Report of Foreign Issuer (6-k)

July 23 2020 - 8:14AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES

EXCHANGE ACT OF 1934

dated

July 23, 2020

Commission

File Number: 001-38104

|

IMMURON

LIMITED

|

|

(Name

of Registrant)

|

Level

3, 62 Lygon Street, Carlton South, Victoria, 3053, Australia 3053

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

This

Report on Form 6-K (including exhibits thereto) is hereby incorporated by reference into the registrant’s Registration Statements

on Form F-3 (File Nos. 333-230762) and 333-215204) to be a part thereof from the date on which this report is submitted, to the

extent not superseded by documents or reports subsequently filed or furnished.

On July 21, 2020, Immuron

Limited (the “Company”) entered into a definitive agreement (the “Purchase Agreement”) with certain institutional

investors providing for the issuance and sale in a registered direct offering of an aggregate of 1,066,668 American Depositary

Shares (the “ADSs”) at a purchase price of $18.75 per share for aggregate gross proceeds of approximately $20.0 million.

Each ADS represents 40 ordinary shares of the Company. The offering is expected to close on or about June 23, 2020, subject to

the satisfaction of customary closing conditions.

Under

the Purchase Agreement, the Company has agreed not to enter into any agreement to issue or announce the issuance or proposed issuance

of any ADSs, ordinary shares or ordinary share equivalents for a period of 15 days following the closing of the offering, subject

to certain customary exceptions. In addition, subject to certain exceptions, the Purchase Agreement provides that for a period

of one year following the closing of the offering, the Company will not effect or enter into an agreement to effect a “variable

rate transaction” as defined in the Purchase Agreement. The Purchase Agreement also contains representations, warranties,

indemnification and other provisions customary for transactions of this nature.

The Company also entered

into a letter agreement, as amended (the “Placement Agent Agreement”), with H.C. Wainwright & Co., LLC (the “Placement

Agent”), pursuant to which the Placement Agent agreed to serve as the exclusive placement agent for the Company in connection

with the offering. The Company agreed to pay the Placement Agent a cash placement fee equal to 7.5% of the aggregate purchase price

for the ADSs sold in the offering, $25,000 for non-accountable expenses and $12,900 for clearing expenses. The Placement Agent

(or its designees) will also receive compensation warrants in an amount equal to 6.0% of the aggregate number of ADSs sold in the

offering, or warrants to purchase up to 64,000 ADSs, at an exercise price of $23.4375 per ADSs and a term expiring on July 21,

2025. The compensation warrants may be exercised on a cashless basis if there is no effective registration statement registering

the ADSs underlying the warrants.

The ADSs to be issued in

the registered direct offering will be issued pursuant to a prospectus supplement dated as of July 21, 2020 which has been filed

with the SEC, in connection with a takedown from the Company’s shelf registration statement on Form F-3 (File No. 333-230762)

(the “Registration Statement”), which became effective on April 17, 2019, and the base prospectus dated as of April

17, 2019 contained in such Registration Statement. This Report shall not constitute an offer to sell or the solicitation to buy

nor shall there be any sale of the ADSs in any state or jurisdiction in which such offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of any such state or jurisdiction.

The foregoing summaries

of the terms of the Purchase Agreement, Placement Agent Agreement and compensation warrants are subject to, and qualified in their

entirety by, the documents attached hereto as Exhibits 10.1, 10.2 10.3 and 10.4, and are incorporated herein by reference.

A

copy of the opinion of Francis Abourizk Lightowlers relating to the legality of the issuance and sale of the ordinary shares underlying

the ADSs is attached as Exhibit 5.1 hereto.

The

Company previously announced the offering in a press release issued on July 21, 2020, which is attached hereto as Exhibit 99.1.

Warning

Concerning Forward Looking Statements

This

Report of Foreign Private Issuer on Form 6-K contains statements which constitute forward looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995 and other securities laws. These forward looking statements are based

upon the Company’s present intent, beliefs or expectations, but forward looking statements are not guaranteed to occur and

may not occur for various reasons, including some reasons which are beyond the Company’s control. For example, this Report

states that the offering is expected to close on or about July 23, 2020. In fact, the closing of the offering is subject to various

conditions and contingencies as are customary in securities purchase agreement in the United States. If these conditions are not

satisfied or the specified contingencies do not occur, this offering may not close. For this reason, among others, you should

not place undue reliance upon the Company’s forward looking statements. Except as required by law, the Company undertakes

no obligation to revise or update any forward looking statements in order to reflect any event or circumstance that may arise

after the date of this Report.

Exhibit

Index

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

IMMURON LIMITED

|

|

|

|

|

|

Dated: July 23, 2020

|

By:

|

/s/ Jerry Kanellos

|

|

|

|

Name: Jerry Kanellos

|

|

|

|

Title: Chief Executive Officer

|

3

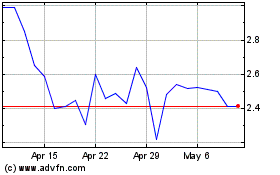

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

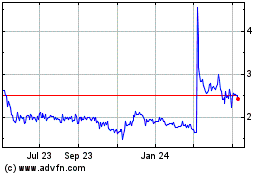

Immuron (NASDAQ:IMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024