Research Frontiers Reports Second Quarter 2020 Financial Results

August 06 2020 - 4:05PM

Research Frontiers Inc. (Nasdaq: REFR) announced its financial

results for its second quarter ended June 30, 2020. Management will

host a conference call today at 4:30 p.m. Eastern Time to discuss

its financial and operating results as well as recent developments.

- Who: Joseph M. Harary, President & CEO,

Seth Van Voorhees, CFO

- Date/Time: August 6, 2020, 4:30 PM ET

- Dial-in Information: 1-888-334-5785

- Replay: Available on Friday, August 7, 2020

for 90 days at www.SmartGlass-IR.com

Key Second Quarter 2020 Comments:

| 1. |

In August 2020, Daimay, the world’s largest supplier of automotive

sun visors, licensed Research Frontiers’ SPD-Smart light-control

film technology for use in automotive sun visors. SPD-Smart

light-control technology will enable Daimay to develop products

that automatically and dynamically adjust the sun visor to deal

with changing light and glare conditions. |

| 2. |

In June 2020, Research Frontiers announced that it has been

added to the Russell 2000® Index effective on June 29, 2020.

The Annual Russell index reconstitution captures the 4,000 largest

US stocks ranking them by total market capitalization. Membership

in the U.S. Russell 2000 Index® remains in place for one year

and also means automatic inclusion in the appropriate growth and

value style indices. Russell indices are widely used by investment

managers and institutional investors for index funds and as

benchmarks for active investment strategies. |

| 3. |

As discussed on our last investor conference call, in April 2020,

Gauzy Ltd. announced that it secured Series C investments from

Hyundai Motor Company, Blue Red Partners VC, and Avery Dennison.

This strategic investment marks the first known equity investment

by an automotive OEM in Research Frontiers’ entire industry. |

| 4. |

The Company’s fee

income from licensing activities for the six months ended June 30,

2020 was $532,286 as compared to $719,692 for the six months ended

June 30, 2019. |

- Lower fees in the automotive and

aircraft markets (believed to be related to temporary customer

shutdowns in these industries due to the COVID-19 pandemic) was

partially offset by higher fee income from licensees in the

architectural and display markets.

| 5. |

Total expenses decreased by $452,011, or 20%, for the for the six

months ended June 30, 2020 as compared to the same period in

2019. |

| 6. |

The Company applied for and received $202,052 in proceeds from the

Paycheck Protection Program (“PPP Loan”) made available under the

CARES Act. The PPP Loan is intended to offer businesses hurt by the

COVID-19 pandemic economic assistance with the potential for the

principal to be forgiven based on certain expenses incurred during

the first 24 weeks after the issuance of the PPP Loan. |

- The Company estimates that $194,140

of the PPP Loan principal will be forgiven based on payroll and

other expenses incurred through June 30, 2020, and all or

substantially all of the remaining loan will be forgiven under the

terms of the CARES Act during the third quarter of 2020.

| 7. |

As of June 30, 2020, the Company had cash and cash equivalents of

$5,841,346 and working capital of $6,270,142. |

- Based upon the Company’s projected

cash flow shortfall of approximately $450,000-500,000 per quarter,

the Company expects to have sufficient working capital for at least

the next 34 months of operations.

For more details, please see the Company’s Quarterly Report on

Form 10-Q which was filed today with the SEC, the contents of which

are incorporated by reference herein.

About Research Frontiers

Research Frontiers (Nasdaq: REFR) is a publicly

traded technology company and the developer of patented SPD-Smart

light-control film technology which allows users to instantly,

precisely and uniformly control the shading of glass or plastic

products, either manually or automatically. Research Frontiers has

licensed its smart glass technology to over 40 companies that

include well known chemical, material science and glass companies.

Products using Research Frontiers’ smart glass technology are being

used in tens of thousands of cars, aircraft, yachts, trains, homes,

offices, museums and other buildings. For more information, please

visit our website at www.SmartGlass.com, and on Facebook, Twitter,

LinkedIn and YouTube.

Note: From time to time Research Frontiers may

issue forward-looking statements which involve risks and

uncertainties. This press release contains forward-looking

statements. Actual results, especially those reliant on activities

by third parties, could differ and are not guaranteed. Any

forward-looking statements should be considered accordingly.

“SPD-Smart” and “SPD-SmartGlass” are trademarks of Research

Frontiers Inc.

CONTACT:Seth L. Van VoorheesChief Financial

OfficerResearch Frontiers Inc.+1-516-364-1902

Info@SmartGlass.com

RESEARCH FRONTIERS INCORPORATED Consolidated

Balance Sheets Unaudited

| |

|

June 30, 2020 (Unaudited) |

|

|

December 31, 2019 |

|

| Assets |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,841,346 |

|

|

$ |

6,591,960 |

|

|

Royalties receivable, net of reserves of $944,052 as of June 30,

2020 and $1,135,598 as of December 31, 2019 |

|

|

652,520 |

|

|

|

656,062 |

|

|

Prepaid expenses and other current assets |

|

|

138,473 |

|

|

|

58,835 |

|

|

Total current assets |

|

|

6,632,339 |

|

|

|

7,306,857 |

|

| |

|

|

|

|

|

|

|

|

| Fixed assets, net |

|

|

50,942 |

|

|

|

141,720 |

|

| Operating lease ROU

assets |

|

|

693,395 |

|

|

|

773,989 |

|

| Deposits and other assets |

|

|

33,567 |

|

|

|

33,567 |

|

|

Total assets |

|

$ |

7,410,243 |

|

|

$ |

8,256,133 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and Shareholders’

Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Current portion of operating lease liabilities |

|

$ |

163,204 |

|

|

$ |

163,236 |

|

|

Accounts payable |

|

|

59,438 |

|

|

|

169,750 |

|

|

Accrued expenses and other |

|

|

83,342 |

|

|

|

46,709 |

|

|

Deferred other income liability |

|

|

7,912 |

|

|

|

- |

|

|

Deferred revenue |

|

|

48,301 |

|

|

|

7,734 |

|

|

Total current liabilities |

|

|

362,197 |

|

|

|

387,429 |

|

| |

|

|

|

|

|

|

|

|

|

Operating lease liabilities, net of current portion |

|

|

731,306 |

|

|

|

812,596 |

|

|

Total liabilities |

|

|

1,093,503 |

|

|

|

1,200,025 |

|

| |

|

|

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

|

|

Common stock, par value $0.0001 per share; authorized 100,000,000

shares, issued and outstanding 31,575,786 in 2020 and 31,254,262 in

2019 |

|

|

3,158 |

|

|

|

3,125 |

|

|

Additional paid-in capital |

|

|

122,837,069 |

|

|

|

122,552,895 |

|

|

Accumulated deficit |

|

|

(116,523,487 |

) |

|

|

(115,499,912 |

) |

|

Total shareholders’ equity |

|

|

6,316,740 |

|

|

|

7,056,108 |

|

| |

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders’ equity |

|

$ |

7,410,243 |

|

|

$ |

8,256,133 |

|

RESEARCH FRONTIERS INCORPORATED Consolidated

Statements of Operations Unaudited

|

|

|

Six Months Ended June 30, |

|

|

Three Months Ended June 30, |

|

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Fee income |

|

$ |

532,286 |

|

|

$ |

719,692 |

|

|

$ |

176,113 |

|

|

$ |

301,035 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

1,452,404 |

|

|

|

1,690,520 |

|

|

|

631,963 |

|

|

|

939,355 |

|

| Research and development |

|

|

330,049 |

|

|

|

543,944 |

|

|

|

146,731 |

|

|

|

313,981 |

|

|

Total expenses |

|

|

1,782,453 |

|

|

|

2,234,464 |

|

|

|

778,694 |

|

|

|

1,253,336 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

(1,250,167 |

) |

|

|

(1,514,772 |

) |

|

|

(602,581 |

) |

|

|

(952,301 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Warrant market adjustment |

|

|

- |

|

|

|

(652,025 |

) |

|

|

- |

|

|

|

(404,435 |

) |

| Other income – PPP loan

forgiveness |

|

|

194,140 |

|

|

|

- |

|

|

|

194,140 |

|

|

|

- |

|

| Net investment income |

|

|

32,452 |

|

|

|

12,422 |

|

|

|

9,460 |

|

|

|

6,258 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(1,023,575 |

) |

|

$ |

(2,154,375 |

) |

|

$ |

(398,981 |

) |

|

$ |

(1,350,478 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted net loss per

common share |

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted weighted

average number of common shares outstanding |

|

|

31,398,818 |

|

|

|

28,909,306 |

|

|

|

31,474,431 |

|

|

|

29,589,084 |

|

RESEARCH FRONTIERS INCORPORATED Consolidated

Statements of Cash Flows Unaudited

|

|

|

Six Months Ended June 30, |

|

|

|

|

2020 |

|

|

2019 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(1,023,575 |

) |

|

$ |

(2,154,375 |

) |

| Adjustments to reconcile net

loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

87,276 |

|

|

|

95,445 |

|

|

Stock-based compensation |

|

|

- |

|

|

|

356,228 |

|

|

Other income – PPP loan forgiveness |

|

|

(194,140 |

) |

|

|

- |

|

|

Bad debts expense |

|

|

53,217 |

|

|

|

22,667 |

|

|

Warrant market adjustment |

|

|

- |

|

|

|

652,025 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

|

Royalty receivables |

|

|

(49,675 |

) |

|

|

(105,780 |

) |

|

Prepaid expenses and other current assets |

|

|

(79,638 |

) |

|

|

(49,743 |

) |

|

Accounts payable and accrued expenses |

|

|

(73,679 |

) |

|

|

(115,475 |

) |

|

Deferred revenue |

|

|

40,567 |

|

|

|

(14,668 |

) |

|

Net cash used in operating activities |

|

|

(1,239,647 |

) |

|

|

(1,313,676 |

) |

| |

|

|

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

Purchases of fixed assets |

|

|

(939 |

) |

|

|

(62,968 |

) |

|

Proceeds from the sale of fixed assets |

|

|

3,713 |

|

|

|

- |

|

|

Net cash provided by (used in) investing activities |

|

|

2,774 |

|

|

|

(62,968 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

Net proceeds from issuances of common stock andwarrants and

exercise of options and warrants |

|

|

284,207 |

|

|

|

5,705,898 |

|

|

Proceeds from PPP Program Funding |

|

|

202,052 |

|

|

|

- |

|

|

Net cash provided by financing activities |

|

|

486,259 |

|

|

|

5,705,898 |

|

|

|

|

|

|

|

|

|

|

|

| Net (decrease) / increase in

cash and cash equivalents |

|

|

(750,614 |

) |

|

|

4,329,254 |

|

| |

|

|

|

|

|

|

|

|

| Cash and cash equivalents at

beginning of period |

|

|

6,591,960 |

|

|

|

2,969,416 |

|

| Cash and cash equivalents at

end of period |

|

$ |

5,841,346 |

|

|

$ |

7,298,670 |

|

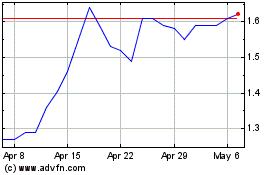

Research Frontiers (NASDAQ:REFR)

Historical Stock Chart

From Mar 2024 to Apr 2024

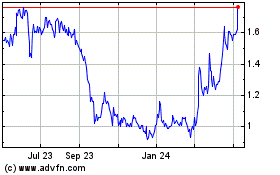

Research Frontiers (NASDAQ:REFR)

Historical Stock Chart

From Apr 2023 to Apr 2024