UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2020

Commission File Number: 001-38655

Farfetch Limited

(Exact Name of Registrant as Specified in Its Charter)

The Bower

211 Old Street

London EC1V 9NR

United Kingdom

+44 (0) 20 7549 5400

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Outlook

On June 25, 2020, in conjunction with the Company’s presentation at an investor conference, Farfetch Limited (the “Company” or “Farfetch”) provided an update on its outlook for Gross Merchandise Value (“GMV”) for its Digital Platform and Brand Platform segments, its Digital Platform Order Contribution Margin, and Adjusted EBITDA for the second quarter ending June 30, 2020 (“Q2 2020”).

Farfetch expects Digital Platform GMV in Q2 2020 of $605 million to $630 million, representing 25% to 30% growth year-over-year. This anticipated performance reflects the vital role of the Farfetch platform in connecting the global luxury fashion community, particularly as the online share of luxury is expected to continue to grow post-COVID-19. The acceleration of transaction growth across the Farfetch Marketplace highlights the anticipated increase in adoption of online luxury by consumers, brands and retailers, fueled in part by the reduction in international travel driving growth in demand from global markets previously underserved by established luxury retailers.

Of particular note, the expected Q2 2020 Digital Platform GMV growth reflects the following (all information as of June 21, 2020):

|

•

|

increased year-over-year transactions from first-time Farfetch Marketplace customers, which has expanded membership in the Access loyalty program and is expected to fuel growth in future periods;

|

|

•

|

high levels of customer engagement, as indicated by record Q2 traffic to Farfetch’s apps and websites, which increased more than 60% year-over-year, and App installs which have more than doubled year-over-year;

|

|

•

|

accelerated year-over-year demand from customers across our European and Middle Eastern markets, and continued strength in the China region, demonstrating clear signs of recovery within online luxury following the onset of COVID-19;

|

|

•

|

a significant increase in the mix of sellers' overall sales of current season (Spring-Summer 2020) stock represented by the Farfetch marketplace;

|

|

•

|

accelerated year-over-year order growth, which is more than compensating for a year-over-year decline in Average Order Value (“AOV”) resulting from the higher mix of new customers (who initially have lower than average AOVs), a higher mix of sales of lower price products and categories, and the impact of foreign currency exchange rate fluctuations; and

|

|

•

|

significant transaction growth generated by Farfetch Platform Solutions enterprise clients.

|

New Guards Group has begun shipping its new season collections and is expected to deliver $60 million to $70 million Brand Platform GMV in Q2 2020, which reflects some delays in Fall-Winter 2020 shipments as retailers focus on selling through current Spring-Summer 2020 inventory ahead of receiving new season product - consistent with the slower ramp up of new season (Fall-Winter 2020) product on the Farfetch Marketplace as compared to the prior year.

Q2 2020 Digital Platform Order Contribution Margin is expected to remain above 30%, and Q2 2020 Adjusted EBITDA loss is expected to improve year-over-year.

Additionally, Farfetch continues to target Adjusted EBITDA profitability for full year 2021.

Forward Looking Statements

This report on Form 6-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this report on Form 6-K that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our expected financial performance and operational performance for the second quarter of 2020, the impact of the COVID-19 pandemic on our operations and supply chain and the broader luxury industry, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management’s current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: purchasers of luxury products may not choose to shop online in sufficient numbers; our ability to generate sufficient revenue to be profitable or to generate positive cash flow on a sustained basis; the volatility and difficulty in predicting the luxury fashion industry; our reliance on a limited number of retailers and brands for the supply of products on our Marketplace; our reliance on retailers and brands to anticipate, identify and respond quickly to new and changing fashion trends, consumer preferences and other factors; our reliance on retailers and brands to make products available to our consumers on our Marketplace and to set their own prices for such products; fluctuation in foreign exchange rates; our reliance on information technologies and our ability to adapt to technological developments; our ability to acquire or retain consumers and to promote and sustain the Farfetch brand; our ability or the ability of third parties to protect our sites, networks and systems against security breaches, or otherwise to protect our confidential information; our ability to successfully launch and monetize new and innovative technology; our acquisition and integration of other companies or technologies, for example, Stadium Goods and New Guards, could divert management’s attention and otherwise disrupt our operations and harm our operating results; we may be unsuccessful in integrating any acquired businesses or realizing any anticipated benefits of such acquisitions; our dependence on highly skilled personnel, including our senior management, data scientists and technology professionals, and our ability to hire, retain and motivate qualified personnel; our ability to successfully implement our business plan during a global economic downturn caused by the COVID-19 pandemic that may impact the demand for our products and services or have a material adverse impact on our or our business partners’ financial condition and results of operations; José Neves, our chief executive officer, has considerable influence over important corporate matters due to his ownership of us, and our dual-class voting structure will limit your ability to influence corporate matters, including a change of control; and the other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 20-F filed with the U.S. Securities and Exchange Commission (“SEC”) for the fiscal year ended December 31, 2019, as such factors may be updated from time to time in our other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov and on our website at http://farfetchinvestors.com. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this report on Form 6-K are inherently uncertain and may not occur, and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this report on Form 6-K relate only to events or information as of the date on which the statements are made in this report on Form 6-K. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

Financial Disclosure Advisory

Farfetch has not yet completed its reporting process for the three months ended June 30, 2020. The preliminary estimates presented herein are based on Farfetch’s reasonable estimates and the information available to it at this time. As such, the Company’s actual results may materially vary from the preliminary estimates presented herein and will not be finalized until we report our final results for Q2 2020 after the completion of our normal quarter end accounting procedures including the execution of our internal controls over financial reporting.

These estimates should not be viewed as a substitute for our full interim results prepared in accordance with IFRS. Accordingly, you should not place undue reliance on these estimates.

Non-IFRS and Other Financial and Operating Metrics

Farfetch reports under International Financial Reporting Standards (“IFRS”). Farfetch provides earnings guidance on a non-IFRS basis and does not provide earnings guidance on an IFRS basis. This report on Form 6-K includes certain financial measures not based on IFRS, including Adjusted EBITDA and Digital Platform Order Contribution Margin (together, the “Non-IFRS Measures”), as well as operating metrics, including GMV, Digital Platform GMV, Brand Platform GMV and Average Order Value.

Management uses the Non-IFRS Measures:

|

•

|

as measurements of operating performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of items not directly resulting from our core operations;

|

|

•

|

for planning purposes, including the preparation of our internal annual operating budget and financial projections;

|

|

•

|

to evaluate the performance and effectiveness of our strategic initiatives; and

|

|

•

|

to evaluate our capacity to fund capital expenditures and expand our business.

|

The Non-IFRS Measures may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. We present the Non-IFRS Measures because we consider them to be important supplemental measures of our performance, and we believe they are frequently used by securities analysts, investors and other interested parties in the evaluation of companies. Management believes that investors’ understanding of our performance is enhanced by including the Non-IFRS Measures as a reasonable basis for comparing our ongoing results of operations. Many investors are interested in understanding the performance of our business by comparing our results from ongoing operations period over period and would ordinarily add back non-cash expenses such as depreciation, amortization and items that are not part of normal day-to-day operations of our business. By providing the Non-IFRS Measures, together with reconciliations to IFRS, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing our strategic initiatives.

Items excluded from the Non-IFRS Measures are significant components in understanding and assessing financial performance. The Non-IFRS Measures have limitations as analytical tools and should not be considered in isolation, or as an alternative to, or a substitute for loss after tax, revenue or other financial statement data presented in our consolidated financial statements as indicators of financial performance. Some of the limitations are:

|

•

|

such measures do not reflect our expenditures, or future requirements for capital expenditures or contractual commitments;

|

|

•

|

such measures do not reflect changes in our working capital needs;

|

|

•

|

such measures do not reflect our share based payments, income tax expense or the amounts necessary to pay our taxes;

|

|

•

|

although depreciation and amortization are eliminated in the calculation of Adjusted EBITDA, the assets being depreciated and amortized will often have to be replaced in the future and such measures do not reflect any costs for such replacements; and

|

|

•

|

other companies may calculate such measures differently than we do, limiting their usefulness as comparative measures.

|

Due to these limitations, the Non-IFRS Measures should not be considered as measures of discretionary cash available to us to invest in the growth of our business and are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with IFRS. In addition, the Non-IFRS Measures we use may differ from the non-IFRS financial measures used by other companies and are not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with IFRS. Furthermore, not all companies or analysts may calculate similarly titled measures in the same manner. We compensate for these limitations by relying primarily on our IFRS results and using the Non-IFRS Measures only as supplemental measures.

Digital Platform Order Contribution Margin is not a measurement of our financial performance under IFRS and does not purport to be an alternative to gross margin derived in accordance with IFRS. We believe that Digital Platform Order Contribution Margin is a useful measure in evaluating our operating performance within our industry because it permits the evaluation of our digital platform productivity, efficiency and performance. We also believe that Digital Platform Order Contribution Margin is a useful measure in evaluating our operating performance because they take into account demand generation expense and are used by management to analyze the operating performance of our digital platform for the periods presented.

A reconciliation of the Company’s Digital Platform Order Contribution Margin guidance to the most directly comparable IFRS financial measure cannot be provided without unreasonable efforts and is not provided herein because of the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations, including adjustments that are made for estimating Digital Platform Services Revenue, the amounts of which, could be material.

“Digital Platform GMV” means GMV excluding In-Store GMV and Brand Platform GMV. Digital Platform GMV was referred to as Platform GMV in previous filings with the SEC.

“Brand Platform GMV” and “Brand Platform Revenue” mean revenue relating to the New Guards operations less revenue from New Guards’: (i) owned e-commerce websites, (ii) direct to consumer channel via our Marketplaces and (iii) directly operated stores. Revenue realized from Brand Platform is equal to GMV as such sales are not commission based.

“Digital Platform Order Contribution Margin” means Digital Platform Order Contribution calculated as a percentage of Digital Platform Services Revenue. Digital Platform Order Contribution Margin was referred to as Platform Order Contribution Margin in previous filings with the SEC. Refer to the Company’s other filings with the SEC for the definitions of “Digital Platform Order Contribution” and “Digital Platform Services Revenue.”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Farfetch Limited

|

|

|

|

|

|

Date: June 25, 2020

|

By:

|

/s/ José Neves

|

|

|

|

José Neves

|

|

|

|

Chief Executive Officer

|

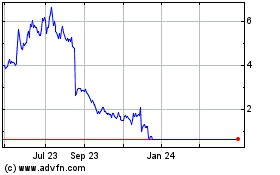

Farfetch (NYSE:FTCH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Farfetch (NYSE:FTCH)

Historical Stock Chart

From Apr 2023 to Apr 2024