UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM S-1/A

AMENDMENT NO. 1

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933 CURRENT REPORT

EXCEED WORLD, INC.

(Exact name of registrant as specified in

its charter)

Date: June 30, 2020

|

Delaware

|

8200

|

98-1339955

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Primary

Standard Classification Code)

|

(IRS Employer

Identification No.)

|

1-2-38-6F, Esaka-cho,

Suita-shi, Osaka 564-0063, Japan

ceo.exceed.world@gmail.com

Telephone: +81-6-6339-4177

(Address, including zip code, and telephone

number,

including area code, of registrant’s principal executive offices)

Please send copies of all correspondence to:

NewRev General Counsel, LLC

8547 E. Arapahoe Road #J453

Greenwood Village, CO 80112

TELEPHONE: (303) 953-4245

Email: conn.flanigan@newrevgc.com

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Approximate date of commencement of proposed

sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. |X|

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, please check the following box and list the

Securities Act registration Statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. |_|

If this Form is a post-effective amendment

filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. |_|

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

Large

accelerated filer |_|

|

Accelerated

filer |_|

|

|

Non-accelerated

filer |X|

|

Smaller reporting company |X|

Emerging Growth company [X]

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Securities Act.

CALCULATION OF REGISTRATION FEE

|

Title of Each

Class of

Securities

to be Registered

|

Amount to be

Registered

|

Proposed

Maximum

Offering Price

Per Share (1)

|

Proposed

Maximum

Aggregate Offering Price

|

Amount of

Registration

Fee (2)

|

|

|

|

|

|

|

|

Common Stock,

$0.0001 par value

|

3,000,000

|

$0.09

|

$270,000

|

$35.046

|

(1) The offering price has been arbitrarily

determined by the Company and affiliated parties and bears no relationship to assets, earnings, or any other valuation criteria.

No assurance can be given that the shares offered hereby will have a market value or that they may be sold at this, or at any

price.

(2) Estimated solely for purposes of calculating

the registration fee in accordance with Rule 457(o) of the Securities Act of 1933.

THE INFORMATION IN THIS PROSPECTUS IS NOT

COMPLETE AND MAY BE CHANGED. THE SECURITIES BEING REGISTERED HEREIN MAY NOT BE SOLD UNTIL THIS REGISTRATION STATEMENT FILED WITH

THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING

AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED. THERE IS NO MINIMUM PURCHASE REQUIREMENT

FOR THE OFFERING TO PROCEED.

PRELIMINARY PROSPECTUS

EXCEED WORLD, INC.

3,000,000 SHARES OF COMMON STOCK

$0.0001 PAR VALUE PER SHARE

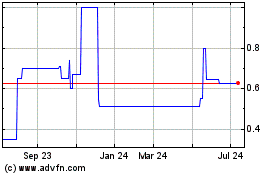

As of the date of this Prospectus, our

shares are quoted on the OTC Pink under the stock symbol “EXDW”.

In this public offering our selling shareholders

are offering 3,000,000 shares of our common stock. We will not receive any of the proceeds from the sale of shares by the

selling shareholders. Rather our selling shareholders will receive any and all proceeds from this offering. There is no minimum

number of shares required to be purchased by each investor. Additionally, there is no guarantee that a public market will

ever develop and you may be unable to sell your shares.

This primary offering will automatically

terminate upon the earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or

(ii) 365 days from the effective date of this Prospectus, unless extended by our directors for an additional 90 days. We may however,

at our discretion terminate the offering at any time.

|

SHARES OFFERED

|

|

PRICE

TO

|

|

SELLING AGENT

|

|

PROCEEDS

TO THE SELLING

|

|

|

BY

SELLING SHAREHOLDERS

|

|

PUBLIC

|

|

COMMISSIONS

|

|

SHAREHOLDERS

|

|

|

Per Share

|

|

$

|

0.09

|

|

Not applicable

|

|

$

|

0.09

|

|

|

Minimum Purchase

|

|

None

|

|

Not applicable

|

|

Not

applicable

|

|

|

Total (3,000,000

shares)

|

|

$

|

270,000

|

|

Not applicable

|

|

$

|

270,000.00

|

|

Currently, our Chief Executive Officer

Tomoo Yoshida directly owns approximately 4.3% of the voting power of our outstanding capital stock, and Force Internationale

Limited, a Cayman Island Company (“Force Internationale”), of which Mr. Yoshida also owns and controls, owns approximately

84.4% of the voting power of our outstanding capital stock. After the offering, assuming all of the shares that are being registered

herein of Force Internationale are sold, Mr. Yoshida and Force Internationale will have the ability to collectively control approximately

79.5% of the voting power of our outstanding capital stock.

The Company estimates the costs of this

offering at $67,000. All expenses incurred in this offering are being paid for by the Company. If the Company has insufficient

funds to do so, it will rely upon funds provided by the Company’s Chief Executive Officer, Tomoo Yoshida. Mr. Yoshida has

no legal obligation to provide the Company funds.

The Company qualifies as an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act, which became law in April 2012 and will be subject

to reduced public company reporting requirements.

THESE SECURITIES ARE SPECULATIVE AND INVOLVE

A HIGH DEGREE OF RISK. YOU SHOULD PURCHASE SHARES ONLY IF YOU CAN AFFORD THE COMPLETE LOSS OF YOUR INVESTMENT. PLEASE

REFER TO ‘RISK FACTORS’ BEGINNING ON PAGE 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION

NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF

THE PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained

in this Prospectus and the information we have referred you to. We have not authorized any person to provide you with any information

about this Offering, the Company, or the shares of our Common Stock offered hereby that is different from the information included

in this Prospectus. If anyone provides you with different information, you should not rely on it.

The following table of contents has been designed

to help you find important information contained in this prospectus. We encourage you to read the entire prospectus.

TABLE OF CONTENTS

You should rely only on the information contained

in this prospectus or contained in any free writing prospectus filed with the Securities and Exchange Commission. We have not

authorized anyone to provide you with additional information or information different from that contained in this prospectus filed

with the Securities and Exchange Commission. We take no responsibility for, and can provide no assurance as to the reliability

of, any other information that others may give you. Our selling shareholders are offering to sell, and seeking offers to buy,

our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate

only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of shares of our common

stock. Our business, financial condition, results of operations and prospects may have changed since that date.

The date of this prospectus is June 30, 2020.

-1-

Table of Contents

PROSPECTUS SUMMARY

In this Prospectus, “Exceed World,

the “Company,’’ ‘‘we,’’ ‘‘us,’’ and ‘‘our,’’

refer to Exceed World, Inc., unless the context otherwise requires. Unless otherwise indicated, the term ‘‘fiscal

year’’ refers to our fiscal year ending September 30. Unless otherwise indicated, the term ‘‘common stock’’

refers to shares of the Company’s common stock.

This Prospectus, and any supplement to this

Prospectus include “forward-looking statements”. To the extent that the information presented in this Prospectus discusses

financial projections, information or expectations about our business plans, results of operations, products or markets, or otherwise

makes statements about future events, such statements are forward-looking. Such forward-looking statements can be identified by

the use of words such as “intends”, “anticipates”, “believes”, “estimates”, “projects”,

“forecasts”, “expects”, “plans” and “proposes”. Although we believe that the expectations

reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks and uncertainties

that could cause actual results to differ materially from such forward-looking statements. These include, among others, the cautionary

statements in the “Risk Factors” section and the “Management’s Discussion and Analysis” section

in this Prospectus.

This summary only highlights selected information

contained in greater detail elsewhere in this Prospectus. This summary may not contain all of the information that you should

consider before investing in our common stock. You should carefully read the entire Prospectus, including “Risk Factors”

beginning on Page 4, and the financial statements in their entirety, before making an investment decision.

All dollar amounts refer to US dollars unless

otherwise indicated.

The Company

The Company is an education service provider

in Japan and it offers a range of e-learning education programs as well as supporting services to complement such education programs

through an internet platform named “Force Club” (“Force Club”), which was launched in 2007. The Company

has offered e-learning programs through Force Club, all of which were procured from independent third-party software developers,

including pre-school learning resources, learning resources supplementing elementary school, junior high school and senior high

school curriculum, preparation courses for university entrance examinations and professional qualification examinations, and English

learning, appealing to a diverse customer base from pre-school children to students and adult learners. The e-learning programs

of Force Club mainly serve as supplemental learning resources and self-learning tools for students and adult learners.

The Company was originally incorporated with

the name Brilliant Acquisition, Inc., under the laws of the State of Delaware on November 25, 2014, with an objective to acquire,

or merge with, an operating business. On January 12, 2016, Thomas DeNunzio of 780 Reservoir Avenue, #123, Cranston, RI 02910,

the sole shareholder of the Company, entered into a Share Purchase Agreement with e-Learning Laboratory Co., Ltd. (“e-Learning”).

Pursuant to the Agreement, Mr. DeNunzio transferred to e-Learning, 20,000,000 shares of our common stock which represents all

of our issued and outstanding shares. Following the closing of the share purchase transaction, e-Learning gained a 100% interest

in the issued and outstanding shares of our common stock and became the controlling shareholder of the Company.

On January 12, 2016, the Company changed its

name to Exceed World, Inc. and filed with the Delaware Secretary of State, a Certificate of Amendment. On January 12, 2016, Mr.

Thomas DeNunzio resigned as our Chief Executive Officer, Chief Financial Officer, President, Director, Secretary, and Treasurer.

Also, on January 12, 2016, Mr. Tomoo Yoshida was appointed as our Chief Executive Officer, Chief Financial Officer, President,

Director, Secretary, and Treasurer.

On February 29, 2016, the Company entered

into a Stock Purchase Agreement with Tomoo Yoshida, our Chief Executive Officer, Chief Financial Officer, President, Director,

Secretary, and Treasurer. Pursuant to this Agreement, Tomoo Yoshida transferred to Exceed World, Inc., 10 shares of the common

stock of E&F Co., Ltd., a Japan corporation (“E&F”), which represents all of its issued and outstanding shares

in consideration of $4,835 (JPY 500,000). Following the effective date of the share purchase transaction on February 29, 2016,

Exceed World, Inc. gained a 100% interest in the issued and outstanding shares of E&F’s common stock and E&F became

a wholly owned subsidiary of Exceed World. On August 4, 2016, the E&F changed its name to School TV Co., Ltd (“School

TV”) and filed with the Legal Affairs Bureau in Osaka, Japan.

On April 1, 2016, e-Learning entered into

stock purchase agreements with 7 Japanese individuals. Pursuant to these agreements, e-Learning sold 140,000 shares of common

stock in total to these individuals and received $270 as aggregate consideration. Each paid JPY0.215 per share. At the time of

purchase the price paid per share by each was the equivalent of about $0.002. This sale of shares was exempt from registration

in accordance with Regulation S of the Securities Act of 1933, as amended ("Regulation S") because the above sales of

the stock were made to non-U.S. persons as defined under Rule 902 section (k)(2)(i) of Regulation S, pursuant to offshore transactions,

and no directed selling efforts were made in the United States by the issuer, a distributor, any of their respective affiliates,

or any person acting on behalf of any of the foregoing.

On August 1, 2016, the Company changed its

fiscal year end from November 30 to September 30.

On August 9, 2016, e-Learning entered into

stock purchase agreements with 33 Japanese individuals. Pursuant to these agreements, e-Learning sold 3,300 shares of common stock

in total to these individuals and received $330 as aggregate consideration. Each paid JPY10 per share. At the time of purchase

the price paid per share by each shareholder was the equivalent to about $0.1. These shares were sold pursuant to the Company’s

effective S-1 Registration Statement deemed effective on July 20, 2016 at 4pm EST.

On October 28, 2016, the Company, with the

approval of its board of directors and its majority shareholders by written consent in lieu of a meeting, authorized the cancellation

of shares owned by e-Learning. e-Learning consented to the cancellation of shares. The total number of shares cancelled was 19,000,000

shares which was comprised of 16,500,000 restricted common shares and 2,500,000 free trading shares.

On October 28, 2016, every one (1) share of

common stock, par value $.0001 per share, of the Company issued and outstanding was automatically reclassified and changed into

twenty (20) shares fully paid and non-assessable shares of common stock of the Company, par value $.0001 per share. (“20-for-1

Forward Stock Split”) No fractional shares were issued. The authorized number of shares, and par value per share, of common

stock are not affected by the 20-for-1 Forward Stock Split.

During July 2017 and August 2017, e-Learning

entered into stock purchase agreements with 24 Japanese individuals. Pursuant to these agreements, e-Learning sold 2,240,000 shares

of its common stock in total to these individuals and received $38,263 as aggregate consideration.

On September 26, 2018, Force Internationale

Limited, a Cayman Island limited company (“Force Internationale”) entered into a Share Purchase Agreement with its

wholly-owned subsidiary, e-Learning Laboratory Co., Ltd., a Japan corporation (“e-Learning”) and 74.5% owner of the

Company. Under this Share Purchase Agreement, e-Learning transferred its 74.5% interest in the Company to Force Internationale.

As consideration for this transfer, Force Internationale paid $26,000.00 to e-Learning. Immediately subsequent, the Company entered

into a Share Purchase Agreement with Force Internationale, to acquire 100% of Force International Holdings Limited, a Hong Kong

limited company (“Force Holdings”) and 100% direct owner of e-Learning. In consideration of this agreement, the Company

issued 12,700,000 common shares to Force Internationale. The result of these transaction is that Force Internationale is a 84.4%

owner of the Company, the Company is a 100% owner of Force Holdings, and Force Holdings is a 100% owner of e-Learning. Prior to

the Share Purchase Agreements, Force Internationale was an indirect owner of 74.5% of the Company and subsequent to the Share

Purchase Agreements, Force Internationale is a direct owner of 84.4% of the Company. The Share Purchase Agreements were approved

by the boards of directors of each of the Company, Force Internationale, Force Holdings, and e-Learning.

On December 6, 2018, the Company entered into

a share contribution agreement (the “Contribution Agreement”) with Force Internationale. Under this Agreement, the

Company transferred 100% of the equity interest of School TV Co., Ltd. ("School TV"), to Force Internationale without

consideration. This Contribution Agreement was approved by the board of directors of the Company, Force Internationale and School

TV. Upon the completion of the disposal, School TV was deconsolidated from the Company's consolidated financial statements. Pursuant

to the Contribution Agreement, the Company no longer has any interest in the previous businesses related to the sale and distribution

of health related products, the promotion of third party consumer goods and services, and a RE/MAX realtor business in Kanagawa,

Okinawa, and Tokyo, Japan.

Currently, we own the following affiliated entities:

|

Name

of Subsidiary

|

State

or Other Jurisdiction of Incorporation or Organization

|

|

|

|

|

Force

International Holdings Limited

|

Hong

Kong

|

|

e-Learning

Laboratory Co., Ltd.

|

Japan

|

|

e-Communications

Co., Ltd.

|

Japan

|

* The following chart illustrates the structure

of our consolidated affiliated entities:

The Company is electing to not opt out of

JOBS Act extended accounting transition period. This may make its financial statements more difficult to compare to other

companies.

Pursuant to the JOBS Act of 2012, as an emerging

growth company the Company can elect to opt out of the extended transition period for any new or revised accounting standards

that may be issued by the PCAOB or the SEC. The Company has elected not to opt out of such extended transition period, which means

that when a standard is issued or revised and it has different application dates for public or private companies, the Company,

as an emerging growth company, can adopt the standard for the private company. This may make comparison of the Company’s

financial statements with any other public company which is not either an emerging growth company nor an emerging growth company

which has opted out of using the extended transition period difficult or impossible as possible different or revised standards

may be used.

The JOBS Act is intended to reduce the regulatory burden on emerging

growth companies. The Company meets the definition of an emerging growth company and so long as it qualifies as an “emerging

growth company,” it will, among other things:

|

|

|

|

·

|

be temporarily exempted from the internal control

audit requirements Section 404(b) of the Sarbanes-Oxley Act;

|

|

|

|

|

·

|

be temporarily exempted from various existing

and forthcoming executive compensation-related disclosures, for example: “say-on-pay”, “pay-for-performance”,

and “CEO pay ratio”;

|

|

|

|

|

·

|

be temporarily exempted from any rules that

might be adopted by the Public Company Accounting Oversight Board requiring mandatory audit firm rotation or supplemental

auditor discussion and analysis reporting;

|

|

|

|

|

·

|

be temporarily exempted from having to

solicit advisory say-on-pay, say-on-frequency and say-on-golden-parachute shareholder votes on executive compensation under

Section 14A of the Securities Exchange Act of 1934, as amended;

|

|

|

|

|

·

|

be permitted to comply with the SEC’s

detailed executive compensation disclosure requirements on the same basis as a smaller reporting company; and,

|

|

|

|

|

·

|

be permitted to adopt any new or revised accounting

standards using the same timeframe as private companies (if the standard applies to private companies).

|

Our company will continue to be an emerging growth company until

the earliest of:

|

|

|

|

·

|

the last day of the fiscal year during which

we have annual total gross revenues of $1 billion or more;

|

|

|

|

|

·

|

the last day of the fiscal year following the

fifth anniversary of the first sale of our common equity securities in an offering registered under the Securities Act;

|

|

|

|

|

·

|

the date on which we issue more than $1 billion

in non-convertible debt securities during a previous three-year period; or

|

|

|

|

|

·

|

the date on which we become a large accelerated

filer, which generally is a company with a public float of at least $700 million (Exchange Act Rule 12b-2).

|

Our principal executive offices are located

at 1-1-36, 1-2-38-6F, Esaka-cho, Suita-shi, Osaka 564-0063, Japan. Our phone number is +81-6-6339-4177.

The Company has elected September 30th as

its fiscal year end.

The Company estimates the costs of this offering

at $67,000. All expenses incurred in this offering are being paid for by the Company. If the Company has insufficient funds to

do so, it will rely upon funds provided by the Company’s Chief Executive Officer, Tomoo Yoshida. Mr. Yoshida has no legal

obligation to provide the Company funds.

-2-

Table of Contents

Our Offering

We have authorized capital stock consisting

of 500,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred

stock, $0.0001 par value per share (“Preferred Stock”). We have 32,700,000 shares of Common Stock and no shares of

Preferred Stock issued and outstanding. Through this offering we will register a total of 3,000,000 shares. These shares

represent 3,000,000 shares of common stock held by our selling stockholders. The selling stockholders will sell shares at a fixed

price of $0.09 for the duration of the offering. There is no arrangement to address the possible effect of the offering on the

price of the stock. We will not receive any proceeds from the selling stockholders.

*We will notify investors of any extension to this offering by

filing a supplement to our prospectus pursuant to Rule 424(b)(3).

|

Securities being offered by the Selling Stockholders

|

3,000,000 shares

of common stock, at a fixed price of $0.09 offered by selling stockholders in a resale offering. As previously mentioned

this fixed price applies at all times for the duration of this offering. This offering will automatically terminate upon the

earliest of (i) such time as all of the common stock has been sold pursuant to the registration statement or (ii) 365 days

from the effective date of this prospectus unless extended by our Board of Directors for an additional 90 days. We may however,

at our discretion terminate the offering at any time.

|

|

|

|

|

Offering price per share

|

The selling shareholders

will sell the shares at a fixed price per share of $0.09 for the duration of this Offering.

|

|

|

|

|

Number of shares outstanding before the offering

of common stock

|

32,700,000 common

shares are currently issued and outstanding.

|

|

|

|

|

Number of shares outstanding after the offering

of common shares

|

32,700,000 common

shares will be issued and outstanding.

|

|

|

|

The minimum number of shares to be

sold in this offering

|

None.

|

|

Use of Proceeds

|

We will not receive any proceeds from

the sale of the shares in this offering.

|

|

|

|

|

Market for the common shares

|

Our common shares

are quoted on the OTC Pink.

|

|

|

|

|

Termination of the Offering

|

This offering will

automatically terminate upon the earlier to occur of (i) 365 days after this registration statement becomes effective with

the Securities and Exchange Commission, or (ii) the date on which all 3,000,000 shares registered hereunder have been sold.

We may, at our discretion, extend the offering for an additional 90 days or terminate the offering at any time.

|

|

|

|

|

Registration Costs

|

We estimate our total offering registration

costs to be approximately $67,000.

|

|

Risk Factors:

|

See “Risk

Factors” and the other information in this prospectus for a discussion of the factors you should consider before deciding

to invest in shares of our common stock.

|

Currently, our Chief Executive Officer Tomoo

Yoshida owns approximately 4.3% of the voting power of our outstanding capital stock and Force Internationale of which Mr. Yoshida

also owns and controls, owns approximately 84.4% of the voting power of our outstanding capital stock. After the offering, assuming

all of the shares that are being registered herein of Force Internationale are sold, Mr. Yoshida and Force Internationale will

have the ability to collectively control approximately 79.5% of the voting power of our outstanding capital stock.

You should rely only upon the information

contained in this prospectus. We have not authorized anyone to provide you with information different from that which is contained

in this prospectus. We are offering to sell common stock and seeking offers to common stock only in jurisdictions where offers

and sales are permitted.

-3-

Table of Contents

RISK FACTORS

Please consider the following risk factors and other information

in this prospectus relating to our business before deciding to invest in our common stock.

This offering and any investment in our common

stock involves a high degree of risk. You should carefully consider the risks described below and all of the information contained

in this prospectus before deciding whether to purchase our common stock. If any of the following risks actually occur, our business,

financial condition and results of operations could be harmed. The trading price of our common stock could decline due to any

of these risks, and you may lose all or part of your investment.

We consider the following to be the material

risks for an investor regarding this offering. Our company should be viewed as a high-risk investment and speculative in nature.

An investment in our common stock may result in a complete loss of the invested amount.

Risks Relating to Our Company

Since one of our products constitutes a

significant portion of our net sales, significant decreases in consumer demand for this product or our failure to produce a suitable

replacement should we cease offering it would harm our financial condition and operating results.

If consumer demand for this product decreases

significantly or we cease offering this product without a suitable replacement, then our financial condition and operating results

would be harmed.

If we lose the services of members of our

senior management team, then our financial condition and operating results could be harmed.

We depend on the continued services of our

Chief Executive Officer, Tomoo Yoshida, who also serves as our Chief Financial Officer, Director, President, Secretary, and Treasurer,

and our senior management team as it works to create an environment of inspiration, motivation and entrepreneurial business success.

Any significant leadership change or senior management transition involves inherent risk and any failure to ensure a smooth transition

could hinder our strategic planning, execution and future performance. While we strive to mitigate the negative impact associated

with changes to our senior management team, there may be uncertainty among investors, employees, Force Club and Premium Members

and others concerning our future direction and performance. Any disruption in our operations or uncertainty could have a material

adverse effect on our business, financial condition or results of operations.

Additionally, although we do not believe that

any of our senior management team are planning to leave or retire in the near term, we cannot assure you that our senior managers

will remain with us. The loss or departure of any member of our senior management team could adversely impact our Force Club and

Premium Member relations and operating results. If any of these executives do not remain with us, our business could suffer. Also,

our continued success will also be dependent on our ability to retain existing, and attract additional, qualified personnel to

meet our needs.

Foreign-currency fluctuations and inflation

in foreign markets could impact our financial position and results of operations.

In 2019, 100% of

our sales occurred in Japan. In preparing our financial statements, we translate revenue and expenses in our markets outside the

United States from their local currencies into U.S. dollars using weighted-average exchange rates. Foreign-currency fluctuations

can also cause losses and gains resulting from translation of foreign-currency-denominated balances on our balance sheet. In addition,

high levels of inflation and currency devaluations in any of our markets could negatively impact our balance sheet and results

of operations. It is difficult to predict future fluctuations and the effect these fluctuations may have upon future reported

results or our overall financial condition.

Difficult economic conditions could

harm our business.

Global economic conditions

continue to be challenging. Difficult economic conditions could adversely affect our business by causing a decline in demand for

our products, particularly if the economic conditions are prolonged or worsen. In addition, such economic conditions may adversely

impact access to capital for us and may otherwise adversely impact our operations and overall financial condition.

We may become

involved in legal proceedings and other matters that, if adversely adjudicated or settled, could adversely affect our financial

results.

We have been, and

may again become in the future, party to litigation, investigations or other legal matters. In general, litigation claims could

result in settlements or damages that could significantly affect financial results. It is not possible to predict the final resolution

of any litigation to which we may become party, and the impact of these matters on our business, results of operations and financial

condition could be material.

Government authorities

may question our tax or customs positions or change their laws in a manner that could increase our effective tax rate or otherwise

harm our business.

As a U.S. company

doing business globally, we are subject to all applicable tax laws. We are subject to audit by tax authorities. If authorities

challenge our tax positions, we may be subject to penalties, interest and payment of back taxes. The tax laws are continually

changing and are further subject to interpretation by the local government agencies. Such situations may require that we defend

our positions and/or adjust our operating procedures in response to such changes. Any or all of these potential risks may increase

our effective tax rate, increase our overall tax costs or otherwise harm our business.

We may be held

responsible for certain taxes or assessments relating to the activities of our Premium Members, which could harm our financial

condition and operating results.

Our Premium Members

are independent contractors and subject to taxation in their country of residency. In the event that our independent distributors

are deemed as employees rather than independent distributors under local laws and regulations, or the interpretation of local

laws and regulations, we may be held responsible for a variety of obligations that are imposed upon employers relating to their

employees, including withholding and related taxes plus any related assessments and penalties, which could harm our financial

condition and operating results. If our independent distributors were deemed to be employees rather than independent contractors,

we would also face the risk of increased liability for their actions.

Market conditions

and the strengths of competitors may harm our business.

Our results of operations

may be harmed by market conditions and competition in the future. In addition, our business may be negatively impacted if we fail

to adequately adapt to trends in consumer behavior and technologies.

The COVID-19 global pandemic may impact our current and future

revenue streams. As a result, we may generate lesser revenues than anticipated

Globally, the COVID-19 pandemic has negatively affected businesses

of all kinds. It is possible that the pandemic may hinder our own operations, resulting in lesser future revenues.

In the second quarter of the Company’s

financial year of 2020, the global outbreak of the coronavirus disease 2019 (“COVID-19”) has significantly affected

economy in Japan, where the Company mainly operates its business. Especially since February 2020, the economy has rapidly declined

due to limited economic activity caused by COVID-19. The Company implemented some measures to prevent infection including shortening

business hours and restricting movements of employees. Our Force Club Members’ activities, which is our main sales resources,

have also been limited due to travel restrictions and social distance rules implemented nationwide and globally. As a result,

the Company’s performance has been inevitably affected. Consequently, the COVID-19 pandemic may adversely affect the Company’s

business operations, financial condition and operating results for 2020, including but not limited to material negative impact

to the Company’s total revenues. Due to the high uncertainty of the evolving situation, the Company has limited visibility

on the full impact brought upon by the COVID-19 pandemic and the related financial impact cannot be estimated at this time.

The aforementioned events may result in a partial loss of your

investment in our common stock.

-4-

Table of Contents

The intellectual property we utilize

may infringe on the rights of others, resulting in costly litigation.

Currently, the rights

of 70% of our products are licensed from third party providers and the remaining 30% are owned by the Company. We expect that

competition for developing new products will become more severe in the competitive education industry. Under such circumstances,

if we depend on development of our own products, it would be time consuming and expensive. Rather, as our established sales system

has proved effective, we plan to continue to use the products developed by other companies. We expect to increase the ratio of

the products licensed by third parties.

In recent years,

there has been significant litigation involving patents and other intellectual property rights. In particular, there has been

an increase in the filing of suits alleging infringement of intellectual property rights, which pressure defendants into entering

settlement arrangements quickly to dispose of such suits, regardless of their merit. Other companies or individuals may allege

that we, or our members consumers, licensees or other parties indemnified by us infringe on their intellectual property rights.

Even if we believe that such claims are without merit, defending such intellectual property litigation can be costly, distract

management's attention and resources, and the outcome is inherently uncertain. Claims of intellectual property infringement also

might require us to redesign affected products, enter into costly settlement or license agreements, pay costly damage awards,

or face a temporary or permanent injunction prohibiting us from marketing or selling certain of our products. Any of these results

may adversely affect our financial condition.

If we are unable to protect our intellectual

property rights, our ability to compete could be negatively impacted.

Many of our products

rely on technologies developed or licensed by third parties, and we may not be able to obtain or continue to obtain licenses and

technologies from these third parties on reasonable terms or at all. The market for our products depends to a significant extent

upon the value associated with our product innovations and our brand equity. We rely upon patent, copyright, trademark and trade

secret laws in Japan and similar laws in other markets, and non-disclosure, confidentiality and other types of agreements with

our employees, members, consumers, suppliers and other parties, to establish, maintain and enforce our intellectual property

rights. Despite these measures, any of our intellectual property rights could be challenged, invalidated, circumvented or misappropriated,

or such intellectual property rights may not be sufficient to permit us to provide competitive advantages, which could result

in costly product redesign efforts, discontinuance of certain product offerings or other competitive harm. The costs required

to protect our intellectual property may be substantial or even not practical.

To enforce and protect

our intellectual property rights, we may initiate litigation against third parties. Any lawsuits that we initiate could be expensive,

take significant time and divert management's attention from other business concerns, and we may ultimately fail to prevail or

recover on any claim. Litigation also puts our intellectual property at risk of being invalidated or interpreted narrowly. Additionally,

we may provoke third parties to assert claims against us. We may not prevail in any lawsuits that we initiate and the damages

or other remedies awarded, if any, may not be commercially valuable. The occurrence of any of these events may adversely affect

our financial condition or diminish our investments in this area.

If we are unable

to protect the confidentiality of our proprietary information and know-how, the value of our products could be adversely affected.

We rely on our licenses,

copyrights, trade secrets, processes and know-how. Despite these measures, any of our intellectual property rights could be challenged,

invalidated, circumvented or misappropriated. We generally seek to protect this information by confidentiality, non-disclosure

and assignment of invention agreements with our employees, consultants, scientific advisors and third parties. Our employees may

leave to work for competitors. Our distributors or sales leaders may seek other opportunities. These agreements may be breached,

and we may not have adequate remedies for any such breach. In addition, our trade secrets may be disclosed to or otherwise become

known or be independently developed by competitors. To the extent that our current or former employees, distributors, sales leaders,

consultants or contractors use intellectual property owned by others in their work for us, disputes may arise as to the rights

in related or resulting know-how and inventions. If, for any of the above reasons, our intellectual property is disclosed or misappropriated,

it would harm our ability to protect our rights and adversely affect our financial condition.

A failure of our

internal controls over financial reporting or our compliance efforts could harm our stock price and our financial and operating

results or could result in fines or penalties.

We have implemented

internal controls to help ensure the accuracy and completeness of our financial reporting and have implemented compliance policies

and programs to help ensure that our employees and members comply with applicable laws and regulations. Our management

regularly reviews our internal controls and various aspects of our business and compliance program, and we regularly assess the

effectiveness of our internal controls. There can be no assurance, however, that our internal or external assessments and audits

will identify all significant deficiencies or material weaknesses in our internal controls. If a material weakness results in

a material misstatement of our financial results, we would be required to restate our financial statements.

Cyber security

risks and the failure to maintain the integrity of company, employee, member data could expose us to data loss, litigation, liability

and harm to our reputation.

We collect, store

and transmit large volumes of company, employee and member data, including personally identifiable information, for business purposes,

including for transactional and promotional purposes, and our various information technology systems enter, process, summarize

and report such data. The integrity and protection of this data is critical to our business.

In addition, a penetrated

or compromised data system or the intentional, inadvertent or negligent release, misuse or disclosure of data could result in

theft, loss or fraudulent or unlawful use of company, employee or member data. Although we take measures to protect the security,

integrity and confidentiality of our data systems, we experience cyber attacks of varying degrees and types on a regular basis,

and our infrastructure may be vulnerable to these attacks. Our security measures may also be breached due to employee error or

malfeasance, system errors or otherwise. Additionally, outside parties may attempt to fraudulently induce employees, users, or

customers to disclose sensitive information to gain access to our data or our users' or customers' data. Any such breach or unauthorized

access could result in the unauthorized disclosure, misuse or loss of sensitive information and lead to significant legal and

financial exposure, regulatory inquiries or investigations, loss of confidence by our members, disruption of our operations and

damage to our reputation. These risks are heightened as we work with third-party partners and as our members use social media,

as the partners and social media platforms could be vulnerable to the same types of breaches.

We will need additional capital to expand

our current operations or to enter into new fields of operations.

Currently, a significant portion of our revenue

derives from sales of our premium package. We expect this revenue to continue to grow. While we will maintain and further increase

the base for sale of this product, we also aim to expand our business by developing other services as well as entering into other

promising market. We will need to seek additional financing either through borrowing, private offerings of our securities or through

strategic partnerships and other arrangements with corporate partners. We cannot be assured that additional financing will be

available to us, or if available, will be available to us on terms favorable to us. If adequate additional financing is not available

on acceptable terms, we may not be able to implement our business development plan or expand our operations.

If we fail to effectively manage our growth

our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the expansion of our operations,

we expect to experience significant and rapid growth in the scope and complexity of our business. We will need to hire additional

personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational

resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance

of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively,

could have a materially adverse effect on our business and financial condition.

Relationships with our majority shareholder

and its parent and affiliates may be on terms which are perceived by investors as more or less favorable than those that could

be obtained from third parties.

Our majority shareholder, Force Internationale,

presently owns 84.4% of our issued and outstanding common stock. While we anticipate that such percentage will be diluted over

time, our majority shareholder, its parent and affiliates will be perceived as having influence over our management and operations,

and any loans or other agreements which we may enter into with our majority shareholder and its parents and affiliates may be

perceived by investors as being on terms that are less favorable than we could otherwise receive; such perception could adversely

impact the price of our common stock. Similarly, such agreements could be perceived as being on terms more favorable than those

that could be obtained from third parties, and any unwillingness by our majority shareholder and its parent and affiliates to

engage with our common stock could discourage investors.

-5-

Table of Contents

If we fail to further penetrate existing

markets, then the growth in sales of our products, along with our operating results, could be negatively impacted.

We plan to expand business around Asia. Recently

the number of foreigners visiting Japan for sightseeing and other purposes is increasing and there has been a growing interest

in Japanese culture. We plan to start providing language education services which include Japanese language education to foreigners.

Our business could be materially and adversely

affected as a result of natural disasters, other catastrophic events, acts of war or terrorism, or cyber-security incidents

and other acts by third parties.

We depend on the ability of our business to

run smoothly, including the ability of Premium Members to engage in their business building activities and the ability of our

programs and products to be available to consumers. Any material disruption caused by natural disasters, including, but not limited

to, fires, floods, hurricanes, volcanoes, and earthquakes; power loss or shortages; environmental disasters; telecommunications

or business information systems failures; acts of war or terrorism and other similar disruptions, including those due to cyber-security

incidents, ransomware, or other actions by third parties, could adversely affect our ability to conduct business.

We depend on the integrity and reliability

of our information technology infrastructure, and any related inadequacies may result in substantial interruptions to our business.

Our ability to provide products and services

to our Force Club and Premium Members depends on the performance and availability of our core transactional systems. While we

continue to invest in our information technology infrastructure, there can be no assurance that there will not be any significant

interruptions to such systems or that the systems will be adequate to meet all of our future business needs.

The most important aspect of our information

technology infrastructure is the system through which we calculate, record and store Premium Member sales and other incentives.

We have encountered, and may encounter in the future, errors in our software or our enterprise network, or inadequacies in the

software and services supplied by our vendors, although to date none of these errors or inadequacies has had a meaningful adverse

impact on our business. Any such errors or inadequacies that we may encounter in the future may result in substantial interruptions

to our services and may damage our relationships with, or cause us to lose, our Force Club and Premium Members if the errors or

inadequacies impair our ability to calculate sales and pay royalty overrides, bonuses and other incentives, which would harm our

financial condition and operating results. Such errors may be expensive or difficult to correct in a timely manner,

and we may have little or no control over whether any inadequacies in software or services supplied to us by third parties are

corrected, if at all.

Anyone who is able to circumvent our security

measures could misappropriate confidential or proprietary information, including that of third parties such as our Force Club

and Premium Members, cause interruption in our operations, damage our computers or otherwise damage our reputation and business.

We may need to expend significant resources to protect against security breaches or to address problems caused by such breaches.

Any actual security breaches could damage our reputation and result in a violation of applicable privacy and other laws, legal

and financial exposure, including litigation and other potential liability, and a loss of confidence in our security measures,

which could have an adverse effect on our results of operations and our reputation as a brand, business partner or employer. In

addition, employee error or malfeasance or other errors in the storage, use or transmission of any such information could result

in a disclosure to third parties. If this should occur, we could incur significant expenses addressing such problems. Since we

collect and store Force Club and Premium Member and vendor information, these risks are heightened.

Risks Relating to the Education Industry

It is expected that if the birthrate continues

to be declining in Japan, the Japanese education industry will face severe competition and face reduced revenues over the medium

and long terms. Taking such risk into consideration, we are planning to develop business in the emerging countries in Asia and

establish education platform adding usability to provision of content. However, if the change in the market is faster than expected

or conversion into new business is not promptly made, our revenue or financial condition may be adversely affected.

Risks Associated with Multi-Level Marketing

Our failure to establish and maintain Force

Club and Premium Member relationships for any reason could negatively impact sales of our products and harm our financial condition

and operating results.

We distribute our products exclusively to

and through Force Club and Premium Members, and we depend upon them directly for substantially all of our sales. Our Force Club

and Premium Members may voluntarily terminate their agreements with us at any time subject to the termination provisions. To increase

our revenue, we must increase the number of, or the productivity of, our Force Club and Premium Members. Accordingly, our success

depends in significant part upon our ability to recruit, retain and motivate a large base of Premium Members. The loss of a significant

number of Force Club or Premium Members for any reason could negatively impact sales of our products and could impair our ability

to attract new Force Club or Premium Members. Our operating results could be harmed if our existing and new business opportunities

and products do not generate sufficient interest to retain existing, and attract new, Force Club and Premium Members. Further,

we may have disputes with our Force Club and Premium Members resulting in cancellation of their contracts, resulting in the loss

of a sales agency relationship and potentially the return of fees to the Force Club or Premium Members. See “Force Club

Membership” below under the heading “Description of Business.”

Adverse publicity associated with our products,

ingredients or network marketing program, or those of similar companies, could harm our financial condition and operating results.

The size of our Force Club and Premium Members

and the results of our operations may be significantly affected by the public’s perception of the Company and similar companies.

This perception is dependent upon opinions concerning:

|

|

•

|

the quality of our

products;

|

|

|

•

|

the quality of similar

products distributed by other companies;

|

|

|

•

|

our Force Club and

Premium Members;

|

Adverse publicity concerning any actual or

purported failure of our Company or our Force Club and Premium Members to comply with applicable laws and regulations could have

an adverse effect on the goodwill of our Company and could negatively affect our ability to attract, motivate and retain Force

Club and Premium Members, which would negatively impact our ability to generate revenue.

In addition, our Force Club and Premium Members’

and consumers’ perception of the quality of our products and as well as similar products distributed by other companies

can be significantly influenced by media attention concerning our products or similar products distributed by other companies.

Adverse publicity questions the benefits of our or similar products could lead to lawsuits or other legal challenges and could

negatively impact our reputation, the market demand for our products, or our general business.

Inability of products

to gain or maintain Force Club or Premium Membership could harm our business.

Our operating results

could be adversely affected if our products, business opportunities, and other initiatives do not generate sufficient enthusiasm

and economic benefit to retain our existing Force Club and Premium Members or to attract new Force Club or Premium Members. Potential

factors affecting the attractiveness of our products, business opportunities, and other initiatives include, among other items,

perceived product quality and value, product exclusivity or effectiveness, economic success in our business opportunity, adverse

media attention, or regulatory restrictions.

Challenges to

the form of our network marketing system could harm our business.

We may be subject

to challenges by government regulators regarding the form of our network marketing system. Legal and regulatory requirements concerning

the multi-level marketing industry generally do not include "bright line" rules and are inherently fact-based and subject

to interpretation. As a result, regulators and courts have discretion in their application of these laws and regulations, and

the enforcement or interpretation of these laws and regulations by government agencies or courts can change. We could also be

subject to challenges by private parties in civil actions. All of these actions and any future scrutiny of us or our industry

could generate negative publicity or further regulatory actions that could result in fines, restrict our ability to conduct our

business in our various markets, enter into new markets, motivate our membership, and attract consumers.

-6-

Table of Contents

Improper actions

by our Members could harm our business.

Actions by our Members,

sanctioned by our Company or not, could violate applicable laws or regulations could result in government or third-party actions

against us, which could harm our business.

The direct selling

industry in Japan continues to experience regulatory and media scrutiny, and other direct selling companies have been suspended

from sponsoring activities in the past. Japan imposes strict requirements regarding how distributors approach prospective

customers. As a result, we continually evaluate and enhance our distributor compliance, education and training efforts in

Japan. However, we cannot be certain that our efforts will successfully prevent regulatory actions against us, including fines,

suspensions or other sanctions, or that the company and the direct selling industry will not receive further negative media attention,

all of which could harm our business.

The loss of key

Premium Members could negatively impact our growth and our revenue.

Currently we have

20 key Premium Members. They are responsible for sales promotion to expand their group and provide support and compliance training

to the members of their group. The loss of a key Premium Member, or a sales leader or a group of leading sales leaders, whether

by their own choice or through disciplinary actions by us for violations of our policies and procedures, could negatively impact

our growth and our revenue.

Laws and regulations may prohibit or

severely restrict direct selling and cause our revenue and profitability to decline, and regulators could adopt new regulations

that harm our business.

Laws and regulations

in Japan are particularly stringent and subject to broad discretion in enforcement by regulators. These laws and regulations are

generally intended to prevent fraudulent or deceptive schemes, often referred to as "pyramid schemes," that compensate

participants primarily for recruiting additional participants without significant emphasis on product sales to consumers.

Complying with these

rules and regulations can be difficult, time-consuming and expensive, and may require significant resources. The laws and regulations

governing direct selling are modified from time to time, and, like other direct selling companies, we are subject from time to

time to government inquiries and investigations related to our direct selling activities. In addition, markets where we currently

do business could change their laws or regulations to prohibit direct selling. If we are unable to continue business in existing

markets or commence operations in new markets because of these laws, our revenue and profitability may decline.

Risks Relating to the Company’s

Stock

The shares of our common stock are currently

not being traded and there can be no assurance that there will be an active market in the future.

Our shares of common stock are traded on the

OTC Pink, which does not have the liquidity or corporate standards of the NYSE or NASDAQ and as such, the price per share quoted

on the OTC Pink may not reflect our value. There can be no assurance that there will be an active market for our shares of common

stock in the future. As a result, investors may not be able to liquidate their investment or liquidate it at a price that reflects

the value of the business.

It is possible that we will not establish

an active market unless our stock is listed for trading on an exchange, and we cannot assure you that we will ever satisfy exchange

listing requirements.

It is possible that a significant trading

market for our shares will not develop unless the shares are listed for trading on a national exchange. Exchange listing would

require us to satisfy a number of tests as to corporate governance, public float, shareholders, equity, assets, market makers

and other matters, some of which we do not currently meet. We cannot assure you that we will ever satisfy listing requirements

for a national exchange or that there ever will be significant liquidity in our shares.

If we issue additional shares of our common

stock, you will experience dilution of your ownership interest.

We may issue shares of our authorized but

unissued equity securities in the future. Such shares may be issued in connection with raising capital, acquiring assets or firing

or retaining employees or consultants. If we issue such shares, your ownership will be diluted.

We do not intend to pay dividends in the

foreseeable future, and investors should not purchase our stock expecting to receive dividends.

We have not paid any dividends on our common

stock in the past, and we do not anticipate that we will pay dividends in the foreseeable future. Accordingly, some investors

may decline to invest in our common stock, and this may reduce the liquidity of our stock.

The limitations on liability for officers,

directors and employees under the laws of the State of Delaware and the existence of indemnification rights for our officers,

directors and employees could result in substantial expenditures by the Company and could discourage lawsuits against our officers,

directors and employees.

Our Articles of Incorporation contain a specific

provision that eliminates the liability of our officers and directors for monetary damages to our company and shareholders. Further,

we intend to provide indemnification to our officers and directors to the fullest extent permitted by the laws of the State of

Delaware. We may also enter into employment and other agreements in the future pursuant to which we will have indemnification

obligations. The foregoing indemnification obligations could result in the Company incurring substantial expenditures to cover

the cost of settlement or damage awards against officers and directors. These obligations may discourage the filing of derivative

litigation by our shareholders against our officers and directors even where such litigation may be perceived as beneficial by

our shareholders.

We are an emerging growth company and cannot

be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive

to investors.

Exceed World will incur increased costs

and compliance risks as a public company.

As a public company, Exceed World will have

additional legal, accounting and other expenses that Exceed World did not have prior to acquiring Force Holdings and its subsidiaries.

-7-

Table of Contents

SUMMARY OF OUR FINANCIAL

INFORMATION

The following table sets forth selected financial information,

which should be read in conjunction with the information set forth in the “Management’s Discussion and Analysis”

section and the accompanying financial statements and related notes included elsewhere in this Prospectus.

|

EXCEED

WORLD, INC.

|

|

CONSOLIDATED

BALANCE SHEETS

|

|

|

|

|

|

|

As

of

|

|

As

of

|

|

|

|

|

September

30, 2019

|

|

September

30, 2018

|

|

|

|

|

|

|

(Restated)

|

|

ASSETS

|

|

|

|

|

|

Current

Assets

|

|

|

|

|

|

|

Cash

and cash equivalents

|

$

|

20,198,362

|

$

|

22,737,755

|

|

|

Marketable

securities

|

|

1,156,108

|

|

830,331

|

|

|

Accounts

receivable

|

|

2,344

|

|

1,032

|

|

|

Short-term

loan receivable

|

|

-

|

|

395,848

|

|

|

Income

tax recoverable

|

|

-

|

|

425,303

|

|

|

Prepaid

expenses

|

|

865,274

|

|

295,510

|

|

|

Inventories

|

|

626,142

|

|

380,925

|

|

|

Due

from related party

|

|

92,524

|

|

-

|

|

|

Other

current assets

|

|

453,291

|

|

255,030

|

|

TOTAL

CURRENT ASSETS

|

|

23,394,045

|

|

25,321,734

|

|

|

|

|

|

|

|

|

Non-current

Assets

|

|

|

|

|

|

|

Property,

plant and equipment, net

|

|

792,452

|

|

343,991

|

|

|

Software,

net

|

|

1,051,398

|

|

2,236,447

|

|

|

Other

intangible assets, net

|

|

176,897

|

|

992,208

|

|

|

Long-term

prepaid expenses

|

|

84,968

|

|

58,341

|

|

|

Deferred

tax assets

|

|

134,936

|

|

287,157

|

|

|

Long-term

loan receivable from related party

|

|

232,128

|

|

-

|

|

|

Insurance

funds

|

|

91,161

|

|

-

|

|

TOTAL

NON-CURRENT ASSETS

|

|

2,563,940

|

|

3,918,144

|

|

|

|

|

|

|

|

|

TOTAL

ASSETS

|

$

|

25,957,985

|

$

|

29,239,878

|

|

|

|

|

|

|

|

|

LIABILITIES

AND SHAREHOLDERS' EQUITY

|

|

|

|

|

|

Current

Liabilities

|

|

|

|

|

|

|

Accounts

payable

|

$

|

1,226,111

|

$

|

4,572,204

|

|

|

Accrued

expenses and other payables

|

|

565,506

|

|

65,811

|

|

|

Deposit

receipt

|

|

-

|

|

100,657

|

|

|

Contingency

liability

|

|

409,428

|

|

-

|

|

|

Income

tax payable

|

|

287,301

|

|

-

|

|

|

Deferred

income

|

|

3,267,399

|

|

4,460,652

|

|

|

Capital

lease obligations, current

|

|

28,683

|

|

9,327

|

|

|

Due

to related parties

|

|

814,153

|

|

338,725

|

|

|

Due

to director

|

|

741,133

|

|

596,059

|

|

|

Other

current liabilities

|

|

735,926

|

|

1,741,639

|

|

TOTAL

CURRENT LIABILITIES

|

|

8,075,640

|

|

11,885,074

|

|

|

|

|

|

|

|

|

Non-current

Liabilities

|

|

|

|

|

|

|

Capital

lease obligations, long-term

|

|

98,964

|

|

41,786

|

|

|

Long-term

note payable

|

|

-

|

|

483,814

|

|

|

Long-term

deferred income

|

|

-

|

|

2,183

|

|

TOTAL

NON-CURRENT LIABILITIES

|

|

98,964

|

|

527,783

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES

|

|

8,174,604

|

|

12,412,857

|

|

|

|

|

|

|

|

|

Shareholders'

Equity

|

|

|

|

|

|

|

Preferred

stock ($0.0001 par value, 20,000,000 shares authorized;

|

|

|

|

|

|

|

none

issued and outstanding as of September 30, 2019 and 2018)

|

|

-

|

|

-

|

|

|

Common

stock ($0.0001 par value, 500,000,000 shares authorized,

|

|

|

|

|

|

|

32,700,000

shares issued and outstanding as of September 30, 2019 and 2018)

|

|

3,270

|

|

3,270

|

|

|

Additional

paid-in capital

|

|

261,516

|

|

99,440

|

|

|

Accumulated

earnings

|

|

16,764,282

|

|

16,896,299

|

|

|

Accumulated

other comprehensive income (loss)

|

|

754,313

|

|

(171,988)

|

|

TOTAL

SHAREHOLDERS' EQUITY

|

|

17,783,381

|

|

16,827,021

|

|

|

|

|

|

|

|

|

TOTAL

LIABILITIES AND SHAREHOLDERS' EQUITY

|

$

|

25,957,985

|

$

|

29,239,878

|

|

EXCEED

WORLD, INC.

|

|

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

|

|

|

|

|

|

|

Year

Ended

|

|

Year

Ended

|

|

|

|

|

September

30, 2019

|

|

September

30, 2018

|

|

|

|

|

|

|

(Restated)

|

|

Revenues

|

$

|

28,393,548

|

$

|

34,878,988

|

|

Cost

of revenues

|

|

16,105,594

|

|

18,654,182

|

|

Gross

profit

|

|

12,287,954

|

|

16,224,806

|

|

|

|

|

|

|

|

|

Operating

expenses

|

|

|

|

|

|

|

Selling

and distribution expenses

|

|

1,908,950

|

|

1,989,146

|

|

|

Administrative

expenses

|

|

10,853,331

|

|

11,623,028

|

|

Total

operating expenses

|

|

12,762,281

|

|

13,612,174

|

|

|

|

|

|

|

|

|

Income

(loss) from operations

|

|

(474,327)

|

|

2,612,632

|

|

|

|

|

|

|

|

|

Other

income (expense)

|

|

|

|

|

|

|

Other

income

|

|

1,270,353

|

|

266,946

|

|

|

Other

expenses

|

|

(845,289)

|

|

(18,171)

|

|

|

Change

in fair value of marketable securities

|

|

365,026

|

|

(568,990)

|

|

|

Interest

expenses

|

|

(1,513)

|

|

(6,082)

|

|

Total

other income (expense)

|

|

788,577

|

|

(326,297)

|

|

|

|

|

|

|

|

|

Net

income before tax

|

|

314,250

|

|

2,286,335

|

|

Income

tax expense (credit)

|

|

446,267

|

|

(89,297)

|

|

Net

income (loss)

|

$

|

(132,017)

|

$

|

2,375,632

|

|

|

|

|

|

|

|

|

Comprehensive

income (loss)

|

|

|

|

|

|

Net

income (loss)

|

|

(132,017)

|

|

2,375,632

|

|

Other

comprehensive income (loss)

|

|

|

|

|

|

|

Foreign

currency translation adjustment

|

|

926,301

|

|

(244,734)

|

|

|

|

|

|

|

|

|

TOTAL

COMPREHENSIVE INCOME

|

$

|

794,284

|

$

|

2,130,898

|

|

|

|

|

|

|

|

|

Income

(loss) per common share

|

|

|

|

|

|

|

Basic

|

$

|

(0.00)

|

$

|

0.12

|

|

|

Diluted

|

$

|

(0.00)

|

$

|

0.12

|

|

Weighted

average common shares outstanding

|

|

|

|

|

|

|

Basic

|

|

32,700,000

|

|

20,173,973

|

|

|

Diluted

|

|

32,700,000

|

|

20,173,973

|

-8-

Table of Contents

|

EXCEED

WORLD, INC.

CONSOLIDATED

BALANCE SHEETS

|

|

|

|

|

As

of

|

|

As

of

|

|

|

|

|

March

31, 2020

|

|

September

30, 2019

|

|

|

|

|

(Unaudited)

|

|

|

|

ASSETS

|

|

|

|

|

|

Current

Assets

|

|

|

|

|

|

|

Cash

and cash equivalents

|

$

|

17,117,857

|

$

|