UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-A

FOR

REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT

TO SECTION 12(b) OR (g) OF THE

SECURITIES

EXCHANGE ACT OF 1934

BorrowMoney.com,

Inc.

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

65-0981503

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(I.R.S.

Employer

Identification No.)

|

|

512

Bayshore Drive

Fort

Lauderdale, Florida

|

|

33304

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Securities

to be registered pursuant to Section 12(b) of the Act: None.

If

this form relates to the registration of a class of securities pursuant to Section 12(b) of the Exchange Act and is effective

pursuant to General Instruction A.(c) or (e), check the following box. [ ]

If

this form relates to the registration of a class of securities pursuant to Section 12(g) of the Exchange Act and is effective

pursuant to General Instruction A.(d) or (e), check the following box. [X]

If

this form relates to the registration of a class of securities concurrently with a Regulation A offering, check the following

box. [ ]

Securities

Act registration statement or Regulation A offering statement file number to which this form relates: Not applicable.

Securities

to be registered pursuant to Section 12(g) of the Act: Common stock, $0.0001 par value

INFORMATION

REQUIRED IN REGISTRATION STATEMENT

|

Item

1.

|

Description

of Registrant’s Securities to be Registered.

|

General

The

following description of our capital stock and certain provisions of our Articles of Incorporation, as amended (the “Articles

of Incorporation”) and Amended Bylaws (“Bylaws”) are summaries and are qualified in their entirety by reference

to the full text of our Articles of Incorporation and Bylaws, each of which have been publicly filed with the Securities and Exchange

Commission (the “SEC”). We encourage you to read our Articles of Incorporation and Bylaws and the applicable provisions

of the Florida Business Corporation Act (“FBCA”) for additional information.

Common

Stock

We

are authorized to issue up to a total of 100,000,000 shares of common stock, par value $0.0001 per share. Holders of our common

stock are entitled to one vote for each share held on all matters submitted to a vote of our shareholders. Holders of our common

stock have no cumulative voting rights. Further, holders of our common stock have no preemptive or conversion rights. Upon our

liquidation, dissolution or winding-up, holders of our common stock are entitled to share in all assets remaining after payment

of all liabilities and the liquidation preferences of any of our outstanding shares of preferred stock. Subject to preferences

that may be applicable to any outstanding shares of preferred stock, holders of our common stock are entitled to receive dividends,

if any, as may be declared from time to time by our board of directors out of our assets which are legally available. The holders

of one-third of the voting power of our issued and outstanding capital stock, represented in person or by proxy, is necessary

to constitute a quorum for the transaction of business at any meeting, unless the representation of a larger number shall be required

by law, in which case, the representation of the number so required shall constitute a quorum.

Preferred

Stock

Our

board of directors has the authority, without further action by the shareholders, to issue up to 20,000,000 shares of preferred

stock, par value $0.0001, in one or more series and to fix the designations, powers, preferences, privileges, and relative participating,

optional, or special rights as well as the qualifications, limitations, or restrictions of the preferred stock, including dividend

rights, conversion rights, voting rights, terms of redemption, and liquidation preferences, any or all of which may be greater

than the rights of the common stock. Our board of directors, without shareholder approval, can issue convertible preferred stock

with voting, conversion, or other rights that could adversely affect the voting power and other rights of the holders of common

stock. Preferred stock could be issued quickly with terms calculated to delay or prevent a change of control or make removal of

management more difficult. Additionally, the issuance of preferred stock may have the effect of decreasing the market price of

our common stock, and may adversely affect the voting and other rights of the holders of common stock.

Anti-Takeover

Effects of Certain Provisions of our Articles of Incorporation, Bylaws and the FBCA

Florida

Law

As

a Florida corporation, we are subject to certain anti-takeover provisions that apply to public corporations under Florida law.

Pursuant

to Section 607.0901 of the FBCA, a Florida corporation may not engage in a broad range of business combinations or other extraordinary

corporate transactions with an interested shareholder without the approval of the holders of two-thirds of the voting shares of

the corporation (excluding shares held by the interested shareholder), unless:

|

|

●

|

The

transaction is approved by a majority of disinterested directors;

|

|

|

●

|

The

interested shareholder has owned at least 80% of the corporation’s outstanding voting shares for at least five years

preceding the announcement date of any such business combination;

|

|

|

●

|

The

interested shareholder is the beneficial owner of at least 90% of the outstanding voting shares of the corporation, exclusive

of shares acquired directly from the corporation in a transaction not approved by a majority of the disinterested directors;

or

|

|

|

●

|

The

consideration paid to the holders of the corporation’s voting stock is at least equal to certain fair price criteria.

|

An

interested shareholder is defined as a person who, together with affiliates and associates, beneficially owns more than 10% of

a corporation’s outstanding voting shares.

In

addition, we are subject to Section 607.0902 of the FBCA which relates to control-share acquisition and provides that a person

who acquires shares in an “issuing public corporation,” as defined in the statute, in excess of certain specified

thresholds generally will not have any voting rights with respect to such shares unless such voting rights are approved by the

holders of a majority of the votes of each class of securities entitled to vote separately, excluding shares held or controlled

by the acquiring person. The thresholds specified in the FBCA are the acquisition of a number of shares representing:

|

|

●

|

one-fifth

or more, but less than one-third, of all voting power of the corporation;

|

|

|

●

|

one-third

or more, but less than a majority, of all voting power of the corporation; or

|

|

|

●

|

a

majority or more of all voting power of the corporation.

|

The

statute does not apply if, among other things, the acquisition:

|

|

●

|

is

approved by the corporation’s board of directors; or

|

|

|

●

|

is

effected pursuant to a statutory merger or share exchange to which the corporation is a party.

|

Board

of Directors Vacancies

Our

Bylaws authorize our board of directors to fill vacant directorships. In addition, the number of directors constituting our board

of directors may be set only by resolution of the board of directors.

Meeting

of Stockholders

Our

Bylaws provide that special meetings of our shareholders may be called by the board of directors.

Authorized

but Unissued Shares

Our

authorized but unissued shares of common stock and preferred stock are available for future issuance without shareholder approval

and may be utilized for a variety of corporate purposes, including future public and private offerings to raise additional capital,

acquisitions and employee benefit plans. The existence of authorized but unissued and unreserved common stock and preferred stock

could render more difficult or discourage an attempt to obtain control of us by means of a proxy contest, tender offer, merger

or otherwise.

Advance

Notice Requirements for Shareholder Proposals

Our

Bylaws provide that shareholders seeking to bring business before our annual meeting of shareholders must provide timely notice

of their intent in writing. To be timely, a shareholder’s notice must be delivered to the board of directors or secretary

not later than the close of business on the last business day of the month of January. Furthermore, our Bylaws provide that shareholders

seeking to bring business before any special meeting of shareholders must provide timely notice of their intent in writing. To

be timely, a shareholder’s notice must be delivered to the board of directors or secretary not later than the close of business

on the tenth calendar day following the date on which notice of such meeting is first given to shareholders.

The

following exhibits are filed as part of this Registration Statement:

Exhibit

No.

|

|

Exhibit

Description

|

|

3.1

|

|

Articles of Incorporation of Sports.Com, Inc. (Incorporated by reference to Exhibit 3.1 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

|

3.2

|

|

Articles of Amendment of Articles of Incorporation changing the name of the Company to Lumigene Corporation (Incorporated by reference to Exhibit 3.2 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

|

3.3

|

|

Articles of Amendment of Articles of Incorporation changing the name of the Company to IBMS, Inc. (Incorporated by reference to Exhibit 3.4 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

|

3.4

|

|

Articles of Amendment of Articles of Incorporation changing the name of the Company to Horizon Group Holdings, Inc. (Incorporated by reference to Exhibit 3.3 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

|

3.5

|

|

Articles of Amendment of Articles of Incorporation changing the name of the Company to BorrowMoney.com, Inc. (Incorporated by reference to Exhibit 3.5 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

|

3.6

|

|

Amended Bylaws (Incorporated by reference to Exhibit 3.6 to the Company’s Registration Statement on Form S-1/A filed with the SEC on May 19, 2017)

|

SIGNATURE

Pursuant

to the requirements of Section 12 of the Securities Exchange Act of 1934, the Registrant has duly caused this registration statement

to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

BORROWMONEY.COM,

INC.

|

|

|

|

|

|

Date:

June 11, 2020

|

By:

|

/s/

Aldo Piscitello

|

|

|

Name:

|

Aldo

Piscitello

|

|

|

Title:

|

President

|

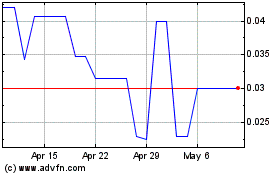

BorrowMoneycom (PK) (USOTC:BWMY)

Historical Stock Chart

From Mar 2024 to Apr 2024

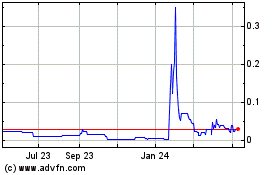

BorrowMoneycom (PK) (USOTC:BWMY)

Historical Stock Chart

From Apr 2023 to Apr 2024