Cartier's Wake-Up Call for Luxury Dreamers -- Heard on the Street

July 16 2020 - 9:18AM

Dow Jones News

By Carol Ryan

European luxury brands may be later than investors think to

benefit from China's rapid economic recovery.

Shares in Compagnie Financière Richemont, owner of the Cartier

and Van Cleef & Arpels jewelry brands, fell 5% in early

European trading Thursday after the Swiss company reported weak

sales for the three months through June. Sales at constant

currencies fell 47% compared with the same quarter of 2019.

Amid a pandemic that has richly rewarded some online players,

the big miss was at Richemont's e-commerce websites Net-a-Porter

and Watchfinder. Sales there fell 42% -- nearly double the drop

that analysts expected -- due to the temporary closure of

distribution centers. Service levels aren't back to normal in many

markets and aggressive price cuts are now needed to entice buyers

to spend online.

On Wednesday, British trench coat maker Burberry gave bearish

guidance about current trading. Its shares are down 8% so far this

week. Both companies sell a slightly larger chunk of their goods to

Chinese customers than the 35% industry norm.

The Chinese economy grew 3.2% in the second quarter compared

with the same period of 2019, according to official data released

Thursday. Investors have been hoping that the country's V-shaped

rebound, combined with its insatiable appetite for European luxury

goods, will offer brands some protection during the crisis.

Sales within China did increase by 49% for Richemont and a

"midteens" percentage at Burberry. But the numbers are deceptive:

Chinese shoppers typically buy overseas, where luxury goods are

cheaper than at home. Without the boost from travel, their spending

globally was down 35% in June compared with the same month last

year, according to UBS estimates.

Luxury consumption is likely to be depressed for several years

in other big luxury markets such as the U.S. and Europe, leaving

brands more dependent than ever on well-heeled Chinese shoppers.

Much of the industry's future demand is expected to come from

China's growing upper-middle class, currently around 65 million

individuals, who earn between $30,000 and $45,000 a year, based on

estimates by Morningstar analyst Jelena Sokolova. The question is

whether that group of consumers will continue to spend such a big

chunk of their disposable income on designer goods -- products

they, by definition, don't need -- in a grimmer economic

environment.

European luxury stocks head into this earnings season trading at

an 80% premium to the MSCI Europe index as a multiple of projected

earnings, according to UBS -- well above the sector's 47% long-term

average. Investors are beginning to wake up to the risks of pricing

brands for perfection when the outlook has never been less

certain.

Write to Carol Ryan at carol.ryan@wsj.com

(END) Dow Jones Newswires

July 16, 2020 09:03 ET (13:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

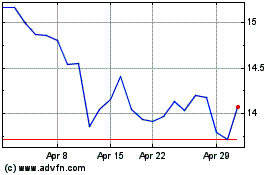

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Mar 2024 to Apr 2024

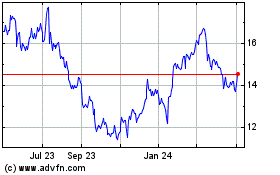

Compagnie Financiere Ric... (PK) (USOTC:CFRUY)

Historical Stock Chart

From Apr 2023 to Apr 2024