Jack in the Box Inc. (NASDAQ: JACK) today reported financial

results for the third quarter ended July 5, 2020.

Increase in same-store sales:

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Company

4.1%

2.8%

1.2%

1.2%

Franchise

6.9%

2.7%

1.5%

0.8%

System

6.6%

2.7%

1.5%

0.8%

Jack in the Box® system same-store sales increased 6.6 percent

for the quarter. Company same-store sales increased 4.1 percent in

the third quarter driven by average check growth of 20.2 percent

while transactions decreased 16.1 percent.

Darin Harris, chief executive officer, said, "In my first six

weeks as CEO, I have witnessed the nimbleness and passion within

this brand. I am proud of the way our franchisees, the teams in our

restaurants, our employees, and our partners have responded swiftly

to the changing occasions of our consumers amidst the pandemic. Our

strong performance in the third quarter is a testament to this

agile approach. Our focus on value combined with indulgent and

flavorful products continues to drive overall performance for the

brand.

This strong performance accelerated throughout the third

quarter, and has continued thus far into the fourth quarter. I am

excited about taking the learnings from this uncertain time and

using them to fuel the remaining part of 2020 as well as our

strategy into 2021."

Earnings from continuing operations were $32.2 million, or $1.40

per diluted share, for the third quarter of fiscal 2020 compared

with $13.5 million, or $0.51 per diluted share, for the third

quarter of fiscal 2019.

Operating Earnings Per Share(1), a non-GAAP measure, were $1.37

in the third quarter of fiscal 2020 compared with $1.07 in the

prior year quarter. A reconciliation of non-GAAP Operating Earnings

Per Share to GAAP results is provided below, with additional

information included in the attachment to this release.

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Diluted earnings per share from continuing

operations – GAAP

$1.40

$0.51

$2.21

$2.67

Loss on early termination of interest rate

swaps

—

0.56

—

0.56

Restructuring charges

—

—

0.04

0.19

Gains on the sale of company-operated

restaurants

(0.03)

—

(0.08)

(0.01)

Gain on sale of corporate office

building

—

—

(0.33)

—

Pension settlement charges

—

—

1.20

—

Operating Earnings Per Share – non-GAAP

(1)

$1.37

$1.07

$3.03

$3.41

(1) Operating Earnings per share may not

add due to rounding.

Adjusted EBITDA(2), a non-GAAP measure, was $72.9 million in the

third quarter of fiscal 2020 compared with $57.8 million for the

prior year quarter.

Results for the third quarter reflect the business and financial

impacts of the COVID-19 pandemic, which include the following:

- Restaurant traffic declined substantially, although did improve

versus the last five weeks of the second quarter. Check growth

continued to drive overall same-store sales growth.

- Higher costs for delivery fees and supplies related to COVID-19

increased Occupancy and Other as a percentage of company restaurant

sales by 90 basis points.

- Higher costs for a new emergency paid sick leave program

increased Labor as a percentage of company restaurant sales by 30

basis points.

- The company did not provide any additional relief to

franchisees in the form of marketing fee reduction or postponement

or rent postponement in the third quarter. The marketing fee

reduction in April, however, did impact slightly over two weeks of

the third quarter, resulting in lower Advertising costs by $0.1

million, and reduced Franchise Contributions for Advertising by

approximately $2.9 million.

- The company implemented a short-term cash preservation

strategy, and as such, did not buy back any shares in the third

quarter. The company also significantly reduced capital

spending.

Restaurant-Level Margin(3), a non-GAAP measure, decreased by 160

basis points to 25.4 percent of company restaurant sales in the

third quarter of fiscal 2020 from 27.0 percent a year ago. The

decrease was due primarily to wage inflation as well as higher

delivery fees and supply costs related to COVID-19. Food and

packaging costs, as a percentage of company restaurant sales,

decreased 20 basis points in the quarter driven by menu price

increases and favorable mix shift, partially offset by increases in

ingredient costs. Commodity costs increased 3.6 percent in the

quarter as compared with the prior year, due primarily to increases

in beef.

Franchise-Level Margin(3), a non-GAAP measure, increased by $5.4

million in the third quarter, primarily driven by higher royalties

and rental revenues as franchise same-store sales increased. The

company did not provide any additional relief to franchisees

through postponements or reductions of rent or marketing in the

third quarter.

Franchise-Level Margin(3), as a percentage of total franchise

revenues, was 41.5 percent in the third quarter of fiscal 2020. The

company adopted the new lease accounting standard, ASC 842, in

fiscal 2020, which resulted in grossing up both franchise rental

revenues and franchise occupancy expenses by approximately $9.7

million and $9.9 million respectively in the third quarter. Without

these adjustments, Franchise-Level Margin(3) would have been 44.4

percent of total franchise revenues. This compares with 42.4

percent in the prior year.

As a percentage of system-wide sales, G&A was 1.1 percent in

the third quarter of fiscal 2020 compared with 2.5 percent in the

prior year quarter. The $10.6 million decrease in G&A, which

excludes advertising, was primarily driven by:

- a decrease of $7.0 million in costs related to litigation

matters versus prior year;

- mark-to-market adjustments on investments supporting the

company's non-qualified retirement plans resulting in a $2.6

million year-over-year decrease in G&A; and

- a $2.5 million decrease in incentive compensation.

- These increases were partially offset by a $2.6 million

increase in insurance.

Advertising costs, which are included in SG&A, decreased

$0.1 million in the third quarter due to the reduction in marketing

fees for April. In the third quarter of fiscal 2020, SG&A

expenses decreased by $10.7 million and were 5.6 percent of

revenues compared with 11.0 percent in the prior year quarter.

Impairment and other charges, net, increased $4.0 million in the

third quarter, driven by a $5.7 million gain on sale of a

restaurant property in the prior year quarter.

Interest expense, net, decreased by $20.8 million in the third

quarter driven by the termination of our interest rate swaps in the

prior year quarter.

The effective tax rate for the third quarter of fiscal 2020 was

27.9 percent, an improvement versus the second quarter, primarily

driven by the improvement in operating earnings before income tax

and nontaxable gains from mark-to-market adjustments associated

with investments supporting the company's non-qualified retirement

plans.

Capital Allocation and Liquidity Position

The company did not repurchase any shares in the third quarter

of fiscal 2020, and as announced on April 15, 2020, temporarily

suspended its share repurchase program. This leaves approximately

$122 million remaining under share repurchase programs authorized

by its Board of Directors, consisting of $22 million remaining that

expire in November 2020 and approximately $100 million remaining

that expire in November 2021.

The company also announced today that on July 31, 2020, its

Board of Directors declared a cash dividend of $0.40 per share on

the company's common stock. The dividend is payable on September 3,

2020, to shareholders of record at the close of business on August

18, 2020. The reinstatement of the dividend reflects the strong

financial health of the company and continued commitment to

shareholders.

As of the end of the third quarter, the company had

approximately $196.9 million in cash, of which $159.5 million was

unrestricted cash.

Conference Call

The company will host a conference call for financial analysts

and investors on Thursday, August 6, 2020, beginning at 8:30 a.m.

PT (11:30 a.m. ET). The conference call will be broadcast live over

the Internet via the Jack in the Box Inc. corporate website. To

access the live call through the Internet, log onto the Investors

section of the Jack in the Box Inc. website at

http://investors.jackinthebox.com at least 15 minutes prior to

the event in order to download and install any necessary audio

software. A replay of the call will be available through the Jack

in the Box Inc. corporate website for 21 days, beginning at

approximately 11:30 a.m. PT on August 6, 2020.

About Jack in the Box Inc.

Jack in the Box Inc. (NASDAQ: JACK), based in San Diego, is a

restaurant company that operates and franchises Jack in the Box®

restaurants, one of the nation’s largest hamburger chains, with

more than 2,200 restaurants in 21 states and Guam. For more

information on Jack in the Box, including franchising

opportunities, visit www.jackinthebox.com

(1) Operating Earnings Per Share

represents diluted earnings per share from continuing operations on

a GAAP basis excluding gains or losses on the sale of

company-operated restaurants, restructuring charges, gain on sale

of corporate office building, pension settlement charges, loss on

early termination of interest rate, and the excess tax benefits

from share-based compensation arrangements. See "Reconciliation of

Non-GAAP Measurements to GAAP Results."

(2) Adjusted EBITDA represents net

earnings on a GAAP basis excluding earnings or losses from

discontinued operations, income taxes, interest expense, net, gains

or losses on the sale of company-operated restaurants, impairment

and other charges, net, depreciation and amortization, the

amortization of franchise tenant improvement allowances and pension

settlement charges. See "Reconciliation of Non-GAAP Measurements to

GAAP Results."

(3) Restaurant-Level Margin and

Franchise-Level Margin are non-GAAP measures. These non-GAAP

measures are reconciled to earnings from operations, the most

comparable GAAP measure, in the attachment to this release. See

"Reconciliation of Non-GAAP Measurements to GAAP Results."

Safe Harbor Statement

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may be identified by words such as “anticipate,”

“believe,” “estimate,” “expect,” “forecast,” “goals,” “guidance,”

“intend,” “plan,” “project,” “may,” “will,” “would” and similar

expressions. These statements are based on management’s current

expectations, estimates, forecasts and projections about our

business and the industry in which we operate. These estimates and

assumptions involve known and unknown risks, uncertainties, and

other factors that are in some cases beyond our control. Factors

that may cause our actual results to differ materially from any

forward-looking statements include, but are not limited to: the

potential impacts to our business and operations resulting from the

coronavirus COVID-19 pandemic, the success of new products,

marketing initiatives and restaurant remodels and drive-thru

enhancements; the impact of competition, unemployment, trends in

consumer spending patterns and commodity costs; the company's

ability to reduce G&A and operate efficiently; the company’s

ability to achieve and manage its planned growth, which is affected

by the availability of a sufficient number of suitable new

restaurant sites, the performance of new restaurants, risks

relating to expansion into new markets and successful franchise

development; the ability to attract, train and retain

top-performing personnel, litigation risks; risks associated with

disagreements with franchisees; supply chain disruption;

food-safety incidents or negative publicity impacting the

reputation of the company's brand; increased regulatory and legal

complexities, including federal, state and local policies regarding

mitigation strategies for controlling the coronavirus COVID-19

pandemic, risks associated with the amount and terms of the

securitized debt issued by certain of our wholly owned

subsidiaries; adverse investor response to the company's temporary

suspension of its stock repurchase program; and stock market

volatility. These and other factors are discussed in the company’s

annual report on Form 10-K and its periodic reports on Form 10-Q

filed with the Securities and Exchange Commission, which are

available online at http://investors.jackinthebox.com or in hard copy

upon request. The company undertakes no obligation to update or

revise any forward-looking statement, whether as the result of new

information or otherwise.

JACK IN THE BOX INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS

(In thousands, except per

share data)

(Unaudited)

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Revenues:

Company restaurant sales

$

82,444

$

78,434

$

262,188

$

257,948

Franchise rental revenues

76,021

63,359

241,990

208,895

Franchise royalties and other

43,239

40,180

133,469

130,840

Franchise contributions for advertising

and other services

40,571

40,386

128,458

131,189

242,275

222,359

766,105

728,872

Operating costs and expenses, net:

Company restaurant costs (excluding

depreciation and amortization):

Food and packaging

24,077

23,058

77,662

74,350

Payroll and employee benefits

25,085

23,121

81,236

76,163

Occupancy and other

12,334

11,052

40,862

38,165

Total company restaurant costs

61,496

57,231

199,760

188,678

Franchise occupancy expenses

48,612

38,371

161,470

127,702

Franchise support and other costs

2,692

2,695

10,339

8,337

Franchise advertising and other services

expenses

42,176

41,882

133,134

136,397

Selling, general and administrative

expenses

13,680

24,389

66,131

66,057

Depreciation and amortization

12,141

12,786

41,151

42,645

Impairment and other charges, net

738

(3,256)

(7,837)

5,567

Gains on the sale of company-operated

restaurants

(1,050)

—

(2,625)

(219)

180,485

174,098

601,523

575,164

Earnings from operations

61,790

48,261

164,582

153,708

Other pension and post-retirement

expenses, net

1,482

342

40,972

1,141

Interest expense, net

15,700

36,494

51,051

67,144

Earnings from continuing operations and

before income taxes

44,608

11,425

72,559

85,423

Income taxes

12,432

(2,048)

21,023

15,699

Earnings from continuing operations

32,176

13,473

51,536

69,724

Earnings (losses) from discontinued

operations, net of taxes

379

(284)

379

2,652

Net earnings

$

32,555

$

13,189

$

51,915

$

72,376

Net earnings per share - basic:

Earnings from continuing operations

$

1.41

$

0.52

$

2.22

$

2.69

Earnings from discontinued operations

0.02

(0.01)

0.02

0.10

Net earnings per share (1)

$

1.42

$

0.51

$

2.24

$

2.79

Net earnings per share - diluted:

Earnings from continuing operations

$

1.40

$

0.51

$

2.21

$

2.67

Earnings from discontinued operations

0.02

(0.01)

0.02

0.10

Net earnings per share (1)

$

1.42

$

0.50

$

2.23

$

2.77

Weighted-average shares outstanding:

Basic

22,847

25,958

23,192

25,933

Diluted

22,916

26,176

23,322

26,150

Dividends declared per common share

$

—

$

0.40

$

0.80

$

1.20

(1) Earnings per share may not add due to

rounding.

JACK IN THE BOX INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

July 5, 2020

September 29,

2019

ASSETS

Current assets:

Cash

$

159,540

$

125,536

Restricted cash

37,373

26,025

Accounts and other receivables, net

88,242

45,235

Inventories

1,835

1,776

Prepaid expenses

13,447

9,015

Current assets held for sale

6,191

16,823

Other current assets

3,504

2,718

Total current assets

310,132

227,128

Property and equipment:

Property and equipment, at cost

1,140,285

1,176,241

Less accumulated depreciation and

amortization

(796,159)

(784,307)

Property and equipment, net

344,126

391,934

Other assets:

Operating lease right-of-use asset

902,858

—

Intangible assets, net

283

425

Goodwill

47,161

46,747

Deferred tax assets

66,132

85,564

Other assets, net

216,008

206,685

Total other assets

1,232,442

339,421

$

1,886,700

$

958,483

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Current maturities of long-term debt

$

13,821

$

774

Current operating lease liabilities

169,347

—

Accounts payable

26,339

37,066

Accrued liabilities

143,344

120,083

Total current liabilities

352,851

157,923

Long-term liabilities:

Long-term debt, net of current

maturities

1,366,171

1,274,374

Long-term operating lease liabilities, net

of current portion

777,883

—

Other long-term liabilities

216,752

263,770

Total long-term liabilities

2,360,806

1,538,144

Stockholders’ deficit:

Preferred stock $0.01 par value,

15,000,000 shares authorized, none issued

—

—

Common stock $0.01 par value, 175,000,000

shares authorized, 82,320,270 and 82,159,002 issued,

respectively

823

822

Capital in excess of par value

491,594

480,322

Retained earnings

1,607,485

1,577,034

Accumulated other comprehensive loss

(117,553)

(140,006)

Treasury stock, at cost, 59,646,773 and

57,760,573 shares, respectively

(2,809,306)

(2,655,756)

Total stockholders’ deficit

(826,957)

(737,584)

$

1,886,700

$

958,483

JACK IN THE BOX INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

40 Weeks Ended

July 5, 2020

July 7, 2019

Cash flows from operating activities:

Net earnings

$

51,915

$

72,376

Earnings from discontinued operations

379

2,652

Earnings from continuing operations

51,536

69,724

Adjustments to reconcile net earnings to

net cash provided by operating activities:

Depreciation and amortization

41,151

42,645

Amortization of franchise tenant

improvement allowances and other

2,383

1,524

Deferred finance cost amortization

4,337

1,903

Excess tax benefits from share-based

compensation arrangements

(71)

(66)

Deferred income taxes

12,567

(1,745)

Share-based compensation expense

7,612

6,589

Pension and postretirement expense

40,972

1,141

Gains on cash surrender value of

company-owned life insurance

(1,861)

(3,117)

Gains on the sale of company-operated

restaurants

(2,625)

(219)

Gains on the disposition of property and

equipment, net

(10,386)

(5,756)

Non-cash operating lease costs

(5,689)

—

Impairment charges and other

195

1,624

Changes in assets and liabilities,

excluding acquisitions:

Accounts and other receivables

(39,198)

(3,555)

Inventories

14

(79)

Prepaid expenses and other current

assets

(5,034)

1,509

Accounts payable

(4,620)

24,321

Accrued liabilities

15,755

9,363

Pension and postretirement

contributions

(4,921)

(5,126)

Franchise tenant improvement allowance

distributions

(7,105)

(7,875)

Other

(4,844)

(16,012)

Cash flows provided by operating

activities

90,168

116,793

Cash flows from investing activities:

Purchases of property and equipment

(16,736)

(25,041)

Proceeds from the sale of property and

equipment

22,790

7,563

Proceeds from the sale and leaseback of

assets

19,828

3,056

Proceeds from the sale of company-operated

restaurants

2,625

133

Collections on notes receivable

—

15,239

Other

1,036

—

Cash flows provided by investing

activities

29,543

950

Cash flows from financing activities:

Borrowings on revolving credit

facilities

111,376

229,798

Repayments of borrowings on revolving

credit facilities

(3,500)

(252,800)

Principal repayments on debt

(7,094)

(32,611)

Debt issuance costs

(216)

(5,088)

Dividends paid on common stock

(18,466)

(30,929)

Proceeds from issuance of common stock

3,559

696

Repurchases of common stock

(155,576)

(14,362)

Payroll tax payments for equity award

issuances

(4,442)

(2,705)

Cash flows used in financing

activities

(74,359)

(108,001)

Net increase in cash and restricted

cash

45,352

9,742

Cash and restricted cash at beginning of

period

151,561

2,705

Cash and restricted cash at end of

period

$

196,913

$

12,447

JACK IN THE BOX INC. AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

The following table presents certain income and

expense items included in our condensed consolidated statements of

earnings as a percentage of total revenues, unless otherwise

indicated. Percentages may not add due to rounding.

CONDENSED CONSOLIDATED

STATEMENTS OF EARNINGS DATA

(Unaudited)

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Revenues:

Company restaurant sales

34.0

%

35.3

%

34.2

%

35.4

%

Franchise rental revenues

31.4

%

28.5

%

31.6

%

28.7

%

Franchise royalties and other

17.8

%

18.1

%

17.4

%

18.0

%

Franchise contributions for advertising

and other services

16.7

%

18.2

%

16.8

%

18.0

%

Total revenues

100.0

%

100.0

%

100.0

%

100.0

%

Operating costs and expenses, net:

Company restaurant costs:

Food and packaging (1)

29.2

%

29.4

%

29.6

%

28.8

%

Payroll and employee benefits (1)

30.4

%

29.5

%

31.0

%

29.5

%

Occupancy and other (1)

15.0

%

14.1

%

15.6

%

14.8

%

Total company restaurant costs (1)

74.6

%

73.0

%

76.2

%

73.1

%

Franchise occupancy expenses (2)

63.9

%

60.6

%

66.7

%

61.1

%

Franchise support and other costs (3)

6.2

%

6.7

%

7.7

%

6.4

%

Franchise advertising and other services

expenses (4)

104.0

%

103.7

%

103.6

%

104.0

%

Selling, general and administrative

expenses

5.6

%

11.0

%

8.6

%

9.1

%

Depreciation and amortization

5.0

%

5.8

%

5.4

%

5.9

%

Impairment and other charges, net

0.3

%

(1.5)

%

(1.0)

%

0.8

%

Gains on the sale of company-operated

restaurants

(0.4)

%

—

%

(0.3)

%

—

%

Earnings from operations

25.5

%

21.7

%

21.5

%

21.1

%

Income tax rate (5)

27.9

%

(17.9)

%

29.0

%

18.4

%

(1) As a percentage of company restaurant sales.

(2) As a percentage of franchise rental revenues.

(3) As a percentage of franchise royalties

and other.

(4) As a percentage of franchise

contributions for advertising and other services.

(5) As a percentage of earnings from

continuing operations and before income taxes.

Jack in the Box system sales (in

thousands):

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Company-owned restaurant sales

$

82,444

$

78,434

$

262,188

$

257,948

Franchised restaurant sales (1)

804,791

747,398

2,480,062

2,428,708

System sales (1)

$

887,235

$

825,832

$

2,742,250

$

2,686,656

(1) Franchised restaurant sales represent

sales at franchised restaurants and are revenues of our

franchisees. System sales include company and franchised restaurant

sales. We do not record franchised sales as revenues; however, our

royalty revenues, marketing fees and percentage rent revenues are

calculated based on a percentage of franchised sales. We believe

franchised and system restaurant sales information is useful to

investors as they have a direct effect on the company's

profitability.

The following table summarizes the year-to-date changes in the

number and mix of Jack in the Box company and franchise

restaurants:

SUPPLEMENTAL RESTAURANT

ACTIVITY INFORMATION

(Unaudited)

2020

2019

Company

Franchise

Total

Company

Franchise

Total

Beginning of year

137

2,106

2,243

137

2,100

2,237

New

—

20

20

—

16

16

Acquired from franchisees

8

(8)

—

—

—

—

Closed

(1)

(18)

(19)

—

(11)

(11)

End of period

144

2,100

2,244

137

2,105

2,242

% of system

6

%

94

%

100

%

6

%

94

%

100

%

JACK IN THE BOX INC. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP MEASUREMENTS TO GAAP RESULTS

(Unaudited)

To supplement the consolidated financial statements, which are

presented in accordance with GAAP, the company uses the following

non-GAAP measures: Operating Earnings Per Share, Adjusted EBITDA,

Restaurant-Level Margin and Franchise-Level Margin. Management

believes that these measurements, when viewed with the company's

results of operations in accordance with GAAP and the accompanying

reconciliations in the tables below, provide useful information

about operating performance and period-over-period changes, and

provide additional information that is useful for evaluating the

operating performance of the company's core business without regard

to potential distortions.

Operating Earnings Per Share

Operating Earnings Per Share represents diluted earnings per

share from continuing operations on a GAAP basis excluding gains or

losses on the sale of company-operated restaurants, restructuring

charges, the gain on sale of corporate office building, pension

settlement charges, loss on early termination of interest rate, and

the excess tax benefits from share-based compensation arrangements

which are now recorded as a component of income tax expense versus

equity prior to fiscal year 2019. Operating Earnings Per Share

should be considered as a supplement to, not as a substitute for,

analysis of results as reported under U.S. GAAP or other similarly

titled measures of other companies. Management believes Operating

Earnings Per Share provides investors with a meaningful supplement

of the company’s operating performance and period-over-period

changes without regard to potential distortions.

Below is a reconciliation of non-GAAP Operating Earnings Per

Share to the most directly comparable GAAP measure, diluted

earnings per share from continuing operations. Figures may not add

due to rounding.

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Diluted earnings per share from continuing

operations – GAAP

$1.40

$0.51

$2.21

$2.67

Loss on early termination of interest rate

swaps

—

0.56

—

0.56

Restructuring charges

—

—

0.04

0.19

Gains on the sale of company-operated

restaurants

(0.03)

—

(0.08)

(0.01)

Gain on sale of corporate office

building

—

—

(0.33)

—

Pension settlement charges

—

—

1.20

—

Operating Earnings Per Share – non-GAAP

(1)

$1.37

$1.07

$3.03

$3.41

(1) Operating Earnings per share may not

add due to rounding.

Adjusted EBITDA

Adjusted EBITDA represents net earnings on a GAAP basis

excluding earnings or losses from discontinued operations, income

taxes, interest expense, net, pension settlement charges, gains or

losses on the sale of company-operated restaurants, impairment and

other charges, net, depreciation and amortization, and the

amortization of franchise tenant improvement allowances and other.

Adjusted EBITDA should be considered as a supplement to, not as a

substitute for, analysis of results as reported under U.S. GAAP or

other similarly titled measures of other companies. Management

believes Adjusted EBITDA is useful to investors to gain an

understanding of the factors and trends affecting the company's

ongoing cash earnings, from which capital investments are made and

debt is serviced.

Below is a reconciliation of non-GAAP Adjusted EBITDA to the

most directly comparable GAAP measure, net earnings (in

thousands).

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Net earnings - GAAP

$

32,555

$

13,189

$

51,915

$

72,376

(Earnings) losses from discontinued

operations, net of taxes

(379)

284

(379)

(2,652)

Income taxes

12,432

(2,048)

21,023

15,699

Interest expense, net

15,700

36,494

51,051

67,144

Pension settlement charges

103

—

39,030

—

Gains on the sale of company-operated

restaurants

(1,050)

—

(2,625)

(219)

Impairment and other charges, net

738

(3,256)

(7,837)

5,567

Depreciation and amortization

12,141

12,786

41,151

42,645

Amortization of franchise tenant

improvement allowances and other

618

387

2,383

1,524

Adjusted EBITDA – non-GAAP

$

72,858

$

57,836

$

195,712

$

202,084

Restaurant-Level Margin

Restaurant-Level Margin is defined as company restaurant sales

less restaurant operating costs (food and packaging, labor, and

occupancy costs) and is neither required by, nor presented in

accordance with GAAP. Restaurant-Level Margin excludes revenues and

expenses of our franchise operations and certain costs, such as

selling, general, and administrative expenses, depreciation and

amortization, impairment and other charges, net, gains or losses on

the sale of company-operated restaurants, and other costs that are

considered normal operating costs. As such, Restaurant-Level Margin

is not indicative of the overall results of the company and does

not accrue directly to the benefit of shareholders because of the

exclusion of corporate-level expenses. Restaurant-Level Margin

should be considered as a supplement to, not as a substitute for,

analysis of results as reported under GAAP or other similarly

titled measures of other companies. The company is presenting

Restaurant-Level Margin because it believes that it provides a

meaningful supplement to net earnings of the company's core

business operating results, as well as a comparison to those of

other similar companies. Management utilizes Restaurant-Level

Margin as a key performance indicator to evaluate the profitability

of company-owned restaurants.

Below is a reconciliation of non-GAAP Restaurant-Level Margin to

the most directly comparable GAAP measure, earnings from operations

(in thousands):

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019

July 5, 2020

July 7, 2019

Earnings from operations - GAAP

$

61,790

$

48,261

$

164,582

$

153,708

Franchise rental revenues

(76,021)

(63,359)

(241,990)

(208,895)

Franchise royalties and other

(43,239)

(40,180)

(133,469)

(130,840)

Franchise contributions for advertising

and other services

(40,571)

(40,386)

(128,458)

(131,189)

Franchise occupancy expenses

48,612

38,371

161,470

127,702

Franchise support and other costs

2,692

2,695

10,339

8,337

Franchise advertising and other services

expenses

42,176

41,882

133,134

136,397

Selling, general and administrative

expenses

13,680

24,389

66,131

66,057

Impairment and other charges, net

738

(3,256)

(7,837)

5,567

Gains on the sale of company-operated

restaurants

(1,050)

—

(2,625)

(219)

Depreciation and amortization

12,141

12,786

41,151

42,645

Restaurant-Level Margin- Non-GAAP

$

20,948

$

21,203

$

62,428

$

69,270

Company restaurant sales

$

82,444

$

78,434

$

262,188

$

257,948

Restaurant-Level Margin % - Non-GAAP

25.4

%

27.0

%

23.8

%

26.9

%

Franchise-Level Margin

Franchise-Level Margin is defined as franchise revenues less

franchise operating costs (occupancy expenses, advertising

contributions, and franchise support and other costs) and is

neither required by, nor presented in accordance with GAAP.

Franchise-Level Margin excludes revenue and expenses of our

company-operated restaurants and certain costs, such as selling,

general, and administrative expenses, depreciation and

amortization, impairment and other charges, net, and other costs

that are considered normal operating costs. As such,

Franchise-Level Margin is not indicative of the overall results of

the company and does not accrue directly to the benefit of

shareholders because of the exclusion of corporate-level expenses.

Franchise-Level Margin should be considered as a supplement to, not

as a substitute for, analysis of results as reported under GAAP or

other similarly titled measures of other companies. The company is

presenting Franchise-Level Margin because it believes that it

provides a meaningful supplement to net earnings of the company's

core business operating results, as well as a comparison to those

of other similar companies. Management utilizes Franchise-Level

Margin as a key performance indicator to evaluate the profitability

of our franchise operations.

Below is a reconciliation of non-GAAP Franchise-Level Margin to

the most directly comparable GAAP measure, earnings from operations

(in thousands):

12 Weeks Ended

40 Weeks Ended

July 5, 2020

July 7, 2019 (1)

July 5, 2020

July 7, 2019 (1)

Earnings from operations - GAAP

$

61,790

$

48,261

$

164,582

$

153,708

Company restaurant sales

(82,444)

(78,434)

(262,188)

(257,948)

Food and packaging

24,077

23,058

77,662

74,350

Payroll and employee benefits

25,085

23,121

81,236

76,163

Occupancy and other

12,334

11,052

40,862

38,165

Selling, general and administrative

expenses

13,680

24,389

66,131

66,057

Impairment and other charges, net

738

(3,256)

(7,837)

5,567

Gains on the sale of company-operated

restaurants

(1,050)

—

(2,625)

(219)

Depreciation and amortization

12,141

12,786

41,151

42,645

Franchise-Level Margin - Non-GAAP

$

66,351

$

60,977

$

198,974

$

198,488

Franchise rental revenues

$

76,021

$

63,359

$

241,990

$

208,895

Franchise royalties and other

43,239

40,180

133,469

130,840

Franchise contributions for advertising

and other services

40,571

40,386

128,458

131,189

Total franchise revenues

$

159,831

$

143,925

$

503,917

$

470,924

Franchise-Level Margin % - Non-GAAP

41.5

%

42.4

%

39.5

%

42.1

%

(1) During the first quarter of 2020, the

Company changed its presentation of Non-GAAP Franchise-Level Margin

to include "amortization of franchise tenant improvement allowances

and other" in its definition thereof. The prior period has been

recast to conform to current year presentation.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200805006009/en/

Investor Contact: Rachel Webb, (858) 571-2683

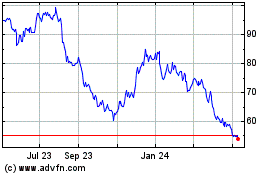

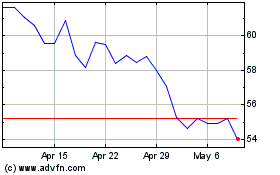

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jack in the Box (NASDAQ:JACK)

Historical Stock Chart

From Apr 2023 to Apr 2024