Viper Energy Partners LP (NASDAQ:VNOM) (“Viper” or the “Company”),

a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG)

(“Diamondback”), today announced financial and operating results

for the second quarter ended June 30, 2020.

SECOND QUARTER HIGHLIGHTS

- Q2 2020 consolidated net loss (including non-controlling

interest) of $(33.1) million; adjusted net loss (as defined and

reconciled below) of $(4.2) million

- Consolidated Adjusted EBITDA (as defined and reconciled below)

of $26.6 million and cash available for distribution to Viper’s

common limited partner units (as reconciled below) of $8.1

million

- Q2 2020 average production of 14,453 bo/d (24,508 boe/d), an

increase of 9% from Q2 2019 average daily oil production

- Q2 2020 cash distribution of $0.03 per common unit

- Due to the current uncertainty in the commodity markets, Viper

has temporarily reduced its distribution to approximately 25% of

cash available for distribution with the retained cash flow

expected to be used to strengthen the balance sheet; the Board of

Directors of Viper’s General Partner reviews the distribution

policy quarterly

- 134 total gross (2.4 net 100% royalty interest) horizontal

wells turned to production on Viper’s acreage during Q2 2020 with

an average lateral length of 8,648 feet

- Initiating average production guidance for Q3 2020 and Q4 2020

of 14,750 to 16,000 bo/d (24,500 to 26,500 boe/d), the midpoint of

which is up 6% from Q2 2020 average daily oil production

- Narrowing full year 2020 average production guidance to 15,250

to 16,000 bo/d (25,250 to 26,250 boe/d)

- As of July 14, 2020, there were approximately 485 gross

horizontal wells currently in the process of active development on

Viper’s acreage, in which Viper expects to own an average 1.7% net

royalty interest (8.1 net 100% royalty interest wells)

- Approximately 440 gross (8.8 net 100% royalty interest)

line-of-sight wells that are not currently in the process of active

development, but for which we have visibility to the potential of

future development in coming quarters, based on Diamondback’s

current completion schedule and third party operators’ permits

- Q1 2020 and Q2 2020 distributions reasonably estimated to not

constitute dividends for U.S. federal income tax purposes; instead

should generally constitute non-taxable reductions to the tax

basis

“Viper’s production in the second quarter was

supported by 14 of Diamondback’s 15 completions in the quarter

having more than an 8% average royalty interest net to Viper, as

third party activity was minimal and some operators curtailed

existing production. Looking ahead to the second half of

2020, we expect Viper’s production to grow sequentially through the

end of the year supported by Diamondback’s completion schedule

which is focused on areas where Viper has significant mineral

ownership, primarily in the Midland Basin. This activity

should lead to strong fourth quarter 2020 exit rate production and

demonstrates the differentiated relationship between Diamondback

and Viper versus other mineral and royalty peers,” stated Travis

Stice, Chief Executive Officer of Viper’s general partner.

FINANCIAL UPDATE

Viper’s second quarter 2020 average realized

prices were $21.00 per barrel of oil, $0.46 per Mcf of natural gas

and $7.69 per barrel of natural gas liquids, resulting in a total

equivalent realized price of $14.55/boe.

During the second quarter of 2020, the Company

recorded total operating income of $32.7 million and consolidated

net loss (including non-controlling interest) of $(33.1)

million.

As of June 30, 2020, the Company had a cash

balance of $9.7 million and $426.5 million available under its

revolving credit facility. During the second quarter, the

Company repurchased $14.1 million of the outstanding principal of

its 5.375% Senior Notes due 2027 (the “Notes) at a 1.5% to 2.5%

discount to par value. Subsequent to the end of the second

quarter, Viper has repurchased an additional $6.0 million of the

outstanding notes at a 1.5% discount to par value. The

aggregate repurchases brought the total outstanding principal

amount of Notes down to $479.9 million as of July 23, 2020.

SECOND QUARTER 2020 CASH

DISTRIBUTION

The Board of Directors of Viper’s General

Partner (the “Board”) declared a cash distribution for the three

months ended June 30, 2020 of $0.03 per common unit. The

distribution is payable on August 20, 2020 to eligible common

unitholders of record at the close of business on August 13,

2020. This distribution represents approximately 25% of total

cash available for distribution with the remaining available cash

flow from the second quarter of 2020 expected to be used to

strengthen the Company’s balance sheet. The Board reviews

Viper’s distribution policy quarterly.

On May 21, 2020, Viper made a cash distribution

to its unitholders and subsequently has reasonably estimated that

such distribution, as well as the distribution payable on August

20, 2020, should not constitute dividends for U.S. federal income

tax purposes. Rather, these distributions should generally

constitute non-taxable reductions to the tax basis of each

distribution recipient’s ownership interest in Viper. The

Form 8937 containing additional information may be found on

www.viperenergy.com under the “Investor Relations” section of

the site.

OPERATIONS AND ACQUISITIONS UPDATE

During the second quarter 2020, there was

limited completion activity on our mineral and royalty acreage as

our operators reacted quickly to oil price volatility by cutting

capital expenditures and mostly ceasing completion activity.

As a result, during the second quarter, Viper estimates that 134

gross (2.4 net 100% royalty interest) horizontal wells with an

average royalty interest of 1.8% were turned to production on its

existing acreage position with an average lateral length of 8,648

feet. Of these 134 gross wells, Diamondback is the operator of 14

with an average royalty interest of 8.4%, and the remaining 120

gross wells, with an average royalty interest of 1.1%, are operated

by third parties.

During the second quarter of 2020, Viper did not

complete any acquisitions, leaving its footprint of mineral and

royalty interests at a total of 24,714 net royalty acres.

The following table summarizes Viper’s gross

well information as of July 14, 2020:

| |

As of July 14, 2020 |

|

|

Diamondback Operated |

|

Third Party Operated |

|

Total |

| Horizontal wells

turned to production: |

|

|

|

|

|

|

Gross wells |

14 |

|

120 |

|

134 |

|

Net 100% royalty interest wells |

1.2 |

|

1.3 |

|

2.4 |

|

Average percent net royalty interest |

8.4% |

|

1.1% |

|

1.8% |

| |

|

|

|

|

|

| Horizontal producing

well count: |

|

|

|

|

|

|

Gross wells |

1,079 |

|

3,401 |

|

4,480 |

|

Net 100% royalty interest wells |

84.4 |

|

51.8 |

|

136.2 |

|

Average percent net royalty interest |

7.8% |

|

1.5% |

|

3.0% |

| |

|

|

|

|

|

| Horizontal active

development well count: |

|

|

|

|

|

|

Gross wells |

66 |

|

419 |

|

485 |

|

Net 100% royalty interest wells |

5.2 |

|

2.9 |

|

8.1 |

|

Average percent net royalty interest |

7.9% |

|

0.7% |

|

1.7% |

| |

|

|

|

|

|

| Line of sight

wells: |

|

|

|

|

|

|

Gross wells |

74 |

|

366 |

|

440 |

|

Net 100% royalty interest wells |

4.3 |

|

4.5 |

|

8.8 |

|

Average percent net royalty interest |

5.8% |

|

1.2% |

|

2.0% |

Despite the continued depressed commodity price

environment, there continues to be active development across

Viper’s asset base, however, near-term activity is expected to be

driven primarily by Diamondback operations. The 485 gross wells

currently in the process of active development are those wells that

have been spud and are expected to be turned to production within

approximately the next six to eight months. The 440 line-of-sight

wells are those that are not currently in the process of active

development, but for which Viper has reason to believe that they

will be turned to production within approximately the next 15 to 18

months. The expected timing of these line-of-sight wells is based

primarily on permitting by third party operators or Diamondback’s

current expected completion schedule. Existing permits or active

development of our royalty acreage does not ensure that those wells

will be turned to production given the current depressed oil

prices.

GUIDANCE UPDATE

Below is Viper’s revised guidance for the full

year 2020, as well as average production guidance for Q3 2020 and

Q4 2020.

|

|

|

| |

Viper Energy Partners |

|

|

|

| Q3 2020 / Q4 2020 Net

Production - MBo/d |

14.75 - 16.00 |

| Q3 2020 / Q4 2020 Net

Production - MBoe/d |

24.50 - 26.50 |

| Full Year 2020 Net Production

- MBo/d |

15.25 - 16.00 |

| Full Year 2020 Net Production

- MBoe/d |

25.25 - 26.25 |

| |

|

| Unit costs ($/boe) |

|

| Depletion |

$9.50 - $11.50 |

| Cash G&A |

$0.60 - $0.80 |

| Non-Cash Unit-Based

Compensation |

$0.10 - $0.25 |

| Interest Expense (a) |

$3.25 - $3.75 |

| |

|

| Production and Ad Valorem

Taxes (% of Revenue) (b) |

7% - 8% |

(a) Assumes 1H2020 actual interest expense plus interest expense

for the remainder of 2020 assuming $480mm in principal of Sr. Notes

and $155mm drawn on the revolver.(b) Includes production taxes of

4.6% for crude oil and 7.5% for natural gas and NGLs and ad valorem

taxes.

CONFERENCE CALL

Viper will host a conference call and webcast

for investors and analysts to discuss its results for the second

quarter of 2020 on Tuesday, August 4, 2020 at 10:00 a.m. CT.

Participants should call (844) 400-1537 (United States/Canada) or

(703) 326-5198 (International) and use the confirmation code

6714088. A telephonic replay will be available from 1:00 p.m. CT on

Tuesday, August 4, 2020 through Tuesday, August 11, 2020 at 1:00

p.m. CT. To access the replay, call (855) 859-2056 (United

States/Canada) or (404) 537-3406 (International) and enter

confirmation code 6714088. A live broadcast of the earnings

conference call will also be available via the internet at

www.viperenergy.com under the “Investor Relations” section of

the site. A replay will also be available on the website

following the call.

About Viper Energy Partners LP

Viper is a limited partnership formed by

Diamondback to own, acquire and exploit oil and natural gas

properties in North America, with a focus on owning and acquiring

mineral and royalty interests in oil-weighted basins, primarily the

Permian Basin and the Eagle Ford Shale. For more information,

please visit www.viperenergy.com.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves in the Permian

Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains forward-looking

statements within the meaning of the federal securities laws.

All statements, other than historical facts, that address

activities that Viper assumes, plans, expects, believes, intends or

anticipates (and other similar expressions) will, should or may

occur in the future are forward-looking statements. The

forward-looking statements are based on management’s current

beliefs, based on currently available information, as to the

outcome and timing of future events, including specifically the

statements regarding the current adverse industry and macroeconomic

conditions, depressed commodity prices, production levels on

properties in which Viper has mineral and royalty interests, any

potential regulatory action that may impose production limits on

Viper’s royalty acreage, the recent acquisitions, Diamondback’s

plans for the acreage discussed above, development activity by

other operators, Viper’s cash distribution policy and the impact of

the ongoing COVID-19 pandemic. These forward-looking statements

involve certain risks and uncertainties that could cause the

results to differ materially from those expected by the management

of Viper. Information concerning these risks and other

factors can be found in Viper’s filings with the Securities and

Exchange Commission, including its Forms 10-K, 10-Q and 8-K, which

can be obtained free of charge on the Securities and Exchange

Commission’s web site at http://www.sec.gov. Viper undertakes no

obligation to update or revise any forward-looking statement.

|

Viper Energy Partners LP |

|

Consolidated Balance Sheets |

|

(unaudited, in thousands, except unit

amounts) |

| |

|

|

|

| |

June 30, |

|

December 31, |

| |

2020 |

|

2019 |

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

9,663 |

|

|

$ |

3,602 |

|

|

Royalty income receivable (net of allowance for credit losses) |

32,118 |

|

|

58,089 |

|

|

Royalty income receivable—related party |

917 |

|

|

10,576 |

|

|

Other current assets |

482 |

|

|

397 |

|

|

Total current assets |

43,180 |

|

|

72,664 |

|

| Property: |

|

|

|

|

Oil and natural gas interests, full cost method of accounting

($1,480,346 and $1,551,767 excluded from depletion at June 30,

2020 and December 31, 2019, respectively) |

2,933,731 |

|

|

2,868,459 |

|

|

Land |

5,688 |

|

|

5,688 |

|

|

Accumulated depletion and impairment |

(373,898 |

) |

|

(326,474 |

) |

|

Property, net |

2,565,521 |

|

|

2,547,673 |

|

| Deferred tax asset (net of

allowance) |

— |

|

|

142,466 |

|

| Other assets |

15,572 |

|

|

22,823 |

|

|

Total assets |

$ |

2,624,273 |

|

|

$ |

2,785,626 |

|

|

Liabilities and Unitholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

11 |

|

|

$ |

— |

|

|

Accounts payable—related party |

— |

|

|

150 |

|

|

Accrued liabilities |

12,439 |

|

|

13,282 |

|

|

Derivative instruments |

33,956 |

|

|

— |

|

|

Total current liabilities |

46,406 |

|

|

13,432 |

|

| Long-term debt, net |

630,507 |

|

|

586,774 |

|

| Derivative instruments |

5,875 |

|

|

— |

|

|

Total liabilities |

682,788 |

|

|

600,206 |

|

| Commitments and

contingencies |

|

|

|

| Unitholders’ equity: |

|

|

|

|

General partner |

849 |

|

|

889 |

|

|

Common units (67,831,342 units issued and outstanding as of

June 30, 2020 and 67,805,707 units issued and outstanding as

of December 31, 2019) |

728,149 |

|

|

929,116 |

|

|

Class B units (90,709,946 units issued and outstanding

June 30, 2020 and December 31, 2019) |

1,080 |

|

|

1,130 |

|

|

Total Viper Energy Partners LP unitholders’ equity |

730,078 |

|

|

931,135 |

|

| Non-controlling interest |

1,211,407 |

|

|

1,254,285 |

|

|

Total equity |

1,941,485 |

|

|

2,185,420 |

|

|

Total liabilities and unitholders’ equity |

$ |

2,624,273 |

|

|

$ |

2,785,626 |

|

|

Viper Energy Partners LP |

|

Consolidated Statements of Operations |

|

(unaudited, in thousands, except per unit

data) |

| |

|

|

|

|

|

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2020 |

2019 |

|

2020 |

2019 |

| Operating

income: |

|

|

|

|

|

|

Royalty income |

$ |

32,444 |

|

$ |

70,442 |

|

|

$ |

109,273 |

|

$ |

130,870 |

|

|

Lease bonus income |

23 |

|

1,749 |

|

|

1,645 |

|

2,909 |

|

|

Other operating income |

202 |

|

3 |

|

|

443 |

|

5 |

|

|

Total operating income |

32,669 |

|

72,194 |

|

|

111,361 |

|

133,784 |

|

| Costs and

expenses: |

|

|

|

|

|

|

Production and ad valorem taxes |

3,110 |

|

4,389 |

|

|

9,257 |

|

8,081 |

|

|

Depletion |

22,782 |

|

16,512 |

|

|

47,424 |

|

32,711 |

|

|

General and administrative expenses |

1,683 |

|

1,723 |

|

|

4,349 |

|

3,418 |

|

|

Total costs and expenses |

27,575 |

|

22,624 |

|

|

61,030 |

|

44,210 |

|

| Income from

operations |

5,094 |

|

49,570 |

|

|

50,331 |

|

89,574 |

|

| Other income

(expense): |

|

|

|

|

|

|

Interest expense, net |

(7,669 |

) |

(2,713 |

) |

|

(16,632 |

) |

(7,262 |

) |

|

Loss on derivative instruments, net |

(34,443 |

) |

— |

|

|

(42,385 |

) |

— |

|

|

Gain (loss) on revaluation of investment |

3,443 |

|

50 |

|

|

(6,677 |

) |

3,642 |

|

|

Other income, net |

519 |

|

547 |

|

|

923 |

|

1,203 |

|

|

Total other expense, net |

(38,150 |

) |

(2,116 |

) |

|

(64,771 |

) |

(2,417 |

) |

| (Loss) income before

income taxes |

(33,056 |

) |

47,454 |

|

|

(14,440 |

) |

87,157 |

|

| Provision for (benefit from)

income taxes |

— |

|

180 |

|

|

142,466 |

|

(34,428 |

) |

| Net (loss)

income |

(33,056 |

) |

47,274 |

|

|

(156,906 |

) |

121,585 |

|

| Net (loss) income attributable

to non-controlling interest |

(11,304 |

) |

45,009 |

|

|

7,015 |

|

85,541 |

|

| Net (loss) income

attributable to Viper Energy Partners LP |

$ |

(21,752 |

) |

$ |

2,265 |

|

|

$ |

(163,921 |

) |

$ |

36,044 |

|

| |

|

|

|

|

|

| Net (loss) income

attributable to common limited partner units: |

|

|

|

|

|

|

Basic |

$ |

(0.32 |

) |

$ |

0.04 |

|

|

$ |

(2.42 |

) |

$ |

0.61 |

|

|

Diluted |

$ |

(0.32 |

) |

$ |

0.04 |

|

|

$ |

(2.42 |

) |

$ |

0.61 |

|

| Weighted average

number of common limited partner units outstanding: |

|

|

|

|

|

|

Basic |

67,831 |

|

62,628 |

|

|

67,827 |

|

59,058 |

|

|

Diluted |

67,831 |

|

62,664 |

|

|

67,827 |

|

59,094 |

|

|

Viper Energy Partners LP |

|

Consolidated Statements of Cash Flows |

|

(unaudited, in thousands) |

| |

|

|

|

| |

Six Months Ended June 30, |

| |

2020 |

|

2019 |

| Cash flows from

operating activities: |

|

|

|

|

Net (loss) income |

$ |

(156,906 |

) |

|

$ |

121,585 |

|

|

Adjustments to reconcile net (loss) income to net cash provided by

operating activities: |

|

|

|

|

Provision for (benefit from) income taxes |

142,466 |

|

|

(34,536 |

) |

|

Depletion |

47,424 |

|

|

32,711 |

|

|

Loss on derivative instruments, net |

42,385 |

|

|

— |

|

|

Net cash payments on derivatives |

(2,554 |

) |

|

— |

|

|

Gain on extinguishment of debt |

(14 |

) |

|

— |

|

|

Loss (gain) on revaluation of investment |

6,677 |

|

|

(3,642 |

) |

|

Amortization of debt issuance costs |

1,152 |

|

|

441 |

|

|

Non-cash unit-based compensation |

670 |

|

|

877 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Royalty income receivable, net |

25,971 |

|

|

(7,996 |

) |

|

Royalty income receivable—related party |

9,659 |

|

|

(5,549 |

) |

|

Accounts payable and accrued liabilities |

(832 |

) |

|

(2,238 |

) |

|

Accounts payable—related party |

(150 |

) |

|

— |

|

|

Income tax payable |

— |

|

|

108 |

|

|

Other current assets |

(85 |

) |

|

(41 |

) |

| Net cash provided

by operating activities |

115,863 |

|

|

101,720 |

|

| Cash flows from

investing activities: |

|

|

|

|

Acquisitions of oil and natural gas interests |

(65,272 |

) |

|

(125,231 |

) |

|

Funds held in escrow |

— |

|

|

(13,215 |

) |

| Net cash used in

investing activities |

(65,272 |

) |

|

(138,446 |

) |

| Cash flows from

financing activities: |

|

|

|

|

Proceeds from borrowings under credit facility |

92,000 |

|

|

171,000 |

|

|

Repayment on credit facility |

(35,000 |

) |

|

(369,500 |

) |

|

Debt issuance costs |

(44 |

) |

|

(258 |

) |

|

Repayment of senior notes |

(13,787 |

) |

|

— |

|

|

Proceeds from public offerings |

— |

|

|

340,860 |

|

|

Public offering costs |

— |

|

|

(221 |

) |

|

Units purchased for tax withholding |

(383 |

) |

|

(353 |

) |

|

Distributions to General Partner |

(40 |

) |

|

(40 |

) |

|

Distributions to public |

(36,928 |

) |

|

(49,491 |

) |

|

Distributions to Diamondback |

(50,348 |

) |

|

(65,143 |

) |

| Net cash (used in)

provided by financing activities |

(44,530 |

) |

|

26,854 |

|

| Net increase

(decrease) in cash |

6,061 |

|

|

(9,872 |

) |

| Cash and cash

equivalents at beginning of period |

3,602 |

|

|

22,676 |

|

| Cash and cash

equivalents at end of period |

$ |

9,663 |

|

|

$ |

12,804 |

|

| |

|

|

|

|

Supplemental disclosure of cash flow

information: |

|

|

|

|

Interest paid |

$ |

17,918 |

|

|

$ |

2,382 |

|

|

Viper Energy Partners LP |

|

Selected Operating Data |

|

(unaudited) |

| |

|

|

|

|

|

| |

|

| |

Three Months Ended June 30, 2020 |

|

Three Months Ended March 31, 2020 |

|

Three Months Ended June 30, 2019 |

| Production

Data: |

|

|

|

|

|

|

Oil (MBbls) |

1,315 |

|

|

1,587 |

|

|

1,202 |

|

|

Natural gas (MMcf) |

2,685 |

|

|

2,658 |

|

|

1,640 |

|

|

Natural gas liquids (MBbls) |

467 |

|

|

479 |

|

|

308 |

|

|

Combined volumes (MBOE)(1) |

2,230 |

|

|

2,509 |

|

|

1,783 |

|

| |

|

|

|

|

|

|

Average daily oil volumes (BO/d) |

14,453 |

|

|

17,441 |

|

|

13,205 |

|

|

Average daily combined volumes (BOE/d) |

24,508 |

|

|

27,575 |

|

|

19,597 |

|

| |

|

|

|

|

|

| Average sales

prices: |

|

|

|

|

|

|

Oil ($/Bbl) |

$ |

21.00 |

|

|

$ |

45.49 |

|

|

$ |

54.81 |

|

|

Natural gas ($/Mcf) |

$ |

0.46 |

|

|

$ |

0.13 |

|

|

$ |

(0.65 |

) |

|

Natural gas liquids ($/Bbl) |

$ |

7.69 |

|

|

$ |

8.94 |

|

|

$ |

18.33 |

|

|

Combined ($/BOE)(2) |

$ |

14.55 |

|

|

$ |

30.62 |

|

|

$ |

39.50 |

|

| |

|

|

|

|

|

|

Oil, hedged ($/Bbl)(3) |

$ |

22.39 |

|

|

$ |

45.49 |

|

|

$ |

54.81 |

|

|

Natural gas, hedged ($/Mcf)(3) |

$ |

(1.01 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.65 |

) |

|

Natural gas liquids ($/Bbl)(3) |

$ |

7.69 |

|

|

$ |

8.94 |

|

|

$ |

18.33 |

|

|

Combined price, hedged ($/BOE)(3) |

$ |

13.60 |

|

|

$ |

30.44 |

|

|

$ |

39.50 |

|

| |

|

|

|

|

|

| Average Costs

($/BOE): |

|

|

|

|

|

|

Production and ad valorem taxes |

$ |

1.39 |

|

|

$ |

2.45 |

|

|

$ |

2.46 |

|

|

General and administrative - cash component |

0.63 |

|

|

0.91 |

|

|

0.70 |

|

|

Total operating expense - cash |

$ |

2.02 |

|

|

$ |

3.36 |

|

|

$ |

3.16 |

|

| |

|

|

|

|

|

|

General and administrative - non-cash component |

$ |

0.13 |

|

|

$ |

0.15 |

|

|

$ |

0.26 |

|

|

Interest expense, net |

$ |

3.44 |

|

|

$ |

3.57 |

|

|

$ |

1.52 |

|

|

Depletion |

$ |

10.21 |

|

|

$ |

9.82 |

|

|

$ |

9.26 |

|

(1) Bbl equivalents are calculated using a conversion rate of

six Mcf per one Bbl.(2) Realized price net of all deducts for

gathering, transportation and processing.(3) Hedged prices reflect

the effect of our matured commodity derivative transactions on our

average sales prices. Our calculation of such effects includes

realized gains and losses on cash settlements for commodity

derivatives, which we do not designate for hedge accounting. We did

not have any derivative contracts prior to February of 2020.

NON-GAAP FINANCIAL MEASURES

Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

our financial statements, such as industry analysts, investors,

lenders and rating agencies. Viper defines Adjusted EBITDA as

net income (loss) plus interest expense, net, non-cash unit-based

compensation expense, depletion, loss (gain) on revaluation of

investments, non-cash loss (gain) on derivative instruments, gain

on extinguishment of debt and provision for (benefit from) income

taxes. Adjusted EBITDA is not a measure of net income as determined

by United States’ generally accepted accounting principles

(“GAAP”). Management believes Adjusted EBITDA is useful

because it allows them to more effectively evaluate Viper’s

operating performance and compare the results of its operations

from period to period without regard to its financing methods or

capital structure. Adjusted EBITDA should not be considered as an

alternative to, or more meaningful than, net income, royalty

income, cash flow from operating activities or any other measure of

financial performance or liquidity presented as determined in

accordance with GAAP. Certain items excluded from Adjusted EBITDA

are significant components in understanding and assessing a

company’s financial performance, such as a company’s cost of

capital and tax structure, as well as the historic costs of

depreciable assets, none of which are components of Adjusted

EBITDA. Viper defines cash available for distribution

generally as an amount equal to its Adjusted EBITDA for the

applicable quarter less cash needed for income taxes payable, debt

service, contractual obligations, fixed charges and reserves for

future operating or capital needs that the board of directors of

Viper’s general partner may deem appropriate, common units

repurchased for tax withholding, dividend equivalent rights and

preferred distributions. Viper’s computations of Adjusted EBITDA

and cash available for distribution may not be comparable to other

similarly titled measures of other companies or to such measure in

its credit facility or any of its other contracts.

The following tables present a reconciliation of

the non-GAAP financial measures of Adjusted EBITDA and cash

available for distribution to the GAAP financial measure of net

loss.

|

Viper Energy Partners LP |

|

(unaudited, in thousands, except per unit

data) |

| |

|

| |

|

| |

Three Months Ended June 30, 2020 |

|

Net loss |

$ |

(33,056 |

) |

|

Interest expense, net |

7,669 |

|

|

Non-cash unit-based compensation expense |

283 |

|

|

Depletion |

22,782 |

|

|

Gain on revaluation of investment |

(3,443 |

) |

|

Non-cash loss on derivative instruments, net |

32,342 |

|

|

Gain on extinguishment of debt |

(14 |

) |

| Consolidated Adjusted

EBITDA |

26,563 |

|

| Less: Adjusted EBITDA

attributable to non-controlling interest |

15,198 |

|

| Adjusted EBITDA

attributable to Viper Energy Partners LP |

$ |

11,365 |

|

| |

|

| Adjustments to

reconcile Adjusted EBITDA to cash available for

distribution: |

|

| Debt service, contractual

obligations, fixed charges and reserves |

$ |

(3,261 |

) |

| Units - dividend equivalent

rights |

(4 |

) |

| Preferred distributions |

(45 |

) |

| Cash available for

distribution to Viper Energy Partners LP unitholders |

$ |

8,055 |

|

| |

|

| Common limited partner units

outstanding |

67,831 |

|

| |

|

| Cash available for

distribution per limited partner unit |

$ |

0.12 |

|

| Cash per unit approved for

distribution |

$ |

0.03 |

|

Adjusted net (loss) income is a non-GAAP

financial measure equal to net income attributable to Viper

adjusted for non-cash loss (gain) on derivative instruments, (gain)

loss on revaluation of investments, gain on extinguishment of debt,

valuation for deferred tax asset and related income tax

adjustments. The Company’s computation of adjusted net income may

not be comparable to other similarly titled measures of other

companies or to such measure in our credit facility or any of our

other contracts.

The following table presents a reconciliation of adjusted net

loss to net (loss) income:

|

Viper Energy Partners LP |

|

Adjusted Net Income (Loss) |

|

(unaudited, in thousands, except per unit

data) |

| |

|

| |

Three Months Ended June 30, 2020 |

|

Net loss |

$ |

(33,056 |

) |

| Non-cash loss on derivative

instruments, net |

32,342 |

|

| Gain on revaluation of

investments |

(3,443 |

) |

| Gain on extinguishment of

debt |

(14 |

) |

| Adjusted net

loss |

(4,171 |

) |

| Less: Adjusted net loss

attributed to non-controlling interests |

(1,341 |

) |

| Adjusted net loss

attributable to Viper Energy Partners LP |

$ |

(2,830 |

) |

| |

|

| Adjusted net loss attributable

to limited partners per common unit |

$ |

(0.04 |

) |

Derivatives

As of the filing date, the Company had the

following outstanding derivative contracts. The Company’s

derivative contracts are based upon reported settlement prices on

commodity exchanges, with crude oil derivative settlements based on

New York Mercantile Exchange West Texas Intermediate pricing and

Crude Oil Brent and with natural gas derivative settlements based

on the New York Mercantile Exchange Henry Hub pricing. When

aggregating multiple contracts, the weighted average contract price

is disclosed.

| |

Crude Oil (Bbls/day, $/Bbl) |

| |

Q3 2020 |

|

Q4 2020 |

|

FY 2021 |

| Swaps - WTI

(Cushing) |

1,000 |

|

|

1,000 |

|

|

— |

| $ |

27.45 |

|

|

$ |

27.45 |

|

|

$ |

— |

|

Collars - WTI (Cushing) |

14,000 |

|

|

14,000 |

|

|

10,000 |

|

Floor Price |

$ |

28.86 |

|

|

$ |

28.86 |

|

|

$ |

30.00 |

|

Ceiling Price |

$ |

32.33 |

|

|

$ |

32.33 |

|

|

$ |

43.05 |

|

Deferred Premium Call Options - WTI (Cushing) |

— |

|

|

8,000 |

|

|

— |

|

Premium |

$ |

— |

|

|

$ |

(1.89 |

) |

|

$ |

— |

|

Strike Price ($/Bbl) |

$ |

— |

|

|

$ |

45.00 |

|

|

$ |

— |

| Basis Swaps

- WTI (Midland-Cushing) |

4,000 |

|

|

4,000 |

|

|

— |

| $ |

(2.60 |

) |

|

$ |

(2.60 |

) |

|

$ |

— |

| |

Natural Gas (Mmbtu/day, $/Mmbtu) |

| |

Q3 2020 |

|

Q4 2020 |

|

FY 2021 |

| Natural Gas

Basis Swaps - Waha Hub |

25,000 |

|

|

25,000 |

|

|

— |

| $ |

(2.07 |

) |

|

$ |

(2.07 |

) |

|

$ |

— |

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@viperenergy.com

Source: Viper Energy Partners LP; Diamondback Energy, Inc.

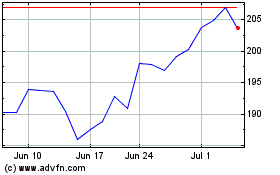

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Mar 2024 to Apr 2024

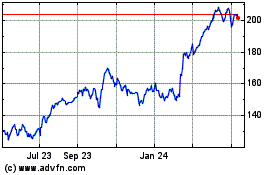

Diamondback Energy (NASDAQ:FANG)

Historical Stock Chart

From Apr 2023 to Apr 2024