Assembly Biosciences Reports Second Quarter 2020 Financial Results and Recent Highlights

August 05 2020 - 4:05PM

Assembly Biosciences, Inc. (Nasdaq: ASMB), a clinical-stage

biotechnology company developing innovative therapeutics targeting

hepatitis B virus (HBV) and diseases associated with the

microbiome, today reported financial results and recent highlights

for the second quarter ended June 30, 2020.

“We have continued to advance the clinical development of our

HBV core inhibitors during 2020 with the achievement of key

milestones. In June, patients began coming off combination therapy

in our Phase 2 open-label extension study of ABI-H0731 and will now

be followed to evaluate the sustained virologic response (SVR)

rate. We expect to be able to report data from these patients off

treatment for 24 weeks (SVR24), early next year,” said John

McHutchison, AO, MD, Chief Executive Officer and President of

Assembly Biosciences. “Additionally, in July we established an

important collaboration with BeiGene, a premier scientific partner

with key operational capabilities in China. This will allow us to

accelerate the clinical development and commercialization of our

core inhibitor candidates in China, where up to 90 million

individuals are infected with hepatitis B.”

Second Quarter 2020 and Recent Highlights

|

HBV Portfolio |

|

|

|

|

|

|

|

|

• |

China Collaboration with BeiGene |

|

|

|

|

• |

On July 20, 2020, Assembly announced its license and collaboration

agreement with BeiGene, Ltd. for Assembly’s portfolio of three

clinical-stage core inhibitors (ABI-H0731, ABI-H2158, ABI-H3733) in

China including Hong Kong, Macau and Taiwan. |

|

|

|

|

• |

Assembly received $40 million upfront and is eligible to receive

approximately $500 million in total potential future milestone

payments. Assembly is also eligible to receive tiered royalties on

net product sales. BeiGene will contribute the initial funding for

clinical development in China, with development costs for the

territory shared equally thereafter. |

|

|

• |

ABI-H0731(‘731): Assembly’s lead core inhibitor candidate |

|

|

|

|

• |

Patients achieving stopping criteria are continuing to transition

off combination therapy in the Phase 2 open-label extension study

(Study 211) and are being monitored for sustained virologic

response. |

|

|

|

|

• |

Assembly initiated a Phase 2 exploratory study evaluating treatment

intensification with ‘731 in combination with a nucleos(t)ide

analogue reverse transcriptase inhibitor (NrtI) in patients with

chronic HBV infection who are not completely virologically

suppressed on NrtI therapy alone. Approximately 10-30% of patients

do not completely suppress HBV DNA after a year or more on standard

of care NrtI therapy, and these patients have an unmet need for a

more effective treatment. |

|

|

• |

ABI-H2158 (‘2158), Assembly’s second-generation, more potent core

inhibitor candidate |

|

|

|

|

• |

Assembly initiated a multi-center, randomized, placebo-controlled

Phase 2 trial to evaluate ‘2158 with entecavir versus placebo with

entecavir in treatment naïve HBeAg positive patients with chronic

HBV infection. |

|

|

|

|

• |

The U.S Food and Drug Administration granted Fast Track designation

for ‘2158 for the treatment of chronic HBV Infection. |

|

|

|

|

|

|

|

Microbiome Portfolio |

|

|

|

|

|

|

|

|

• |

Assembly presented preclinical data from its immuno-oncology

microbiome program in an e-poster at the American Association for

Cancer Research (AACR) 2020 Virtual Annual Meeting. |

|

|

• |

Assembly will regain worldwide rights to the gastrointestinal

programs previously licensed to AbbVie (formerly Allergan

pre-acquisition) in the fourth quarter of 2020. The Company is

exploring strategic alternatives with respect to its microbiome

portfolio. |

|

|

|

|

|

|

|

Corporate Highlights |

|

|

|

|

|

|

|

|

• |

In June 2020, William Delaney IV, PhD joined as Chief Scientific

Officer, Virology. |

Anticipated Milestones and Events

|

HBV Portfolio |

|

|

|

|

|

|

|

|

• |

‘731 |

|

|

|

|

• |

Additional interim analyses from Study 211 will be presented at the

European Association for the Study of the Liver’s (EASL) Digital

International Liver Congress, rescheduled to August 27-29, 2020;

abstracts were accepted as an oral presentation (HBeAg negative

patients) and as a late-breaking poster (HBeAg positive

patients). |

|

|

• |

’2158 |

|

|

|

|

• |

Phase 1b clinical data on multiple dose cohorts will be presented

as a late-breaking poster at EASL. |

|

|

• |

The analytical methodologies for Assembly’s highly sensitive HBV

nucleic acid (DNA and pgRNA) assays will be featured in a poster at

EASL. |

|

|

|

|

|

|

|

Upcoming Events and Conferences |

|

|

• |

William Blair Biotech Focus Conference: August 6, 2020 |

|

|

• |

Baird’s 2020 Global Healthcare Conference: September 9, 2020 |

Second Quarter 2020 Financial Results

|

|

• |

Cash, cash equivalents and marketable securities

were $226.7 million as of June 30, 2020, compared to $249.1 million

as of March 31, 2020. This excludes the $40.0 million upfront

payment received in July 2020 as part of the collaboration

agreement with BeiGene. Including the proceeds from the

collaboration, Assembly’s cash position is projected to fund

operations into the second half of 2022. |

|

|

• |

Revenues from collaborative research were $39.4

million for the three months ended June 30, 2020 compared to $3.1

million for the same period in 2019. This includes the recognition

of deferred revenue and reimbursements incurred under the

collaboration agreement with AbbVie (formerly Allergan

pre-acquisition) for which AbbVie provided written notice of

termination in June 2020. As a result, we recognized the remaining

deferred revenue balance of $36.0 million. Assembly will continue

to recognize additional collaboration revenue into the fourth

quarter of 2020 for reimbursement activities that occur through the

120-day transition period. |

|

|

• |

Research and development expenses were $23.3

million for the three months ended June 30, 2020, compared to $18.7

million for the same period in 2019. The increase was primarily due

to an increase of $3.9 million in research and development expenses

related to the HBV program. Research and development expenses

include non-cash stock-based compensation expenses of $3.6 million

for the three months ended June 30, 2020 and $3.1 million for the

same period in 2019. |

|

|

• |

General and administrative expenses were $9.5

million for the three months ended June 30, 2020 compared to $4.1

million for the same period in 2019. The increase was primarily due

to a non-recurring reversal of previously recognized stock-based

compensation expense of $3.6 million related to forfeited awards

following the departure of one of Assembly’s former executive

officers in 2019. General and administrative expenses include

non-cash stock-based compensation expenses of $3.5 million for the

three months ended June 30, 2020 and $(1.1) million for the same

period in 2019. |

|

|

• |

Net income (loss) attributable to common

stockholders was $7.5 million, or $0.21 per basic and

$0.19 per diluted share, for the three months ended June 30, 2020

compared to $(18.5) million, or $(0.72) per basic and diluted

share, for the same period in 2019. This was primarily due to the

recognition of the remaining deferred revenue balance as noted

above. |

About Assembly BiosciencesAssembly

Biosciences, Inc. is a clinical-stage biotechnology company

developing innovative therapeutics targeting hepatitis B virus

(HBV) and diseases associated with the microbiome. The HBV program

is focused on advancing a new class of potent, oral core inhibitors

that have the potential to increase cure rates for chronically

infected patients. The microbiome program is developing novel

oral live microbial biotherapeutic candidates with Assembly’s fully

integrated platform, including a robust process for strain

identification and selection, GMP manufacturing expertise and

targeted delivery to the lower gastrointestinal tract with the

GEMICEL® technology. For more information, visit

assemblybio.com.

Forward-Looking Statements The information in

this press release contains forward-looking statements that are

subject to certain risks and uncertainties that could cause actual

results to materially differ. These risks and uncertainties

include: Assembly’s ability to initiate and complete clinical

trials involving its HBV Cure and Microbiome therapeutic product

candidates in the currently anticipated timeframes; safety and

efficacy data from clinical studies may not warrant further

development of Assembly’s product candidates; clinical and

nonclinical data presented at conferences may not differentiate

Assembly’s product candidates from other companies’ candidates;

Assembly may not observe sustained virologic response in patients

who stop therapy in Study 211; the timing and ability to implement

strategic alternatives with respect to the Microbiome program;

Assembly’s ability to maintain financial resources necessary to

continue its clinical trials and fund business operations; any

impact that the spread of the coronavirus and resulting COVID-19

pandemic may have on Assembly’s business and operations, including

initiation and continuation of its clinical trials or timing of

discussions with regulatory authorities; and other risks identified

from time to time in Assembly’s reports filed with the U.S.

Securities and Exchange Commission (the SEC). You are urged to

consider statements that include the words may, will, would, could,

should, might, believes, hopes, estimates, projects, potential,

expects, plans, anticipates, intends, continues, forecast,

designed, goal or the negative of those words or other comparable

words to be uncertain and forward-looking. Assembly intends such

forward-looking statements to be covered by the safe harbor

provisions contained in Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. More information about Assembly’s risks and

uncertainties are more fully detailed under the heading “Risk

Factors” in Assembly's filings with the SEC, including its most

recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. Except as required by law,

Assembly assumes no obligation to update publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Contacts

Lauren GlaserSenior Vice President, Investor Relations and

Corporate Affairs(415) 521-3828lglaser@assemblybio.com

Solebury TroutLuke Brown(646) 378-2944lbrown@troutgroup.com

|

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(In thousands except for share amounts and par

value) |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

2020 |

|

2019 |

|

|

(Unaudited) |

|

|

|

ASSETS |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

96,709 |

|

|

$ |

46,732 |

|

|

Marketable securities |

|

130,005 |

|

|

|

227,311 |

|

|

Accounts receivable from collaboration |

|

3,315 |

|

|

|

3,374 |

|

|

Prepaid expenses and other current assets |

|

5,059 |

|

|

|

5,363 |

|

|

Total current assets |

|

235,088 |

|

|

|

282,780 |

|

|

|

|

|

|

|

Property and equipment, net |

|

2,063 |

|

|

|

1,830 |

|

|

Operating lease right-of-use (ROU) assets |

|

10,780 |

|

|

|

11,975 |

|

|

Other assets |

|

5,232 |

|

|

|

1,684 |

|

|

Indefinite-lived intangible asset |

|

29,000 |

|

|

|

29,000 |

|

|

Goodwill |

|

12,638 |

|

|

|

12,638 |

|

|

Total assets |

$ |

294,801 |

|

|

$ |

339,907 |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

Current liabilities |

|

|

|

|

Accounts payable |

$ |

3,640 |

|

|

$ |

1,731 |

|

|

Accrued clinical expenses |

|

4,362 |

|

|

|

4,826 |

|

|

Other accrued expenses |

|

6,019 |

|

|

|

8,286 |

|

|

Deferred revenue - short-term |

|

— |

|

|

|

6,411 |

|

|

Operating lease liabilities - short-term |

|

3,250 |

|

|

|

3,186 |

|

|

Total current liabilities |

|

17,271 |

|

|

|

24,440 |

|

|

|

|

|

|

|

Deferred tax liabilities |

|

2,531 |

|

|

|

2,531 |

|

|

Deferred revenue - long-term |

|

— |

|

|

|

30,637 |

|

|

Operating lease liabilities - long-term |

|

7,884 |

|

|

|

9,082 |

|

|

Total liabilities |

|

27,686 |

|

|

|

66,690 |

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

Preferred stock, $0.001 par value; 5,000,000 shares authorized; no

shares issued or outstanding |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 100,000,000 shares authorized as of

June 30, 2020 and December 31, 2019; 32,807,519 and 32,558,307

shares issued and outstanding as of June 30, 2020 and December

31, 2019, respectively |

|

33 |

|

|

|

32 |

|

|

Additional paid-in capital |

|

725,784 |

|

|

|

712,807 |

|

|

Accumulated other comprehensive income (loss) |

|

104 |

|

|

|

(201 |

) |

|

Accumulated deficit |

|

(458,806 |

) |

|

|

(439,421 |

) |

|

Total stockholders' equity |

|

267,115 |

|

|

|

273,217 |

|

|

Total liabilities and stockholders' equity |

$ |

294,801 |

|

|

$ |

339,907 |

|

| |

|

|

|

|

ASSEMBLY BIOSCIENCES, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) |

|

(In thousands except for share and per share amounts) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

Collaboration revenue |

$ |

39,376 |

|

|

$ |

3,080 |

|

|

$ |

43,457 |

|

|

$ |

6,966 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

23,327 |

|

|

|

18,700 |

|

|

|

46,373 |

|

|

|

41,405 |

|

|

General and administrative |

|

9,470 |

|

|

|

4,080 |

|

|

|

18,199 |

|

|

|

13,597 |

|

|

Total operating expenses |

|

32,797 |

|

|

|

22,780 |

|

|

|

64,572 |

|

|

|

55,002 |

|

|

Income (loss) from operations |

|

6,579 |

|

|

|

(19,700 |

) |

|

|

(21,115 |

) |

|

|

(48,036 |

) |

|

|

|

|

|

|

|

|

|

|

Other income |

|

|

|

|

|

|

|

|

Interest and other income, net |

|

691 |

|

|

|

1,186 |

|

|

|

1,730 |

|

|

|

2,463 |

|

|

Total other income |

|

691 |

|

|

|

1,186 |

|

|

|

1,730 |

|

|

|

2,463 |

|

|

Income (loss) before income taxes |

|

7,270 |

|

|

|

(18,514 |

) |

|

|

(19,385 |

) |

|

|

(45,573 |

) |

|

|

|

|

|

|

|

|

|

|

Income tax benefit |

|

— |

|

|

|

11 |

|

|

|

— |

|

|

|

18 |

|

|

Net income (loss) |

$ |

7,270 |

|

|

$ |

(18,503 |

) |

|

$ |

(19,385 |

) |

|

$ |

(45,555 |

) |

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

Unrealized gain on marketable securities, net of tax |

|

190 |

|

|

|

52 |

|

|

|

305 |

|

|

|

160 |

|

|

Comprehensive income (loss) |

$ |

7,460 |

|

|

$ |

(18,451 |

) |

|

$ |

(19,080 |

) |

|

$ |

(45,395 |

) |

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, basic |

$ |

0.21 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.55 |

) |

|

$ |

(1.77 |

) |

|

Weighted average common shares outstanding, basic |

|

35,307,669 |

|

|

|

25,740,500 |

|

|

|

35,229,570 |

|

|

|

25,690,617 |

|

|

Net income (loss) per share, diluted |

$ |

0.19 |

|

|

$ |

(0.72 |

) |

|

$ |

(0.55 |

) |

|

$ |

(1.77 |

) |

|

Weighted average common shares outstanding, diluted |

|

37,291,474 |

|

|

|

25,740,500 |

|

|

|

35,229,570 |

|

|

|

25,690,617 |

|

| |

|

|

|

|

|

|

|

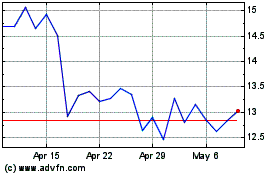

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assembly Biosciences (NASDAQ:ASMB)

Historical Stock Chart

From Apr 2023 to Apr 2024