Container Shipping Lines Cancel Sailings to Weather Coronavirus Storm

April 06 2020 - 5:02PM

Dow Jones News

By Costas Paris

Global container shipping lines have canceled more than 160

sailings over the past week as they try to maintain freight rates

in the face of billions of dollars in potential losses driven by

falling trade demand.

The service cancellations have grown from 45 last week to 212,

according to Copenhagen-based consulting firm Sea-Intelligence ApS,

a trend indicating that the summer peak season could be largely

muted and that the shipping lines that carry most of the world's

manufactured and retail goods expect the economic fallout from the

coronavirus pandemic to extend into the peak shipping season.

Sea-Intelligence estimates the biggest international carriers

will see combined losses ranging from $800 million to $23 billion

this year, depending on how they manage the economic impact from

widespread coronavirus-driven lockdowns.

The financial fallout for the shipping lines appears to be

relatively mild so far compared with that of airlines and other

transportation operators that depend on passengers.

But shipping lines are hunkering down with major national

economies wavering while their businesses halt operations,

factories idle assembly lines and job losses mount. Carriers

including Denmark's Maersk Line, Switzerland-based Mediterranean

Shipping Co. and Japan's Ocean Network Express Pte. Ltd. are trying

to guard against crashing freight rates on major trade lanes as

capacity increasingly outweighs demand.

"It's a developing storm," said Sea-Intelligence Chief Executive

Lars Jensen. "The challenge will be to carefully manage capacity

going forward so to prevent a freight rate collapse."

Mr. Jensen said industrywide losses could reach $23 billion if

liners embark in an all-out price war similar to that after the

2008 financial crisis, when freight prices fell to levels that

barely covered fuel costs.

"The rate collapse during the financial crisis was partly caused

by an inability to reduce capacity in a timely fashion," he said.

"The potential loss is of such a staggering magnitude that carriers

are highly likely to blank far more sailings in case we begin to

see rates slide too far."

Cancellations focused on Asia-Europe and trans-Pacific services

began to mount in January and February when the coronavirus began

to spread in China, pushing Beijing to bring economic activity to a

near standstill.

China is now pushing out cargo again, but demand has nosedived

with urban centers in the U.S. and Europe increasingly being locked

down. Some U.S. ports have pulled back operating hours at cargo

terminals because of the diminished demand.

Freight rates are currently around 20% below break-even levels

but have held relatively steady since the start of the year as the

blanked sailings restrained capacity and price-focused

competition.

"The trick is not to fall into the temptation to gain market

share by putting more ships into the water," said Mr. Jensen.

He predicts the pandemic will cut demand for container shipping

this year by about 10% overall, about the same decline as in 2009,

when the financial crisis unfolded disrupting world trade.

Denmark's A.P. Møller-Mærsk A/S, parent of Maersk Line,

suspended its 2020 financial guidance in March, saying the

coronavirus will have an unknown impact on its bottom line. Maersk

Line, considered a bellwether for global trade and the world's

biggest boxship operator, had earlier said it was expecting an

operating profit of $5.5 billion this year.

Write to Costas Paris at costas.paris@wsj.com

(END) Dow Jones Newswires

April 06, 2020 16:47 ET (20:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

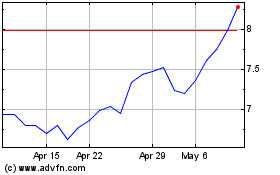

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

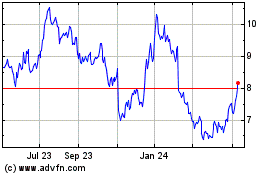

AP Moller Maersk AS (PK) (USOTC:AMKBY)

Historical Stock Chart

From Apr 2023 to Apr 2024