and warrants

to purchase shares of common stock, to existing holders of our

common stock, with substantially similar terms as the Senior

Secured Notes and Series B warrant issued to Starboard1.”

Mr. Tobia continued, “We worked on a tight timeline to complete

the Woodford portfolio purchase; however, our strategic committee

continues its focus on identifying potential operating company

acquisitions. Acacia’s liquidity and financial flexibility create

inherent advantages in today’s market. Acacia is starting to

exhibit some of the potential of its operating model, and we are

adding investment professionals to build out our execution

capability.”

Second Quarter 2020 Financial Summary:

- Cash and short-term investments totaled $184.0 million at June

30, 2020, compared to $158.1 million at March 31, 2020 and $168.3

million at December 31, 2019.

- Debt, which represents the Senior Secured Notes issued to

Starboard, was $115.0 million at June 30, 2020.

- Book value totaled $164.7 million as of June 30, 2020, compared

to $175.0 million at December 31, 2019. Acacia’s current book value

reflects issuance of Senior Secured Notes and liabilities

associated with upfront funding of the life science portfolio

acquisition, and reflects the allocated value based on U.S. GAAP of

assets transferred as of June 30, 2020.

- Gross revenues were $2.1 million.

- General and administrative expenses for the second quarter of

2020 increased by $1.8 million or 47%, compared with the second

quarter of 2019, due to business development efforts and personnel

expenses.

- Operating loss was $6.7 million.

- GAAP net income to common stockholders was $4.2 million, or

$0.09 per diluted share, compared to a net loss of $(5.8 million),

or $(0.12) per diluted share, in the second quarter last year. The

second quarter of 2020 included an $82 million benefit related to

the change of the fair value of equity securities derivative and

forward contract, partially offset by a $63 million non-cash charge

related to the change in fair value of warrants and embedded

derivatives, $4.2 million in non-recurring transaction-related

expenses and a $4.9 million foreign exchange loss.

Investor Conference Call:

The Company will host a conference call today, Monday, August

10, 2020, to discuss these results and provide a business update at

11 a.m. ET/ 8 a.m. PT.

To access the live call, please dial (877) 407-0778 (U.S. and

Canada) or (201) 689-8565 (international). The conference call will

also be simultaneously webcasted on the investor relations section

of the Company’s website at http://acaciaresearch.com under the

News & Events tab. Following the conclusion of the live call, a

replay of the webcast will be available on the Company's website

for at least 30 days.

Information About Non-GAAP Financial Measures

As used herein, “GAAP” refers to accounting principles generally

accepted in the United States of America. This earnings release

includes financial measures, including (1) non-GAAP net income and

(2) non-GAAP Earnings Per Share (“EPS”), that are considered

non-GAAP financial measures as defined in Rule 101 of Regulation G

promulgated by the Securities and Exchange Commission (the “SEC”).

Generally, a non-GAAP financial measure is a numerical measure of a

company’s historical or future performance, financial position, or

cash flows that either excludes or includes amounts that are not

normally excluded or included in the most directly comparable

measure calculated and presented in accordance with GAAP. The

presentation of this non-GAAP financial information is not intended

to be considered in isolation or as a substitute for, or superior

to, the financial information prepared and presented in accordance

with GAAP.

Non-GAAP Net income and EPS. We define non-GAAP net income as

net income calculated in accordance with GAAP, plus unrealized

change in fair value of investments, loss on investment, non-cash

stock compensation charges and non-cash patent amortization

charges. Non-GAAP EPS is defined as non-GAAP net income divided by

the weighted average outstanding shares, on a fully-diluted basis,

calculated in accordance with GAAP, for the respective reporting

period. Additional information regarding these non-GAAP measures is

available in previously disclosed SEC filings.

These non-GAAP measures are presented because they are important

metrics used by management as a means to assess financial

performance.

There are a number of limitations related to the use of non-GAAP

net income and EPS versus net income and EPS calculated in

accordance with GAAP and these non-GAAP measures should not be

considered alternatives to financial metrics derived in accordance

with GAAP. Management compensates for these limitations by

providing specific information regarding the GAAP amounts excluded

from non-GAAP net income and EPS and evaluating non-GAAP net income

and EPS in conjunction with net income and EPS calculated in

accordance with GAAP.

Due to uncertainties related to our ability to utilize certain

deferred tax assets in future periods, we have recorded a full

valuation allowance against our net deferred tax assets for the

periods presented herein. Tax expense for the periods presented

reflects foreign taxes withheld on revenue agreements with

licensees in foreign jurisdictions and other state taxes, and the

impact of the full valuation allowance recorded for net operating

loss and foreign tax credit related tax assets generated during the

periods. As such, no tax benefit was recognized for net operating

loss and foreign tax credit related tax benefits generated during

the applicable periods presented. Accordingly, there are no income

tax effects related to our adjustments to arrive at our non-GAAP

measures included herein.

1As previously disclosed by us when we entered into the

Securities Purchase Agreement dated November 18, 2019, by and among

the Company, Starboard and the Buyers named therein, we have the

option to complete one or more rights offerings to our stockholders

(a “Stockholder Offering”) of senior secured notes with terms

substantially identical to the notes issued to Starboard, in an

aggregate principal amount of up to $100.0 million, and warrants to

purchase up to 27,397,261 shares of common stock with terms

substantially similar to the Series B Warrants. As soon as

reasonably practicable, the Company intends to, but has not yet to

commenced, a Stockholder Offering of up to $31.5 million of senior

secured notes, and warrants to purchase shares of common stock,

with substantially similar terms as the Senior Secured Notes and

Series B Warrants issued to Starboard. Additional details,

including the timing of the Stockholder Offering, are to be

determined at a later date and, while the Company can provide no

assurance that a Stockholder Offering will be ultimately initiated

or completed or that any holders of its common stock will exercise

any such rights in connection with the Stockholder Offering, we

believe that a Stockholder Offering is not only a potential source

to aid in our current capital-raising goals, but also a means of

allowing our stockholders to participate in our anticipated future

growth. The description of the Stockholder Offering is contained

herein for informational purposes only and is not an offer to buy

or the solicitation of an offer to sell any securities. The Company

has not yet filed a registration statement with the SEC for

Stockholder Offering, but intends and expects to do so and expects

to promptly commence the Stockholder Offering as soon as

practicable after the SEC declares such registration statement

effective. The Stockholder Offering will be made only by means of a

prospectus that the Company intends to file with the SEC as part of

the registration statement. Such prospectus will be delivered to

holders of the Company’s common stock as of the record date of the

rights offering.

About Acacia Research Corporation

Founded in 1993, Acacia Research Corporation (ACTG) invests in

Intellectual Property Assets and partners with inventors and patent

owners to realize the financial value in their patented inventions.

Acacia bridges the gap between invention and application,

facilitating efficiency and delivering monetary rewards to the

patent owner.

Information about Acacia Research Corporation and its

subsidiaries is available at www.acaciaresearch.com.

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995

This news release contains forward-looking statements within the

meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995. These statements are based upon our

current expectations and speak only as of the date hereof. Our

actual results may differ materially and adversely from those

expressed in any forward-looking statements as a result of various

factors and uncertainties, including the ability to successfully

implement our strategic plan, the ability to successfully build out

a new leadership team within a certain timeframe, the ability to

streamline financial reporting, the ability to successfully develop

licensing programs and attract new business, changes in demand for

current and future intellectual property rights, legislative,

regulatory and competitive developments addressing licensing and

enforcement of patents and/or intellectual property in general,

general economic conditions, including the impact of the COVID-19

pandemic and the success of our investments. Our Annual Report on

Form 10-K, recent and forthcoming Quarterly Reports on Form 10-Q,

recent Current Reports on Form 8-K, and any amendments to the

foregoing, and other SEC filings discuss some of the important risk

factors that may affect our business, results of operations and

financial condition. We undertake no obligation to revise or update

publicly any forward-looking statements for any reason.

The results achieved in the most recent quarter are not

necessarily indicative of the results to be achieved by us in any

subsequent quarters, as it is currently anticipated that Acacia

Research Corporation’s financial results will vary, and may vary

significantly, from quarter to quarter. This variance is expected

to result from a number of factors, including risk factors

affecting our results of operations and financial condition

referenced above, and the particular structure of our licensing

transactions, which may impact the amount of inventor royalties and

contingent legal fees expenses we incur from period to period.

ACACIA RESEARCH

CORPORATION

UNAUDITED CONDENSED

CONSOLIDATED BALANCE SHEETS

(In thousands, except share

and per share data)

June 30,

December 31,

2020

2019

ASSETS Current assets: Cash and cash equivalents

$

164,280

$

57,359

Trading securities - debt

-

93,843

Trading securities - equity

19,697

17,140

Equity securities derivative

7,369

-

Equity securities forward contract

75,534

-

Prepaid investment

93,956

-

Accounts receivable

1,393

511

Prepaid expenses and other current assets

1,894

2,912

Total current assets

364,123

171,765

Long-term restricted cash

-

35,000

Investment at fair value

4,063

1,500

Patents, net of accumulated

amortization

19,245

7,814

Leased right-of-use assets

1,249

1,264

Other non-current assets

5,466

818

Total assets

$

394,146

$

218,161

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND

STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable

$

3,235

$

1,765

Accrued expenses and other

current liabilities

2,716

7,265

Accrued compensation

1,998

507

Royalties and contingent legal

fees payable

2,143

2,178

Senior Secured Notes Payable - short term

113,401

-

Total current liabilities

123,493

11,715

Series A warrant liabilities

6,952

3,568

Series A embedded derivative liabilities

29,513

17,974

Series B warrant liabilities

58,290

-

Long-term lease liabilities

1,249

1,264

Other long-term liabilities

593

593

Total liabilities

220,090

35,114

Series A redeemable convertible preferred stock, par

value $0.001 per share; stated value $100 per share; 350,000 shares

authorized, issued and outstanding as of June 30, 2020 and December

31, 2019, respectively; aggregate liquidation preference of $35,000

as of June 30, 2020 and December 31, 2019, respectively

9,400

8,089

Stockholders' equity: Preferred stock, par value $0.001 per

share; 10,000,000 shares authorized; no shares issued or

outstanding

-

-

Common stock, par value $0.001 per share; 300,000,000 shares

authorized; 49,306,137 and 50,370,987 shares issued and outstanding

as of June 30, 2020 and December 31, 2019, respectively

49

50

Treasury stock, at cost, 4,604,365 and 2,919,828 shares as of June

30, 2020 and December 31, 2019, respectively

(43,270

)

(39,272

)

Additional paid-in capital

650,843

652,003

Accumulated deficit

(444,799

)

(439,656

)

Total Acacia Research Corporation stockholders' equity

162,823

173,125

Noncontrolling interests

1,833

1,833

Total stockholders' equity

164,656

174,958

Total liabilities, redeemable convertible preferred stock,

and stockholders' equity

$

394,146

$

218,161

ACACIA RESEARCH

CORPORATION

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share

and per share data)

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

Revenues

$

2,118

$

5,460

$

5,933

$

8,847

Portfolio operations: Inventor royalties

645

2,623

1,071

3,976

Contingent legal fees

12

375

246

552

Litigation and licensing expenses - patents

1,459

1,855

2,496

5,656

Amortization of patents

1,305

818

2,348

1,474

Other portfolio expenses (income)

(74

)

-

(308

)

650

Total portfolio operations

3,347

5,671

5,853

12,308

Net portfolio income (loss)

(1,229

)

(211

)

80

(3,461

)

General and administrative expenses(1)

5,519

3,763

10,397

7,418

Operating loss

(6,748

)

(3,974

)

(10,317

)

(10,879

)

Other income (expense):

Change in fair value of

investment, net

2,677

6,980

6,785

13,888

Gain (loss) on sale of

investment

554

(1,642

)

(2,762

)

(7,232

)

Impairment of other

investment

-

(8,195

)

-

(8,195

)

Change in fair value of the Series A and B warrants and embedded

derivatives

(62,902

)

-

(67,284

)

-

Change in fair value of equity

securities derivative and forward contract

81,553

-

81,553

-

Change in fair value of trading

securities

3,525

(61

)

(2,592

)

614

Gain (loss) on sale of trading

securities

(7,121

)

31

(7,009

)

(12

)

Loss on foreign currency

exchange

(4,890

)

-

(4,890

)

-

Interest expense on Senior

Secured Notes

(768

)

-

(768

)

-

Interest income and other

266

1,113

801

1,984

Total other income (expense)

12,894

(1,774

)

3,834

1,047

Income (loss) before income taxes

6,146

(5,748

)

(6,483

)

(9,832

)

Income tax benefit (expense)

2

(9

)

1,340

(323

)

Net income (loss) including noncontrolling interests in

subsidiaries

6,148

(5,757

)

(5,143

)

(10,155

)

Net loss attributable to

noncontrolling interests in subsidiaries

-

-

-

14

Net income (loss) attributable to

Acacia Research Corporation

$

6,148

$

(5,757

)

$

(5,143

)

$

(10,141

)

Net income (loss) attributable to

common stockholders - basic and diluted

$

4,201

$

(5,757

)

$

(7,105

)

$

(10,141

)

Basic net income (loss) per common share

$

0.09

$

(0.12

)

$

(0.14

)

$

(0.20

)

Weighted average number of shares outstanding - basic

48,457,620

49,696,016

49,166,508

49,676,059

Diluted net income (loss) per common share

$

0.09

$

(0.12

)

$

(0.14

)

$

(0.20

)

Weighted average number of shares outstanding - diluted

49,033,824

49,696,016

49,166,508

49,676,059

(1) General and administrative expenses were

comprised of the following:

Three Months Ended

Six Months Ended

June 30,

June 30,

2020

2019

2020

2019

General and administrative

expenses

$

5,096

$

3,302

$

9,642

$

6,965

Non-cash stock compensation

expense - G&A

423

461

755

453

Total general and administrative

expenses

$

5,519

$

3,763

$

10,397

$

7,418

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200810005314/en/

Acacia Research Investor Contact: FNK IR Rob Fink,

646-809-4048 rob@fnkir.com

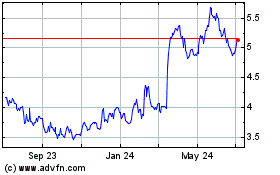

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

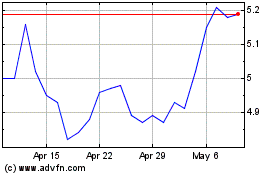

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024