Merck Venture Arm Invests in Quantum Computing Startup Seeqc

April 09 2020 - 2:14PM

Dow Jones News

By Sara Castellanos

Quantum computing startup Seeqc Inc. has raised more than $11

million in venture capital funding from investors including a

subsidiary of German company Merck KGaA, which is interested in

using the technology for materials science and pharmaceutical

development.

M Ventures, the corporate venture arm of Merck, has invested $5

million in Elmsford, N.Y.-based Seeqc, betting that in several

years, the startup's technology could save Merck time and money

related to simulating drugs and chemicals. The Series A is expected

to close later this spring, according to a Seeqc spokesperson.

"We think this technology will change the world of simulations

for us if it proves to be scalable," said Philipp Harbach, head of

in silico research at Merck.

Over the past two years, Merck has formed a quantum-computing

task force of about 50 experts who are exploring use cases for a

technology that could one day prove to be more powerful than

traditional computers, including supercomputers.

Some experts say quantum computing could possibly be used by

researchers combating the coronavirus pandemic to speed up certain

calculations related to drug discovery and hospital logistics.

However, neither Merck nor Seeqc have plans to use the technology

for purposes related to the new coronavirus.

Instead, Merck is interested in experimenting with technology

from Seeqc and other quantum computing-related vendors including

Germany-based HQS Quantum Simulations to benefit materials science

and drug discovery over the next several years, Mr. Harbach

said.

Simulations of chemicals and pharmaceuticals, which Merck

manufactures, are costly and time-consuming to complete using

standard computers, even supercomputers. Validating the drugs in

labs adds more time to a process that can take years. Predicting

positive and negative effects of specific drugs, for example, is a

computationally complex problem because it requires simulating the

structure of molecules and their chemical features.

Quantum computing could potentially speed up drug and materials

development, therefore cutting costs, Mr. Harbach said, because the

technology has the potential to sort through a vast number of

possibilities nearly instantaneously and come up with a probable

solution. "If you can mimic a real-life experiment on a quantum

computer, that could basically make things much faster in

development, and of course much cheaper," Mr. Harbach said.

By 2023, about 20% of organizations, including businesses and

governments, are expected to budget for quantum-computing projects,

up from less than 1% in 2018, according to research and advisory

firm Gartner Inc.

Founded in 2019, Seeqc is a spinout of Elmsford-based Hypres

Inc., a developer of superconductor electronics. Aside from M

Ventures, the startup's other investors include BlueYard Capital,

Cambium, New Lab and the Partnership Fund for New York City.

There is currently no commercial-grade quantum computer on the

market, but many companies are building quantum-computing systems

using different technologies and architectures. They face

engineering challenges that are making the road to market longer

than planned.

Seeqc is building a quantum computing system using a so-called

hybrid architecture that combines classical and quantum computing

and is meant for very specific use cases, said John Levy, Seeqc's

co-chief executive.

One of the benefits of the system is that it could reduce

decoherence and therefore run an algorithm more reliably, Mr. Levy

said. Decoherence refers to changes in temperature, noise,

frequency and motion that can jostle quantum particles and hurt the

accuracy of a calculation or prevent it from being completed.

The company is currently raising more money from investors and

will use the funding to build a "toy-level" version of its quantum

computer. "The idea is to deliver, within a three-year time

horizon, an architecture that's built around a real-world problem

and has the potential to scale, " Mr. Levy said.

Write to Sara Castellanos at sara.castellanos@wsj.com

(END) Dow Jones Newswires

April 09, 2020 13:59 ET (17:59 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

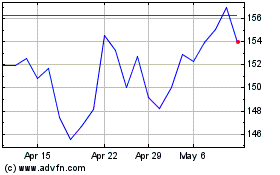

Merck KGAA (TG:MRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Merck KGAA (TG:MRK)

Historical Stock Chart

From Apr 2023 to Apr 2024