Filed by Clever

Leaves International Inc.

Pursuant to Rule

425 under the Securities Act of 1933, and

deemed filed pursuant

to Rule 14a-12 under the

Securities Exchange

Act of 1934

Subject Company:

Schultze Special

Purpose Acquisition Corp.

(Commission File

No. 001-38760)

CLEVER LEAVES AND SCHULTZE SPECIAL PURPOSE

ACQUISITION CORP. BUSINESS COMBINATION WEBCAST SCRIPT

Operator (for the recording)

Good morning, Thank you for standing by

and welcome to the Clever Leaves and Schultze Special Purpose Acquisition Corp. Webcast. I would now like to turn the call over

to Gary Julien, Executive Vice President and Director of Schultze Special Purpose Acquisition Corp. to begin.

COVER SLIDE: Gary Julien

Thank you, and good morning. We appreciate

everyone joining us. Please note that today’s press release and related SEC documents can be found on the Schultze Special

Purpose Acquisition Corp. website at https://samcospac.com under the “Investor Relations” tab as well as on the www.sec.gov

website. In addition, the investor deck that will be presented as part of our discussion has been posted to our website and has

been filed with the SEC.

The presentation is for informational purposes

only and does not constitute an offer to sell, a solicitation of an offer to buy or a recommendation to purchase any equity, debt

or other financial instruments of Clever Leaves International Inc. or Schultze Special Purpose Acquisition Corp. as defined under

US Federal Securities Laws.

The presentation has been prepared to assist

interested parties in making their own evaluation of the proposed investment and for no other purpose. The information contained

herein does not purport to be all-inclusive. We refer you to the cautionary language regarding forward-looking statements that

can be found in our SEC Filings for a more detailed review of the risks and uncertainties contained herein.

The presentation also includes non-Generally

Accepted Accounting Principles or non-GAAP financial measures such as EBITDA. Non-GAAP financial measures should not be considered

as alternatives to GAAP measures of financial performance or liquidity.

With me today from Schultze Special Purpose

Acquisition Corp. is George Schultze, Chairman, President, & CEO; and from Clever Leaves are, Kyle Detwiler, Chief Executive

Officer, and Andrés Fajardo, President.

SLIDE 1: Key Leadership Slide –

Gary Julien, Andrés Fajardo, Kyle Detwiler

Gary: Turning to slide 1, I know

that I speak for all of us about how excited we are to be discussing our proposed business combination.

By way of background, George Schultze is

the founder and CEO, and I am a Managing Director at Schultze Asset Management, a firm with over two decades of experience in event-driven

and special situation investing. Our firm has deployed more than $3.2 billion in capital since our inception with a notable track

record in our active investment strategy. We launched our SPAC, SAMA, in December 2018 raising $130 million. Collectively, our

team has significant experience, both as investors and operators, in building businesses within the private and public domain,

which have resulted in significant monetization events. Sample case studies include Werner, Armor Holdings and AboveNet. Since

SAMA’s launch, we’ve evaluated several dozen acquisition opportunities and are incredibly excited at the opportunity

to present to investors this transaction with Clever Leaves.

We view Clever Leaves as uniquely positioned

to meaningful scale its business as a global industry market leader in pharmaceutical-grade cannabis. With a highly attractive,

ultra-low-cost operating model, significant scale, global distribution capability and an impressive management team, Clever Leaves

is ideally situated for sizable growth. We also believe that our cultural alignment and backgrounds in building businesses, including

through targeted M&A, creates a solid partnership with Clever Leaves to assist the company in its growth journey.

Now, I would like to turn the call over

to Clever Leaves’ President Andrés Fajardo and CEO Kyle Detwiler, who will together walk you through the majority

of the presentation.

Andrés: Thank you, Gary.

I co-founded Clever Leaves in 2016, and I managed it from the very beginning to become Latin America’s #1 cannabis cultivation

and extraction operation. My prior work experiences include serving as a former President/CEO of IQ Outsourcing (a 2,000 person

outsourced business services solutions provider), and as a Principal Member at Booz & Company, a globally recognized consulting

firm. I also hold an MBA from Harvard Business School.

Kyle: It’s Kyle Detwiler speaking.

I am the CEO of Clever Leaves. Previously, I co-founded Silver Swan Capital, an investment firm focused on niche and under-followed

sectors. Prior to that, I was a Principal at Blackstone’s Tactical Opportunities Fund and an investment professional at KKR

spending significant time on investments in natural resources, health care and Latin America. Similar to Andres, I also hold an

MBA with distinction from Harvard Business School.

When we analyzed the cannabis industry,

which was early in its infancy in 2016, we recognized a striking opportunity to address fundamental misalignments in the industry

where production capacity had been constructed not where it made economic or environmental sense, but where it was first legalized.

We see the opportunity to build something much like Chiquita has done with bananas or pharmaceutical companies in Southeast Asia

have done.

SLIDE 2: Investment Highlights - Kyle

Detwiler

We strongly believe that Clever Leaves

is well-positioned to disrupt the global cannabis industry with our “better mouse trap”. Let me frame our discussion

on slide 2 with our investment highlights before we delve more deeply into the business itself.

|

|

●

|

First, we are a global leader in low-cost,

medical-focused cannabis cultivation and extraction. Our scale, as we will soon explain, provides us with a competitive and sustainable

advantage relative to our peer set.

|

|

|

●

|

Second, we are a vertically integrated

multi-national operator with operations spanning Latin America, Europe, and North America. We are more capital efficient than the

Canadian LP or US MSO model, and more financeable as well.

|

|

|

●

|

Third, we focus on high-quality pharmaceutical-grade,

GMP-certified production authorized for export, which puts us in very exclusive company.

|

|

|

●

|

Fourth, we have been purpose-built for

significant growth, profitability and operating leverage.

|

|

|

●

|

Fifth, we have a talented and exceptional

leadership team with significant related operational and regulatory expertise.

|

|

|

●

|

Sixth, as we will demonstrate later in

the presentation, we have a highly-attractive valuation relative to our multi-national operator peer set.

|

|

|

●

|

And finally, we are expecting to list

on the NASDAQ due to our federally-legal business model which we believe will attract additional high-quality institutional investor

following, expanding on the $125 million of capital we have raised to date.

|

SLIDE 3: Vertically Integrated Platform

- Kyle Detwiler

Turning now to slide 3, Clever Leaves employs

approximately 500 professionals globally. We are best distinguished by our ability to leverage our low-cost and pharma quality

competitive advantages in a highly regulated industry across genetics, cultivation, extraction, R&D, and distribution, and

to selectively compete downstream in consumer or medical brands.

In Latin America, we are the #1 licensed

producer of medical cannabis and hemp with 1.8M of square feet of GACP-certified cultivation and the region’s only EU GMP-certified

extraction operation. Clever Leaves also has an exclusive distribution network in Brazil and a Latin American supply agreement

with Canopy Growth.

In Europe, we have applied to be a licensed

producer and expect to receive full licensing status in the second half of this year. We have an 85-hectare property in southern

Portugal which already consists of one hectare of greenhouse operations and has further expansion plans underway. Our intention

is to extend our EU GMP certification to our Portuguese operations in the future.

Our distribution network in Germany is

through Iqanna, a pharmaceutical brand and importer/distributor of medical cannabis product, and Cansativa, in which we are a minority

investor, which focuses on GDP and GMP-certified cannabis importation and distribution. We will discuss both of these relationships

and their importance in further detail shortly.

In North America, we own Herbal Brands,

a branded manufacturer and distributor of health and wellness products in over 10,000 retail locations across the US.

SLIDE 4: Colombia Leading the World

- Kyle Detwiler

Turning now to slide 4, we answer why we

are growing in Colombia.

At Blackstone and KKR, I spent significant

time spearheading investments in Latin America. In the late 2000s at KKR, I identified the attractive economics of the sugarcane

industry in Brazil, which seeded the idea for us to look at Colombia for cannabis production. In this part of the world, we can

limit our environment damage, keep costs low, and not have to “trick” the cannabis plant into thinking it is being

grown somewhere else.

If you look at the Southern California

greenhouses for cannabis growers, those properties used to grow red roses, and after that, tomatoes. However, due to globalization

and the proliferation of free trade, which I view as a good social initiative, the flower industry migrated to equatorial countries

like Colombia. Now, 70% of all cut flowers imported to U.S. come from Colombia. So in other words, we all already benefit from

a supply chain that has already figured out how to send a massive amount of red roses to the U.S. on refrigerated trucks, boats,

and airplanes for holidays like Valentine’s Day.

The optics of Colombia have changed dramatically

over the last two decades. This has in turn created a unique opportunity for the country to become a major export hub for quality

cannabis based upon its significant cost advantages and favorable location and climate.

SLIDE 5: Ideally Suited for Industrial

Scale Production - Kyle Detwiler

As you can see on slide 5, cannabis production

will inevitably evolve similar to how other industries have evolved over time. While Saudi oil fields have a 3x cost advantage

over Canadian oil sands and emit lower levels of C02 per barrel, and Chinese manufacturing has a 5x cost advantage over

US manufacturing with lower hourly wages and a slightly longer workday, Colombian cannabis similarly has a structural cost advantage

over Canadian cannabis, but in this case, it is even higher, at 8x! It is only for a brief moment in time that people will produce

cannabis in the snowy fields of Canada. One doesn’t grow avocados in Canada, so why would cannabis be any different?

SLIDE 6: Colombia Operating Advantages

- Kyle Detwiler

Turning to slide 6, as I just mentioned,

Colombia provides growing conditions that are unsurpassed nearly anywhere in the world and are supported by well-established infrastructure.

These advantages are clear.

Being near the equator provides 12 hours

of daily sunlight throughout the entire year and warm weather, while the soil itself is of high quality. Water is abundant, and

innovations from the Colombian flower industry allow us to provide 2/3rds of our water needs from our own water collection, increasing

our sustainability. This facilitates year-round cultivation without the need for light supplementation. The high elevation of around

8,300 feet compared to under 600 feet elevation in Canada also leads to improved pest mitigation. And finally, labor rates are

also much lower in Colombia.

Our cost advantages are two-fold. First,

our production costs are less than $0.20 per gram, which is well below the average Canadian cost of $2.14 per gram. These superior

unit economics do not merely generate excess returns. They suggest that in the long run, cultivation probably won’t exist

as we know it in a country like Canada and arguably even in many parts of the United States.

Second, our relative capital efficiency

is dramatic. Capacity has been built in Canada at a cost of around $200 per square foot. However, Clever Leaves has become one

of the largest federally legal producers in the world by creating capacity at $14 per square foot. Said another way, a dollar invested

with Clever Leaves can go 14 times as far as it can in Canada in terms of production capacity.

I will now turn the webcast over to Andrés.

SLIDE 7: Global Leader in Cultivation

and Extraction – Andrés Fajardo

On slide 7, you can see how Clever Leaves

cultivation and production footprint compares favorably amongst the largest operators in the world. We currently have 1.9M square

feet of cultivation and 104,400 kg of annual dry flower extraction capacity. With limited investment, we are able to increase our

extraction capacity to 324,400 kg annually. This combination of scale in two critical portions of the value chain is distinctive.

SLIDE 8: “Better Mouse Trap”

Has Received Media Attention - Andrés Fajardo

Turning to slide 8, we provide some examples

of how our “better mouse trap” has garnered a lot of interest from the media, including leading publications and TV

outlets such as FT, Barron’s, Forbes, Yahoo! Finance, CNBC, and BNN Bloomberg, which we expect will continue. Clever Leaves

has also benefited from the engagement of Former US Senate Majority Leader Tom Daschle, a strong figure in the health care community

as well as foreign affairs with Colombia.

SLIDE 9: EU GMP Certification Accelerates

European Pharma Expansion – Andrés Fajardo

On slide 9, we are pleased to report that

in early July, we received our EU GMP certification as a vertically integrated botanical extractor. This places us in very select

company as the criteria to meet these requirements are rather stringent and bolster our competitiveness in global cannabis. This

milestone, which took years for us to achieve, unlocks materially higher price points for our products by creating an early mover

advantage for us. While we are among only a handful of companies in the world to achieve EU GMP certification, we are the first

and only company in Latin America with this certification of quality.

SLIDE 10: Colombia Greenhouse Cultivation

Site – Andrés Fajardo

Turning to slide 10, you can see a recent

picture of our primary greenhouse cultivation site in Colombia. We have already completed 1.8M square feet of greenhouse and have

had a perpetual harvest cycle in operation since November 2018. We were also GACP-certified in May 2020. For those new to the industry,

this facility is one of the largest cannabis greenhouse facilities in the world.

SLIDE 11: Project Apollo: Colombia Outdoor

Cultivation Site – Andrés Fajardo

On slide 11, while lower operating costs

per gram and lower cap-ex costs per square foot provide us with a meaningful and sustainable advantage compared to our peers, they

are only a starting point. If Clever Leaves is to truly become the Chiquita of cannabis, we have to be the absolute best in the

world. This is why we created Project Apollo, our 73M square feet outdoor cultivation site. This open field provides us with the

potential to be an unrivaled global leader with over 5x more cultivation hectares than the top Canadian LPs combined. For those

unfamiliar with real estate in Latin America, securing a site of this quality, flatness, and clean title, in addition to suitable

local infrastructure took several years, and is quite rare.

Slide 12: Colombian Pharma Grade Extraction

Operations – Andrés Fajardo

Turning to slide 12, as we mentioned earlier,

we currently have 104,400 kg per year of dry flower extraction capacity in our EU GMP-certified facility, the only one in Latin

America, and this can be expanded to 300,000+ kg annually with limited incremental investment.

We have systems in place for C02 extraction,

distillation and isolation, and THC removal.

We can produce bulk products such as crude

oil extracts, distillates, and isolates, and end products such as tinctures.

And our facility allows for further expansion

as we have 3 adjacent lots under contract, 1 lot currently under construction, and 29,000 square feet of expansion capacity.

SLIDE 13: Scale and Strategy Set Clever

Leaves Apart from LatAm Operators – Andrés Fajardo

Our advantages in the marketplace are not

just limited to the Canadian LPs, MSOs, and MNOs. With a superior company structure, we are also far ahead of the LatAm operators

across all key criteria, as shown on slide 13.

Our target end-market is global, not just

regional. Our cultivation capacity is larger than the listed peer companies combined, and we are the only operator that is EU GMP-certified.

We have an over 26,000 kg extraction quota for THC products, which is more than 2x that of our peer companies, whereas most other

operators in Colombia do not have any required production quotas. Colombia only permits the export of extracted products, so another

differentiator is our access to THC flower sales in Portugal, subject to receiving a sales license that is expected in the second

half of this year. This allows us to compete across the entire value chain, from extracts to flower.

SLIDE 14: Europe is Primed for Cannabis

– Andrés Fajardo

On slide 14, while many companies are pursuing

the opportunity in Canada and the United State, we believe Europe is an opportunity. With a similar sized economy to the US, federally-legal

cannabis regulation, high start-up costs including the coveted EU GMP certification, fewer operators capable of meeting the European

quality requirements translates into higher pricing. The average price per gram of cannabis retail is around $9.30 in Europe and

about $22 in Germany. These price points are significantly higher than what the market will bear in Canada and the US, and due

to the pharmaceutical nature of the European industry, often requiring physician prescriptions, switching costs for patients are

higher.

SLIDE 15: Expansion into Portugal –

Andrés Fajardo

Turning to slide 15, we have been developing

a team and expansion project in Portugal since late 2018. We already acquired 85 hectares south of Lisbon last summer with 100,000

square feet of existing greenhouse and room for substantial expansion. After completing our first test harvest just a few months

ago, we anticipate having our full license to cultivate cannabis flower for export in the second half of this year.

Portugal offers us an important foothold

for us on the continent and several advantages in terms of access to flower sales. Portugal has a favorable regulatory framework,

a stable economy with infrastructure and talent, and a fantastic climate for cultivation purposes.

Compared to the rest of the EU, operations

are relatively low cost, enabling the country to compete in the European cannabis flower industry.

I will now turn things back over to Kyle

to discuss Germany on slide 16.

Slide 16: Germany: Leading the European

Medical Market – Kyle Detwiler

Thank you, Andrés.

In Germany, we have made strategic investments

in its cannabis industry so that we can access its significant and valuable customer base. As we demonstrate on slide 16, Germany

is the largest medical cannabis geography on the continent and a rapidly growing market for healthcare insurance coverage of medical

cannabis.

The German cannabis model is very different

from the US and Canada. With a strong pharmaceutical underpinning, there are no dispensaries in Germany—cannabis use must

be prescribed by a physician and all distribution occurs at pharmacies and pharmacies are highly fragmented, with no chain of more

than 4 locations.

Since the onset of legalization, this high-growth

market already consists of only about 100,000 patients. Current penetration relative to the US and Canada is negligible, as there

is one only medical cannabis patient in Germany compared to 13 in the US and 10 in Canada for every 1,000 people.

Our intention is to use Germany as a platform

to expand further into the European cannabis industry, which commands highly favorable importation margins.

In terms of the recreational market, there

are already roughly 3.7M cannabis users in Germany, or about 4% of the population. If the market were to be legalized, it would

be potentially be as large as California and generate $9.68B in sales by 2028.

SLIDE 17: Success in Germany Requires

Significant Strategic Investment in Distribution – Kyle Detwiler

On slide 17, you can see how Canadian LPs

have shown how important it is to own the supply chain. In fact, most early movers have embarked on distribution through acquisition

or through contractual distribution to unlock the EU market.

We have taken a “dual track”

approach which has reduced our reliance on German import partners. We are already an influential investor in Cansativa, which is

one of the largest German medical cannabis importers and distributors, and have additional licensing in process under Iqanna, which

we own outright, for additional paths for importation or commercial partnerships.

SLIDE 18: German Distribution Assets

Unlock the EU Industry – Kyle Detwiler

Turning to slide 18, we demonstrate how

we have created an ecosystem to connect our low-cost product with one of the highest price points markets.

Our indicative margins point to importer

gross margins that are equal to cultivator’s gross revenue in a market with a population that is about 2.3x bigger than Canada.

As we said earlier, we have an investor

partnership with Cansativa, an existing distributor, and licensed, GDP and GMP-certified asset. Our relationship includes a 5-year

supply agreement and exclusivity on Colombian and LatAm imports. We also have a 100% ownership stake in Iqanna, which is a pending

global pharma brand with pending licenses for importation and distribution that is focused on wholesale, large-scale distribution.

SLIDE 19: Brazil Requires Importation

of Medical Cannabis – Kyle Detwiler

I think it is now clear why we are targeting

Europe, and Germany in particular, but we have also not lost sight of opportunities within LatAm. On slide 19, for example, take

Brazil, where cannabis is legal for medical uses and we have 210 million potential patients to serve.

Similar to Germany, but contrasting with

the US and Canadian model, the Brazilian regulation prohibits domestic product. Distribution is generally conducted through pharmacies,

and quite important, GMP certification is required.

We are positioned to be an early-mover

there, with exporting to begin as early as Q1 of 2021 with our first $1 million supply agreements in motion.

SLIDE 20: Building the B2B Sales Pipeline

– Kyle Detwiler

Clever Leaves also has a substantial B2B

opportunity as I will now detail on slide 20. In April, we announced a LatAm supply agreement with Canopy Growth as our partner

of choice which entails us providing them with a steady supply of extracted cannabis products. This is a one-year agreement with

an option to renew for two additional years. We completed our first shipment in January from our GMP-certified facilities in Colombia.

Our partnership is truly a win-win. For

Clever Leaves, it affirms our position as a cannabis leader in LatAm, paves the way for Colombia to become a hub in the global

supply chain.

For Canopy Growth, it accelerates their

time to market, ensures future supply availability from the only EU GMP-certified cannabis facility in Latin America, and enables

an asset-light strategy.

We are also building a sales pipeline across

a variety of industries spanning global and LatAm operators, pharma, nutraceutical, and cosmetics companies, and government agencies.

While our focus is primarily on Europe

and to a lesser extent LatAm, we are also expanding our distribution capabilities in Australia/New Zealand and while positioning

ourselves for additional geographies as markets invariably become legalized for medicinal cannabis.

SLIDE 21: Financial Projections –

Kyle Detwiler

On slide 21, we have included our near-term

forecast and longer term financial target.

In 2020, we are focused on commercialization,

with positive EBITDA generation expected in 2021 and rapid growth thereafter. We anticipate our gross margins to grow from 63%

this year to 76% by 2022 as our business continues to scale. We currently anticipate a longer term target of achieving $500 million

in revenue and $200 million in EBITDA, with a 75% gross margin.

As you can see, our revenue is skewed heavily

to Herbal Brands this year but that is expected to shift to our cannabinoid extracts later this year. By 2022, we estimate a nearly

equal contribution from extracts and dried flower products, and we anticipate the gradual launch of select branded products in

select geographies.

I will now turn the webcast to Gary Julien

to discuss the transaction, beginning on slide 22.

SLIDE 22: Transaction Overview –

Gary Julien

Thanks, Kyle. We view the Clever Leaves

investment opportunity and entry price as uniquely attractive for investors.

The transaction is valued at an enterprise

value of approximately $255M which translates to a $333M fully diluted market capitalization based primarily on $111M in anticipated

cash on the balance sheet at closing.

Clever Leaves’ existing shareholders

will be rolling over the vast majority of their equity ownership at 96% reflecting continuing majority ownership of the combined

company. As an incentive for continued value creation, Clever Leaves will have an earn-out of up to 1.8M common shares solely tied

to the performance of the stock. There is also a minimum cash condition of $60.0 million, reflecting less than half of our current

cash position, evidencing the limited capital required for Clever Leaves to achieve its plan going forward.

The pro forma equity ownership will comprise

current Clever Leaves shareholders at 55.6%, existing SAMA shareholders (or the public float) at 39.4%, and SAMA founders at 4.9%.

As mentioned earlier, we expect to list

on the NASDAQ, where we will be one of only a handful of cannabis companies, and close the transaction in the fourth quarter this

year.

On the bottom of the slide, we itemize

sources and uses. Notable items are an expected post-closing cash balance of $111.0 million and roll-over debt of $37.0 million.

To re-emphasize, there is very little cash needed to for the company to achieve its plan but we all recognize the importance of

having a strong balance sheet.

SLIDE 23: Pro Forma Capitalization and

Growth Opportunities – Gary Julien

Assuming the transaction is consummated

as we have shown, Clever Leaves will be one of the best-capitalized cannabis companies, on both a relative and absolute basis,

with approximately $111.0 million in cash and $37.0 million in debt as shown on slide 23.

Our capital deployment opportunities will

consist of accelerating existing growth initiatives such as our greenhouse expansion in Portugal, making the best use of our EU

GMP certification, investment in the Company’s sales team and distribution capabilities, Project Apollo, and our launch of

Iqanna.

We may also pursue opportunistic M&A

in distribution assets, opportunities that capitalize on US regulatory developments, and even non-cannabis opportunities where

linkage to cannabis can augment growth. We expect to benefit from attractive organic and M&A investment opportunities where

capital availability amongst our peers and targets has become increasingly scarce.

Importantly, our intention is to use this

capital infusion to maintain a healthy balance sheet while enabling Clever Leaves to execute its growth plans, all while mitigating

uncertainty and regulatory changes in this evolving industry.

In our industry, companies with the strongest

balance sheets have commanded premium valuation, and we believe, Clever Leaves can achieve that result over time given its operating

model and solid cash position.

We expect that the company will achieve

positive Free Cash Flow by the fourth quarter of 2021 and we do not expect to tap the equity capital markets anytime soon following

this transaction.

SLIDE 24: Public Comparable Companies

– Growth and Margin – Gary Julien

According to our projections and analyst

consensus estimates of our peers, on slide 24 we anticipate that Clever Leaves will achieve a three-year revenue CAGR through 2022

of 162%.

From an EBITDA margin standpoint, we expect

that Clever Leaves will have amongst the highest margins versus our peers by 2022 at 33% as the company ramps and capitalizes on

its low-cost business model.

While we are starting from a low base,

our expected growth rates for revenue and EBITDA are impressive by any measure.

SLIDE 25: Public Comparable Companies

– Trading Multiples – Gary Julien

As you can see on slide 25, we believe

the transaction is attractively valued when looking at the company on a multi-year basis.

On an EV/revenue basis, we are valued at

3.6x for 2021 and 1.8x for 2022 while on an EV/EBITDA basis, we are valued at 23.6x 2021 and 5.4x 2022. The significant reduction

in the valuation multiple in 2022 is naturally driven by the company’s projected global product adoption and highly attractive

economic model.

Now, to wrap things up, I will turn the

webcast back over to Kyle.

SLIDE 26: Investment Highlights –

Kyle Detwiler

Thank you, Gary.

To conclude, I want to reiterate and reinforce

our investment highlights.

As we have now explained, Clever Leaves

has built a better mouse trap as the global leader in low-cost medical-focused cultivation with pharma-grade production primed

for export. What we are doing here is disruptive and can change the industry, and we are excited for you to join us on this journey.

The industry has been waiting for a low-cost, large scale producer, and we believe Clever Leaves will earn strong margins while

helping shape the future of the industry.

We have significant opportunities for growth,

profitability and leverage supported by a highly skilled team and passionate team. Our valuation is highly attractive compared

to our multi-national operator peers and we are aiming for a NASDAQ listing in the fourth quarter this year.

That concludes our presentation and we

encourage you to review our appendix slides at your convenience. Thank you for your time today and goodbye.

8

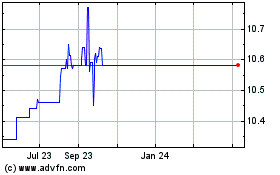

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Schultze Special Purpose... (NASDAQ:SAMA)

Historical Stock Chart

From Apr 2023 to Apr 2024