0001425292FALSE12/312020Q1P1Y919.53.03.72.800014252922020-01-012020-03-31xbrli:shares00014252922020-05-05iso4217:USD00014252922020-03-3100014252922019-12-3100014252922019-01-012019-03-31iso4217:USDxbrli:shares0001425292cvi:CommonUnitholdersMember2019-12-310001425292us-gaap:GeneralPartnerMember2019-12-310001425292cvi:CommonUnitholdersMember2020-01-012020-03-310001425292cvi:CommonUnitholdersMember2020-03-310001425292us-gaap:GeneralPartnerMember2020-03-310001425292cvi:CommonUnitholdersMember2018-12-310001425292us-gaap:GeneralPartnerMember2018-12-3100014252922018-12-310001425292cvi:CommonUnitholdersMember2019-01-012019-03-310001425292cvi:CommonUnitholdersMember2019-03-310001425292us-gaap:GeneralPartnerMember2019-03-3100014252922019-03-31cvi:manufacturing_facilityxbrli:pure0001425292cvi:CoffeyvilleResourcesLLCMembercvi:CVRPartnersLPMember2020-01-012020-03-310001425292cvi:CoffeyvilleResourcesLLCMembercvi:CVRRefiningGPLLCMember2020-01-012020-03-310001425292srt:ParentCompanyMembercvi:IEPEnergyLLCMember2020-03-310001425292us-gaap:SubsequentEventMember2020-05-060001425292cvi:CatalystInventoryMembersrt:RestatementAdjustmentMember2019-12-310001425292us-gaap:MachineryAndEquipmentMember2020-03-310001425292us-gaap:MachineryAndEquipmentMember2019-12-310001425292us-gaap:BuildingAndBuildingImprovementsMember2020-03-310001425292us-gaap:BuildingAndBuildingImprovementsMember2019-12-310001425292us-gaap:TransportationEquipmentMember2020-03-310001425292us-gaap:TransportationEquipmentMember2019-12-310001425292us-gaap:LandAndLandImprovementsMember2020-03-310001425292us-gaap:LandAndLandImprovementsMember2019-12-310001425292us-gaap:ConstructionInProgressMember2020-03-310001425292us-gaap:ConstructionInProgressMember2019-12-310001425292us-gaap:PropertyPlantAndEquipmentOtherTypesMember2020-03-310001425292us-gaap:PropertyPlantAndEquipmentOtherTypesMember2019-12-310001425292srt:MinimumMember2020-01-012020-03-310001425292srt:MaximumMember2020-01-012020-03-310001425292cvi:RailcarsMember2020-03-310001425292cvi:RailcarsMember2019-12-310001425292us-gaap:RealEstateMember2020-03-310001425292us-gaap:RealEstateMember2019-12-310001425292us-gaap:SeniorNotesMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2020-03-310001425292us-gaap:SeniorNotesMembercvi:NinePointTwoFivePercentSeniorSecuredNotesDue2023Member2019-12-310001425292us-gaap:SeniorNotesMembercvi:SixPointFiveZeroPercentNotesDue2021Member2020-03-310001425292us-gaap:SeniorNotesMembercvi:SixPointFiveZeroPercentNotesDue2021Member2019-12-310001425292cvi:ABLCreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-03-310001425292cvi:ABLCreditFacilityMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-01-012020-03-310001425292cvi:ABLCreditFacilityMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-01-012020-03-310001425292cvi:ProductAmmoniaMember2020-01-012020-03-310001425292cvi:ProductAmmoniaMember2019-01-012019-03-310001425292cvi:ProductUANMember2020-01-012020-03-310001425292cvi:ProductUANMember2019-01-012019-03-310001425292cvi:ProductUreaProductsMember2020-01-012020-03-310001425292cvi:ProductUreaProductsMember2019-01-012019-03-310001425292cvi:ProductFertilizerSalesExclusiveofFreightMember2020-01-012020-03-310001425292cvi:ProductFertilizerSalesExclusiveofFreightMember2019-01-012019-03-310001425292cvi:ProductFreightRevenueMember2020-01-012020-03-310001425292cvi:ProductFreightRevenueMember2019-01-012019-03-310001425292cvi:ProductsOtherMember2020-01-012020-03-310001425292cvi:ProductsOtherMember2019-01-012019-03-3100014252922020-04-012020-03-3100014252922021-01-012020-03-3100014252922022-01-012020-03-310001425292cvi:PhantomStockUnitsMember2020-01-012020-03-310001425292cvi:PhantomStockUnitsMember2019-01-012019-03-310001425292cvi:OtherAwardsMember2020-01-012020-03-310001425292cvi:OtherAwardsMember2019-01-012019-03-3100014252922020-02-192020-02-1900014252922019-03-112019-03-110001425292cvi:CommonUnitholdersMember2019-03-112019-03-110001425292srt:ParentCompanyMember2019-03-112019-03-1100014252922019-05-132019-05-130001425292cvi:CommonUnitholdersMember2019-05-132019-05-130001425292srt:ParentCompanyMember2019-05-132019-05-1300014252922019-08-122019-08-120001425292cvi:CommonUnitholdersMember2019-08-122019-08-120001425292srt:ParentCompanyMember2019-08-122019-08-1200014252922019-11-112019-11-110001425292cvi:CommonUnitholdersMember2019-11-112019-11-110001425292srt:ParentCompanyMember2019-11-112019-11-1100014252922019-01-012019-12-310001425292cvi:CommonUnitholdersMember2019-01-012019-12-310001425292srt:ParentCompanyMember2019-01-012019-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

|

|

|

|

|

|

|

|

|

|

|

(Mark One)

|

|

|

|

☑

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the quarterly period ended

|

March 31, 2020

|

|

OR

|

|

|

|

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

For the transition period from to .

|

|

Commission file number: 001-35120

______________________________________________

CVR PARTNERS, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

|

|

56-2677689

|

(State or other jurisdiction of

incorporation or organization)

|

|

|

|

(I.R.S. Employer

Identification No.)

|

2277 Plaza Drive, Suite 500, Sugar Land, Texas 77479

(Address of principal executive offices) (Zip Code)

(281) 207-3200

(Registrant’s telephone number, including area code)

_____________________________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common units representing limited partner interests

|

UAN

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

☐

|

Accelerated filer

|

☑

|

Non-Accelerated filer

|

☐

|

|

Smaller reporting company

|

☐

|

Emerging growth company

|

☐

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

There were 113,282,973 common units representing limited partner interests of CVR Partners, LP (“common units”) outstanding at May 5, 2020.

TABLE OF CONTENTS

CVR PARTNERS, LP - Quarterly Report on Form 10-Q

March 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART I. Financial Information

|

|

|

|

PART II. Other Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This Quarterly Report on Form 10-Q (including documents incorporated by reference herein) contains statements with respect to our expectations or beliefs as to future events. These types of statements are “forward-looking” and subject to uncertainties. See “Important Information Regarding Forward-Looking Statements” section of this filing.

Important Information Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q (this “Report”) contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, but not limited to, those under Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond our control. All statements other than statements of historical fact, including without limitation, statements regarding future operations, financial position, estimated revenues and losses, growth, capital projects, unit repurchases, impacts of legal proceedings, projected costs, prospects, plans and objectives are forward-looking statements. The words “could,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “may,” “continue,” “predict,” “potential,” “project,” and similar terms and phrases are intended to identify forward-looking statements.

Although we believe our assumptions concerning future events are reasonable, a number of risks, uncertainties and other factors could cause actual results and trends to differ materially from those projected or forward-looking. Forward-looking statements, as well as certain risks, contingencies, or uncertainties that may impact our forward-looking statements, include, but are not limited to, the following:

•our ability to make cash distributions on our common units;

•the volatile nature of our business and the variable nature of our distributions;

•the severity, magnitude, duration, and impact of the novel coronavirus 2019 (“COVID-19”) pandemic and of businesses’ and governments’ responses to such pandemic on our operations, personnel, commercial activity, and supply and demand across our and our customers’ and suppliers’ businesses;

•changes in market conditions and market volatility arising from the COVID-19 pandemic, including fertilizer, natural gas, and other commodity prices and the impact of such changes on our operating results and financial position;

•the ability of our general partner to modify or revoke our distribution policy at any time;

•the cyclical and seasonal nature of our business;

•the impact of weather on our business including our ability to produce, market, or sell fertilizer products profitably or at all;

•the dependence of our operations on a few third-party suppliers, including providers of transportation services, and equipment;

•our reliance on, or our ability to procure economically or at all, pet coke we purchase from CVR Energy, Inc. (together with its subsidiaries, but excluding the Partnership and its subsidiaries, “CVR Energy”) and third-party suppliers or our reliance on the natural gas, electricity, oxygen, nitrogen, sulfur processing, compressed dry air and other products that we purchase from third parties;

•the supply and price levels of essential raw materials;

•our production levels, including the risk of a material decline in those levels;

•accidents or other unscheduled shutdowns or interruptions affecting our facilities, machinery, or equipment, or those of our suppliers or customers;

•potential operating hazards from accidents, fire, severe weather, tornadoes, floods or other natural disasters

•our ability to obtain, retain, or renew permits, licenses and authorizations to operate our business;

•competition in the nitrogen fertilizer businesses including potential impacts of domestic and global supply and demand;

•capital expenditures;

•existing and future laws, rulings and regulations, including but not limited to those relating to the environment, climate change, and/or the transportation or production of hazardous chemicals like ammonia, including potential liabilities or capital requirements arising from such laws, rulings, or regulations;

•alternative energy or fuel sources, and the end-use and application of fertilizers;

•risks of terrorism, cybersecurity attacks, the security of chemical manufacturing facilities and other matters beyond our control;

•our lack of asset diversification;

•our dependence on significant customers and the creditworthiness and performance by counterparties;

•our potential loss of transportation cost advantage over our competitors;

•our partial dependence on customers and distributors, including to transport goods and equipment;

•risks associated with third party operation of or control over important facilities necessary for operation of our nitrogen fertilizer facilities;

•The volatile nature of ammonia, potential liability for accidents involving ammonia including damage or injury to property, the environment or human health and increased costs related to the transport or production of ammonia;

•our potential inability to successfully implement our business strategies, including the completion of significant capital programs or projects;

•our reliance on CVR Energy’s senior management team and conflicts of interest they may face operating each of CVR Partners and CVR Energy;

•control of our general partner by CVR Energy;

•our ability to continue to license the technology used in our operations;

•restrictions in our debt agreements;

•risks associated with noncompliance with continued listing standards of the New York Stock Exchange (“NYSE”) including potential suspension or delisting and the impacts thereof on our common unit price, valuation, access to capital or liquidity;

•changes in our treatment as a partnership for U.S. federal income or state tax purposes;

•rulings, judgments or settlements in litigation, tax or other legal or regulatory matters;

•instability and volatility in the capital and credit markets;

•competition with CVR Energy and its affiliates;

•our ability to recover under our insurance policies for damages or losses in full or at all; and

•the factors described in greater detail under “Risk Factors” in Item 1A of our Annual Report on Form 10-K for the year ended December 31, 2019 and this Report and our other filings with the Securities and Exchange Commission (the “SEC”).

All forward-looking statements included in this Report are based on information available to us on the date of this Report. Except as required by law, we undertake no obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise.

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

ASSETS

|

|

|

|

|

Current assets:

|

|

|

|

|

Cash and cash equivalents

|

$

|

58,014

|

|

|

$

|

36,994

|

|

|

Accounts receivable

|

14,868

|

|

|

34,264

|

|

|

Inventories

|

55,092

|

|

|

48,296

|

|

|

Prepaid expenses and other current assets

|

5,266

|

|

|

5,406

|

|

|

Total current assets

|

133,240

|

|

|

124,960

|

|

|

Property, plant, and equipment, net

|

940,328

|

|

|

951,959

|

|

|

|

|

|

|

|

Goodwill

|

40,969

|

|

|

40,969

|

|

|

Other long-term assets

|

19,437

|

|

|

20,067

|

|

|

Total assets

|

$

|

1,133,974

|

|

|

$

|

1,137,955

|

|

|

|

|

|

|

|

LIABILITIES AND PARTNERS’ CAPITAL

|

|

|

|

|

Current liabilities:

|

|

|

|

|

Accounts payable

|

$

|

22,500

|

|

|

$

|

21,069

|

|

|

Accounts payable to affiliates

|

1,585

|

|

|

2,578

|

|

|

Deferred revenue

|

37,634

|

|

|

27,841

|

|

|

Other current liabilities

|

30,863

|

|

|

24,043

|

|

|

Total current liabilities

|

92,582

|

|

|

75,531

|

|

|

Long-term liabilities:

|

|

|

|

|

Long-term debt

|

633,315

|

|

|

632,406

|

|

|

Other long-term liabilities

|

9,384

|

|

|

10,474

|

|

|

Total long-term liabilities

|

642,699

|

|

|

642,880

|

|

Commitments and contingencies (See Note 11)

|

|

|

|

|

Partners’ capital:

|

|

|

|

|

Common unitholders, 113,282,973 units issued and outstanding at March 31, 2020

and December 31, 2019

|

398,692

|

|

|

419,543

|

|

|

General partner interest

|

1

|

|

|

1

|

|

|

Total partners’ capital

|

398,693

|

|

|

419,544

|

|

|

Total liabilities and partners’ capital

|

$

|

1,133,974

|

|

|

$

|

1,137,955

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31,

|

|

|

|

|

|

|

|

(in thousands, except unit data)

|

2020

|

|

2019

|

|

|

|

|

|

Net sales

|

$

|

75,080

|

|

|

$

|

91,873

|

|

|

|

|

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

Cost of materials and other

|

23,991

|

|

|

23,730

|

|

|

|

|

|

|

Direct operating expenses (exclusive of depreciation and amortization)

|

35,123

|

|

|

34,820

|

|

|

|

|

|

|

Depreciation and amortization

|

15,597

|

|

|

16,584

|

|

|

|

|

|

|

Cost of sales

|

74,711

|

|

|

75,134

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

5,354

|

|

|

6,846

|

|

|

|

|

|

|

(Gain) loss on asset disposals

|

(13)

|

|

|

454

|

|

|

|

|

|

|

Operating (loss) income

|

(4,972)

|

|

|

9,439

|

|

|

|

|

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

Interest expense, net

|

(15,783)

|

|

|

(15,650)

|

|

|

|

|

|

|

Other income, net

|

27

|

|

|

20

|

|

|

|

|

|

|

Loss before income taxes

|

(20,728)

|

|

|

(6,191)

|

|

|

|

|

|

|

Income tax expense (benefit)

|

7

|

|

|

(112)

|

|

|

|

|

|

|

Net loss

|

$

|

(20,735)

|

|

|

$

|

(6,079)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per unit data

|

$

|

(0.18)

|

|

|

$

|

(0.05)

|

|

|

|

|

|

|

Distributions declared and paid per common unit

|

$

|

—

|

|

|

$

|

0.12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common units outstanding:

|

|

|

|

|

|

|

|

|

Basic and Diluted

|

113,283

|

|

|

113,283

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF PARTNERS’ CAPITAL

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Units

|

|

|

|

General

Partner

Interest

|

|

|

|

|

|

Total Partners’ Capital

|

|

(in thousands, except unit data)

|

Issued

|

|

Amount

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2019

|

113,282,973

|

|

|

$

|

419,543

|

|

|

$

|

1

|

|

|

|

|

|

|

$

|

419,544

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Land exchange with affiliate

|

—

|

|

|

(116)

|

|

|

—

|

|

|

|

|

|

|

(116)

|

|

|

Net loss

|

—

|

|

|

(20,735)

|

|

|

—

|

|

|

|

|

|

|

(20,735)

|

|

|

Balance at March 31, 2020

|

113,282,973

|

|

|

$

|

398,692

|

|

|

$

|

1

|

|

|

|

|

|

|

$

|

398,693

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Units

|

|

|

|

General

Partner

Interest

|

|

|

|

|

|

Total Partners’ Capital

|

|

(in thousands, except unit data)

|

Issued

|

|

Amount

|

|

|

|

|

|

|

|

|

|

Balance at December 31, 2018

|

113,282,973

|

|

|

$

|

499,825

|

|

|

$

|

1

|

|

|

|

|

|

|

$

|

499,826

|

|

|

Cash distributions to common unitholders - Affiliates

|

—

|

|

|

(4,670)

|

|

|

—

|

|

|

|

|

|

|

(4,670)

|

|

|

Cash distributions to common unitholders - Non-affiliates

|

—

|

|

|

(8,924)

|

|

|

—

|

|

|

|

|

|

|

(8,924)

|

|

|

Net loss

|

—

|

|

|

(6,079)

|

|

|

—

|

|

|

|

|

|

|

(6,079)

|

|

|

Balance at March 31, 2019

|

113,282,973

|

|

|

$

|

480,152

|

|

|

$

|

1

|

|

|

|

|

|

|

$

|

480,153

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

CVR PARTNERS, LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

Cash flows from operating activities:

|

|

|

|

|

Net loss

|

$

|

(20,735)

|

|

|

$

|

(6,079)

|

|

|

Adjustments to reconcile net loss to net cash provided by operating activities:

|

|

|

|

|

Depreciation and amortization

|

15,597

|

|

|

16,584

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

(477)

|

|

|

1,108

|

|

|

Other adjustments

|

1,262

|

|

|

1,212

|

|

|

Change in assets and liabilities:

|

|

|

|

|

Current assets and liabilities

|

32,645

|

|

|

38,253

|

|

|

Non-current assets and liabilities

|

(585)

|

|

|

846

|

|

|

Net cash provided by operating activities

|

27,707

|

|

|

51,924

|

|

|

Cash flows from investing activities:

|

|

|

|

|

Capital expenditures

|

(6,710)

|

|

|

(3,500)

|

|

|

|

|

|

|

|

Proceeds from sale of assets

|

48

|

|

|

—

|

|

|

Net cash used in investing activities

|

(6,662)

|

|

|

(3,500)

|

|

|

Cash flows from financing activities:

|

|

|

|

|

Cash distributions to common unitholders - Affiliates

|

—

|

|

|

(4,670)

|

|

|

Cash distributions to common unitholders - Non-affiliates

|

—

|

|

|

(8,924)

|

|

|

Other financing activities

|

(25)

|

|

|

—

|

|

|

Net cash used in financing activities

|

(25)

|

|

|

(13,594)

|

|

|

Net increase in cash and cash equivalents

|

21,020

|

|

|

34,830

|

|

|

Cash and cash equivalents, beginning of period

|

36,994

|

|

|

61,776

|

|

|

Cash and cash equivalents, end of period

|

$

|

58,014

|

|

|

$

|

96,606

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(1) Organization and Nature of Business

CVR Partners, LP (referred to as “CVR Partners” or the “Partnership”) is a Delaware limited partnership and formed by CVR Energy, Inc. (together with its subsidiaries, but excluding the Partnership and its subsidiaries, “CVR Energy”) to own, operate and grow its nitrogen fertilizer business. The Partnership produces nitrogen fertilizer products at two manufacturing facilities, which are located in Coffeyville, Kansas (the “Coffeyville Facility”) and East Dubuque, Illinois (the “East Dubuque Facility”). Both facilities manufacture ammonia and are able to further upgrade to other nitrogen fertilizer products, principally urea ammonium nitrate (“UAN”). Nitrogen fertilizer is used by farmers to improve the yield and quality of their crops, primarily corn and wheat. The Partnership’s product sales are sold on a wholesale basis in the United States of America. As used in these financial statements, references to CVR Partners, the Partnership, “we”, “us”, and “our” may refer to consolidated subsidiaries of CVR Partners or one or both of the facilities, as the context may require.

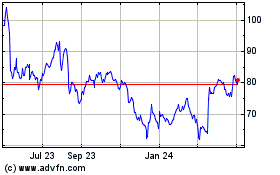

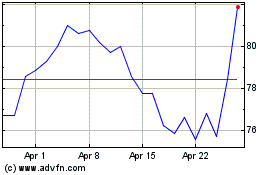

The Partnership’s common units are listed on the New York Stock Exchange (“NYSE”) under the symbol “UAN.” On April 20, 2020, the average closing price of the Partnership’s common units over a 30 consecutive trading-day period had fallen below $1.00 per share, resulting in noncompliance with the continued listing compliance standards in Section 802.01C of the NYSE Listing Company Manual. The Partnership received written notification of this noncompliance from the NYSE on April 22, 2020, and currently has until January 1, 2021 to regain compliance or be subject to the NYSE’s suspension and delisting procedures. See the Form 8-K filed by the Partnership with the SEC on April 24, 2020 for further discussion.

As of March 31, 2020, public security holders held approximately 66% of the Partnership’s outstanding limited partner interests and Coffeyville Resources, LLC (“CRLLC”), a wholly-owned subsidiary of CVR Energy, held approximately 34% of the Partnership’s outstanding limited partner interests and 100% of the Partnership’s general partner interest is held by CVR GP, LLC (“CVR GP” or the “general partner”), a wholly owned subsidiary of CVR Energy. As of March 31, 2020, Icahn Enterprises L.P. (“IEP”) and its affiliates owned approximately 71% of the common stock of CVR Energy.

Unit Repurchase Program

On May 6, 2020, the board of directors of the Partnership’s general partner authorized a unit repurchase program (the “Unit Repurchase Program”). The Unit Repurchase Program enables the Partnership to repurchase up to $10 million of the Partnership’s common units. Repurchases under the Unit Repurchase Program may be made from time-to-time through open market transactions, block trades, privately negotiated transactions, or otherwise in accordance with applicable securities laws. The timing, price, and amount of repurchases (if any) will be made at the discretion of management of our general partner and are subject to market conditions, as well as corporate, regulatory, and other considerations. This Unit Repurchase Program does not obligate the Partnership to acquire any common units and may be cancelled or terminated by our general partner’s board of directors at any time.

Management and Operations

The Partnership, including CVR GP, is party to a number of agreements with CVR Energy and its subsidiaries to manage certain business relationships between the Partnership and the other parties thereto. The various rights and responsibilities of the Partnership, and its partners, are set forth in the Partnership’s limited partnership agreement and, as applicable, those agreements with CVR Energy. CVR GP manages and operates the Partnership via a combination of the general partner’s senior management team and CVR Energy’s senior management team pursuant to a services agreement among CVR Energy, CVR GP, and the Partnership. See Part II, Item 8 of CVR Partners’ Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Form 10-K”) for further discussion. Common unitholders have limited voting rights on matters affecting the Partnership and have no right to elect the general partner’s directors on an annual or continuing basis.

(2) Basis of Presentation

The accompanying condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). These condensed consolidated financial statements should be read in conjunction with the December 31, 2019 audited consolidated financial statements and notes thereto included in the 2019 Form 10-K.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

In the opinion of the Partnership’s management, the accompanying condensed consolidated financial statements reflect all adjustments that are necessary for fair presentation of the financial position and results of operations of the Partnership for the periods presented. Such adjustments are of a normal recurring nature, unless otherwise disclosed.

Certain reclassifications have been made within the condensed consolidated balance sheets as of December 31, 2019 and the condensed consolidated statements of operations for the three months ended March 31, 2019. As of December 31, 2019, catalyst inventory of $5.6 million has been reclassified to Other long-term assets to conform to current presentation.

The preparation of the condensed consolidated financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, revenues, and expenses, and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. Results of operations and cash flows for the interim periods presented are not necessarily indicative of the results that will be realized for the year ending December 31, 2020 or any other interim or annual period.

(3) Recent Accounting Pronouncements

Recent Accounting Pronouncements - Adoption of Credit Losses Standard

In June 2016, the Financial Accounting Standards Board (“FASB”) issued Accounting Standard Update (“ASU”) 2016-13, Financial Instruments - Credit Losses (Topic 326). The ASU replaces the incurred loss model with a current expected credit loss model for more timely recognition of expected impairment losses for most financial assets and certain other instruments that are not measured at fair value through net income. Effective January 1, 2020, we adopted this ASU with no material impact on the Partnership’s consolidated financial position or results of operations.

Recent Accounting Pronouncements - Adoption of Fair Value Measurement Standard

In August 2018, the FASB issued ASU 2018-13, Fair Value Measurement (Topic 820). The ASU eliminates such disclosures as the amount of, and reasons for, transfers between Level 1 and Level 2 of the fair value hierarchy. Certain disclosures are required to be applied on a retrospective basis and others on a prospective basis. Effective January 1, 2020, we adopted this ASU with no material impact on the Partnership’s disclosures.

Recent Accounting Pronouncements - New Accounting Standards Issued But Not Yet Implemented

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848). This ASU was issued because, by the end of 2021, banks will no longer be required to report information that is used to determine London Interbank Offered Rate (“LIBOR”), which is used globally by all types of entities. As a result, LIBOR could be discontinued, as well as other interest rates used globally. ASU 2020-04 provides companies with optional expedients for contract modifications under Topics 310, 470, 842, and 815-15, excluded components of certain hedging relationships, fair value hedges, and cash flow hedges, as well as certain exceptions, which are intended to help ease the potential accounting burden associated with transitioning away from these reference rates. Companies can apply the ASU immediately. However, the guidance will only be available for a limited time (generally through December 31, 2022). The Partnership is currently evaluating the impact that adopting this new accounting standard will have on its consolidated financial statements and related disclosures.

(4) Inventories

Inventories consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

Finished goods

|

$

|

26,583

|

|

|

$

|

17,612

|

|

|

Raw materials

|

124

|

|

|

243

|

|

|

Parts, supplies and other

|

28,385

|

|

|

30,441

|

|

|

Total inventories

|

$

|

55,092

|

|

|

$

|

48,296

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(5) Property, Plant and Equipment

Property, plant and equipment consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

Machinery and equipment

|

$

|

1,384,588

|

|

|

$

|

1,378,651

|

|

|

Buildings and improvements

|

17,399

|

|

|

17,221

|

|

|

Automotive equipment

|

16,637

|

|

|

16,691

|

|

|

Land and improvements

|

14,040

|

|

|

14,075

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction in progress

|

6,121

|

|

|

5,198

|

|

|

Other

|

1,752

|

|

|

1,752

|

|

|

|

1,440,537

|

|

|

1,433,588

|

|

|

Less: Accumulated depreciation

|

500,209

|

|

|

481,629

|

|

|

Total property, plant and equipment, net

|

$

|

940,328

|

|

|

$

|

951,959

|

|

(6) Leases

Lease Overview

We lease railcars and certain facilities to support the Partnership’s operations. Most leases include one or more options to renew, with renewal terms that can extend the lease term from one to 20 years or more. The exercise of lease renewal options is at our sole discretion. Certain leases also include options to purchase the leased property. The depreciable life of assets and leasehold improvements are limited by the expected lease term, unless there is a transfer of title or purchase option reasonably certain of exercise. Certain of our lease agreements include rental payments which are adjusted periodically for factors such as inflation. Our lease agreements do not contain any material residual value guarantees or material restrictive covenants. Additionally, we do not have any material lessor or sub-leasing arrangements.

Balance Sheet Summary as of March 31, 2020 and December 31, 2019

The following tables summarize the ROU asset and lease liability balances for the Partnership’s operating and finance leases at March 31, 2020 and December 31, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

Operating Leases:

|

|

|

|

|

ROU asset, net

|

|

|

|

|

|

|

|

|

|

Railcars

|

$

|

9,835

|

|

|

$

|

10,826

|

|

|

Real estate and other

|

2,492

|

|

|

2,581

|

|

|

Lease liability

|

|

|

|

|

|

|

|

|

|

Railcars

|

$

|

10,137

|

|

|

$

|

11,088

|

|

|

Real estate and other

|

183

|

|

|

288

|

|

|

|

|

|

|

|

Finance Leases:

|

|

|

|

|

ROU asset, net

|

|

|

|

|

Real estate and other

|

$

|

176

|

|

|

$

|

201

|

|

|

Lease liability

|

|

|

|

|

Real estate and other

|

$

|

180

|

|

|

$

|

205

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Lease Expense Summary for the Three Months Ended March 31, 2020 and 2019

We recognize lease expense on a straight-line basis over the lease term. For the three months ended March 31, 2020 and 2019, we recognized lease expense comprised of the following components:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

|

|

|

|

Operating lease expense

|

$

|

1,111

|

|

|

$

|

1,023

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance lease expense:

|

|

|

|

|

|

|

|

|

Amortization of ROU asset

|

$

|

27

|

|

|

$

|

105

|

|

|

|

|

|

|

Interest expense on lease liability

|

2

|

|

|

6

|

|

|

|

|

|

Short-term lease expense, recognized within Direct operating expenses (exclusive of depreciation and amortization), was $0.1 million and $0.1 million for the three months ended March 31, 2020 and 2019, respectively.

Lease Terms and Discount Rates

The following outlines the remaining lease terms and discount rates used in the measurement of the Partnership’s ROU assets and liabilities at March 31, 2020 and December 31, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2020

|

|

December 31, 2019

|

|

Weighted-average remaining lease term (years)

|

|

|

|

|

Operating Leases

|

3.2

|

|

3.4

|

|

Finance Leases

|

2.0

|

|

2.3

|

|

Weighted-average discount rate

|

|

|

|

|

Operating Leases

|

5.1

|

%

|

|

5.1

|

%

|

|

Finance Leases

|

4.0

|

%

|

|

3.9

|

%

|

Maturities of Lease Liabilities

The following summarizes the remaining minimum lease payments through maturity of the Partnership’s ROU assets and liabilities at March 31, 2020:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

Operating Leases

|

|

Financing Leases

|

|

Remainder of 2020

|

$

|

2,901

|

|

|

$

|

80

|

|

|

2021

|

3,459

|

|

|

107

|

|

|

2022

|

3,020

|

|

|

—

|

|

|

2023

|

1,163

|

|

|

—

|

|

|

2024

|

486

|

|

|

—

|

|

|

Thereafter

|

162

|

|

|

—

|

|

|

Total lease payments

|

11,191

|

|

|

187

|

|

|

Less: imputed interest

|

(871)

|

|

|

(7)

|

|

|

Total lease liability

|

$

|

10,320

|

|

|

$

|

180

|

|

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(7) Other Current Liabilities

Other current liabilities consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

Accrued interest

|

$

|

17,469

|

|

|

$

|

2,518

|

|

|

Personnel accruals

|

4,246

|

|

|

8,187

|

|

|

|

|

|

|

|

Operating lease liabilities

|

3,318

|

|

|

3,523

|

|

|

Sales incentives

|

2,611

|

|

|

1,614

|

|

|

Prepaid revenue contracts

|

309

|

|

|

277

|

|

|

Share-based compensation

|

358

|

|

|

5,011

|

|

|

Other accrued expenses and liabilities

|

2,552

|

|

|

2,913

|

|

|

Total other current liabilities

|

$

|

30,863

|

|

|

$

|

24,043

|

|

Other current liabilities include amounts accrued by the Partnership and owed to CVR Energy and its affiliates of $5.5 million at December 31, 2019, with no such amounts accrued as Other current liabilities at March 31, 2020. See Note 13 (“Related Party Transactions”) for additional discussion.

(8) Long-Term Debt

Long-term debt consists of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

March 31, 2020

|

|

December 31, 2019

|

|

9.25% Senior Secured Notes, due 2023 (1)

|

$

|

645,000

|

|

|

$

|

645,000

|

|

|

6.50% Notes, due 2021

|

2,240

|

|

|

2,240

|

|

|

|

|

|

|

|

Unamortized discount and debt issuance costs

|

(13,925)

|

|

|

(14,834)

|

|

|

Total long-term debt

|

$

|

633,315

|

|

|

$

|

632,406

|

|

(1)The estimated fair value of long-term debt outstanding was approximately $506.3 million and $673.8 million as of March 31, 2020 and December 31, 2019, respectively.

Credit Facility

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

Total Capacity

|

|

Amount Borrowed as of March 31, 2020

|

|

Outstanding Letters of Credit

|

|

Available Capacity as of March 31, 2020

|

|

Maturity Date

|

|

Asset Based (AB) Credit Facility (2)

|

$

|

49,607

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

49,607

|

|

|

September 30, 2021

|

(2)At the option of the borrowers, loans under the AB Credit Facility initially bear interest at an annual rate equal to (i) 2.00% plus LIBOR or (ii) 1.00% plus a base rate, subject to a 0.50% step-down based on the previous quarter’s excess availability.

Covenant Compliance

The Partnership, and its subsidiaries, were in compliance with all covenants under their respective debt instruments as of March 31, 2020.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(9) Revenue

The following table presents the Partnership’s revenue, disaggregated by major product:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31,

|

|

|

|

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

|

|

|

|

Ammonia

|

$

|

14,147

|

|

|

$

|

13,352

|

|

|

|

|

|

|

UAN

|

47,014

|

|

|

64,064

|

|

|

|

|

|

|

Urea products

|

3,533

|

|

|

4,671

|

|

|

|

|

|

|

Net sales, exclusive of freight and other

|

64,694

|

|

|

82,087

|

|

|

|

|

|

|

Freight revenue

|

7,722

|

|

|

8,018

|

|

|

|

|

|

|

Other revenue

|

2,664

|

|

|

1,768

|

|

|

|

|

|

|

Net sales

|

$

|

75,080

|

|

|

$

|

91,873

|

|

|

|

|

|

The Partnership sells its products, on a wholesale basis, under a contract or by purchase order. The Partnership’s contracts with customers generally contain fixed pricing and most have terms of less than one year. The Partnership recognizes revenue at the point in time at which the customer obtains control of the product, which is generally upon delivery and acceptance by the customer. The customer acceptance point is stated in the contract and may be at one of the Partnership’s manufacturing facilities, at one of the Partnership’s off-site loading facilities or at the customer’s designated facility. Freight revenue recognized by the Partnership represents the pass-through finished goods delivery costs incurred prior to customer acceptance and is reimbursed by customers. An offsetting expense for freight is included in Cost of materials and other. Qualifying taxes collected from customers and remitted to governmental authorities are not included in reported revenues.

Depending on the product sold and the type of contract, payments from customers are generally either due prior to delivery or within 15 to 30 days of product delivery.

The Partnership generally provides no warranty other than the implicit promise that goods delivered are free of liens and encumbrances and meet the agreed upon specifications. Product returns are rare, and as such, the Partnership does not record a specific warranty reserve or consider activities related to such warranty, if any, to be a separate performance obligation.

The Partnership has an immaterial amount of variable consideration for contracts with an original duration of less than a year. A small portion of the Partnership’s revenue includes contracts extending beyond one year, some of which contain variable pricing in which the majority of the variability is attributed to the market-based pricing. The Partnership’s contracts do not contain a significant financing component.

The Partnership has an immaterial amount of fee-based revenue, included in other revenue in the table above, that is recognized based on the net amount of the proceeds received.

Transaction Price Allocated to Remaining Performance Obligations

As of March 31, 2020, the Partnership had approximately $9.5 million of remaining performance obligations for contracts with an original expected duration of more than one year. The Partnership expects to recognize approximately $3.0 million of these performance obligations as revenue by the end of 2020, an additional $3.7 million in 2021, and the remaining balance thereafter. The Partnership has elected to not disclose the amount of transaction price allocated to remaining performance obligations for contracts with an original expected duration of less than one year. The Partnership has elected to not disclose variable consideration allocated to wholly unsatisfied performance obligations that are based on market prices that have not yet been determined.

Contract Balances

The Partnership’s deferred revenue is a contract liability that primarily relates to fertilizer sales contracts requiring customer prepayment prior to product delivery to guarantee a price and supply of nitrogen fertilizer. Deferred revenue is recorded at the point in time in which a prepaid contract is legally enforceable and the associated right to consideration is unconditional prior to transferring product to the customer. An associated receivable is recorded for uncollected prepaid

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

contract amounts. Contracts requiring prepayment are generally short-term in nature and, as discussed above, revenue is recognized at the point in time in which the customer obtains control of the product.

A summary of the deferred revenue activity for the three months ended March 31, 2020 is presented below:

|

|

|

|

|

|

|

|

|

|

(in thousands)

|

|

|

|

|

Balance at December 31, 2019

|

$

|

27,841

|

|

|

|

|

Add:

|

|

|

|

|

New prepay contracts entered into during the period (1)

|

16,725

|

|

|

|

|

Less:

|

|

|

|

|

Revenue recognized that was included in the contract liability balance at the beginning of the period

|

5,581

|

|

|

|

|

Revenue recognized related to contracts entered into during the period

|

1,185

|

|

|

|

|

Other changes

|

166

|

|

|

|

|

Balance at March 31, 2020

|

$

|

37,634

|

|

|

|

(1) Includes $15.6 million where payment associated with prepaid contracts was collected as of March 31, 2020.

(10) Share-Based Compensation

A summary of compensation expense for the three months ended March 31, 2020 and 2019 is presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31,

|

|

|

|

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

|

|

|

|

Phantom Units

|

$

|

(259)

|

|

|

$

|

790

|

|

|

|

|

|

|

Other Awards (1)

|

(218)

|

|

|

318

|

|

|

|

|

|

|

Total share-based compensation expense

|

$

|

(477)

|

|

|

$

|

1,108

|

|

|

|

|

|

(1)Other awards include the allocation of compensation expense for certain employees of CVR Energy and certain of its subsidiaries who perform services for the Partnership under the services agreement with CVR Energy and the Limited Partnership Agreement, respectively, and participate in equity compensation plans of CVR Partners’ affiliates.

(11) Commitments and Contingencies

There have been no material changes in the Partnership’s commitments and contingencies disclosed in the 2019 Form 10-K. In the ordinary course of business, the Partnership may become party to lawsuits, administrative proceedings, and governmental investigations, including environmental, regulatory, and other matters. The outcome of these matters cannot always be predicted accurately, but the Partnership accrues liabilities for these matters if the Partnership has determined that it is probable a loss has been incurred and the loss can be reasonably estimated. While it is not possible to predict the outcome of such proceedings, if one or more of them were decided against us, the Partnership believes there would be no material impact on its consolidated financial statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

(12) Supplemental Cash Flow Information

Cash flows related to income taxes, interest, leases, and capital expenditures included in accounts payable are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

Supplemental disclosures:

|

|

|

|

|

Cash received for income taxes, net of payments

|

$

|

(1)

|

|

|

$

|

—

|

|

|

Cash paid for interest

|

49

|

|

|

53

|

|

|

Cash paid for amounts included in the measurement of lease liabilities:

|

|

|

|

|

Operating cash flows from operating leases

|

1,118

|

|

|

966

|

|

Operating cash flows from finance leases

|

2

|

|

|

9

|

|

Financing cash flows from finance leases

|

25

|

|

|

135

|

|

|

|

|

|

|

Non-cash investing activities:

|

|

|

|

|

|

|

|

|

|

Change in capital expenditures included in accounts payable

|

(1,117)

|

|

|

(668)

|

|

(13) Related Party Transactions

Effective January 1, 2020, the Partnership entered into a new Coffeyville Master Service Agreement (the “Coffeyville MSA”) between Coffeyville Resources Nitrogen Fertilizer LLC (“CRNF”) and Coffeyville Resources Refining & Marketing, LLC, an indirect, wholly-owned subsidiary of CVR Energy (“CRRM”) and a new Corporate Master Service Agreement (the “Corporate MSA”) between CRLLC and certain of its affiliates, including CVR GP and the Partnership and its subsidiaries. For a description of these agreements, see Note 9 (“Related Party Transactions”) in Part II, Item 8 of the 2019 Form 10-K.

Activity associated with the Partnership’s related party arrangements for the three months ended March 31, 2020 and 2019 is summarized below.

Related Party Activity

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31,

|

|

|

|

|

(in thousands)

|

2020

|

|

2019

|

|

|

Sales to related parties (1)

|

$

|

540

|

|

|

$

|

2

|

|

|

|

Purchases from related parties (2)

|

5,938

|

|

|

8,985

|

|

|

|

|

|

|

|

|

|

|

March 31, 2020

|

|

December 31, 2019

|

|

|

Prepaid expenses (3)

|

60

|

|

|

249

|

|

|

|

Due to related parties (4)

|

949

|

|

|

7,826

|

|

|

(1)Sales to related parties, included in Net sales, consist primarily of sales of feedstocks and services to CRRM under the Coffeyville MSA.

(2)Purchases from related parties, included in Cost of materials and other, Direct operating expenses (exclusive of depreciation and amortization), and Selling, general and administrative expenses, consist primarily of pet coke and hydrogen purchased from CRRM under the Coffeyville MSA.

(3)Prepaid expenses, included in Prepaid expenses and other current assets, are amounts paid for feedstocks and services provided by CRRM under the Coffeyville MSA.

(4)Due to related parties, included in Accounts payable to affiliates, Other current liabilities, and Other long-term liabilities, consist primarily of amounts payable for feedstocks and other supplies and services provided by CRRM and CRLLC under the Coffeyville MSA and Corporate MSA.

Property Exchange

On October 22, 2019, the audit committee of CVR Energy and the Conflicts Committee of the board of directors of CVR GP each agreed to authorize the exchange of certain parcels of property owned by subsidiaries of CVR Energy with an equal number of parcels owned by subsidiaries of CVR Partners, all located in Coffeyville, Kansas (the “Property Exchange”). On

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

February 19, 2020, a subsidiary of CVR Energy and a subsidiary of CVR Partners executed the Property Exchange agreement. This Property Exchange will enable each such subsidiary to create a more usable, contiguous parcel of land near its own operating footprint. CVR Energy and the Partnership accounted for this transaction in accordance with the ASC 805-50 guidance on transferring assets between entities under common control. This transaction resulted in a net reduction to the Partnership’s partners’ capital of approximately $0.1 million.

Distributions to CVR Partners’ Unitholders

Distributions, if any, including the payment, amount, and timing thereof, are subject to change at the discretion of the Board of Directors of CVR Partners’ general partner. There were no distributions paid by the Partnership during the three months ended March 31, 2020 related to the fourth quarter of 2019, and no distributions were declared for the first quarter of 2020.

The following table presents distributions paid by the Partnership to CVR Partners’ unitholders, including amounts paid to CVR Energy, during 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions Paid (in thousands)

|

|

|

|

|

|

Related Period

|

|

Date Paid

|

|

Distribution Per

Common Unit

|

|

Public Unitholders

|

|

CVR Energy

|

|

Total

|

|

2018 - 4th Quarter

|

|

March 11, 2019

|

|

$

|

0.12

|

|

|

$

|

8,924

|

|

|

$

|

4,670

|

|

|

$

|

13,594

|

|

|

2019 - 1st Quarter

|

|

May 13, 2019

|

|

0.07

|

|

|

5,205

|

|

|

2,724

|

|

|

7,929

|

|

|

2019 - 2nd Quarter

|

|

August 12, 2019

|

|

0.14

|

|

|

10,411

|

|

|

5,449

|

|

|

15,860

|

|

|

2019 - 3rd Quarter

|

|

November 11, 2019

|

|

0.07

|

|

|

5,205

|

|

|

2,724

|

|

|

7,930

|

|

|

Total distributions

|

|

|

|

$

|

0.40

|

|

|

$

|

29,745

|

|

|

$

|

15,567

|

|

|

$

|

45,313

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition, results of operations, and cash flows should be read in conjunction with the unaudited condensed consolidated financial statements and related notes and with the statistical information and financial data appearing in this Report, as well as our Annual Report on Form 10-K for the year ended December 31, 2019 filed with the Securities and Exchange Commission (“SEC”) on February 20, 2020 (the “2019 Form 10-K”). Results of operations for the three months ended March 31, 2020 and cash flows for the three months ended March 31, 2020 are not necessarily indicative of results to be attained for any other period. See “Important Information Regarding Forward-Looking Statements”.

Partnership Overview

CVR Partners, LP (“CVR Partners” or the “Partnership”) is a Delaware limited partnership formed in 2011 by CVR Energy, Inc. (“CVR Energy”) to own, operate, and grow our nitrogen fertilizer business. We produce and distribute nitrogen fertilizer products, which are used by farmers to improve the yield and quality of their crops. The Partnership produces these products at two manufacturing facilities, which are located in Coffeyville, Kansas and East Dubuque, Illinois. Our principal products are ammonia and urea ammonium nitrate (“UAN”). All of our products are sold on a wholesale basis. References to CVR Partners, the Partnership, “we”, “us”, and “our” may refer to consolidated subsidiaries of CVR Partners or one or both of the facilities, as the context may require. Additionally, as the context may require, references to CVR Energy may refer to CVR Energy and its consolidated subsidiaries which include its petroleum refining, marketing, and logistics operations.

Strategy and Goals

Mission and Core Values

Our mission is to be a top tier North American nitrogen-based fertilizer company as measured by safe and reliable operations, superior performance and profitable growth. The foundation of how we operate is built on five core Values:

•Safety - We always put safety first. The protection of our employees, contractors and communities is paramount. We have an unwavering commitment to safety above all else. If it’s not safe, then we don’t do it.

•Environment - We care for our environment. Complying with all regulations and minimizing any environmental impact from our operations is essential. We understand our obligation to the environment and that it’s our duty to protect it.

•Integrity - We require high business ethics. We comply with the law and practice sound corporate governance. We only conduct business one way—the right way with integrity.

•Corporate Citizenship - We are proud members of the communities where we operate. We are good neighbors and know that it’s a privilege we can’t take for granted. We seek to make a positive economic and social impact through our financial donations and the contributions of time, knowledge and talent of our employees to the places where we live and work.

•Continuous Improvement - We believe in both individual and team success. We foster accountability under a performance-driven culture that supports creative thinking, teamwork and personal development so that employees can realize their maximum potential. We use defined work practices for consistency, efficiency and to create value across the organization.

Our core Values are driven by our people, inform the way we do business each and every day and enhance our ability to accomplish our mission and related strategic objectives.

Strategic Objectives

We have outlined the following strategic objectives to drive the accomplishment of our mission:

Safety - We aim to achieve continuous improvement in all environmental, health and safety areas through ensuring our people’s commitment to environmental, health and safety comes first, the refinement of existing policies, continuous training, and enhanced monitoring procedures.

Reliability - Our goal is to achieve industry-leading utilization rates at both of our facilities through safe and reliable operations. We are focusing on improvements in day-to-day plant operations, identifying alternative sources for plant inputs to reduce lost time due to third-party operational constraints, and optimizing our commercial and marketing functions to maintain plant operations at their highest level.

Market Capture - We continuously evaluate opportunities to improve the facilities’ realized pricing at the gate and reduce variable costs incurred in production to maximize our capture of market opportunities.

Financial Discipline - We strive to be efficient as possible by maintaining low operating costs and disciplined deployment of capital.

Achievements

During the first quarter of 2020, we successfully executed a number of achievements in support of our strategic objectives shown below through the date of this filing:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Safety

|

|

Reliability

|

|

Market Capture

|

|

Financial Discipline

|

|

Operated all facilities and corporate offices safely and reliably and maintained financial discipline amid COVID-19 pandemic.

|

ü

|

|

ü

|

|

|

|

ü

|

|

Maintained high asset reliability and utilization at both facilities during the first quarter of 2020.

|

ü

|

|

ü

|

|

ü

|

|

|

|

Achieved 8% improvement in total recordable incident rate for the first quarter 2020 compared to the first quarter 2019.

|

ü

|

|

|

|

|

|

|

Industry Factors and Market Conditions

Within the nitrogen fertilizer business, earnings and cash flows from operations are primarily affected by the relationship between nitrogen fertilizer product prices, utilization, and operating costs and expenses, including petroleum coke and natural gas feedstock costs.