Glencore Posts Loss, Cancels Dividend -- WSJ

August 07 2020 - 3:02AM

Dow Jones News

By Alistair MacDonald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 7, 2020).

LONDON -- Commodities giant Glencore PLC reported a loss for the

first half of the year and scrapped its dividend, as the

coronavirus pandemic sapped demand and lowered prices and

production at its mining division.

The global miner and commodities trader, though, reported record

profits on its trading floor, but investors sent shares down

sharply. Glencore stock was down more than 4% in midmorning trading

in London, recovering somewhat from steeper losses earlier in the

session.

Glencore said the outlook remains uncertain in the short term

and it will focus on reducing debt down to $16 billion by the end

of 2020.

To help reduce that debt, it is scrapping a $2.6 billion

dividend, the first time it has canceled its payout since 2016,

when its shares plunged on concerns over leverage.

The FTSE 100 miner posted a net loss of $2.6 billion for the six

months ended June 30 compared with a $226 million profit a year

earlier. This was driven by impairments of $3.2 billion as a result

of lower commodity prices related to the uncertainty arising from

the pandemic.

Adjusted earnings before interest, taxes, depreciation and

amortization fell to $4.83 billion from $5.58 billion, beating

market consensus.

The company benefited from record earnings of $2 billion in its

trading division, with oil in particular generating money -- $1.27

billion in profits -- amid historic volatility caused by the

economic effects of coronavirus.

In capitalising on trading opportunities the company increased

its leverage, helping make debt reduction a priority, executives

said.

"It's a strong performance under the challenging conditions

related to coronavirus," Ivan Glasenberg, Glencore's chief

executive, said.

The commodities it mines and drills for were particularly hard

hit by the effects of coronavirus. Copper prices fell 11% in the

period, thermal coal was down 16%, zinc was down 25% and oil down

36%. The miner doesn't produce, to any great degree, the

commodities that have performed well during the pandemic, including

iron ore and precious metals like gold.

Glencore said that commodity prices were improving in the second

half, including a rise in oil of about 10%.

"There is a very positive upside momentum going into the second

half," said Chief Financial Officer Steven Kalmin.

The company's shares have lagged peers by 12% over the past 12

months, according to RBC, which said questions remain for the miner

on its environmental, social and governance issues, the leadership

succession and the various regulatory investigations.

Glencore said in July 2018 that it had received a subpoena from

the U.S. Justice Department, demanding records related to its

compliance with American antibribery and money-laundering laws in

Congo, Nigeria and Venezuela. It has said it is cooperating with

the probe.

Glencore has also said it is the subject of an investigation by

the U.S. Commodity Futures Trading Commission.

Mr. Glasenberg declined to comment about the regulatory

investigations.

The company is also in the middle of management change, with Mr.

Glasenburg having signaled he will step down once a new generation

of senior management is in place.

--Jaime Llinares Taboada contributed to this article.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

August 07, 2020 02:47 ET (06:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

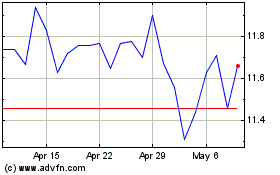

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

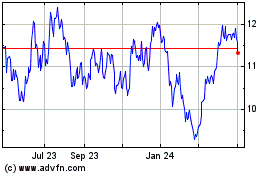

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Apr 2023 to Apr 2024