Current Report Filing (8-k)

May 27 2020 - 4:57PM

Edgar (US Regulatory)

false0000071829

0000071829

2020-05-20

2020-05-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 20, 2020

Newpark Resources, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

001-02960

|

72-1123385

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

9320 Lakeside Boulevard,

|

Suite 100

|

|

|

The Woodlands,

|

Texas

|

77381

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (281) 362-6800

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13a-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

NR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 21, 2020, the following proposals were submitted to the stockholders of Newpark Resources, Inc. (the "Company") at the Company’s 2020 Annual Meeting of Stockholders.

|

|

|

|

|

|

1.

|

The election of six director nominees to the Board of Directors;

|

|

2.

|

An advisory vote on named executive officer compensation; and

|

|

3.

|

The ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year 2020.

|

The proposals are more fully described in the Company’s Proxy Statement. The following are the final vote results along with a brief description of each proposal.

Proposal 1: Election of Directors: The stockholders of the Company elected each of the following director nominees for a term that will continue until the 2021 Annual Meeting of Stockholders.

|

|

|

|

|

|

|

|

|

|

|

Director

|

Votes For

|

Withheld

|

Broker Non-Votes

|

|

Anthony J. Best

|

72,639,371

|

|

955,237

|

|

9,602,628

|

|

|

G. Stephen Finley

|

68,941,260

|

|

4,653,348

|

|

9,602,628

|

|

|

Paul L. Howes

|

72,334,577

|

|

1,260,031

|

|

9,602,628

|

|

|

Roderick A. Larson

|

55,717,428

|

|

17,877,180

|

|

9,602,628

|

|

|

John C. Mingé

|

69,719,987

|

|

3,874,621

|

|

9,602,628

|

|

|

Rose M. Robeson

|

69,956,205

|

|

3,638,403

|

|

9,602,628

|

|

Proposal 2: An advisory vote on named executive officer compensation: The stockholders of the Company approved, on a non-binding advisory basis, the compensation of the named executive officers as described in the Company’s Proxy Statement.

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

64,142,104

|

|

8,617,983

|

|

834,521

|

|

9,602,628

|

|

Proposal 3: Ratification of the Appointment of Independent Registered Public Accounting Firm: The stockholders of the Company ratified the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year 2020.

|

|

|

|

|

|

|

|

|

|

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

78,999,017

|

|

3,038,444

|

|

1,159,775

|

|

—

|

|

Item 8.01 Other Events

On May 20, 2020, the Compensation Committee approved the annual grant of long-term incentive awards with an effective date of May 21, 2020 (the “May 2020 NEO Awards”) to each of the Named Executive Officers of the Company: namely, Paul L. Howes, Gregg S. Piontek, E. Chipman Earle, Matthew S. Lanigan and David A. Paterson (collectively, the “NEOs”). The total grant date value of the May 2020 NEO Awards (except for Mr. Paterson who did not receive an annual award in 2019) represented a 21% reduction from the grant date value of our long term incentive awards that were issued to our NEOs in May 2019 (the “May 2019 NEO Awards”). Similar to the May 2019 NEO Awards, the May 2020 NEO Awards were split between time-based restricted stock units and performance-based cash focused on the relative ranking of our total shareholder return over a three year period within a certain designated peer group selected by the Compensation Committee. The Compensation Committee elected to increase the relative portion of performance-based awards on a grant date value basis from 43% in 2019 to 58% in 2020, resulting in a decrease in the relative value and dilutive effect of equity awards issued from 57% in 2019 to 42% in 2020.

On May 21, 2020, our Board of Directors authorized a 15% reduction in the total annual grant date value of awards to be issued to each of our non-employee Directors under our 2014 Non-Employee Directors’ Restricted Stock Plan (the “May 2020 Director Awards”). Similar to the May 2020 NEO Awards, the Board elected not only to decrease the overall value of such awards relative to 2019, but also to shift their make up toward cash in order to dampen the dilutive effect of issuing equity

awards at the Company’s currently reduced stock price. The Board elected to grant restricted cash for the first time to non-employees Directors resulting in the May 2020 Director Awards consisting of 51% restricted cash and 49% restricted shares on a grant date value basis.

Item 9.01 Exhibits

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

NEWPARK RESOURCES, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

Date:

|

May 27, 2020

|

By:

|

/s/ Gregg S. Piontek

|

|

|

|

|

Gregg S. Piontek

|

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

|

(Principal Financial Officer)

|

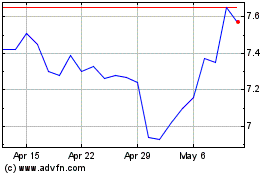

Newpark Resources (NYSE:NR)

Historical Stock Chart

From Mar 2024 to Apr 2024

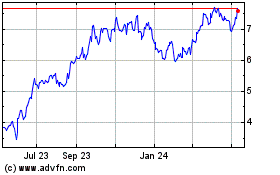

Newpark Resources (NYSE:NR)

Historical Stock Chart

From Apr 2023 to Apr 2024