Nasdaq Indexes Lead Way on Both Sides of Atlantic

August 03 2020 - 5:59AM

Dow Jones News

By Ben Dummett

Nasdaq Inc. is cleaning up on both sides of the Atlantic.

In the U.S., the stock-exchange operator's Nasdaq indexes are

the country's best-performing major stock benchmarks this year. In

Europe, the Nasdaq-owned Copenhagen exchange's index is leading the

charge.

Like its U.S. counterpart, Denmark's stock exchange is thriving

in a coronavirus world. But the narrower base of big stocks behind

the gain could make it a riskier bet.

The Copenhagen exchange's OMX Copenhagen 20 index is largely

dominated by the health-care sector. High single- and double-digit

gains in three constituents -- Novo Nordisk A/S, Genmab A/S and

Coloplast A/S -- all of which are health-care stocks, have helped

lift the benchmark more than 13% year to date. Meanwhile, Europe's

other 18 country equity benchmarks are all trading lower.

That outperformance comes as Europe battles the

coronavirus-induced recession, pushing investors into so-called

growth and defensive sectors. Health-care stocks are often in that

group because sick people can't do without drugs and treatment.

Insulin maker Novo Nordisk and Coloplast, a supplier of continence

care and other products, both reported higher sales for their

latest quarters, citing supply stockpiling as a reason.

Still, the concentration leaves the market index at risk of an

abrupt downturn if any of these health-care companies suffer a

surprise setback. Novo Nordisk, for example, carries an index

weighting of 33%. That compares with a combined weighting of about

40% for the five biggest stocks in the Nasdaq Composite Index --

Apple Inc., Microsoft Corp., Amazon.com Inc., Facebook Inc. and

Alphabet Inc. -- big drivers behind its outperformance in 2020.

Together with Genmab, a Danish biotech company, and Coloplast, the

three health-care stocks' total weighing is close to 50%.

"There is some stock-specific risk that you really need to look

out for, " said Kenneth Lamont, a research analyst at

Morningstar.

In 2018, Novo Nordisk fell 7.3% in one session on disappointing

earnings. Danske Bank at the time blamed the sell off for a big

part of a 3% drop in OMXC20 and its underperformance against rival

markets that day.

The Xact OMXC25 and iShares MSCI Denmark ETF are exchange-traded

funds that allow investors to bet on the Copenhagen exchange. While

each ETF tracks more companies than included in the OMXC20,

health-care weightings remain the biggest for each.

The OMXC25 trades at around 29 times projected earnings of the

constituent companies, compared with a 10-year average of 18.6

times, according to Danske Bank, suggesting valuation is another

potential risk. The growth outlook of companies such as Genmab

helps to explain the richer valuation. In June, the biotech company

struck a $750 million deal with AbbVie Inc. to develop cancer

treatments, and the stock is up about 15% since then.

Still, Danske Bank recommends underweighting the Danish market.

Growth stocks like health care are expensive, and more cyclical

stocks should perform relatively better over the next three to nine

months as the economy recovers, said Chief Equity Strategist

Mattias Sundling.

Germany's DAX stock index, which has big weightings in

industrials and autos, has gained more than 45% from its low in

March, outperforming the OMXC20's 37% gain over the same period, in

a possible sign of support for that view.

-- To receive our Markets newsletter every morning in your

inbox, click here.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

August 03, 2020 05:44 ET (09:44 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

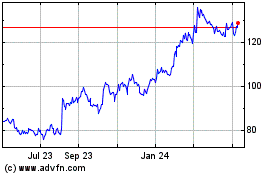

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

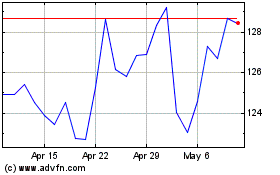

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024