By Dylan Tokar

The Justice Department in recent years has issued a series of

policies designed to incentivize companies to invest in programs

that ensure employees don't violate the law.

Few have been as central to those efforts as Andrew Weissmann,

who was chief of the department's criminal fraud section from 2015

to 2017.

Mr. Weissmann helped launch a precursor to the FCPA Corporate

Enforcement Policy, a leniency program that gives companies

discounts on financial penalties if they voluntarily disclose

potential bribery issues, cooperate with prosecutors and take steps

to prevent future violations of the U.S. Foreign Corrupt Practices

Act.

He also sought outside expertise to bolster the department's

understanding of corporate compliance, hiring a former compliance

officer for Microsoft Corp., Pfizer Inc. and Standard Chartered PLC

to advise prosecutors on assessing the compliance programs of

companies investigated by the agency. The compliance consultant

left in 2017, and the position hasn't been renewed.

"Compliance officers are really important and have a really

tough job," Mr. Weissmann says. "It's a very useful role for the

U.S. government, which is trying to reduce the incidence of

criminal behavior within companies. The goal is to try and figure

out how do you make that role as effective as possible."

Mr. Weissmann, who later served on special counsel Robert

Mueller's team investigating Russia's interference in the 2016 U.S.

presidential election, will rejoin law firm Jenner & Block LLP

in July. He spoke about the importance of corporate compliance

officers in an interview with Risk & Compliance Journal. Edited

excerpts follow.

WSJ: Since your time leading the Justice Department's fraud

section, the DOJ has continued down a path of trying to get

companies to invest in corporate compliance. Have these policies

been successful?

Mr. Weissmann: One of the goals [of the FCPA leniency policy]

was to have more consistency internally -- clear guidelines and

metrics as to how prosecutors in the fraud section doing FCPA cases

would evaluate companies on the criteria of voluntary disclosure,

cooperation and remediation. I think on that point it has been

successful.

My general sense from the defense bar is it has also been

successful in terms of knowing what to expect. In other words, "If

we do X, will we be likely to get result Y?" Companies can evaluate

the risks and rewards if they decide not to voluntarily disclose or

if they decide not to fully cooperate. They can look at the

program, and they can look at the announced resolutions to see how

other companies were treated.

WSJ: The DOJ no longer has a dedicated compliance expert and is

instead choosing to focus on training prosecutors to have that

expertise. Is that sufficient?

Mr. Weissmann: It's not that when I was there that we were

outsourcing all of the compliance issues to one person. It's that

we had a person who could run point to make sure that there was

training and there was implementation at the line-attorney

level.

We had somebody who was full time, overseeing a whole variety of

compliance issues. Thinking through compliance policy, thinking

through training, thinking through consistency in evaluating the

presentations that were made by companies. Soliciting input from

external stakeholders, including companies, in terms of what we

should or should not be doing.

My biggest concern is not whether the department has somebody

internally or externally -- there are advantages to both. One thing

I liked about having somebody who had worked in a whole variety of

companies is that it gave some comfort to companies that when they

came in and had their programs evaluated, it wasn't going to be

some DOJ lawyer who's never been in a company.

It's great to have training. But it's useful, like in many

things, to have somebody who owns a program, because then you can

make sure that there's consistency and that everyone is devoting

the necessary time to the matter at hand.

WSJ: The DOJ in 2018 implemented a policy to prevent the

department and its domestic counterparts from penalizing a company

twice for the same misconduct. You have said you also proposed

doing that on an international scale. Can you explain?

Mr. Weissmann: When I was at DOJ we wrote up two similar but

related policies, which I would say were high-level principles more

than anything else.

We wrote up one set of principles that was for how the

department should deal with the piling-on problem when it comes to

domestic counterparts. The second thing that we worked on was a

similar set of principles that would work internationally.

If you want a company to voluntarily self-disclose, and you

create a policy like the FCPA [leniency] policy in the U.S., it is

much less effective if companies know they're going to have to pay

100% of the fine again to another foreign country.

If you believe in the piling-on policy as it applies

domestically, there's little reason not to try and get that policy

applied throughout the OECD [Organization for Economic Cooperation

and Development] to member countries.

WSJ: The coronavirus pandemic is likely front-of-mind for a lot

of compliance officers and prosecutors. How could the pandemic

affect corporate enforcement?

Mr. Weissmann: I would suspect that in the short term, while it

will be hard for companies and prosecutors to do in-person

interviews, you may see a drop in individual indictments, meaning

indictments of people. But I think you still will see the regular

pace of corporate prosecutions because those are more amenable to

interviews that can happen through videoconferencing, like Webex

and Zoom.

WSJ: What should compliance officers be doing to protect their

companies during the pandemic?

Mr. Weissmann: Generally speaking, what a good risk management

system should look at is: "Are there particular stresses

financially on a company right now and how might that affect

behavior?" That's where you would want to reassess whether you have

the right enterprise risk assessment for your company.

Write to Dylan Tokar at dylan.tokar@wsj.com

(END) Dow Jones Newswires

May 27, 2020 17:54 ET (21:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

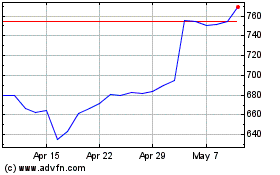

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

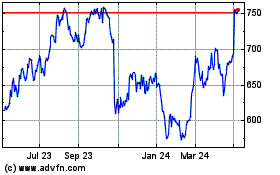

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024