Two Chinese Tech Firms Prepare Hong Kong Listings as U.S. Pressure Rises

May 27 2020 - 9:20AM

Dow Jones News

By Joanne Chiu

Two of China's most valuable U.S.-listed companies are pushing

ahead with multibillion-dollar share sales in Hong Kong, amid

growing pressure from U.S. lawmakers on Chinese companies to

disclose their financial information or delist.

The listing plans of NetEase Inc., an online games company, and

JD.com Inc., the operator of an e-commerce website, will be

reviewed on Thursday by the listing committee of the Hong Kong

Stock Exchange, people familiar with the situation told the Wall

Street Journal.

If it secures the listing approval, NetEase will begin taking

orders from investors early next week, aiming to raise between $2

and $3 billion from the secondary listing ahead of a trading debut

on June 11, a person familiar with the situation said.

JD.com plans to raise around $2.5 billion to $3 billion and

start trading in Hong Kong on June 18, the date of its annual sales

event, another person familiar with the situation said. It will

kick off the stock sale in Hong Kong in the week of June 8.

Both fundraisings have been increased in size, compared to

earlier plans, as the two companies' U.S.-traded securities have

risen this year. The final sizes will depend on market conditions

and the prices of their American depositary receipts as the

secondary listing nears, the people said.

Bigger peer Alibaba Group Holding Ltd. raised roughly $13

billion through a stock sale in the city last November.

NetEase joined the Nasdaq in 2010. Its American depositary

receipts have risen nearly 26% this year, giving it a market

capitalization of nearly $50 billion as of Wednesday. The

equivalent securities for JD.com, which went public in the U.S. in

2014, have risen 49% this year, giving it a market value of around

$77 billion.

The listings come at a sensitive time for Chinese companies --

and for Hong Kong.

Rising U.S.-China tensions and recent admissions of accounting

fraud at Luckin Coffee, a Chinese cafe chain that only went public

last year, have prompted heightened scrutiny of U.S.-listed Chinese

companies.

Legislation passed by the Senate -- and now introduced in the

House -- would kick Chinese companies off U.S. stock exchanges

unless their audits are inspected by U.S. regulators.

Meanwhile, Beijing's move to impose new national-security laws

on Hong Kong has raised concerns over the city's status as a major

financial hub.

Hong Kong's stock exchange has changed its rules to court more

listings by tech and biotechnology groups, aiming to rejuvenate a

market dominated by less dynamic sectors such as banking and

property.

Robin Li, founder of Chinese search-engine operator Baidu Inc.,

this month told the state-backed China Daily newspaper the company

paid close attention to heightened scrutiny of Chinese companies

and was constantly exploring options including a secondary listing

in Hong Kong or elsewhere.

Write to Joanne Chiu at joanne.chiu@wsj.com

(END) Dow Jones Newswires

May 27, 2020 09:05 ET (13:05 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

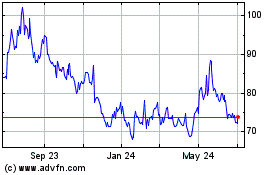

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

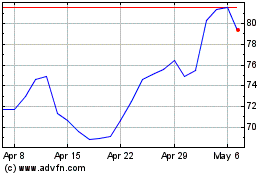

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024