Pipeline Operator Williams Comes Under Fire -- Update

April 07 2020 - 6:46PM

Dow Jones News

By Corrie Driebusch and Rebecca Elliott

An influential proxy adviser has taken the unusual step of

urging shareholders to withhold votes for the chairman of Williams

Cos. after the pipeline operator adopted a poison pill to fend off

unwanted suitors.

Institutional Shareholder Services Inc., or ISS, recommends

against supporting Williams Chairman Stephen Bergstrom in director

elections at the company's annual meeting April 28, according to a

client note from the proxy adviser that was viewed by The Wall

Street Journal. The report cites the "highly restrictive" nature of

the pill, which kicks in if an unwanted shareholder buys a stake of

just 5%.

Williams, whose pipelines transport oil and natural gas, on

March 19 joined a swell of more than 20 companies adopting poison

pills as their shares plunge amid the coronavirus pandemic.

Poison pills are antitakeover measures that can also be used to

neutralize shareholder activists. When an outsider buys up more

than a certain amount of the stock of a company with one, new

shares flood the market and make it more expensive to acquire a

controlling stake. Many investors frown on poison pills because

they can insulate companies from sometimes-beneficial outside

forces and suitors who might offer a significant takeover

premium.

The threshold for the Williams pill, which will remain in effect

until next March, is exceptionally low compared with others.

According to ISS, of the 14 companies that adopted poison pills

between March 13 and March 30, all of the others chose triggers

ranging from 10% to 20%. It calls the threshold for the Williams

pill "extremely rare."

The proxy firm adds that it recognizes this is a "unique time"

and it doesn't take a broad stand against implementing poison pills

in this environment. ISS recommends a "cautionary" vote for all

other Williams directors, including Chief Executive Alan

Armstrong.

A Williams spokeswoman called the ISS recommendation

"perplexing," saying in a written statement that the company's

board acted in the best interest of shareholders and that the 5%

trigger level isn't "highly restrictive." She added that Williams

reached out to major shareholders after adopting the pill and none

of them indicated that they would vote against any board members in

the coming election.

The Tulsa, Okla., company has said it adopted the pill in

response to its share-price decline, not because of a specific

threat.

Williams' stock fell more than 25% in March and was down more

than 40% since the start of the year as of Monday's close, battered

by the pandemic as well as a sharp decline in energy prices. The

company's market capitalization was about $16 billion as of

Monday.

Glass Lewis & Co., another major proxy adviser, has said it

doesn't believe shareholders ought to withhold votes from any board

members over the pill at this time.

Mr. Bergstrom is running unopposed on the director slate, so

there is little to no chance of his removal. Last year, nearly 99%

of investors voted for him, according to the ISS report. However,

ISS carries a lot of clout with big institutional shareholders and

a significant vote against the chairman would send a message to the

company as well as any others considering a similar move.

Sabastian Niles, a partner at law firm Wachtell, Lipton, Rosen

& Katz who advises corporate clients on activism and takeover

defense, said he tells companies that their pills should be

designed with circumstances that are specific to them in mind.

"ISS and institutional investors are not writing a blank check

and companies should not reflexively rush to adopt a pill

prematurely and without good reason," he said.

ISS criticizes Williams for what it says is a failure to

consider alternatives, such as a shorter-term pill or one with a

higher trigger level, and for not using its annual meeting to seek

shareholder ratification of the plan.

Write to Corrie Driebusch at corrie.driebusch@wsj.com and

Rebecca Elliott at rebecca.elliott@wsj.com

(END) Dow Jones Newswires

April 07, 2020 18:31 ET (22:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

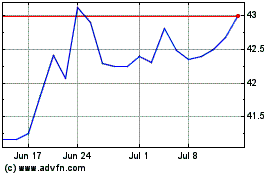

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

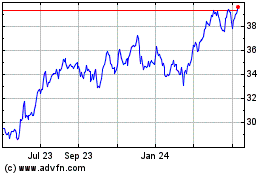

Williams Companies (NYSE:WMB)

Historical Stock Chart

From Apr 2023 to Apr 2024