UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

|

|

|

|

|

|

|

ý

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2019

OR

|

|

|

|

|

|

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number 001-32327

|

|

|

|

|

|

|

|

A.

|

Full title of the plan and the address of the plan, if different from that of the issuer named below:

|

MOSAIC UNION SAVINGS PLAN

|

|

|

|

|

|

|

|

B.

|

Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

|

The Mosaic Company

101 East Kennedy Boulevard

Suite 2500

Tampa, Florida 33602

813-775-4200

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Financial Statements and Supplemental Schedule

December 31, 2019 and 2018

(With Report of Independent Registered Public Accounting Firm Thereon)

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm

|

|

|

|

|

|

Financial Statements:

|

|

|

|

|

|

Statements of Net Assets Available for Benefits

|

|

|

|

|

|

Statements of Changes in Net Assets Available for Benefits

|

|

|

|

|

|

Notes to Financial Statements

|

|

|

|

|

|

Supplemental Schedule

|

|

|

|

|

|

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

|

|

Report of Independent Registered Public Accounting Firm

To the Plan Participants and Plan Administrator

Mosaic Union Savings Plan:

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of the Mosaic Union Savings Plan (the Plan) as of December 31, 2019 and 2018, the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively, the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2019 and 2018, and the changes in net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Accompanying Supplemental Information

The Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2019 has been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplemental information is the responsibility of the Plan's management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

KPMG LLP

We have served as the Plan’s auditor since 2005.

Minneapolis, Minnesota

June 24, 2020

MOSAIC UNION SAVINGS PLAN

Statements of Net Assets Available for Benefits

December 31, 2019 and 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan's interest in the Mosaic Investment Plan and Mosaic Union Savings Plan Master Trust, at fair value

|

|

|

|

|

|

$

|

225,074,017

|

|

$

|

187,959,468

|

|

|

|

Receivables:

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer contributions

|

|

|

|

|

|

5,252,360

|

|

|

5,683,330

|

|

|

|

|

Notes receivable from participants

|

|

|

|

|

|

8,447,377

|

|

|

9,105,010

|

|

|

|

|

|

|

|

Total receivables

|

|

|

13,699,737

|

|

|

14,788,340

|

|

|

|

|

|

|

|

Net assets available for benefits

|

|

$

|

238,773,754

|

|

$

|

202,747,808

|

|

See accompanying notes to financial statements.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Statements of Changes in Net Assets Available for Benefits

Years ended December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Additions to net assets attributed to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Plan's interest in net investment income (loss) of the Mosaic Investment Plan and Mosaic Union Savings Plan Master Trust

|

|

|

|

|

|

$

|

36,069,299

|

|

$

|

(8,849,508)

|

|

|

|

|

|

|

|

Net investment income (loss)

|

|

|

36,069,299

|

|

|

(8,849,508)

|

|

|

Contributions:

|

|

|

|

|

|

|

|

|

|

|

|

|

Participants

|

|

|

|

|

|

|

15,785,889

|

|

|

14,574,357

|

|

|

|

Employer

|

|

|

|

|

|

|

10,583,366

|

|

|

10,365,969

|

|

|

|

|

|

|

|

Total contributions

|

|

|

26,369,255

|

|

|

24,940,326

|

|

|

Other

|

|

|

|

|

|

|

|

—

|

|

|

2,568

|

|

|

|

|

|

|

|

Total additions

|

|

|

62,438,554

|

|

|

16,093,386

|

|

|

Deductions from net assets attributed to:

|

|

|

|

|

|

|

|

|

|

|

|

|

Benefits paid

|

|

|

|

|

|

|

27,120,763

|

|

|

28,519,055

|

|

|

|

Administrative fees

|

|

|

|

|

|

|

285,685

|

|

|

386,065

|

|

|

|

|

|

|

|

Total deductions

|

|

|

27,406,448

|

|

|

28,905,120

|

|

|

|

|

|

|

|

Net increase (decrease)

|

|

|

35,032,106

|

|

(12,811,734)

|

|

|

Net transfers from (to) qualified plans

|

|

|

|

|

|

|

|

993,840

|

|

|

(186,183)

|

|

|

Net assets available for benefits:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning of year

|

|

|

|

|

|

|

202,747,808

|

|

|

215,745,725

|

|

|

|

End of year

|

|

|

|

|

|

$

|

238,773,754

|

|

$

|

202,747,808

|

|

See accompanying notes to financial statements.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

(1)Description of the Plan

The following description of the Mosaic Union Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

The Plan was established pursuant to collective bargaining agreements with the unions.

(a)General

The following union hourly employees of The Mosaic Company (the Company) are eligible to participate upon their hire date:

Employees represented by Local #188‑A of the United Steelworkers of America at the Carlsbad, New Mexico operations;

Employees represented by Local #1625 International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the New Wales, Florida operations;

Employees represented by Local #35C International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Four Corners, Florida operations;

Employees represented by Local #1625 International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Port Sutton, Florida facility (through December 23, 2003);

Employees represented by Local #12458‑02 of the United Steelworkers of America at the Hutchinson, Kansas operations (through October 31, 2005);

Employees represented by Local #22 Bakery, Confectionary, Tobacco Workers and Grain Millers at the Savage, Minnesota operations;

Employees represented by Locals #39C, 439C, and 814C International Chemical Workers Union Council of the United Food and Commercial Workers International Union at the Bartow, Riverview and Hookers Prairie, Florida operations;

Employees represented by Allied‑Industrial Union and its Local #4‑227, AFL‑CIO, CLC at the Houston, Texas operations (through December 11, 2008); and

Employees represented by Local #7‑662 of the United Steelworkers of America at the Pekin, Illinois operations.

Pursuant to certain collective bargaining agreements, newly hired represented employees are automatically enrolled in the Plan upon meeting the eligibility requirements. A participant is assumed to have authorized the Company to withhold from each paycheck a union-negotiated percentage of pay on a before‑tax basis. Automatic payroll withholding can begin no sooner than 45 days from date of hire. A participant has the right to decline automatic enrollment within 45 days from date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974 (ERISA), as amended.

(b)Contributions

The Plan is funded by contributions from participants in the form of payroll deductions/salary reductions from 1% to 75% of participants’ eligible pay (subject to Internal Revenue Service (IRS) annual statutory limits of $19,000 and $18,500 for 2019 and 2018, respectively) in before-tax dollars. Additional before-tax “catch-up” contributions are allowed above the IRS annual dollar limit for employees at least age 50 or who will reach age 50 during a given calendar year. Participants direct the investment of their contributions into various investment options offered by the Plan. The Plan is also funded by Company matching contributions, which are subject to certain limitations imposed by Section 415 of the Internal Revenue Code (IRC). Participants should refer to their collective bargaining agreement, summary plan description, or contact their local Human Resources to determine the specific matching contributions.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

Pursuant to certain collective bargaining agreements, the Company added a Defined Contribution Retirement Plan (DCRP) feature to the Plan. Pursuant to certain collective bargaining agreements, the Plan was amended to allow certain participants to freeze their defined benefit accruals and begin participating in the DCRP feature of the Plan. The Company contribution to the DCRP feature is based on a percentage of an employee’s eligible pay. The Plan has become the primary retirement vehicle for employees covered by certain collective bargaining agreements. Generally, a participant must be employed on the last day of the Plan year to be eligible for the DCRP contribution.

Participants may roll over their vested benefits from other qualified retirement plans to the Plan.

(c)Participant Accounts

Each participant’s account is credited with the participant’s contributions and allocations of (a) the Company contributions, and (b) Plan earnings (losses). Each participant’s account is charged with an allocation of certain administrative expenses. Allocations are based on earnings or account balances, as defined. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s vested account.

(d)Administrative Expenses

Administrative expenses are to be paid by the Plan but may be paid by the Company.

(e)Investments

The Plan’s investments are held in the Mosaic Investment Plan and Mosaic Union Savings Plan Master Trust (the Master Trust) which is administered by Fidelity Investments.

Participants can choose from among twenty-four investment funds and may elect to change the investment direction of their existing account balances and their future contributions daily.

(f)Vesting

Participants are immediately vested in the portion of their Plan account related to participant contributions, Company matching contributions, and earnings thereon. Certain participants eligible for DCRP contributions are vested in their DCRP account after either three years of service, attaining age 65, or death while an employee. Forfeited, non-vested accounts will be used to reduce future employer contributions. In 2019 and 2018, Company contributions were reduced by $50,669 and $50,312, respectively, from forfeited non-vested accounts.

(g)Payment of Benefits

Participants may withdraw their vested account balance upon termination of employment. Under certain conditions of financial hardship, participants working for the Company may withdraw certain funds. Certain withdrawals are available after age 59½ or in the event of disability. Additionally, while still employed, in-service withdrawals are available subject to certain requirements and limitations.

Subject to potential IRS penalties, participants whose employment is terminated and have a vested account balance in excess of $5,000 may receive their distribution in a lump sum or installments that commence immediately after termination or a later date, but no later than age 70½. Participants may be entitled to additional forms of payment or may need to obtain spousal consent to a distribution or withdrawal if the participant had an account balance from another qualified plan, that plan was maintained by a company that was acquired by the Company, and the participant’s account balance was transferred to this Plan.

(h)Notes Receivable from Participants

Eligible participants may borrow from their fund accounts a minimum loan amount of $500 up to a maximum equal to the lesser of $50,000 or 50% of their account balance. Eligible participants may have one loan outstanding at any given time. Account balances attributable to the annual Company contributions are not available for loans. Loan terms range from 6 months to 5 years. The loans are secured by the balance in the participant’s account and bear interest at a fixed rate of 1% above the prevailing prime rate, as quoted in The Wall

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

Street Journal at time of issuance. Interest rates on outstanding loans ranged from 4.25% to 9.0% in 2019 and from 4.25% to 9.0% in 2018. Principal and interest are paid through payroll deductions.

(i)Plan Termination

Although it has not expressed any interest to do so, the Company reserves the right under the Plan (subject to the collective bargaining agreements) to make changes at any time or even suspend or terminate the Plan subject to the provisions of ERISA. Upon termination of the Plan, participants will become fully vested in all amounts in their accounts.

(2)Summary of Significant Accounting Policies

(a)Basis of Accounting

The financial statements of the Plan are prepared under the accrual basis of accounting and have been prepared in accordance with U.S. Generally Accepted Accounting Principles (GAAP).

(b)Recently Issued Accounting Guidance

Recently Adopted Accounting Standards

In February 2017, the FASB issued ASU No. 2017-06, Defined Contribution Pension Plans (Topic 962): Employee Benefit Plan Master Trust Reporting. ASU 2017-06 requires disclosure of the dollar amount of the plan’s interest in each type of investment held by a master trust, as well as the master trust’s other assets and liabilities on a gross basis, and the dollar amount of the Plan’s interest in each balance. ASU 2017-06 was adopted on January 1, 2019 and applied retrospectively to all periods presented. The adoption did not have a material impact on the Plan’s financial statements.

Pronouncements Issued But Not Adopted

In August 2018, the FASB issued ASU No. 2018-13, Fair Value Measurement (Topic 820): Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Financial Measurement. ASU 2018-13 is effective for fiscal years beginning after December 15, 2019. Early adoption is permitted.

The Company does not expect this update to have a material impact on the Plan’s financial statements.

(c)Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

(d)Investment Valuation and Income Recognition

Master Trust investments are stated at fair value. The Master Trust’s investments in common/collective trust funds hold indirect investments in fully responsive investment contracts and as a result they are recognized at fair value and not contract value which is required for direct investments. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value for shares of mutual and common/collective trust funds is the net asset value of those shares or units, as determined by the respective funds.

Net appreciation (depreciation) in the fair value of investments includes realized gains and losses on investments bought and sold and the change in appreciation (depreciation) from one period to the next. Purchases and sales of securities are accounted for on a trade‑date basis. Dividend income is recorded on the ex‑dividend date. Interest from investments is recorded on the accrual basis.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

(e)Notes Receivable from Participants

Notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest. Interest income is recorded on the accrual basis. Related fees are recorded as administrative expenses and are expensed when they are incurred. No allowance for credit losses has been recorded as of December 31, 2019 or 2018. If a participant ceases to make loan repayments and the plan administrator deems the participant loan to be in default, the participant loan balance is reduced and a benefit payment is recorded.

(f)Payment of Benefits

Benefit payments are recorded when paid.

(g)Administrative Expenses

Certain expenses of maintaining the Plan are paid directly by the Company and are excluded from these financial statements. Fees related to the administration of notes receivable from participants are charged directly to the participant's account and are included in administrative expenses. Investment related expenses are included in the Plan’s interest in net investment income of the Master Trust.

(3)Interest in Master Trust

The Plan’s investments are held in the Master Trust. The Plan maintains a divided beneficial interest in each of the investment accounts of the Master Trust.

The Plan’s interest in the investments of the Master Trust is based on the individual Plan participants’ investment balances (divided interest). Investment income (loss) is allocated by the Trustee on a daily basis through a valuation of each participating plan’s investments and each participant’s share of each investment. Expenses relating to the Master Trust are allocated to the individual funds based upon each participant’s pro rata share, per-share calculation, or by transaction in a specific fund. The Plan held a 24.4% and 23.6% interest in the Master Trust at December 31, 2019 and 2018, respectively.

The net assets of the Master Trust for the years ended December 31 are as follows:

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Master Trust

|

|

|

Plan's interest

in the

Master Trust

|

|

|

Master Trust

|

|

|

Plan's interest

in the

Master Trust

|

|

Investments, at fair value:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mosaic Company common stock

|

|

|

|

|

|

$

|

18,282,012

|

|

$

|

2,747,880

|

|

|

$

|

23,815,752

|

|

|

$

|

|

3,407,324

|

|

|

|

Mutual funds

|

|

|

|

|

|

|

399,938,672

|

|

|

85,263,183

|

|

|

|

235,247,297

|

|

|

|

|

48,095,429

|

|

|

|

Common collective trust funds

|

|

|

|

|

|

|

518,973,421

|

|

|

136,997,591

|

|

|

|

555,965,419

|

|

|

|

|

136,314,642

|

|

|

|

|

|

|

|

Total Investments

|

|

|

937,194,105

|

|

|

225,008,654

|

|

|

|

815,028,468

|

|

|

|

|

187,817,395

|

|

|

Non-interest bearing cash

|

|

|

|

|

|

|

|

2,948,623

|

|

|

65,363

|

|

|

|

3,381,844

|

|

|

|

|

142,073

|

|

|

|

|

|

|

|

Total assets

|

|

|

940,142,728

|

|

|

225,074,017

|

|

|

|

818,410,312

|

|

|

|

|

187,959,468

|

|

|

|

|

|

|

|

Net assets

|

|

$

|

940,142,728

|

|

$

|

225,074,017

|

|

|

$

|

818,410,312

|

|

|

$

|

|

187,959,468

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income of the Master Trust for the years ended December 31 is summarized as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Interest and dividend income

|

|

|

|

|

|

|

$

|

13,061,274

|

|

$

|

14,772,455

|

|

|

Total net realized and unrealized appreciation (depreciation) in fair value of investments

|

|

|

|

|

|

|

|

44,800,392

|

|

|

(52,825,485)

|

|

|

|

Investment income (loss)

|

|

|

|

|

|

$

|

57,861,666

|

|

$

|

(38,053,030)

|

|

|

Plan's interest in the Master Trust investment income (loss)

|

|

|

|

|

|

|

$

|

36,069,299

|

|

$

|

(8,849,508)

|

|

(4)Fair Value Measurements

Accounting Standards Codification (ASC) 820, Fair Value Measurements, defines fair value as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at fair value, the Plan considers the principal or most advantageous market in which it would transact and considers assumptions that market participants would use when pricing the asset or liability, such as inherent risk, transfer restrictions, and risk of nonperformance.

ASC 820 also establishes a fair value hierarchy that requires the Plan to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value measurement. ASC 820 established three levels of inputs that may be used to measure fair value:

•Level 1: quoted prices in active markets for identical assets or liabilities;

•Level 2: inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices in active markets for similar assets or liabilities, quoted prices for identical or similar assets or liabilities in markets that are not active, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; or

•Level 3: unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Notes to Financial Statements

December 31, 2019 and 2018

Master Trust

Master Trust investments measured at fair value on a recurring basis consisted of the following types of instruments as of December 31, 2019 (Level 1, 2, and 3 inputs are defined above):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at fair value as of December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mosaic Company common stock

|

|

|

|

|

|

|

$

|

18,282,012

|

|

$

|

—

|

$

|

—

|

$

|

18,282,012

|

|

|

Mutual funds

|

|

|

|

|

|

|

|

399,938,672

|

|

|

—

|

|

|

—

|

|

|

399,938,672

|

|

|

Common/collective trust funds

|

|

|

|

|

|

|

|

—

|

|

|

518,973,421

|

|

|

—

|

|

|

518,973,421

|

|

|

|

|

Total investments at fair value

|

|

|

|

|

$

|

418,220,684

|

|

$

|

518,973,421

|

|

$

|

—

|

$

|

937,194,105

|

|

Master Trust investments measured at fair value on a recurring basis consisted of the following types of instruments as of December 31, 2018 (Levels 1, 2, and 3 inputs are defined above):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets at fair value as of December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Total

|

|

Mosaic Company common stock

|

|

|

|

|

|

|

$

|

23,815,752

|

|

$

|

—

|

|

$

|

—

|

|

$

|

23,815,752

|

|

|

Mutual funds

|

|

|

|

|

|

|

|

235,247,297

|

|

|

—

|

|

|

—

|

|

|

235,247,297

|

|

|

Common/collective trust funds

|

|

|

|

|

|

|

|

—

|

|

|

555,965,419

|

|

|

—

|

|

|

555,965,419

|

|

|

|

|

Total investments at fair value

|

|

|

|

|

$

|

259,063,049

|

|

$

|

555,965,419

|

|

$

|

—

|

$

|

815,028,468

|

|

Common stock traded on national exchanges are valued at their closing market prices.

The fair values of the mutual funds are based on observable unadjusted market quotations for identical assets and are priced on a daily basis at the close of the NYSE.

Common/collective trusts (CCTs) are valued utilizing the respective net asset values as reported by such trusts, which represents readily determinable fair value, and are reported at fair value.

For each of the Master Trust’s funds (other than money market funds and short-term bond funds), a participant is prohibited from exchanging into a fund account for 60 calendar days after the participant has exchanged out of that fund account.

For the years ended December 31, 2019 and 2018, the Master Trust held no assets in which significant unobservable inputs (Level 3) were used in determining fair value and there were no transfers between levels.

(5)Federal Income Tax Status

The Plan has received a determination letter from the IRS dated August 17, 2015 stating that the Plan is qualified under Section 401(a) of the IRC and, therefore, is exempt from taxation. Subsequent to this determination by the IRS, the Plan was amended. Once qualified, the Plan is required to operate in conformity with the IRC to maintain its qualification. The Plan Administrator believes the Plan is being operated in compliance with the applicable requirements of the IRC, and therefore, the Plan, as amended, is qualified and is tax-exempt.

U.S. GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS.

The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2019, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2014.

(6)Risks and Uncertainties

The Plan invests in various investment securities through the Master Trust. Investment securities are exposed to various risks such as interest rate, market, and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants’ account balances and the amounts reported in the statements of net assets available for benefits.

A portion of the Plan’s net assets held in the Master Trust are invested in the common stock of the Company. At December 31, 2019 and 2018, approximately 1.2% and 1.7%, respectively, of the Plan’s total assets were invested in the Company’s common stock. The underlying value of the Company common stock is entirely dependent upon the performance of the Company and the market’s evaluation of such performance.

(7)Party-in-Interest Transactions

Transactions resulting in Plan assets being transferred to or used by a related party are prohibited under ERISA unless a specific exemption applied. Vanguard Fiduciary Trust Company is a party in interest as defined by ERISA as a result of being trustee of the Plan through November 7, 2018. The Plan invests in funds managed by Vanguard Fiduciary Trust Company. Fidelity Management Trust Company is a party‑in‑interest as defined by ERISA as a result of being trustee of the Plan. The Plan also engages in transactions involving the acquisition or disposition of common stock of the Company, a party in interest with respect to the Plan. The Plan also engages in loans to participants. These transactions are covered by an exemption from the “prohibited transactions” provisions of ERISA and the IRC.

(8)Reconciliation of Financial Statements to Form 5500

The following is a reconciliation of net assets available for benefits per the financial statements to Form 5500:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Benefits paid to participants per the financial statements

|

|

|

|

|

|

|

$

|

27,120,763

|

|

$

|

28,519,055

|

|

|

Less corrective distributions

|

|

|

|

|

|

|

|

(10,501)

|

|

|

(14,426)

|

|

|

Benefits paid to participants per Form 5500

|

|

|

|

|

|

|

$

|

27,110,262

|

|

$

|

28,504,629

|

|

(9)Subsequent Events

On March 27, 2020, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act was signed into law to provide temporary relief for retirement plans in response to the COVID-19 outbreak which was declared a pandemic by the World Health Organization. The Mosaic Company has adopted certain provisions to allow eligible participants to receive CARES Act distributions and delay loan repayments. The Company has also adopted a waiver of required minimum distributions. Written amendments to the Plan to reflect these temporary operational changes will be adopted at a later date in accordance with applicable law and IRS guidance.

The Plan has evaluated subsequent events from the statement of net assets available for benefits date through June 24, 2020, the date at which financial statements were available to be issued, and determined there were no additional items to disclose.

SUPPLEMENTAL SCHEDULE

Schedule

MOSAIC UNION SAVINGS PLAN

Plan No. 019

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of issuer

|

|

|

|

|

|

|

|

Description

|

|

|

|

value **

|

|

Mosaic Investment Plan and Mosaic Union Savings Plan Master Trust

|

|

|

|

|

|

|

|

Plan's interest in Master Trust

|

|

|

$

|

225,074,017

|

|

|

Notes receivable from participants*

|

|

|

|

|

|

|

|

Participant loans due through December 2023 with interest rates ranging from 4.25% to 9.0%.

|

|

|

|

8,447,377

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

233,521,394

|

|

|

|

|

|

|

|

|

|

*

|

Indicates party-in-interest to the Plan

|

|

|

|

|

|

|

|

|

**

|

Historical cost is not required for participant directed accounts

|

See accompanying report of independent registered public accounting firm.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

Incorporated Herein

by Reference to

|

|

Filed with

Electronic

Submission

|

|

23

|

|

|

|

|

|

X

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the trustee (or other person who administers the employee benefit plan) has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Tampa, State of Florida, on the 24th day of June, 2020.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOSAIC UNION SAVINGS PLAN

|

|

|

|

|

|

|

|

|

|

By:

|

|

Global Benefits Committee,

as Plan Administrator

|

|

|

|

|

|

|

|

By:

|

|

/s/ Christopher A. Lewis

|

|

|

|

|

Christopher A. Lewis, Chair

|

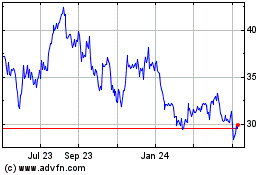

Mosaic (NYSE:MOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

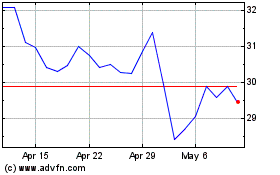

Mosaic (NYSE:MOS)

Historical Stock Chart

From Apr 2023 to Apr 2024