PART

I

ITEM

1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not

applicable

ITEM

2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not

applicable

ITEM

3. KEY INFORMATION

|

|

A.

|

Selected

Financial Data

|

The

selected financial data presented below for the four years ended December 31, 2019, is presented in U.S. dollars and is derived

from our financial statements prepared in accordance with Generally Accepted Accounting Principles in the United States (“U.S.

GAAP”). We have derived the selected financial data as of December 31, 2019, 2018, 2017, and 2016 and for the years ended

December 31, 2019, 2018, 2017, and 2016 from our audited financial statements included elsewhere in this Annual Report on Form

20-F. The information set forth below should be read in conjunction with our financial statements (including notes thereto) included

under Item 18 and “Operating and Financial Review and Prospects” included under Item 5 and other information provided

elsewhere in this annual report on Form 20-F and our financial statements and related notes. The selected financial data in this

section is not intended to replace the financial statements and is qualified in its entirety thereby.

|

|

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

$

|

|

|

Revenues from continuing operations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Net loss

|

|

|

(3,637,368

|

)

|

|

|

(5,588,334,

|

)

|

|

|

(4,141,613

|

)

|

|

|

(1,502,204

|

)

|

|

Net comprehensive loss

|

|

|

(3,794,909

|

)

|

|

|

(5,381,156

|

)

|

|

|

(4,208,936

|

)

|

|

|

(1,466,776

|

)

|

|

Basic and diluted

loss per share (1)

|

|

|

(.18

|

)

|

|

|

(7.17

|

)

|

|

|

(6.00

|

)

|

|

|

(5.00

|

)

|

|

Total assets

|

|

|

496,737

|

|

|

|

460,234

|

|

|

|

59,275

|

|

|

|

48,380

|

|

|

Shareholders’ deficit

|

|

|

(2,230,775

|

)

|

|

|

(3,733,435

|

)

|

|

|

(2,009,266

|

)

|

|

|

(1,191,960

|

)

|

|

Cash dividends declared

per share (2)

|

|

|

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Weighted average number of common shares outstanding

|

|

|

21,454,189

|

|

|

|

751,028

|

|

|

|

690,306

|

|

|

|

321,441

|

|

Notes:

|

|

(1)

|

On

May 29, 2019 the Company effected a 100 for 1 reverse split. All share amounts have been adjusted for the split. In 2019 we

issued 25,413,839 shares of common stock (2,541,383,900 pre-split shares) pursuant to certain transactions set forth in Item

4, below. We issued 37,988 (3,798,781 pre-split) shares in 2018. We issued 269,143 (26,914,315 pre-split) common shares in

2017. We issued 162,868 (16,286,796 pre-split) common shares in 2016.

|

|

|

(2)

|

We

have not declared or paid any dividends since incorporation.

|

Exchange

Rate Data

The

following table sets forth the exchange rates for Canadian dollars expressed in U.S. dollars that have been used in the audited

financial statements included elsewhere in this Annual Report on Form 20-F.

|

$1 Canadian dollar equivalent in U.S. dollars

|

|

|

|

|

At December 31, 2018

|

|

|

0.7329

|

|

|

At December 31, 2019

|

|

|

0.7715

|

|

|

Average for the year ended December 31, 2019

|

|

|

0.7538

|

|

|

|

B.

|

Capitalization

and Indebtedness

|

Not

applicable

|

|

C.

|

Reasons

for the Offer and Use of Proceeds

|

Not

applicable

Investment

in our common shares involves a high degree of risk. You should carefully consider, among other matters, the following risk factors

in addition to the other information in this Annual Report on Form 20-F when evaluating our business because these risk factors

may have a significant impact on our business, financial condition, operating results or cash flow. If any of the material risks

described below or in subsequent reports we file with the Securities and Exchange Commission (“SEC”) actually occur,

they may materially harm our business, financial condition, operating results or cash flow. Additional risks and uncertainties

that we have not yet identified or that we presently consider to be immaterial may also materially harm our business, financial

condition, operating results or cash flow.

RISKS

RELATED TO OUR BUSINESS AND INDUSTRY

Our

limited operating history makes evaluating our business and future prospects difficult and may increase the risk of your investment.

We

have a very limited operating history on which investors can base an evaluation of our business, operating results and prospects.

We have no operating history with respect to commercializing our software applications and products. Consequently, it is difficult

to predict our future revenues, if any, and appropriately budget for our expenses, and we have limited insight into trends that

may emerge and affect our business.

We

began processes to develop relationships with potential customers and distribution partners in November 2016. Completion of our

cognitive assessment and remediation tools and the further development and commercialization of our products is dependent upon

the availability of sufficient funds. This limits our ability to accurately forecast the cost of the development of our products.

If the markets and applications of our products do not develop as we expect or develop more slowly than we expect, our business,

prospects, financial condition and operating results will be harmed.

We

have a history of operating losses and expect to continue incurring losses for the foreseeable future.

We

were incorporated in 2011. We reported a net loss of $3,637,368 for the fiscal year ended December 31, 2019 and had a net

loss of $5,588,334 during the fiscal year ended December 31, 2018. As of December 31, 2019, we had an accumulated deficit

of $16,214,826. We cannot anticipate when, if ever, our operations will become profitable. We expect to incur

significant net losses as we develop and commercialize our products and pursue our business strategy. We intend to invest

significantly in our business before we expect cash flow from operations to be adequate to cover our operating expenses. If

we are unable to execute our business strategy and grow our business, for any reason, our business, prospects, financial

condition and results of operations will be adversely affected.

As

reflected in the financial statements for the years ended December 31, 2019, and December 31, 2018, included elsewhere in this

Annual Report on Form 20-F, we had no revenues from continuing operations in 2019 and 2018 and need additional cash resources

to maintain its operations. These factors raise substantial doubt about our ability to continue as a going concern. Our ability

to continue as a going concern is dependent on our ability to raise additional capital. We cannot predict when, if ever, we will

be successful in raising additional capital and, accordingly, we may be required to cease operations at any time, if we do not

have sufficient working capital to pay our operating costs.

If

we are unable to obtain additional funding, our business operations will be harmed.

We

raised an aggregate of $270,018 through loans and issuance of convertible debentures and warrants in 2019. We raised an aggregate

of $1,867,982 through issuance of convertible debentures and warrants in 2018. We anticipate that we will continue to incur losses

and negative cash flows from operations, and that such losses will increase over the next several years due to development costs

associated with our MegaTeam and Ehave Dashboard products, until our products reach commercial profitability. As a result of these

expected losses and negative cash flows from operations, along with our current cash position, based on our current projections,

we may not have sufficient resources to fund operations through the third quarter of 2020. To the extent that we are required

to raise additional funds to conduct research and acquire facilities, and to cover costs of operations, we intend to do so through

additional public or private offerings of debt or equity securities. There are no assurances that we will be successful in obtaining

the level of financing needed for our operations, and we may be unable to secure such funding when needed in adequate amounts

or on acceptable terms, if at all. Any additional equity financing may involve substantial dilution to our then existing shareholders.

In February 2019, we entered a definitive agreement to sell the Ehave Connect asset in consideration for $904,516 (CAD$1,200,000)

of cash and shares of the purchaser’s common shares. That transaction closed in May 2019. However, the Company recorded

USD $256,408 (CAD $340,170) of expenses directly associated with the Asset Purchase Agreement The inability to raise the additional

capital will restrict our ability to develop and conduct business operations. If we cannot raise additional capital, we will need

to reduce our cash burn to last 12 months by focusing our efforts on existing products only, leveraging research funding to conduct

additional clinical studies on efficacy and integration and development of new techniques for assessment and rehabilitation.

Our

independent auditors have expressed their concern as to our ability to continue as a going concern.

We

reported an accumulated deficit of $16,214,826 and had a stockholders’ deficit of $2,230,775 at December 31, 2019. As a

result of our financial condition, we have received a report from our independent registered public accounting firm for our financial

statements for the years ended December 31, 2019 and 2018 that includes an explanatory paragraph describing the uncertainty as

to our ability to continue as a going concern without the infusion of significant additional capital. There can be no assurance

that management will be successful in implementing its plans. If we are unable to raise additional financing we may cease operations.

Our

products may not be successful in gaining market acceptance, which would negatively impact our revenues.

Currently,

our business strategy is to continue to support the clinical trials of our therapeutic video games, develop the Ehave Dashboard,

and gain access to additional technologies at a time and in a manner that we believe is best for our development. We may have

difficulties in reaching market acceptance, which could negatively impact our revenues, for a number of reasons including:

|

|

●

|

any

delays in securing partnerships and strategic alliances;

|

|

|

●

|

any

technical delays and malfunctions;

|

|

|

●

|

failure

to receive regulatory approval on a timely basis or at all; and

|

|

|

●

|

failure

to receive a sufficient level of reimbursement from government, insurers or other third-party payors.

|

If

we are unable to keep up with rapid technological changes in our field, we will be unable to operate profitably.

Our

industry is characterized by extensive research efforts and rapid technological progress. If we fail to anticipate or respond

adequately to technological developments, our ability to operate profitably could suffer. We cannot assure you that research and

discoveries by other companies will not render our software or potential products uneconomical or result in products superior

to those we develop or that any products or services we develop will be preferred to any existing or newly-developed products.

Many

of our potential competitors are better established and have significantly greater resources which may make it difficult for us

to compete in the markets in which we intend to sell our products.

The

market for the products we develop is highly competitive. Many of our potential competitors are well established with larger and

better resources, longer relationships with customers and suppliers, greater name recognition and greater financial, technical

and marketing resources than we have. Increased competition may result in price reductions, reduced gross margins, loss of market

share and loss of licensees, any of which could materially and adversely affect our business, operating results and financial

condition. We cannot ensure that prospective competitors will not adopt technologies or business plans similar to ours or develop

products which may be superior to ours or which may prove to be more popular. It is possible that new competitors will emerge

and rapidly acquire market share. We cannot ensure that we will be able to compete successfully against future competitors or

that the competitive pressures will not materially and adversely affect our business, operating results and financial condition.

If

we lose any of our key management personnel or consultants, we may not be able to successfully manage our business or achieve

our objectives.

Our

future success depends in large part upon the leadership and performance of our management and consultants. The Company’s

operations and business strategy are dependent upon the knowledge and business contacts of our executive officers and our consultants.

Although, we hope to retain the services of our officers and consultants, if any of our officer or consultants should choose to

leave us for any reason before we have hired additional personnel, our operations may suffer. If we should lose their services

before we are able to engage and retain qualified employees and consultants to execute our business plan, we may not be able to

continue to develop our business as quickly or efficiently.

In

addition, we must be able to attract, train, motivate and retain highly skilled and experienced technical employees in order to

successfully develop our business. Qualified technical employees often are in great demand and may be unavailable in the time

frame required to satisfy our business requirements. We may not be able to attract and retain sufficient numbers of highly skilled

technical employees in the future. The loss of technical personnel or our inability to hire or retain sufficient technical personnel

at competitive rates of compensation could impair our ability to successfully grow our business. If we lose the services of any

of our personnel, we may not be able to replace them with similarly qualified personnel, which could harm our business.

Developments

or assertions by us or against us relating to intellectual property rights could materially impact our business.

Pursuant

to an amendment to the collaboration agreement, effective January 1, 2014, with Toronto’s Hospital for Sick Children (the

“Hospital”), all intellectual property rights to the cognitive assessment and rehabilitation software jointly developed

with the Hospital belong to the Hospital. Our agreement with Multi-Health Systems Inc. (“MHS”), as amended, provides

that all right, title and interest in and to certain tests and other materials published by MHS relating to the tests are and

will remain solely and exclusively vested in MHS.

We

will attempt to protect proprietary and intellectual property rights to our products through licensing and distribution arrangements

although we currently do not have any patents or applications for our products.

Litigation

may also be necessary in the future to enforce our intellectual property rights or to determine the validity and scope of the

proprietary rights of others or to defend against claims of invalidity. Such litigation could result in substantial costs and

the diversion of resources.

As

we create or adopt new software, we will also face an inherent risk of exposure to the claims of others that we have allegedly

violated their intellectual property rights.

Our

products could infringe on the intellectual property rights of others which may result in costly litigation and, if we do not

prevail, could also cause us to pay substantial damages and prohibit us from selling or licensing our products.

Third

parties may assert infringement or other intellectual property claims against us. We may have to pay substantial damages, including

damages for past infringement if it is ultimately determined that our products or technology infringe a third party’s proprietary

rights. Further, we may be prohibited from selling or providing products before we obtain additional licenses, which, if available

at all, may require us to pay substantial royalties or licensing fees. Even if claims are determined to be without merit, defending

a lawsuit takes significant time, may be expensive and may divert management’s attention from our other business concerns.

Any public announcements related to litigation or interference proceedings initiated or threatened against us could cause our

business to be harmed and our stock price to decline.

We

have identified material weaknesses in our internal control over financial reporting, and if we are unable to achieve and maintain

effective internal control over financial reporting or effective disclosure controls, we may be at risk to accurately report financial

results or detect fraud, which could have a material adverse effect on our business.

As

directed by Section 404 of the Sarbanes-Oxley Act of 2002, the SEC adopted rules requiring an annual assessment by management

of the effectiveness of a public company’s internal controls over financial reporting and an attestation report by the company’s

independent auditors addressing this assessment, if applicable. As discussed in Item 15 “Controls and Procedures”

based on a review of our internal controls over financial reporting, management concluded that our internal controls over financial

reporting was not effective due to the existence of a material weakness relating to a lack of sufficient accounting records and

underlying supporting detail as of December 31, 2019. A material weakness is defined as a deficiency, or a combination of deficiencies,

in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company’s

annual or interim financial statements will not be prevented or detected on a timely basis by the company’s internal controls.

Management has since addressed this weakness and has implemented the necessary changes to have effective controls over financial

reporting. For additional information, see Item 15 “Controls and Procedures.”

We

cannot assure you that we will be able to remediate our existing material weaknesses in a timely manner, if at all, or that in

the future additional material weaknesses will not exist, reoccur or otherwise be discovered, a risk that is significantly increased

in light of the complexity of our business. If our efforts to remediate these material weaknesses, as described in Item 15 “Controls

and Procedures”, are not successful or if other deficiencies occur, our ability to accurately and timely report our financial

position, results of operations, cash flows or key operating metrics could be impaired, which could result in late filings of

our annual or interim reports under the Exchange Act, restatements of our consolidated financial statements or other corrective

disclosures. Our failure to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 on an ongoing, timely basis

could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm our business

and negatively impact the trading price of the common shares. In addition, future changes in our accounting, financial reporting,

and regulatory environment may create new areas of risk exposure. Failure to modify our existing control environment accordingly

may impair our controls over financial reporting and cause our investors to lose confidence in the reliability of our financial

reporting, which may adversely affect our share price, suspension of trading or delisting of our common shares by Pink Open Market,

or, if we regain the eligibility to have our common shares quoted on the OTCQB Venture Market, the OTCQB Venture Market, or other

material adverse effects on our business, reputation, results of operations, financial condition or liquidity. Furthermore, if

we continue to have these existing material weaknesses, other material weaknesses or significant deficiencies in the future, it

could create a perception that our financial results do not fairly state our financial condition or results of operations. Any

of the foregoing could have an adverse effect on the value of our shares.

The

market for our products is immature and volatile and if it does not develop, or if it develops more slowly than we expect, the

growth of our business will be harmed.

The

market for software-based systems for mental health or treatments using psychedelics is a new and unproven market, and it is uncertain

whether it will achieve and sustain demand and market adoption. Our success will depend to a substantial extent on the willingness

of customers and healthcare professionals to use our systems, as well as on our ability to demonstrate the value of our software

and products to customers and to develop new applications that provide value to customers and users. If customers and users do

not perceive the benefits of our products, then our market may not develop at all, or it may develop more slowly than we expect,

either of which could significantly adversely affect our operating results. In addition, we have limited insight into trends that

might develop and affect our business. We might make errors in predicting and reacting to relevant business, legal and regulatory

trends, which could harm our business. If any of these events occur, it could materially adversely affect our business, financial

condition or results of operations.

If

our security measures are breached and unauthorized access to a customer’s data are obtained, our products may be perceived

as insecure, we may incur significant liabilities, our reputation may be harmed and we could lose sales and customers.

Our

products involve the storage and transmission of customers’ proprietary information, as well as protected health information,

or PHI, which, in the United States, is regulated under the Health Insurance Portability and Accountability Act of 1996 and its

implementing regulations, collectively “HIPAA,” and other state and federal privacy and security laws. Because of

the extreme sensitivity of this information, the security features of our product are very important. If our security measures,

some of which will be managed by third parties, are breached or fail, unauthorized persons may be able to obtain access to sensitive

data, including HIPAA-regulated protected health information. A security breach or failure could result from a variety of circumstances

and events, including but not limited to third-party action, employee negligence or error, malfeasance, computer viruses, attacks

by computer hackers, failures during the process of upgrading or replacing software, databases or components thereof, power outages,

hardware failures, telecommunication failures, user errors, and catastrophic events.

If

our security measures were to be breached or fail, our reputation could be severely damaged, adversely affecting customer or investor

confidence, customers may curtail their use of or stop using our products and our business may suffer. In addition, we could face

litigation, damages for contract breach, penalties and regulatory actions for violations of HIPAA and other state and federal

privacy and security regulations, significant costs for investigation, remediation and disclosure and for measures to prevent

future occurrences. In addition, any potential security breach could result in increased costs associated with liability for stolen

assets or information, repairing system damage that may have been caused by such breaches, incentives offered to customers or

other business partners in an effort to maintain the business relationships after a breach and implementing measures to prevent

future occurrences, including organizational changes, deploying additional personnel and protection technologies, training employees

and engaging third-party experts and consultants. While we maintain insurance covering certain security and privacy damages and

claim expenses, we may not carry insurance or maintain coverage sufficient to compensate for all liability and in any event, insurance

coverage would not address the reputational damage that could result from a security incident.

We

plan to outsource important aspects of the storage and transmission of customer information, and thus rely on third parties to

manage functions that have material cyber-security risks. These outsourced functions include services such as software design

and product development, software engineering, database consulting, data-center security, IT, network security, data storage and

Web application firewall services. We cannot assure you that any measures that are taken will adequately protect us from the risks

associated with the storage and transmission of customers’ proprietary information and protected health information.

We

may experience cyber-security and other breach incidents that may remain undetected for an extended period. Because techniques

used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until launched against

us, we may be unable to anticipate these techniques or to implement adequate preventive measures. In addition, in the event that

our customers authorize or enable third parties to access their data or the data of their employees on our systems, we cannot

ensure the complete integrity or security of such data in our systems as we would not control access. If an actual or perceived

breach of our security occurs, or if we are unable to effectively resolve such breaches in a timely manner, the market perception

of the effectiveness of our security measures could be harmed, we could be subject to regulatory action or other damages and we

could lose sales and customers.

If

we fail to comply with applicable health information privacy and security laws and other state and federal privacy and security

laws, we may be subject to significant liabilities, reputational harm and other negative consequences, including decreasing the

willingness of current and potential customers to work with us.

Once

our products are deployed in the United States, we will be subject to data privacy and security regulation by both the federal

government and the states in which we conduct our business. HIPAA established uniform federal standards for certain “covered

entities,” which include health care providers, health plans, and health care clearing houses, governing the conduct of

specified electronic health care transactions and protecting the security and privacy of protected health information, or PHI.

The Health Information Technology for Economic and Clinical Health Act, or HITECH, which was signed into law on February 17, 2009,

makes certain of HIPAA’s privacy and security standards directly applicable to “business associates,” which

are individuals or entities that create, receive, maintain, or transmit PHI in connection with providing a service for or on behalf

of a covered entity. HITECH also increased the civil and criminal penalties that may be imposed against covered entities, business

associates and other persons, and gave state attorneys general new authority to file civil actions for damages or injunctions

in federal courts to enforce HIPAA’s requirements and seek attorney’s fees and costs associated with pursuing federal

civil actions.

In

addition, states have enacted privacy and security laws and regulations that regulate the use and disclosure of certain data,

with some state laws covering medical and healthcare information. These laws vary by state and could impose additional requirements

and penalties on us. For example, some states impose restrictions on the use and disclosure of health information pertaining to

mental health or substance abuse. Further, state laws and regulations may require us to notify affected individuals in the event

of a data breach involving individually identifiable information, which may be broader than the type of information covered by

HIPAA. In addition, the Federal Trade Commission may use its consumer protection authority to initiate enforcement actions in

data privacy and security matters.

If

we are unable to protect the privacy and security of our customers’ data, we could be found to have breached our contracts

with our customers, we could face civil and criminal penalties under federal and state laws, we could be subject to litigation

and we could suffer reputational harm or other damages. We may not be able to adequately address the business, technical and operational

risks created by HIPAA and other privacy and security regulations. Furthermore, we are unable to predict what changes to HIPAA

or other laws or regulations might be made in the future or how those changes could affect our business or the costs of compliance.

Our

proprietary software may not operate properly, which could damage our reputation, give rise to claims against us or divert application

of our resources from other purposes, any of which could harm our business and operating results.

Proprietary

software development is time-consuming, expensive and complex, and may involve unforeseen difficulties. We may encounter technical

obstacles, and it is possible that we discover additional problems that prevent our proprietary applications from operating properly.

We are currently implementing software with respect to a number of new applications and services. If our software does not function

reliably or fails to achieve client expectations in terms of performance, clients could assert liability claims against us or

attempt to cancel their contracts with us. This could damage our reputation and impair our ability to attract or maintain clients.

Moreover,

data services are complex as those we offer have in the past contained, and may in the future develop or contain, undetected defects

or errors. Material performance problems, defects or errors in our existing or new software and applications and services may

arise in the future and may result from interface of our offering with systems and data that we did not develop and the function

of which is outside of our control or undetected in our testing. These defects and errors and any failure by us to identify and

address them could result in loss of revenue or market share, diversion of development resources, injury to our reputation and

increased service and maintenance costs. The costs incurred in correcting any defects or errors may be substantial and could adversely

affect our operating results.

We

depend on data centers operated by third parties for our products, and any disruption in the operation of these facilities could

adversely affect our business.

We

provide our products through a third-party data center. While we control and have access to our servers and all of the components

of our network that are located in our external data centers, we do not control the operation of these facilities. The owners

of our data centers have no obligation to renew agreements with us on commercially reasonable terms, or at all. If we are unable

to renew any such agreements we may enter into on commercially reasonable terms, or if our data center operator is acquired, we

may be required to transfer our servers and other infrastructure to new data center facilities, and we may incur significant costs

and possible service interruption in connection with doing so.

Problems

faced by our third-party data center locations could adversely affect the experience of our customers. The operators of the data

centers could decide to close their facilities without adequate notice. In addition, any financial difficulties, such as bankruptcy,

faced by the operators of the data centers or any of the service providers with whom we or they contract may have negative effects

on our business, the nature and extent of which are difficult to predict. Additionally, if our data centers are unable to keep

up with our growing needs for capacity, this could have an adverse effect on our business. For example, a rapid expansion of our

business could affect the service levels at our data centers or cause such data centers and systems to fail. Any changes in third-party

service levels at our data centers or any disruptions or other performance problems with our products could adversely affect our

reputation or result in lengthy interruptions in our services. Interruptions in our services might reduce our revenue, cause us

to issue refunds to customers for prepaid and unused subscriptions, subject us to potential liability or adversely affect our

renewal rates.

If

currency exchange rates fluctuate substantially in the future, the results of our operations, which are reported in U.S. dollars,

could be adversely affected.

As

our trials are primarily based in Canada and we seek to operate our business on a global scale, we are exposed to the effects

of fluctuations in currency exchange rates. We incur certain operating expenses in Canadian dollars. Fluctuations in the exchange

rates between the U.S. dollar and the Canadian dollar could result in the dollar equivalent of such expenses being higher. This

could have a negative impact on our reported results of operations. Although we may in the future decide to undertake foreign

exchange hedging transactions to cover a portion of our foreign currency exchange exposure, we currently do not hedge our exposure

to foreign currency exchange risks.

Our

future U.S. operations and relationships with healthcare providers, investors, consultants, third-party payors, patients, and

other customers may be subject to applicable anti-kickback, fraud and abuse and other healthcare laws and regulations, which in

the event of a violation could expose us to criminal sanctions, civil penalties, contractual damages, reputational harm and diminished

profits and future earnings.

Our

future U.S. operations and arrangements with healthcare providers, physicians and third-party payors may expose us to broadly

applicable fraud and abuse and other federal and state healthcare laws and regulations. These laws may constrain the business

and/or financial arrangements and relationships through which we market, sell and distribute our products. Potentially applicable

U.S. laws include:

|

|

●

|

the

federal Anti-Kickback Statute, which prohibits the offer, payment, solicitation or receipt of any form of remuneration in

return for referring, ordering, leasing, purchasing or arranging for, or recommending the ordering, purchasing or leasing

of, items or services payable by Medicare, Medicaid or any other federal healthcare program;

|

|

|

|

|

|

|

●

|

federal

false claims laws and civil monetary penalty laws, including the False Claims Act, which prohibit, among other things, individuals

or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid or other government

healthcare programs that are false or fraudulent, or making a false statement to avoid, decrease or conceal an obligation

to pay money to the federal government;

|

|

|

|

|

|

|

●

|

HIPAA,

which imposes federal criminal and civil liability for executing, or attempting to execute, a scheme to defraud any healthcare

benefit program and making false statements relating to healthcare matters;

|

|

|

●

|

HIPAA,

as amended by the Health Information Technology for Economic and Clinical Health Act, and its implementing regulations, also

imposes certain requirements relating to the privacy, security and transmission of individually identifiable health information;

and

|

|

|

|

|

|

|

●

|

analogous

state laws and regulations, such as state anti-kickback and false claims laws, which may be broader in scope and apply to

referrals and items or services reimbursed by any third-party payers, including commercial insurers, many of which differ

from each other in significant ways and often are not preempted by federal law, thus complicating compliance efforts.

|

Because

of the breadth of these laws and the narrowness of the statutory exceptions and regulatory safe harbors available under such laws,

it is possible that some of our business activities could be subject to challenge under one or more of such laws. The scope and

enforcement of each of these laws is uncertain and subject to rapid change in the current environment of healthcare reform. Our

risk of being found in violation of these laws is increased by the fact that some of these laws are open to a variety of interpretations.

If our past or present operations, practices, or activities are found to be in violation of any of the laws described above or

any other governmental regulations that apply to us, we may be subject to penalties, including civil and criminal penalties, exclusion

from participation in government healthcare programs, such as Medicare and Medicaid, imprisonment, damages, fines, disgorgement,

contractual damages, reputational harm, diminished profits and future earnings, and the curtailment or restructuring of our operations,

any of which could adversely affect our ability to operate our business and our results of operations. Further, defending against

any such actions can be costly, time-consuming and may require significant resources. Therefore, even if we are successful in

defending against any such actions that may be brought against us, our customers may be unwilling to use our products and our

business may be impaired.

We

may not be in compliance with rules and regulations of the U.S. Food and Drug Administration (the “FDA”) should they

become applicable to any products we develop in the future.

We

have no current plans to market, advertise or sell computerized cognitive assessment aids in the United States. Types of computerized

cognitive assessment aids for the measurement and assessment of behavioral and cognitive abilities such as brain games are games

purporting to increase intelligence or cognitive function are currently regulated by the FDA as Class II medical devices. Such

brain games may be subject to clinical processes to determine their accuracy or validity. Terminology such as “neuroplasticity”,

“attention” and “working memory” have become ubiquitous as the “brain game” market has grown.

Current clinical practice refers to the use of cognitive software for the measurement of deficits as an “assessment”,

and the use of software tools as rehabilitation methods as “remediation”. Should we decide in the future to market,

advertise, or sell products that may be considered by the FDA as computerized cognitive assessment aids, we may be required to

undergo costly and time consuming clinical trials to prove the accuracy and validity of our computerized cognitive assessment

aids, should we have any such products to market, sell or advertise in the future.

The

results of any future clinical trials that we may need to perform in the future may not support our medical device candidate requirements

or intended use claims or may result in the discovery of unanticipated inconsistent data.

We

have no current plans to market, advertise or sell computerized cognitive assessment aids in the United States. The clinical trial

process may fail to demonstrate that our computerized cognitive assessment aids that we may develop in the future, are safe, effective,

and consistent for the desired or proposed indicated uses, which could cause us to abandon a product and may delay development

of others. Any requirement to perform unanticipated clinical trials or delay or termination of any such unanticipated future clinical

trials may delay or inhibit our ability to commercialize any computerized cognitive assessment aids that we may develop in the

future; and affect our ability to generate revenues.

A

security breach or disruption or failure in a computer or communications systems could adversely affect us.

Our

operations depend on the continued and secure functioning of our computer and communications systems and the protection of electronic

information (including sensitive personal information as well as proprietary or confidential information) stored in computer databases

maintained by us or by third parties. Such systems and databases are subject to breach, damage, disruption or failure from, among

other things, cyber-attacks and other unauthorized intrusions, power losses, telecommunications failures, fires and other natural

disasters, armed conflicts or terrorist attacks. We may be subject to threats to our computer and communications systems and databases

of unauthorized access, computer hackers, computer viruses, malicious code, cyber-crime, cyber-attacks and other security problems

and system disruptions. Unauthorized persons may attempt to hack into our systems to obtain personal data relating to clinical

trial participants or employees or our confidential or proprietary information or of third parties or information relating to

our business and financial data. If, despite our efforts to secure our systems and databases, events of this nature occur, we

could expose clinical trial participants or employees to financial or medical identity theft, lose clinical trial participants

or employees or have difficulty attracting new clinical trial participants or employees, be exposed to the loss or misuse of confidential

information or business and financial data, have disputes with clinical trial participants or employees, suffer regulatory sanctions

or penalties under applicable laws, incur expenses as a result of a data privacy breach, or suffer other adverse consequences

including legal action and damage to our reputation.

RISKS

ASSOCIATED WITH OUR COMMON SHARES AND COMPANY

We

expect that our stock price will fluctuate significantly.

The

trading price of our common shares may be highly volatile and could be subject to wide fluctuations in response to various factors,

some of which are beyond our control. In addition to the factors discussed in this “Risk Factors” section and elsewhere

in this report, these factors include:

|

|

●

|

announcement

of new products by our competitors;

|

|

|

|

|

|

|

●

|

release

of new products by our competitors;

|

|

|

|

|

|

|

●

|

adverse

regulatory decisions;

|

|

|

|

|

|

|

●

|

developments

in our industry or target markets; and

|

|

|

|

|

|

|

●

|

general

market conditions including factors unrelated to our operating performance.

|

Recently,

the stock market in general has experienced extreme price and volume fluctuations. Continued market fluctuations could result

in extreme market volatility in the price of our common shares which could cause a decline in the value of our shares.

Market

prices for securities of software development companies generally are volatile and the share price for our common shares has been

historically volatile. This increases the risk of securities litigation. Factors such as announcements of technological innovations,

new commercial products, patents, the development of proprietary rights, results of clinical trials, regulatory actions, publications,

financial results, our financial position, future sales of shares by us or our current shareholders and other factors could have

a significant effect on the market price and volatility of the common shares.

We

are unable to predict the impact of COVID-19 on our company.

Our

diagnostic and treatment tools, MegaTeam and Ninja Reflex, are currently used in hospitals and other medical settings. Because

of strain on hospitals and their resources by treatment of patients with COVID-19, hospitals and other facilities are canceling

or postponing non-emergency treatments which may include the use of our tools for the treatment of ADHD and related illnesses.

Additionally, people are generally avoiding medical facilities except in emergency situations and therefore would not be seeking

to utilize our tools in such a setting. While we do not expect this trend to continue indefinitely, its duration and impact cannot

be quantified at this time and may negatively impact our business as it is related to MegaTeam and Ninja Reflex.

If

our business is unsuccessful, our shareholders may lose their entire investment.

Although

shareholders will not be bound by or be personally liable for our expenses, liabilities or obligations beyond their total original

capital contributions, should we suffer a deficiency in funds with which to meet our obligations, the shareholders as a whole

may lose their entire investment in our Company.

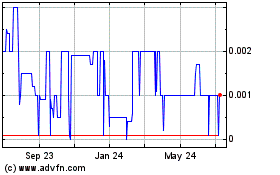

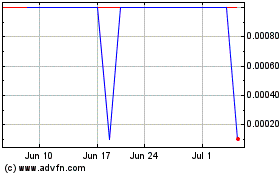

Trading

of our common shares on the Pink Open Market is limited and sporadic, making it difficult or impossible for our shareholders to

sell their shares or liquidate their investments.

There

is a very limited market for our common shares. On April 30, 2019, our common shares were removed from the OTCQB Venture Market

to the Pink Open Market. Prior to the listing of our common shares for trading on the OTCQB Venture Market in November 2016, there

was no public market for our common shares. The Pink Open Market is a significantly more limited market than the OTCQB Venture

Market and established exchanges such as the New York Stock Exchange or NASDAQ. There is no assurance that a sufficient market

will develop in our shares, and the lack of an active market will impair your ability to sell your common shares at the time you

wish to sell them or at a price that you consider reasonable. The lack of an active market may also reduce the fair value of our

common shares. An inactive market may also impair our ability to raise capital to continue to fund operations by selling shares

and may impair our ability to acquire other companies or technologies by using our shares as consideration. Even after trading

volume increases, trading through the Pink Open Market or the OTCQB Venture Market, if our shares regain eligibility to be quoted

on the OTCQB Venture Market, is frequently thin and highly volatile.

We

may not regain or maintain the eligibility to have our common shares quoted on the OTCQB Venture Market, which may have an unfavorable

impact on our stock price and liquidity.

On

April 30, 2019, our common shares were removed from the OTCQB Venture Market to the Pink Open Market because we were unable to

cure our bid price deficiency. The OTCQB Venture Market requires a minimum bid price of $0.01. Broker-dealers often decline to

trade in over-the-counter stocks that are quoted on the OTC Pink tier given the market for such securities are often limited,

the stocks are more volatile, and the risk to investors is greater. The OTC Pink marketplace also does not provide as much liquidity

as the OTCQB Venture Market. Many broker-dealers will not trade or recommend OTC Pink stocks for their clients. Because the OTCQB

generally increases transparency by maintaining higher reporting standards and requirements and imposing management certification

and compliance requirements, broker-dealers are more likely to trade stocks on the OTCQB marketplace than on the OTC Pink marketplace.

If we do not regain our eligibility to be quoted on the OTCQB Venture Market or maintain such eligibility once we regain the eligibility,

these factors may reduce the potential market for our common shares by reducing the number of potential investors. This may make

it more difficult for investors in our common shares to sell shares to third parties or to otherwise dispose of their shares and

could cause our stock price to decline.

We

effected a reverse split of our common stock on a 100 for 1 basis effective as of May 29, 2019, to cure the bid price deficiency;

however, we have not yet made reapplication to the OTCQB Venture Market.

The

share consolidation may decrease the liquidity of our common shares.

At

the special meeting of our shareholders held on May 6, 2019, our shareholders approved a resolution authorizing the amendment

of our articles to consolidate our issued and outstanding common shares in up to three consecutive share consolidations to occur

at any time as determined by our board of directors, within one calendar year of the date of the special meeting, provided that

the first consolidation, the second consolidation, and the third consolidation shall collectively effect a consolidation on a

basis of between (i) two pre-consolidation shares to one post-consolidation share, and (ii) 200 pre-consolidation shares to one

post-consolidation share. On May 13, 2019, we determined a share consolidation ratio of 100 pre-consolidation shares to one post-consolidation

share, that was effective as of May 29, 2019. The liquidity of our common shares may be affected adversely by the share consolidation

given the reduced number of shares that are outstanding following the share consolidation. In addition, the share consolidation

will increase the number of shareholders who own odd lots (less than 100 shares) of our common shares, creating the potential

for such shareholders to experience an increase in the cost of selling their shares and greater difficulty effecting such sales.

Our

common shares are subject to the “penny stock” rules of the SEC and we have no established market for our securities,

which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The

SEC has adopted Rule 15g-9 which establishes the definition of a “penny stock,” for the purposes relevant to us, as

any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share,

subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker

or dealer approve a person’s account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor

a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to

approve a person’s account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information

and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks

are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating

the risks of transactions in penny stocks.

The

broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating

to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability

determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally,

brokers may be less willing to execute transactions in securities subject to the “penny stock” rules. This may make

it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock.

Disclosure

also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the

commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the

rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to

be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny

stocks.

We

are a “foreign private issuer”, and you may not have access to the information you could obtain about us if we were

not a “foreign private issuer”.

We

are considered a “foreign private issuer” under the Securities Act of 1933, as amended. As a foreign private issuer

we will not have to file quarterly reports with the SEC nor will our directors, officers and 10% stockholders be subject to Section

16(b) of the Exchange Act. Such exemption may result in shareholders having less data and there being fewer restrictions on insiders’

activities in our securities. As a foreign private issuer we will not be subject to the proxy rules of Section 14 of the Exchange

Act. Furthermore, Regulation FD does not apply to non-U.S. companies and will not apply to us. Accordingly, you may not be able

to obtain information about us as you could obtain if we were not a “foreign private issuer”.

Because

the majority of our assets and of our officers and directors are located outside the United States, it may be difficult for an

investor to enforce within the United States any judgments obtained against us or any of our officers and directors.

A

majority of our assets are presently located outside of the United States. In addition, some of our directors and officers are

nationals and/or residents of countries other than the United States, and all or a substantial portion of such persons’

assets are located outside the United States. As a result, it may be difficult for an investor to effect service of process or

enforce within the United States any judgments obtained against us or our officers or directors, including judgments predicated

upon the civil liability provisions of the securities laws of the United States or any state thereof. In addition, there is uncertainty

as to whether the courts of Canada would recognize or enforce judgments of United States courts obtained against us or our directors

and officers predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

There is even uncertainty as to whether the Canadian courts would have jurisdiction to hear original actions brought in Canada

against us or our directors and officers predicated upon the securities laws of the United States or any state thereof.

Because

we do not intend to pay any cash dividends on our common shares, our shareholders will not be able to receive a return on their

shares unless they sell them.

We

intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any

cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our shareholders will not be able to receive

a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

Because

we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our shareholders

have limited protections against interested director transactions, conflicts of interest and similar matters.

The

Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York Stock Exchange, the NYSE American

and NASDAQ, as a result of Sarbanes-Oxley Act of 2002, require the implementation of various measures relating to corporate governance.

These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities

which are listed on those exchanges. Because we will not be seeking to be listed on any of the exchanges, we will not be presently

required to comply with many of the corporate governance provisions.

The

concentration of the capital stock ownership with our insiders enable their exercise of significant control over our corporate

governance and affairs which may result in their taking actions with which other shareholders do not agree and may limit the ability

of other shareholders to influence corporate matters.

As

of May 1, 2020, approximately 46.7% of our outstanding common shares was controlled by our officers, directors, beneficial owners

of 10% or more of our securities and their respective affiliates. These shareholders, if they act together, may be able to exercise

significant influence over the outcome of all corporate actions requiring approval of our shareholders, including the election

of directors and approval of significant corporate transactions, which may result in corporate action with which other shareholders

do not agree. This concentration of ownership may also have the effect of delaying or preventing a change in control which might

be in other shareholders’ best interest but which might negatively affect the market price of our common shares.

Our

authorized capital consists of an unlimited number of shares of one class designated as common shares. We may, in the future,

issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our

Articles of Incorporation authorizes the issuance of an unlimited number of our common shares, no par value, of which 25,413,919

shares are currently issued and outstanding. The future issuance of common shares may result in substantial dilution in the percentage

of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary

basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting

the value of the shares held by our investors and may have an adverse effect on any trading market of our common shares.

Offers

or availability for sale of a substantial number of our common shares may cause the price of our common shares to decline.

If

our shareholders sell substantial amounts of our common shares in the public market, including shares issued in the public offering

and shares issued upon conversion of outstanding convertible notes or exercise of outstanding warrants, or upon the expiration

of any statutory holding period, under Rule 144, or upon the exercise of outstanding options or warrants, it could create a circumstance

commonly referred to as an “overhang” and in anticipation of which the market price of our common shares could fall.

The existence of an overhang, whether or not sales have occurred or are occurring, also could make more difficult our ability

to raise additional financing through the sale of equity or equity-related securities in the future at a time and price that we

deem reasonable or appropriate.

We

qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act, or JOBS Act. As a result, we

are permitted to, and intend to, rely on exemptions from certain disclosure requirements.

For

so long as we are an emerging growth company, we will not be required to:

●

have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act

of 2002;

●

comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm

rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements

(i.e., an auditor discussion and analysis);

●

submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay” and “say-on-frequency;”

and

●

disclose certain executive compensation related items such as the correlation between executive compensation and performance and

comparisons of the chief executive officer’s compensation to median employee compensation.

We

will remain an “emerging growth company” for up to five years, or until the earliest of (i) the last day of the first

fiscal year in which our total annual gross revenues exceed $1.07 billion, (ii) the date that we become a “large accelerated

filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, which would occur if the market value

of our ordinary shares that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed

second fiscal quarter or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding

three year period.

Until

such time, however, we cannot predict if investors will find our common shares less attractive because we may rely on these exemptions.

If some investors find our common shares less attractive as a result, there may be a less active trading market for our common

shares and our share price may be more volatile.

In

addition, when these exemptions cease to apply, we expect to incur additional expenses and devote increased management effort

toward ensuring compliance with them. We cannot predict or estimate the amount of additional costs we may incur as a result of

us ceasing to be an emerging growth company or the timing of such costs. In addition, once we no longer qualify as an emerging

growth company under the JOBS Act and lose the ability to rely on the exemptions related thereto, depending on our status as per

Rule 12b-2 of the Securities Exchange Act of 1934, as amended, our independent registered public accounting firm may also need

to attest to the effectiveness of our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of

2002. We will be performing the system and process evaluation and testing (and any necessary remediation) required to comply with

the management certification and eventual auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002 when

we are no longer an emerging growth company. This process will require the investment of substantial time and resources, including

by our senior management. As a result, this process may divert internal resources and take a significant amount of time and effort

to complete.

Since

we have elected under Section 107 of the JOBS Act to use the extended transition period with respect to complying with new or

revised accounting standards, our financial statements may not be comparable to companies that comply with public company effective

dates making it more difficult for an investor to compare our results with other public companies.

Section

107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in

Section 102(b)(2)(B) of the Act for complying with new or revised accounting standards. In other words, as an emerging growth

company we can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies.

We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not

be comparable to those of companies that comply with such new or revised accounting standards.

We

may be classified as a Passive Foreign Investment Company, or PFIC, for U.S. federal income tax purposes in 2019 and may continue

to be, or become, a PFIC in future years, which may have negative tax consequences for U.S. investors.

We

will be treated as a PFIC for U.S. federal income tax purposes in any taxable year in which either (i) at least 75% of our gross

income is “passive income” or (ii) on average at least 50% of our assets by value produce passive income or are held

for the production of passive income. Based on our estimated gross income, the average value of our gross assets, and the nature

of our business, we may be classified as a PFIC in the current taxable year and may be treated, or may become, a PFIC in future

years. If we are treated as a PFIC for any taxable year during which a U.S. investor held our common shares, certain adverse U.S.

federal income tax consequences could apply to the U.S. investor. See “Item 10. Additional Information – E. Taxation–

Passive Foreign Investment Company Rules.”

ITEM

4. INFORMATION ON THE COMPANY

|

|

A.

|

History

and Development of the Company

|

We

were incorporated under the laws of the Province of Ontario (specifically under the Business Corporations Act (Ontario)) on October

31, 2011, in the Province of Ontario, Canada, and did business as Behavioural Neurological Applications and Solutions. Effective

November 4, 2015, we changed our name to Ehave, Inc.

Our

principal office is located at 18851 NE 29th Ave, suite 700, Aventura, FL 33180and our telephone number is (954) 233-3511.

The

SEC maintains an Internet site that contains reports and other information regarding us that we file electronically with the SEC

website at www.sec.gov. We also make available free of charge on our website at www.ehave.com, as soon as reasonably practicable

after such reports are available on the SEC website.

We

are not aware of any indication of any public takeover offers by third parties in respect of our common shares during our last

and current financial years.

Sale

of Ehave Connect Assets

On

March 22, 2019, we entered into an Asset Purchase Agreement with ZYUS Life Sciences Inc. (“ZYUS”), pursuant to which

we sold to ZYUS all of our property and assets, including intellectual property, relating to our business relating to our technology

stack, data models, user interface flows, application programming interfaces and all existing builds to the health informatics

Ehave Connect platform, which includes but is not limited to the input, tracking and extraction of clinical data, but excluding

intellectual property in certain patient outcome reporting applications, clinical games, clinical patient data, facts related

to patient assessments and personal property (the “Asset Sale”). The Ehave Connect platform contains components specifically

designed to be used by medical cannabis patients to efficiently gather and verify patient-reported outcomes and experiences, evaluate

treatment progress, enhance patient engagement and improve data modeling.

In

connection with the Agreement, ZYUS (i) paid us a total purchase price of CAD $1.2 million (US$895,122) in cash, CAD $260,000

(US$193,943) of which was provided to us upon execution of a non-binding term sheet and CAD $100,000 (US$74,594) of which was

provided to us on April 30, 2019, pursuant to an advance, and (ii) issued to us at closing 361,011 common shares of ZYUS (the

“Consideration Shares”). ZYUS has a security interest in the Consideration Shares in support of any indemnity claims

by ZYUS pursuant to the Agreement until the second anniversary of the closing date.

The

Agreement also contains representations, warranties and covenants of the parties customary for transactions similar to those contemplated

by the Agreement. Pursuant to the Agreement, ZYUS, among other things, agreed not to redeem, purchase or otherwise acquire any

of its outstanding shares or other securities, subject to certain exceptions, from the date of the Agreement and until the closing

date of the Asset Sale, and we agreed to enter into a six month lock-up agreement restricting the resale of the Consideration

Shares if ZYUS completes an initial public offering or going public transaction. Such representations and warranties are made

solely for purposes of the Agreement and, in some cases, may be subject to qualifications and limitations agreed to by the parties

in connection with the negotiated terms of the Agreement and may have been qualified by disclosures that were made in connection

with the parties’ entry into the Agreement.

The

Agreement also contains indemnification provisions by each party. We will deliver a security agreement granting ZYUS a security

interest in the Consideration Shares in support of any indemnity claims by ZYUS pursuant to the Agreement until the second anniversary

of the closing date.

In

addition, we agreed to enter into a non-competition agreement with ZYUS, pursuant to which we agree not to, for a period of four

years from the date of the non-competition agreement, within Canada and the United States, conduct business or have any financial

or other interest in any business that is the same as or substantially similar to or is competitive with the business of a healthcare

software development company for stakeholders in health sectors related to plant-based therapeutics. The non-competition agreement

also includes a confidentiality provision that prohibits us from using the confidential information relating to the assets acquired

in the Asset Sale for its own benefit or for the benefit of others.

The

foregoing descriptions of the Agreement, the security agreement and the non-competition agreement are qualified in their entirety

by reference to the full text of the Agreement, a form of the security agreement and a form of the non-competition agreement,

a copy of which is attached to our Annual Report on Form 20-F as Exhibits 4.60, 4.61 and 4.62 filed on May 15, 2019.

On

May 22, 2019, the Asset Sale closed. Pursuant to the Purchase Agreement, at closing, the Company received from ZYUS (i) CAD$840,000

in cash (the remaining portion of the total cash purchase price of CAD $1.2 million), of which CAD $260,000 had been provided

to us upon execution of a non-binding term sheet and CAD$100,000 had been provided to us on April 30, 2019, pursuant to an advance,

and (ii) 361,011 common shares of ZYUS, priced at CAD$5.54 per share.

On

the closing date, pursuant to the Purchase Agreement, the Company executed (i) a six month lock-up agreement restricting the resale

of the Consideration Shares if ZYUS completes an initial public offering or going public transaction; (ii) a security agreement

granting ZYUS a security interest in the Consideration Shares in support of any indemnity claims by ZYUS pursuant to the Purchase

Agreement until the second anniversary of the closing date; and (iii) a non-competition agreement with ZYUS, pursuant to which

we agreed not to, for a period of four years from the date of the non-competition agreement, within Canada and the United States,

conduct business or have any financial or other interest in any business that is the same as or substantially similar to or is

competitive with the business of a healthcare software development company for stakeholders in health sectors related to plant-based

therapeutics. The non-competition agreement also includes a confidentiality provision that prohibits the Company from using confidential

information relating to the assets acquired in the Asset Sale for its own benefit or for the benefit of others.

In

connection with the closing of the Asset Sale, the Company terminated certain collaboration and services agreements with certain

third-party partners.

On

October 30, 2018, we entered in an agreement (the “CHT Agreement”) with Companion Healthcare Technologies Inc. (“CHT”),

for the use of Ehave Connect whereby CHT would acquire the exclusive rights to Ehave Connect for use in companion animals. On

April 18, 2019, we and CHT agreed that upon closing of the Asset Sale, the CHT Agreement shall be terminated, and we, as consideration,

within ten business days following the date of the closing of the Asset Sale, shall pay CHT, in cash, up to CAD$242,000, which

includes up to $37,000 for legal fees that CHT incurred in connection with the CHT Agreement, provided that the agreement to terminate

the CHT Agreement and our obligation to pay CHT shall no longer be effective if the closing of the Asset Sale does not occur on

or prior to June 30, 2019.

Share

Consolidation

At

the special meeting of our shareholders held on May 6, 2019, our shareholders approved a resolution authorizing the amendment

of our articles to consolidate our issued and outstanding common shares in up to three consecutive share consolidations to occur

at any time as determined by our board of directors, within one calendar year of the date of the special meeting, provided that

the first consolidation, the second consolidation, and the third consolidation shall collectively effect a consolidation on a

basis of between (i) two pre-consolidation shares to one post-consolidation share, and (ii) 200 pre-consolidation shares to one

post-consolidation share. On May 13, 2019, we determined a share consolidation ratio of 100 pre-consolidation shares to one post-consolidation

share, which was effective as of May 29, 2019.

Removal

of our Common shares from the OTCQB Venture Market to Pink Open Market

On

April 30, 2019, our common shares were removed from the OTCQB Venture Market to the Pink Open Market because we were unable to

cure our bid price deficiency. The OTCQB Venture Market requires a minimum bid price of $0.01. Broker-dealers often decline to

trade in over-the-counter stocks that are quoted on the OTC Pink tier given the market for such securities are often limited,

the stocks are more volatile, and the risk to investors is greater. The share consolidation effective as of May 29, 2019, did

cure the bid price deficiency; however, the expected increase in the price of our common shares from the share consolidation may

not be maintained, and there can be no assurance that the market price of our common shares following the share consolidation

will remain above the minimum bid price requirement to restore or maintain eligibility for quotation of our common shares on OTCQB

Venture Market. As of the date of this report we have not made a new application for our common shares to be quoted on the OTCQB

Venture Market.

Financings

From