Current Report Filing (8-k)

May 19 2020 - 8:30AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

May 18, 2020

SIBANNAC,

INC.

(Exact name of registrant as specified in

its charter)

|

Nevada

|

|

333-122009

|

|

33-0903494

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer

|

|

of Incorporation)

|

|

|

|

Identification Number)

|

|

|

|

|

|

|

9535 E Doubletree Ranch Road, Ste 120

Scottsdale, AZ 85258

Tel. (480) 407-6445

(Address and Telephone Number of Principal

Executive Offices)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act: None

Securities registered pursuant to Section

12(g) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 par value

|

N/A

|

N/A

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§ 240.12b 2 of this chapter). Emerging growth company ☐

If any emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

SIBANNAC, INC.

Form 8-K

Current Report

|

|

item 1.01

|

entry into a material definitive agreement

|

The Company has entered

into a non-binding Memorandum of Understanding to acquire 51% ownership of a twenty-year old firm in the Apricot Seed processing

and consumer sales business. Apricots contain high amounts of naturally occurring Vitamin B-17. Through a third-party farming conglomerate,

the target company has an exclusive contractual right to nearly the entire offtake of domestically grown Apricot seeds in the United

States.

|

|

ITEM 4.01

|

mATTERS RELATED TO ACCOUNTANTS AND FINANCIAL STATEMENTS

|

The Company has engaged

the firm of Semple, Marchal & Cooper, LLP, as its independent Auditor. The firm is located at 2700 North Central Avenue, 9th

Floor, Phoenix, AZ 85004.

The books and records of the company are

being forwarded to the firm to audit the current financial statements, which is anticipated to be completed and the audit published

by the end of the third quarter.

|

|

ITEM 5.02

|

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION

OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN DIRECTORS

|

The Company is proud

to announce the addition of two new members of the Board of Directors:

James D. Staudohar

James D. Staudohar is a veteran of corporate

finance, having served in senior management for successful public companies and private enterprise. In addition to serving on the

Board, Mr. Staudohar will chair the Company’s Audit Committee.

Mr. Staudohar has served in senior financial

positions for Honeywell, Control Data Corp. and the Dayton Hudson Corporation. He was Vice President and Controller of B. Dalton

Booksellers and its 750 stores and held the same positions for Modern Merchandising. Jim has served as CFO of several companies,

perhaps most notably as Senior Vice President and Chief Financial Officer of Best Products, then a $5 billion firm listed on the

NYSE.

In addition to his financial experience,

Mr. Staudohar has served on the Board of Directors, as Chair of the Audit Committee, and as a member of the Compensation Committee

of Iveda Solutions, Inc. He previously served on the Board of Directors of Smith & Wesson Holding Corporation, the publicly

traded parent company of the gun manufacturer, from 2002-2004. He also served as the Chair of Smith & Wesson’s Audit

Committee and as a member of the Nominating Committee. Mr. Staudohar received his B.A. Degree in Accounting from the University

of Minnesota.

Mr. Staudohar has also served as President

of Ballet Arizona, and as a board member of Phoenix Sister Cities and as a volunteer of the Mayo Clinic.

Booker T. Evans, Jr.

Mr. Evans is a renowned trial attorney,

having been a member of some of the leading law firms in the country over one of the most distinguished legal careers. Mr. Evan’s

practice has been concentrated in commercial litigation and white- collar criminal defense, product liability, insurance matters,

criminal and civil RICO cases, and health law matters. Booker has substantial civil and criminal trial experience, along with post-conviction

case experience in the federal court system and is often retained in matters involving the Federal Sentencing Guidelines.

He has been named to Arizona's Finest Lawyers,

a Southwest Super Lawyer in Arizona, a Top 50 Super Lawyer and a Super Lawyer in White Collar Criminal Defense, a Top 100 Trial

Lawyer and a Best Lawyer in America by US News & World Report.

Prior to entering private practice, he

served as a Chief Deputy District Attorney in Las Vegas, Assistant United States Attorney in Nevada and Arizona, and Corporate

Counsel for Arizona Public Service Company.

|

|

ITEM 5.03

|

AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR.

|

The Company has filed

Amendments to the Articles of Incorporation with the State of Nevada, providing designations for the Preferred Class A shares as

well as creating a Preferred Class B. The designations are annexed as Exhibit A. The Company is in the process of rolling back

the authorized common shares with the State of Nevada to 60,000,000, the issuance as of the date of acquisition of Imbutek Holdings

in July 2017.

The current stock ledger from the Company’s

Transfer Agent, Transhare Corporation, reflects the common share structure of issued and outstanding at 16,127,194 shares. Of these,

14,037,194 are restricted and of the remaining 2,090,000, 1,015,866 are currently on deposit.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

SIBANNAC, INC.

|

|

Date: May 19, 2020

|

By: /s/ David Mersky

|

|

|

|

|

David Mersky

|

|

|

|

Chief Executive Officer

|

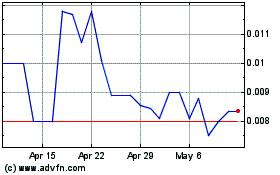

Sibannac (PK) (USOTC:SNNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sibannac (PK) (USOTC:SNNC)

Historical Stock Chart

From Apr 2023 to Apr 2024