EMJ Capital investment strategy gains 56 percent year-to-date on strength of technology-focused holdings, positively profiled...

May 27 2020 - 11:07AM

EMJ Capital Ltd.’s investment strategy (the Strategy) had a

year-to-date(1) total return of 56 percent primarily due to a

concentrated portfolio of long and short equity investments that

rose despite the coronavirus-based market decline in March, as

described in a May 6, 2020 Bloomberg article. The article

spotlighted EMJ Capital Ltd. founder Eric Jackson’s focus on deep

research, data science and his network of experts, and reported

that EMJ Capital was up 28 percent in Q1 2020 while only 5 of 61

hedge funds tracked by Venator Capital Management Ltd. posted

positive returns at the same time.

See article: EMJ Capital featured in

Bloomberg.

“The strategy has yet to have a negative month

in 2020,” said Eric Jackson. “We’ve gained tremendous

outperformance from our long positions and continue to see many new

investment opportunities to take advantage of on both the long and

short side.” The Bloomberg article highlighted Jackson’s positions

in Zoom Video Communications Inc. (NASDAQ: ZM) and Delivery Hero SE

(DHER: GR) and noted that “Jackson tries to hunt down data on

technology usage that will lead him to winners” and that he

doubled-down on his Zoom holdings when he noticed a sudden spike in

downloads of the Zoom app in China more than a month before the

coronavirus was declared a pandemic.

Jackson’s Strategy typically includes

investments in 11 to 20 long equity positions and the same number

of short equity positions. “To be selected among our longs, we have

to have high conviction that a stock has a reasonable chance of

doubling or tripling over the next two to three years, while our

shorts are intended to be profit centers,” said Jackson.

“While the FAANG names are great companies,

they’re unlikely to double and triple in the next two to three

years,” Jackson said. “We are constantly looking ahead for the next

big winners to drive our gains in 2021 and beyond, and I’m excited

about our current portfolio and some of the opportunities we’ve

identified for future investments.”

The Strategy’s 2019 full-year performance was a

total return of 11.85 percent. As of May 5, 2020, the Strategy had

a total return of 130.78 percent, or compound annual growth rate of

45.01 percent, since its inception in October 2017. Indicated rates

of return for the Strategy are historical total returns during the

relevant periods and assume reinvestment of all dividends. Returns

are net of fees (except the 2020 year-to-date performance figure

quoted in the Bloomberg article which was a gross return) but do

not take into account withdrawal charges or income taxes payable by

any investor in the Strategy, which may reduce the return.

Additional important information about the investment performance

of the Strategy is available

here.

About EMJ Capital

Ltd.

EMJ Capital Ltd. was founded in 2017 by Eric

Jackson and is registered with the Ontario Securities Commission as

a Restricted Portfolio Manager that advises separately managed

accounts for sophisticated investors who qualify as “permitted

clients” and are not individuals, using the same concentrated

investment strategy. For more information on EMJ Capital Ltd.,

please contact Eric Jackson, Founder, President and Portfolio

Manager; phone: (416) 897-9263; email: info@emjcapital.ltd; web:

www.emjcapital.ltd.

(1) - Return measured from the period beginning

January 1, 2020 and ending May 5, 2020.

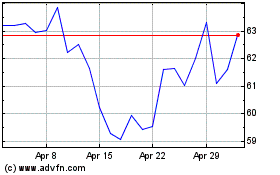

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

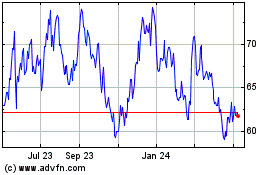

Zoom Video Communications (NASDAQ:ZM)

Historical Stock Chart

From Apr 2023 to Apr 2024