Victory Square Technologies Inc. (“

Victory

Square'' or the “

Company”) (CSE:VST)

(OTC:VSQTF) (FWB:6F6) is pleased to announce its portfolio company,

FansUnite Entertainment Inc. (“

FansUnite”), has

completed a non-brokered private placement in the amount of

$3,131,918 CAD. Concurrent to the financing, FansUnite has

completed the acquisition of McBookie, a leading provider of

betting services in the U.K. These two milestones pave the way for

FansUnite to list on the CSE commencing Tuesday, May 5th, 2020

(CSE:FANS).

The total consideration payable in connection

with the acquisition of McBookie is $2,200,000.

McBookie is and has been a leading provider of

betting services in the U.K. for over 10 years. With a focus on B2C

offerings in the Scottish market, McBookie's two biggest markets

are Football and Horse Racing. McBookie also offers casino and

virtual sports offerings.

Under the terms of the financing, FansUnite

issued 8,948,326 common shares at $0.35 cents for a total of

$3,131,918.

FansUnite is a Sports and Entertainment company,

focusing on technology related to regulated and lawful online

sports betting, casino and other related products. The principal

business will be operating the FansUnite B2C Sportsbook and the

McBookie website, offering online sports betting and casino to the

UK market. FansUnite is also a provider of technology solutions,

products and services in the global gaming and entertainment

industries and looks to acquire technology platforms and assets

with high-growth potential in new or developing markets.

FansUnite’s M&A activity will focus on the sports, gaming and

entertainment industries.

"The successful private placement, acquisition

of McBookie, and public listing is great news for FansUnite, and

Victory Square shareholders," said Shafin Diamond Tejani, CEO of

Victory Square. “During the past 36 months, FansUnite has achieved

significant milestones in terms of growth, product development and

customer acquisition. And, our team will continue to work closely

to help them successfully build, develop and grow with the

objective of creating long-term value for Victory Square

shareholders.”

"This is a great milestone for our FansUnite

Team,” said Darius Eghdami, Chief Executive Officer of FansUnite.

“We’ve assembled a strong team with decades of experience in the

gaming industry and are excited to build on our momentum.”

Shares for Debt Transaction

In addition, the Company reports that its board

of directors has approved the settlement of $237,675 of debt

through the issuance of common shares of Victory Square (the

"Debt Settlement"). Pursuant to the Debt

Settlement, the Company would issue up to 2,726,317 common shares

of the Company (the "Shares") at a deemed price of

$0.08 per Share, including 2,437,500 common shares to a director

and officer of the Company (the “Creditor”).

The issuance of the Shares to the Creditor is

subject to the approval of the Canadian Securities Exchange. All

securities issued will be subject to a four month hold period which

will expire on the date that is four months and one day from the

date of issue.

There was no material undisclosed information at

the time of Debt Settlement.

As an insider participated in the Debt

Settlement, it is considered to be a "related party transaction"

under Multilateral Instrument 61-101 - Protection of Minority

Security Holders in Special Transactions ("MI

61-101"). All of the independent directors of the Company,

acting in good faith, considered the transaction and have

determined that the deemed value of the securities being issued to

the insider and the consideration being paid is reasonable. The

Company intends to rely on the exemptions from the valuation and

minority shareholder approval requirements of MI 61-101 contained

in sections 5.5(b) and 5.7(b) of MI 61-101.

Check out VictorySquare.com and sign up to VST's

official newsletter at www.VictorySquare.com/newsletter.

On behalf of the board,

Shafin Diamond TejaniChief Executive

OfficerVictory Square Technologies

For further information about the Company,

please contact:

Investor Relations Contact – Alex TziliosEmail:

alexandros@victorysquare.comTelephone: 778-867-0482

Media Relations Contact – Howard Blank,

DirectorEmail: howard@victorysquare.comTelephone: 604-928-6066

ABOUT VICTORY SQUARE TECHNOLOGIES

INC.

Victory Square (VST) builds, acquires and

invests in promising startups, then provides the senior leadership

and resources needed to fast-track growth. The result: rapid

scale-up and monetization, with a solid track record of public and

private exits.

VST's sweet spot is the cutting-edge tech that's

shaping the 4th Industrial Revolution. Our portfolio consists of 20

global companies using AI, VR/AR and blockchain to disrupt sectors

as diverse as fintech, insurance, health and gaming.

What we do differently for

startups

VST isn't just another investor. With real skin

in the game, we're committed to ensuring each company in our

portfolio succeeds. Our secret sauce starts with selecting startups

that have real solutions, not just ideas. We pair you with senior

talent in product, engineering, customer acquisition and more. Then

we let you do what you do best — build, innovate and disrupt. In

24-36 months, you'll scale and be ready to monetize.

What we do differently for

investors

VST is a publicly-traded company headquartered

in Vancouver, Canada, and listed on the Canadian Securities

Exchange (VST), Frankfurt Exchange (6F6) and the OTCQX (VSQTF). For

investors, we offer early-stage access to the next unicorns before

they're unicorns. Our portfolio represents a uniquely liquid and

secure way for investors to get access to the latest cutting-edge

technologies. Because we focus on market-ready solutions that scale

quickly, we're able to provide strong and stable returns while also

tapping into emerging global trends with big upsides. For more

information, please visit www.victorysquare.com.

ABOUT THE CANADIAN SECURITIES EXCHANGE

(CSE)

The Canadian Securities Exchange, or CSE, is

operated by CNSX Markets Inc. Recognized as a stock exchange in

2004, the CSE began operations in 2003 to provide a modern and

efficient alternative for companies looking to access the Canadian

public capital markets.

The Canadian Securities Exchange has neither

approved nor disapproved the contents of this news release and

accepts no responsibility for the adequacy or accuracy hereof.

FORWARD-LOOKING INFORMATION

This news release contains “forward-looking

information” within the meaning of applicable securities laws

relating to the outlook of the business of Victory Square,

including, without limitation, statements relating to future

performance by any portfolio company of the Company, the impact of

any portfolio company’s performance on the Company, the strategic

direction of the Company, and the potential spin out of its

FansUnite division and strategy thereof for going public. Such

forward-looking statements may, without limitation, be preceded by,

followed by, or include words such as “believes”, “expects”,

“anticipates”, “estimates”, “intends”, “plans”, “continues”,

“project”, “potential”, “possible”, “contemplate”, “seek”, “goal”,

or similar expressions, or may employ such future or conditional

verbs as “may”, “might”, “will”, “could”, “should” or “would”, or

may otherwise be indicated as forward-looking statements by

grammatical construction, phrasing or context. All statements other

than statements of historical fact contained in this news release

are forward-looking statements. Forward-looking information is

based on certain key expectations and assumptions made by the

management of Victory Square. Although Victory Square believes that

the expectations and assumptions on which such forward-looking

information is based are reasonable, undue reliance should not be

placed on them because Victory Square can give no assurance that

they will prove to be correct. Actual results and developments may

differ materially from those contemplated by these statements. The

statements contained in this news release are made as of the date

of this news release. Victory Square disclaims any intent or

obligation to update publicly any forward-looking information,

whether as a result of new information, future events or results or

otherwise, other than as required by applicable securities

laws.

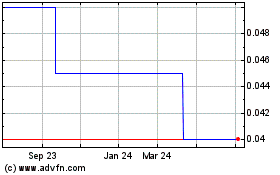

FansUnite Entertainment (CSE:FANS)

Historical Stock Chart

From Mar 2024 to Apr 2024

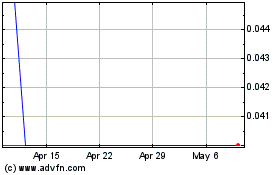

FansUnite Entertainment (CSE:FANS)

Historical Stock Chart

From Apr 2023 to Apr 2024