Authentic, Simon Win Contest to Lend Money to Brooks Brothers

July 10 2020 - 7:22PM

Dow Jones News

By Soma Biswas

Apparel-licensing firm Authentic Brands Group LLC and mall owner

Simon Property Group Inc. won a competition to supply financing to

carry Brooks Brothers Group Inc. through bankruptcy, elbowing aside

a rival by offering an extraordinary zero-interest loan

package.

The $80 million loan from a venture between Authentic and Simon

beat out WHP Global Inc.'s $75 million offer, Brooks Brothers

lawyers said Friday during a virtual hearing in the U.S. Bankruptcy

Court in Wilmington, Del.

The two ventures, both of which are exploring bids for control

of Brooks Brothers, specialize in plucking recognizable brands out

of struggling or bankrupt companies and giving them a new life,

aiming for profitability that eluded them in the past.

Brooks Brothers became their latest target after the storied

company filed for bankruptcy protection Wednesday, a victim of the

coronavirus pandemic's impact on retail.

The retailer, which struggled in recent years with a shift

toward more casual dress styles at work, had been searching for a

buyer since last year with the help of investment bank PJ Solomon.

Brooks Brothers is continuing discussions with multiple interested

buyers, lawyers for the company said at Friday's hearing.

The company accepted the "significantly better" loan offer from

Authentic and Simon after negotiations over the prior 24 hours,

said Brooks Brothers lawyer Connor Flaherty.

The unprecedented winning loan comes with no interest or fees,

Brooks Brothers' advisers said.

Both loan offers required the Brooks Brothers branding and

trademarks as collateral, ensuring that even if the company winds

up liquidating, the lenders would gain control over the

intellectual property. Lenders that finance companies through

bankruptcy have greater power over the process than nearly any

other participant.

The growing list of retail bankruptcies has created many

opportunities for licensing firms such as Authentic and WHP, which

was founded in 2018 with backing from Oaktree Capital Management

LP.

Simon has also become a frequent bidder for bankrupt retailers

with the added motivation of keeping key tenants in its malls,

paying rent.

The Authentic-Simon venture, Sparc LLC, also owns the branding

behind retails names Aéropostale, Nautica and Forever 21. Last

week, it made an offer to buy denim chain Lucky Brands Dungarees

LLC out of bankruptcy.

Last year, Authentic teamed up with Saks Fifth Avenue parent

Hudson's Bay Co. to buy high-end department store Barneys New York

Inc. out of bankruptcy.

WHP owns Anne Klein, the women's clothing line, and recently

bought out midprice men's apparel brand Joseph Abboud from Men's

Wearhouse owner Tailored Brands Inc.

Write to Soma Biswas at soma.biswas@wsj.com

(END) Dow Jones Newswires

July 10, 2020 19:07 ET (23:07 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

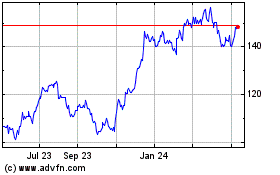

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

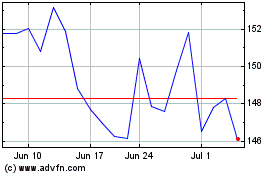

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024