Current Report Filing (8-k)

May 11 2020 - 5:26PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 5, 2020

FOOTHILLS

EXPLORATION, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

000-55872

|

|

27-3439423

|

(State

or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer

Identification No.)

|

4607

Lakeview Canyon Road, Suite 235

Westlake Village, CA 91361

(Address

of principal executive offices) (Zip Code)

(800)

234-5510

(Registrant’s

telephone number, including area code)

10940

Wilshire Blvd., 23rd Floor

Los

Angeles, CA 90024

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

|

|

|

|

|

|

N/A

|

|

N/A

|

|

N/A

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

8.01. Other Events

On

June 4, 2019, the Company closed on a convertible loan transaction with JSJ Investments, Inc. (“JSJ”) in the principal

amount of $57,000 (the “Note”), before giving effect to certain transactional costs including legal fees yielding

a net of $57,000. The maturity date for this Note was May 29, 2020 (“Maturity Date”), and is this was the date upon

which the principal sum, as well as any accrued and unpaid interest, was due and payable. Interest on any unpaid principal balance

of this Note accrues at the rate of 10% per annum. JSJ is entitled, at any time, after the 180th daily anniversary

of the Note, to convert any or all of its principal, accrued interest and fees due pursuant to the Note into common shares of

the Company by sending in a Notice of Conversion to the Company. All capitalized terms used herein shall have the same meaning

as in the Note agreements. For more information on this Note, please refer to the Company’s current report filed on Form

8-K on June 10, 2019.

Pursuant

to terms of the Note, the Company covenanted to JSJ to initially reserve with its transfer agent a total of 1.8 million shares

of its Common Stock for conversions (the “Share Reserve”), which was subsequently increased to 50,000,000. The Company

further covenanted that at all times it would reserve a minimum of eight times of the number of shares of Company Common Stock

issuable upon conversion of the Note in accordance with the terms of the Note.

On

April 3, 2020, the Company’s transfer agent received the 5th Notice of Conversion from JSJ, in which JSJ sought

to convert $2,029.88 of the Note’s then outstanding principal balance at the Conversion Price of $0.000055 per share (45%

discount to $0.0001) into 36,906,928 shares of the Company’s Common Stock. On April 3rd, the Company had 783,202,615

shares of Common Stock issued and outstanding. To date, JSJ has converted a total of $14,578.95 in principal into a total of 49,819,525

shares of the Company’s Common Stock at a weighted average price of $0.0002926 per share across four previous conversions

submitted to the Company’s stock transfer agent between March 4 and March 24, 2020.

On

April 3, 2020, the Company’s stock transfer agent advised JSJ that there were insufficient shares of the Company’s

Common Stock available to satisfy its Notice of Conversion, as there remained only 180,475 shares in JSJ’s Share Reserve.

On May 5, 2020, the Company received a Notice of Default from JSJ due to a failure to issue the shares pursuant to the 5th

Notice of Conversion received. The notice details a total default amount of $210,454.62 owed for the Company’s failure

to abide by the terms of the Note, including liquidated damages of $2,000 per day for the Company’s failure to deliver the

shares pursuant to the April 3rd Notice of Conversion.

The

Company and JSJ may or may not continue discussions concerning possible extensions of payment terms and amounts, however no assurance

can be given that the Company will be able to reach agreement with JSJ. In that event, JSJ has advised the Company that JSJ intends

to pursue its available legal remedies, including but not limited to litigation, to recover all amounts asserted to be owed to

JSJ under the applicable loan documents.

Litigation

pursued by JSJ against the Company can further erode the financial condition and materially and adversely affect operations of

the Company and could result in cross-defaults with other lenders. Management is actively working with all of its debtholders

to seek resolution on these matters; however, no assurances can be given that management will be able to reach agreement with

any of its lenders. As a further result the foregoing the Company may be compelled to seek protection under appropriate state

or federal insolvency laws.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

Date:

May 11, 2020

|

|

|

|

|

|

FOOTHILLS

EXPLORATION, INC.

|

|

|

|

|

|

By:

|

/s/

B. P. Allaire

|

|

|

|

B.

P. Allaire

|

|

|

|

Chief

Executive Officer

|

|

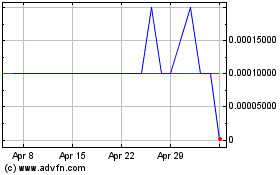

Foothills Exploration (PK) (USOTC:FTXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

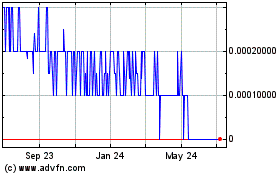

Foothills Exploration (PK) (USOTC:FTXP)

Historical Stock Chart

From Apr 2023 to Apr 2024