UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

Filed

by the Registrant

|

[X]

|

|

|

|

|

Filed

by a Party other than the Registrant

|

[ ]

|

|

|

|

|

Check

the appropriate box:

|

|

|

[X]

|

Preliminary

Proxy Statement

|

|

|

|

|

[ ]

|

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

[ ]

|

Definitive

Proxy Statement

|

|

|

|

|

[ ]

|

Definitive Additional

Materials

|

|

|

|

|

[ ]

|

Soliciting Material

Pursuant to §240.14a-12

|

BorrowMoney.com,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

[X]

|

No

fee required.

|

|

|

|

|

[ ]

|

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

|

|

|

|

|

|

(1)

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

(2)

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount

on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

(4)

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

(5)

Total fee paid:

|

|

|

|

|

[ ]

|

Fee

paid previously with preliminary materials.

|

|

|

|

|

|

Payment

of Filing Fee (Check the appropriate box):

|

|

|

[ ]

|

Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date

of its filing.

|

|

|

|

|

|

|

|

(1)

Amount Previously Paid:

|

|

|

|

|

|

|

|

(2)

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

(3)

Filing Party:

|

|

|

|

|

|

|

|

(4)

Date Filed:

|

BorrowMoney.com,

Inc.

512

Bayshore Drive Suite 201

Fort Lauderdale Florida, 33304

June

23, 2020

Dear

Stockholder:

On

behalf of our Board of Directors, I cordially invite you to a Special Meeting of Stockholders (the “Special Meeting”)

of BorrowMoney.com, Inc., to be held at 9:00 a.m. Eastern Standard Time on Thursday, August 21, 2018, at 512 Bayshore Drive Suite

201 Fort Lauderdale, FL 33304.

The

business of the Special Meeting is described in detail in the attached notice of meeting and proxy statement. Also included is

a proxy card and postage paid return envelope.

It

is important that your shares are represented and voted at the Special Meeting, regardless of the size of your holdings. Whether

or not you plan to attend, please complete and return the enclosed proxy or vote over the telephone or internet, as applicable,

to ensure that your shares will be represented at the Special Meeting. If you attend the Special Meeting, you may withdraw your

proxy by voting in person.

|

|

Sincerely,

|

|

|

|

|

|

Aldo

Piscitello

|

|

|

Chairman

of the Board and

|

|

|

Chief

Executive Officer

|

BorrowMoney.com,

INC.

512

Bayshore Drive, Fort Lauderdale, FL 33304

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON August 21, 2020

TO

THE STOCKHOLDERS OF BORROWMONEY.COM, INC.:

NOTICE

IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Special Meeting”) of BorrowMoney.com, Inc., a

Florida corporation, will be held at 512 Bayshore Drive Suite 201 Fort Lauderdale, FL 33304. at 9:00 a.m., Eastern Standard

Time, on August 21, 2020, and at any adjournment or postponement thereof. This Notice of Special Meeting and Proxy Statement

describe the following matters proposed by our board of directors (“Board”) to be considered and voted upon by

our stockholders at the Special Meeting:

|

|

(1)

|

to

approve an amendment to our certificate of incorporation to increase our authorized common stock to 500,000,000 shares, $.001

par value (the “Amendment”);

|

|

|

|

|

|

|

(2)

|

to

approve the adjournment of the Special Meeting, if necessary or appropriate, to solicit additional proxies; and

|

|

|

|

|

|

|

(3)

|

to

transact such other further business as may properly come before the Special Meeting or any postponement or adjournment thereof.

|

Only

stockholders at the close of business on June 23, 2020, the record date, are entitled to receive notice of, and to vote at, the

Special Meeting or any adjournment or postponement thereof.

We

are asking you to approve the increase in the authorized shares because our Board has declared a five-for-one (5 for 1) stock

split, subject to stockholder approval of the Amendment. We believe the Amendment and the stock split will provide the Company

with increased flexibility for potential business and financial

transactions.

Your

vote is important. Whether you own relatively few or a large number of shares of our stock, it is important that your shares be

represented and voted at the Special Meeting. If you are unable to attend the meeting in person, I urge you to complete, date,

and sign the enclosed proxy card and promptly return it to us in

the

envelope provided.

A

quorum of stockholders must be present at the Special Meeting for any business to be conducted. The presence at the Special Meeting,

in person or by proxy, of stockholders entitled to cast a majority of the votes entitled to be cast as of the Record Date will

constitute a quorum. Abstentions will be treated as shares present for quorum purposes. Broker shares for which the nominee has

not received voting instructions from the record holder and does not have discretionary authority to vote the shares on certain

proposals will be treated as shares present for quorum purposes. On the Record Date, there were [21,833,000] shares of

our common stock outstanding and entitled to vote. Thus, [20,000,000] shares of our common stock must be represented by

stockholders present at the Special Meeting or by proxy to have a quorum.

If

a quorum is not present at the Special Meeting, the stockholders who are represented may adjourn the Special Meeting until a quorum

is present. The persons named as proxies will vote those proxies for such adjournment, unless marked to be voted against any proposal

for which an adjournment is sought, to permit further solicitation of proxies.

We

believe the Amendment is in the best interest of the company and our stockholders. Please consider the enclosed carefully. We

hope you will support the Amendment with your vote

Whether

or not you plan to attend the Special Meeting, please complete, sign, date and return the enclosed proxy in the envelope provided

or vote over the telephone or internet, as applicable.

|

|

By

Order of the Board of Directors

|

|

|

|

|

|

Aldo

Piscitello

|

|

|

Chairman

of the Board and

|

|

|

Chief

Executive Officer

|

|

|

|

|

Dated:

June 23, 2020

|

|

BorrowMoney.com,

INC.

512

Bayshore Drive, Fort Lauderdale, FL 33304

(212)

265-2525

INFORMATION

CONCERNING SOLICITATION AND VOTING

FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 21, 2020

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING AND VOTING

Q:

Why am I being asked to review these materials?

A:

BorrowMoney.com, Inc. (“BorrowMoney.com,” the “Company” or “we”) is providing these proxy

materials to you in connection with the solicitation of proxies by the BorrowMoney.com Board of Directors (the “Board”)

for use at a special meeting of Stockholders to be held on Thursday August 21, 2020, at 9:00 a.m. Eastern Standard Time (the “Special

Meeting”), and any adjournments or postponements thereof. The Special Meeting will take place at 512 Bayshore Drive Fort

Lauderdale Florida 33304. Our Board is soliciting proxies for the purposes set forth in this Proxy Statement and the accompanying

Notice of Special Meeting of Stockholders. Stockholders are invited to attend the Special Meeting and are requested to vote on

the proposals described in this proxy statement. It is anticipated that this proxy statement and the form of proxy solicited on

behalf of our Board will be filed with the Securities and Exchange Commission (“SEC”) and mailed to our stockholders

on or about July 06, 2020.

Q:

What information is contained in these materials?

A:

The information included in this proxy statement relates to the proposals to be voted on at the Special Meeting and the voting

process.

Q:

What does it mean if I received more than one proxy or voting instruction form?

A:

It means that your shares are registered differently or are in more than one account. Please provide voting instructions for

each proxy you receive to help ensure that all of your shares are voted.

Q:

On what proposals will BorrowMoney.com stockholders vote at the Special Meeting?

A:

At this Special Meeting, we are asking you to approve an amendment to the Company’s Certificate of Incorporation to

increase the authorized shares of common stock to 500,000,000 (the “Amendment”) because, as previously announced,

the Board has declared a five-for-one (5 for 1) stock split, subject to stockholder approval of the Amendment. We believe this

stock split will further improve our liquidity and make our shares more accessible, both to institutions and to the individual

shareholders and will provide the Company with increased flexibility for potential business and financial transactions. In addition,

the Amendment will provide the Company with sufficient shares to provide equity incentives for our executives, directors, employees

and consultants.

At

this Special Meeting, we are also asking you to approve an adjournment of the Special Meeting, if necessary or appropriate, to

solicit additional proxies in the event that there are insufficient shares of common stock present, in person or by proxy, voting

in favor of Amendment.

For

a more detailed discussion of each of these proposals, please see the information included elsewhere in the proxy statement relating

to these proposals.

Q:

What are the Board’s voting recommendations?

A:

The Board recommends that you vote your shares “FOR” the amendment to the Company’s Certificate of Incorporation

and “FOR” an adjournment of the Special Meeting, if necessary or appropriate, to solicit

additional

proxies

If

you give us your signed proxy but do not specify how to vote, we will vote your shares:

(1) to approve an amendment to our certificate of incorporation to increase our authorized

capital to 500,000,000 shares of common stock; and (2) to approve the adjournment of

the Special Meeting, if necessary or appropriate, to solicit additional proxies.

We

are not aware of any matter to be presented at the Special Meeting other than those described in the Notice of Meeting. If any

other matters are properly brought before the Special Meeting for consideration, the person named on your proxy will have the

discretion to vote your shares according to such person’s best judgment.

Q:

Who is entitled to vote at the Special Meeting?

A:

Holders of our common stock outstanding as of the close of business on June 23, 2020, the record date, are entitled to vote

at the Special Meeting. As of the record date, there were [21,833,000] shares of common stock outstanding. On each proposal

presented for a vote at the Special Meeting, each stockholder is entitled to one vote for each share of common stock owned as

of the record date.

Q:

What is the difference between a stockholder of record and a stockholder who holds stock in street name?

A:

If your shares are registered in your name, you are a stockholder of record with respect to those shares. As a stockholder

of record, you have the right to vote in person at the Special Meeting or to vote by proxy on the proxy card included with these

materials.

If

your shares are held in the name of your broker, bank or other nominee, you are considered to be the “beneficial owner”

of such shares, which are held in “street name.” If your shares are held in street name, your bank or brokerage firm

(the record holder of your shares) forwarded these proxy materials, along with a voting instruction card, to you. As the beneficial

owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your

shares in accordance with your instructions. If you do not give instructions to your bank or brokerage firm, it will nevertheless

be entitled to vote your shares with respect to “routine” items, but it will not be permitted to vote your shares

with respect to “non-routine” items. In the case of a non-routine item, your shares will be considered “broker

non-votes” on that proposal.

Q:

If I hold my shares in street name through my broker, will my broker vote these shares for me?

A:

If you provide instructions on how to vote by following the instructions provided to you by your broker, your broker will

vote your shares as you have instructed. If you do not provide your broker with voting instructions, your broker will vote your

shares only if the proposal is a “routine” management proposal on which your broker has discretion to vote. On matters

considered “non-routine,” brokers may not vote your shares without your instruction. Shares that brokers are not authorized

to vote are referred to as “broker non-votes.”

We

believe the proposal to amend the Company’s Certificate of Incorporation is considered a “non-routine” proposal

and as such, brokers are prohibited from voting uninstructed shares with respect to such proposal, as a result, a broker non-vote

will occur, and your shares will not be voted on this matter. We believe the proposal to adjourn the Special Meeting,

if necessary or appropriate, to solicit additional proxies is considered a “routine” proposal and as such, brokers

are permitted to vote uninstructed shares with respect to such proposal.

Q:

What are the quorum requirements for the Special Meeting?

A:

The presence of holders of a majority of our outstanding shares of common stock in person or by proxy constitutes a quorum

for the Special Meeting. Both abstentions and broker non-votes are counted as present for purpose of determining the presence

of a quorum.

Q:

What is the voting requirement to approve each of the proposals?

A:

The proposal to approve the amendment of the Certificate of Incorporation to increase the Company’s number of authorized

shares of common stock requires the affirmative vote of the holders of a majority of the outstanding shares of our common stock

entitled to vote at the Special Meeting. As a result, abstentions, failures to vote and broker non-votes will have the same effect

as a vote “against” this proposal.

The

proposal to approve one or more adjournments to the Special Meeting requires the affirmative vote of the majority of the shares

present in person or by proxy and entitled to vote on the matter. As a result, abstentions will have the effect of an “AGAINST”

vote on this matter and broker non-votes and failures to vote will have no impact on the vote for this proposal.

Q:

What do I need to do now to vote at the Special Meeting?

A:

Stockholders of record may vote their shares in any of four ways:

●

Submitting a Proxy by Mail: If you choose to submit your proxy by mail, simply mark your proxy, date and sign it and return

it in the postage-paid envelope provided;

●

Submitting a Proxy by Telephone: Submit a proxy for your shares by 11:59 p.m., Eastern Standard Time, on July 06, 2020

by telephone by using the telephone number provided on your proxy card. Telephone voting is available 24 hours a day;

●

Submitting a Proxy by Internet: Submit your proxy via the internet. The website for internet proxy voting is on your proxy

card. Internet proxy voting is also available 24 hours a day and will close at 11:59 p.m., Eastern Standard Time, on July 06,

2020; or

●

Voting in Person: If you were registered as a stockholder on our books on June 23, 2020 or if you have a letter from your

broker identifying you as a beneficial owner of our shares as of that date and granting you a legal proxy, you may vote in person

by attending the Special Meeting.

If

you submit a proxy by telephone or via the internet, you should not return your proxy card. Instructions on how to submit a proxy

by telephone or via the internet are located on the proxy card enclosed with this proxy statement.

Street

name holders may submit a proxy by telephone or the internet, if their bank or broker makes these voting methods available, in

which case the bank or broker will enclose related instructions with this proxy statement. If you hold your shares through a bank

or broker, follow the voting instructions you receive from your bank or broker.

Q:

Can I change my vote or revoke my proxy?

A:

Yes. If you are a stockholder of record, you may change your vote or revoke your proxy at any time before the applicable vote

at the Special Meeting by:

●

Delivering to Vstock/Broadridge Shareowner Services a written notice, bearing a date later than the proxy, stating that you revoke

the proxy;

●

Submitting a later-dated proxy relating to the same shares by mail, telephone or the internet prior to the applicable vote at

the Special Meeting; or

●

Attending the Special Meeting and voting in person (although attendance at the Special Meeting will not, by itself, revoke a proxy).

You

should send any written notice or a new proxy card to: BorrowMoney.com, Inc. c/o Ado Piscitello 521 Bayshore drive suite 201 Fort

Lauderdale, FL 33304, or follow the instructions provided on your proxy card to submit a proxy by telephone or via the internet.

You may request a new proxy card by calling BorrowMoney.com, Proxy Processing at (212) 265-2525.

Q:

Will anyone contact me regarding this vote?

A:

We have retained Director Svetlana Coliban to distribute proxy solicitation materials to brokers, banks, and other nominees.

The fee for this service is estimated to be $5,000, plus reimbursement for reasonable out-of-pocket costs and expenses,

Payable as a warrant/convertible note of 100,000 Shares, by BorrowMoney.com, Inc. To Svetlana Coliban and or, his nonaffiliated

assignee instructed by Svetlana Coliban In addition to solicitation by mail, our directors, officers and employees may solicit

proxies from stockholders by telephone, letter, facsimile or in person but will not receive any additional compensation for these

services. Following the original mailing of the proxy solicitation materials,

we

will request brokers, custodians, nominees and other record holders to forward copies of the proxy statement and related soliciting

materials to beneficial owners for whom they hold shares of our common stock and to request authority for the exercise of proxies.

In such cases, upon the request of the record holders, we will reimburse such holders for their reasonable expenses.

Q:

Who has paid for this proxy solicitation?

A:

All expenses incurred in connection with the solicitation of proxies, including the printing and mailing of this proxy statement,

will be borne by BorrowMoney.com.

Q:

Where can I find the voting results of the Special Meeting?

A:

We will announce preliminary voting results at the Special Meeting and publish final detailed voting results on a Form 8-K,

which we expect to file with the SEC within four business days after the Special Meeting.

Q:

Are there any dissenters’ rights or appraisal rights with respect to any of the proposals described in this proxy statement?

A:

There are no rights of appraisal or similar dissenter’s rights with respect to any matter to be acted upon pursuant

to this proxy statement.

PROPOSAL

NO. 1 — APPROVAL OF AN AMENDMENT TO OUR

CERTIFICATE OF INCORPORATION TO INCREASE THE NUMBER OF

AUTHORIZED SHARES OF COMMON STOCK

Proposal

Our

Certificate of Incorporation currently authorizes the issuance of 100,000,000 shares of common stock, par value $.001. As of the

Record Date [21,833,000] shares of common stock were outstanding and [0) additional shares reserved for issuance

under our employee compensation plans.

Description

of the Amendment

Our

Board unanimously approved an amendment to Article IV of the Certificate of Incorporation (the “Amendment”), subject

to stockholder approval, to increase the number of shares of common stock authorized for issuance under the Certificate of Incorporation

to a total of 500,000,000 shares. A copy of the Amendment increasing authorized common stock is attached to this proxy statement

as Annex A. The information in this proxy statement is qualified in its entirety by the complete text of the Amendment.

If

the Amendment is approved by a majority of our outstanding shares of common stock, it will become effective upon its filing with

the Secretary of State of the State of Florida. The Company expects to file the Amendment with the Secretary of State of the State

of Florida shortly after its approval by stockholders. The authorized but unissued shares of common stock would be available for

issuance from time to time for such purposes and for such consideration as the Board may determine to be appropriate without further

action by the stockholders, except for those instances in which applicable law or stock exchange rules require stockholder approval.

The additional shares of authorized common stock, when issued, would have the same rights and privileges as the shares of common

stock currently issued and outstanding, including the same voting rights, and rights to dividends and other distributions and

will be identical in all other respects to our common stock as now authorized.

Purposes

of the Amendment

The

primary purpose of the Amendment is to provide enough additional authorized shares so that the Company can conduct a five-for-one

(5 for 1) forward split of outstanding common stock which will be effected in the form of a stock Forward Split in which stockholders

on the record date for the stock dividend will receive four additional shares of common stock for each share they hold on such

date (the “Stock Forward Split.”) The Company announced on June 19, 2020 that the Board has approved the Stock Dividend,

subject to stockholder approval of the Amendment. In accordance with the Company’s Certificate of Incorporation and By-laws

a stockholder vote is not required for the Stock Forward Split, provided there are a sufficient number of shares of Common Stock

authorized under the Company’s Certificate of Incorporation.

Upon

the effective date of the Amendment, we will have approximately [390,835,000] shares of common stock authorized and available

for future issuance. If the proposed Amendment of the Certificate of Incorporation is approved, the Board plans to set a record

date for the Stock Forward Split shortly after the Special Meeting. Other than the Stock Forward Split or as permitted or required

under our existing contractual obligations and outstanding options, the Board has no immediate plans, understandings, agreements

or commitments to issue additional shares of common stock for any purposes.

The

Board believes that the increase in the number of authorized shares of common stock will make a sufficient number of shares available,

should we decide to use our shares for one or more of such previously mentioned purposes or otherwise. We reserve the right to

seek a further increase in authorized shares from time to time in the future as considered appropriate by the Board.

Background

of the Proposal

In

June 19, 2020, the Board announced a five-for-one forward split

BorrowMoney.com

Announces 5 for 1 Stock Split

About

BorrowMoney.com, Inc.

Fort

Lauderdale, FL – June 19, 2020 – BorrowMoney.com, Inc. (“BorrowMoney.com” (OTC: BWMY, the “Company”,

“we” or “us”) operates a recognized Fintech online loan marketplace for consumers seeking loans and other

credit-based offerings. Its internet portal provides services to lending institutions, generating qualified leads for local mortgage

and lending professionals. Through its proprietary platform, it offers institutional lenders the digital solution of technologically

gathered leads. The Company also generates revenues by selling advertising space on its website to various industries, including

the real estate industry with membership fees and lead packages.

Borrowmoney.com’s

marketplace encompasses most consumer credit categories, including mortgages, home equity loans, automobile loans, and personal

loans, and it also has category for submissions to lenders for business loans. Its proprietary internet platform allows consumers

to find realtors within a desired geographic area for the purchase, sale or rental of rent real property.

What

may not be obvious from the company’s name, Borrymoney.com’s technology powers lead generation campaigns for many

types of business, enabling them to span digital and traditional media acquisition channels, promoting their brand and product

offerings. . The BorrowMoney.com platform and “smart” back-office proprietary technology is capable of dispatching,

tracking and tracing a live person in the same manner as it tracks its financial leads.

Its

most recent milestone involved BorrowMoney.com’s response to the significant demand for dispatching live nurses for a program

entailing a high demand testing service during the COVID-19 pandemic. With its streamlined functioning and efficient technology

solution, Borrowmoney.com provided an expedited solution filling this growing need.

For

further details, visit www.BorrowMoney.com

Aldo

Piscitello, Chairman of the Board, President & CEO said: “This stock split is intended to further improve our liquidity

and to make our shares more accessible, both to institutions and to the individual shareholders.”

SAFE

HARBOR REGARDING FORWARD-LOOKING STATEMENTS

As

used herein, the terms “BorrowMoney.com,” “the Company,” “we,” “our” and “us”

refer to BorrowMoney.com, Inc., a Florida corporation, and its consolidated subsidiaries as a combined entity, except where it

is clear that the terms mean only BorrowMoney.com, Inc.

The

information contained in this Press Release contains forward-looking statements and information within the “safe harbor”

provisions of the Private Securities Litigation Reform

Act

of 1995, Section 27A of the Securities Act of 1933, and Section 21E of the Securities Exchange Act of 1934. This information includes

assumptions made by, and information currently available to management, including statements regarding future economic performance

and financial condition, liquidity and capital resources, acceptance of the Company’s products by the market, and management’s

plans and objectives. In addition, certain statements included in this and our future filings with the Securities and Exchange

Commission (“SEC”), in press releases, and in oral and written statements made by us or with our approval, which are

not statements of historical fact, are forward-looking statements. Words such as “may,” “could,” “should,”

“would,” “believe,” “expect,” “anticipate,” “estimate,” “intend,”

“seeks,” “plan,” “project,” “continue,” “predict,” “will,”

“should,” and other words or expressions of similar meaning are intended by the Company to identify forward-looking

statements, although not all forward-looking statements contain these identifying words. These forward-looking statements are

found at various places throughout this report and in the documents incorporated herein by reference. These statements are based

on our current expectations about future events or results and information that is currently available to us, involve assumptions,

risks, and uncertainties, and speak only as of the date on which such statements are made.

Our

actual results may differ materially from those expressed or implied in these forward-looking statements. Factors that may cause

such a difference, include, but are not limited to those discussed in our Annual Report on Form 10-K and subsequent reports filed

with the SEC, as well as: the approval of the shareholders of the amendment to the Certificate of Incorporation, the risk of an

unfavorable outcome of the pending governmental investigations or shareholder class action lawsuits, reputational harm caused

by such investigations and lawsuits, the willingness of independent insurance agencies to outsource their computer and other processing

needs to third parties; pricing and other competitive pressures and the Company’s ability to gain or maintain share of sales

as a result of actions by competitors and others; changes in estimates in critical accounting judgments; changes in or failure

to comply with laws and regulations, including accounting standards, taxation requirements (including tax rate changes, new tax

laws and revised tax interpretations) in domestic or foreign jurisdictions; exchange rate fluctuations and other risks associated

with investments and operations in foreign countries.

Except

as expressly required by the federal securities laws, the Company undertakes no obligation to update any such factors, or to publicly

announce the results of, or changes to any of the forward-looking statements contained herein to reflect future events, developments,

changed circumstances, or for any other reason.

Readers

should carefully review the disclosures and the risk factors described in the documents we file from time to time with the SEC,

including future reports on Forms 10-Q and 8-K, and any amendments thereto. You may obtain our SEC filings at our website, www.BorrowMoney.com

under the “Investor Information” section, or over the Internet at the SEC’s web site www.sec.gov.

Potential

Effects of the Amendment

Upon

filing the Amendment, the Board may cause the issuance of additional shares of common stock without further vote of our stockholders,

except as provided under the Florida General Corporation Law (or any national securities exchange on which shares of our common

stock are then listed or traded). Under our Certificate of Incorporation, our stockholders do not have preemptive rights to subscribe

to additional securities which may be issued by the Company, which means that current stockholders do not have a prior right to

purchase any new issue of our capital stock in order to maintain their proportionate ownership of common stock. In addition, if

the Board elects to issue additional shares of common stock, such issuance could have a dilutive effect on the earnings per share,

voting power and holdings of current stockholders.

In

addition to the corporate purposes discussed above, the Amendment could, under certain circumstances, have an antitakeover effect.

For example, the existence of authorized but unissued shares of common stock could render more difficult or discourage an attempt

to obtain control of us by means of a proxy contest, tender offer, merger or otherwise. Although the increased proportion of unissued

authorized shares to issued shares could have or be used for an anti-takeover effect, the Amendment is not being proposed in response

to any effort of which the Company is aware to accumulate shares of our Common Stock or obtain control of the Company.

Our

Common Stock is currently registered under the Securities Exchange Act of 1934, as amended, and the Company is subject to the

periodic reporting and other requirements of the Exchange Act. The Amendment will not affect the registration of the Company’s

Common Stock under the Exchange Act.

No

Appraisal Rights

Under

the Florida General Corporation Law, our stockholders are not entitled to appraisal rights with respect to the

Amendment.

The

affirmative vote of the holders of a majority of the outstanding shares of common stock entitled to vote at the Special Meeting

will be necessary for the approval of the Amendment.

The

Board unanimously recommends that stockholders vote FOR the adoption of the Amendment to the Certificate of Incorporation to increase

the number of authorized shares of our common stock to 500 million.

PROPOSAL

NO 2 — ADJOURNMENT OF THE SPECIAL MEETING

Our

stockholders may be asked to consider and act upon one or more adjournments of the Special Meeting, if necessary or appropriate,

to solicit additional proxies in favor of the Amendment.

If

a quorum is not present at the Special Meeting, our stockholders may be asked to vote on the proposal to adjourn the Special Meeting

so that we can solicit additional proxies in favor of the Amendment. If a quorum is present at the Special Meeting, but there

are not sufficient votes at the time of the Special Meeting to approve the Amendment, our stockholders may also be asked to vote

on the proposal to approve the adjournment of the Special Meeting to permit further solicitation of proxies in favor of the Amendment.

If

the adjournment proposal is submitted for a vote at the Special Meeting, and if our stockholders vote to approve the adjournment

proposal, the meeting will be adjourned, and the Board will use the additional time to solicit additional proxies in favor of

approval of the Amendment, including the solicitation of proxies from stockholders that have previously voted against it.

DISSENTERS’

RIGHT OF APPRAISAL

Stockholders

do not have any dissenter or appraisal rights in connection with these actions.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information, as of JUNE 23, 2020, the record date, respecting the beneficial ownership of our

outstanding common stock by: any holder of more than 5%; base on [21,833,000] shares of common stock outstanding.

|

|

|

Current Beneficial Ownership

|

|

|

Directors and executive officers, Qualified Holders

|

|

|

20,000,000

|

|

|

|

91.60

|

%

|

Name:

ALDO PISCITELLO

List

of all Shareholder Less than 5%. *

|

VALLY,NORMA

|

11000

|

|

IWASZ,KHRISTINA

|

50000

|

|

LENZ,FRED

|

125000

|

|

LENZ,BRIANNA

|

100000

|

|

BIRKEMEIER,LUCY

|

75000

|

|

PEREIRA,GARY

|

100000

|

|

WILLIAMS,MELANIE

ANN

|

1000

|

|

WILLIAMS,MARIANNE

|

1000

|

|

PARK,CHONG

|

100000

|

|

BRICKER,GEORGE

W

|

1000

|

|

ROMERO,MARY

|

1000

|

|

ROMERO,KEITH

|

1000

|

|

ROMERO,JOHN

|

1000

|

|

ROMERO,WENDY

S

|

1000

|

|

ROMERO,TIMOTHY

M

|

1000

|

|

SCHWARZ,WILLIAM

F

|

1000

|

|

PINARD,MICHAEL

|

1000

|

|

LENZ,BEN

|

1000

|

|

LENZ,JAMES

|

1000

|

|

WILLIAMS,MICHAEL

|

1000

|

|

WILLIAMS,RONNIE

L

|

100000

|

|

WILLIAMS,JENNY

R

|

1000

|

|

BITTINGER,WILBUR

|

1000

|

|

SCHNIEPP,BARRY

|

1000

|

|

WILLIAMS,ARTHUR

|

1000

|

|

WILLIAMS,DONNA

|

1000

|

|

LOMNESS,PHILLIP

J

|

1000

|

|

SMATHERS,STEVE

|

1000

|

|

CHARLES,TED

|

1000

|

|

CHARLES,JANINE

|

1000

|

|

WILLIAMS,RONNIE

L

|

100000

|

|

LARICOS,JOHN

|

200000

|

|

LISI,CARLO

|

15000

|

|

LISI,GIANCARLO

B.

|

10000

|

|

LISI,MARIO

VINCENT

|

10000

|

|

ADDESSI,CHARLES

A

|

100

|

|

TRUONG,TUAN

|

100

|

|

WERNER,JOHN

|

20000

|

|

DANZA,ALBERT

|

30000

|

|

OLIVO,JULIO

|

746200

|

|

FIORE,GIUSEPPE

|

7600

|

|

MARCHETTA,RALPH

|

10000

|

|

CEDE

& CO

|

100000

|

|

HOLDERS QUALIFIED *

|

|

8.40%

|

|

|

Outstanding Shares: 21,833, 000

|

|

(1)

For purposes of this table, a person is deemed to be the beneficial owner of a security if he or she: (a) has or shares

voting power or dispositive power with respect to such security, or (b) has the right to acquire such ownership within 60

days. “Voting power” is the power to vote or direct the voting of shares, and “dispositive power” is

the power to dispose or direct the disposition of shares, irrespective of any economic interest in such shares.

(2)

In calculating the percentage ownership or percent of equity vote for a given individual or group, the number of common

shares outstanding includes unissued shares subject to options, warrants, rights or conversion privileges exercisable within

60 days held by such individual or group, but such shares are not deemed outstanding for any other person or group.

Percentage is based on [21,833,000] shares of our common stock outstanding as of

June

19, 2020.

OTHER

MATTERS

At

the time of the preparation of this proxy statement, the Board has not been informed of any other matters to be brought before

the Special Meeting other than those proposals specifically set forth in the Notice of Special Meeting and referred to herein.

If you execute the enclosed proxy and any other business should come before the meeting, we expect that the persons named in the

enclosed proxy will vote your shares in accordance with their best judgment on that matter.

STOCKHOLDER

PROPOSALS

The

Company encourages stockholders to contact the Corporate Secretary prior to submitting a stockholder proposal. Stockholder proposals

must conform to the Company’s Bylaws and the requirements of the SEC.

Pursuant

to Rule 14a-8 under the Exchange Act, some stockholder proposals may be eligible for inclusion in our 2020 proxy statement. In

order for a stockholder proposal to be considered for inclusion in the proxy material for our 2020 Annual Meeting of Stockholders

pursuant to SEC Rule 14a-8, your proposal must be received by our Corporate Secretary no later than July 06, 2020 (unless the

meeting date is changed by more than 30 days from August 21, 2020, in which case a proposal must be a received a reasonable time

before we print proxy materials for the 2020 Annual Meeting) and must be submitted in compliance with the rule. Proposals should

be directed to our Corporate Secretary, BorrowMoney.com, Inc., 512 Bayshore Drive suite 201 Fort Lauderdale FL 33304, and should

comply with the requirements of Rule 14a-8.

If

our Corporate Secretary receives at the address listed above any stockholder proposal intended to be presented at the 2020 Annual

Meeting without inclusion in the proxy statement for the meeting after August 21, 2020 (unless the meeting date is changed by

more than 30 days from the anniversary of the 2020 Annual Meeting, in which case a proposal must be received a reasonable time

before we print proxy materials for the 2020 Annual Meeting), SEC Rule 14a-4(c) provides that the proxies designated by the Board

will have discretionary authority to vote on such proposal. The proxies designated by the Board also will have such discretionary

authority, notwithstanding the stockholder’s compliance with the deadlines described above, if we advise stockholders in

the proxy statement for the meeting about the nature of the matter and how management intends to vote on such matter, and the

stockholder does not comply with specified provisions of the SEC’s rules.

Stockholders

who wish the Corporate Governance Committee to consider their recommendations for nominees for the position of director should

submit their recommendations in writing by mail to our Corporate Secretary, BorrowMoney.com, Inc., 512 Bayshore Drive suite 201

Fort Lauderdale FL 33304.

Section

3.10 of our Bylaws creates certain advance notice requirements for stockholder nominations of directors at both annual and special

meetings. To be timely, a director nomination by a stockholder for an annual meeting must be submitted not less than 90 nor more

than 120 days before the anniversary date of the immediately preceding annual meeting. In the case of a nomination at a special

meeting or if the meeting date is moved by more than thirty days from the anniversary date of the immediately preceding annual

meeting, notice of such nomination must be given within ten days that notice of such meeting was provided or made public. Nominations

for the 2020 Annual Meeting of Stockholders must be received between June 1, 2020 and August 31, 2020.

In

addition, Section 3.10 of our Bylaws requires disclosures relating to the nominees and their relationships with stockholders proposing

their nomination. Among other things, Section 3.10 of our Bylaws requires a proposed nominee to: (1) represent and promise that

the nominee is not, nor will become, party to any understanding with another person (a) to vote or act as a Director in a certain

manner or (b) concerning compensation, reimbursement or indemnification without disclosure to the Company; and (2) represent that,

if elected to the Board, such nominee would comply with Regulation FD and Company governance, trading, ethics, stock ownership

and other policies.

Section

3.10 of our Bylaws also requires disclosures similar to a stockholder proposing business for an annual meeting. In addition, a

proposing stockholder, including its affiliates, must disclose all agreements or other understandings with a director nominee

it has proposed, as well as any other material interest involved in such nomination.

HOUSEHOLDING

The

SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements

and annual reports with respect to two or more stockholders sharing the same address by delivering a single set of proxy materials

addressed to those stockholders. This practice, which is commonly referred to as “house holding,” is designed to reduce

duplicate mailings and save significant printing and postage costs as well as natural resources. BorrowMoney.com and some brokers

household proxy materials unless contrary instructions have been received from the affected stockholders. BorrowMoney.com will

promptly deliver, upon oral or written request, a separate copy of this proxy statement to any stockholder residing at an address

to which only one copy was mailed. Requests for additional copies should be directed to Investor Relations, BorrowMoney.com, Inc.,

at the address set forth on the front page of this proxy statement. You may also contact the above if you (and other stockholders

sharing the same address) are receiving multiple copies of proxy materials and wish to receive only one.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

The

Company will provide, without charge to any stockholder upon written request, a copy of the Company’s Annual Report on Form

10-K, including financial statements and schedules thereto, for the fiscal year ended August 31, 2019, as filed with the SEC (without

exhibits). All such requests should be delivered to Investor Relations, BorrowMoney.com, Inc., at the address set forth on the

front page of this proxy statement. Copies of exhibits will be provided upon written request and payment of a reasonable fee to

cover the costs of reproducing and mailing.

THE

BOARD HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE,

SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING ENVELOPE OR VOTE OVER THE TELEPHONE OR INTERNET, AS APPLICABLE.

PROMPT RESPONSES WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING AND YOUR COOPERATION IS APPRECIATED. STOCKHOLDERS OF RECORD

WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXY CARDS.

Unless

you vote by telephone or over the internet, please date, sign and return the proxy card at your earliest convenience in the enclosed

return envelope. No postage is required if mailed in the United States.

|

|

By

Order of Board of Directors of BorrowMoney.com, Inc.

|

|

|

|

|

|

Aldo

Piscitello

|

|

|

Chairman

of the Board and

|

|

|

Chief

Executive Officer

|

|

Dated:

June 23, 2020

|

|

Annex

A

CERTIFICATE

OF AMENDMENT TO THE

CERTIFICATE

OF INCORPORATION

BorrowMoney.com,

Inc. (the “Corporation”), a corporation organized and existing under and by virtue of the General Corporation

Law of the State of Florida (the “FDOC”), does hereby certify as follows:

FIRST:

That the Board of Directors of the Corporation, in accordance with Section 607.1006, of the FDOC, duly adopted resolutions approving

a proposed amendment to the Certificate of Incorporation of the Corporation and calling for the submission of the proposed amendment

to the stockholders of the Corporation for consideration thereof.

SECOND:

That thereafter, pursuant to resolutions of its Board of Directors, a meeting of the stockholders of the Corporation was duly

called and held, at which meeting the necessary number of shares as required by statute was voted in favor of the amendment.

THIRD:

That, pursuant to resolutions of its Board of Directors, the Certificate of Incorporation of the Corporation is hereby amended

by deleting the last sentence of the first paragraph of Article 4 thereof and replacing it with the following:

“The

total number of shares of Common Stock authorized to be issued is 500,000,000 and each such share shall have a par value of ten

cents ($.001).”

FOURTH:

That the foregoing amendment was duly adopted in accordance with the provisions of Section 607.0123, of the FDOC.

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to be executed by its authorized officer, this

day of , 2020.

A-1

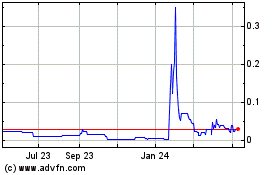

BorrowMoneycom (PK) (USOTC:BWMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

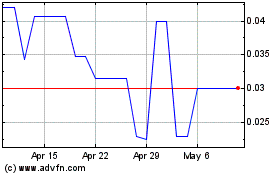

BorrowMoneycom (PK) (USOTC:BWMY)

Historical Stock Chart

From Apr 2023 to Apr 2024