By Xie Yu, Avantika Chilkoti and Paul Vigna

Stocks rallied Monday as investors cheered early signs that

lockdowns in the U.S. and Europe may be helping slow the

coronavirus pandemic, even as Americans brace for another difficult

week.

Major indexes in the U.S. opened sharply higher and climbed

modestly as the day progressed, with the Dow Jones Industrial

Average up more than 1,200 points. All 30 stocks in the index

climbed, as did all 11 sectors in the S&P 500. Beaten-down

retail and travel stocks were among the biggest gainers.

New York Gov. Andrew Cuomo said the number of daily deaths from

Covid-19, the pneumonialike disease caused by the virus, have been

"effectively flat" in his state for the past two days, suggesting

social-distancing measures have proved effective. The number of

daily hospitalizations, intubations and people in intensive care

units is also down.

Health authorities have warned that new models show the number

of cases is likely to reach a new high in coming days.

"Everyone is just desperate for good pieces of news," said Peter

Cecchini, chief market strategist at Cantor Fitzgerald. "It doesn't

necessarily reflect anything fundamental. Nothing's changed."

Indeed, with volatility in the market as elevated as it has been

lately, he said, Monday's swings are typical.

The blue-chip index rose 1,269 points, or 6%, although it is

still down more than 20% this year.

The Dow is on pace for its 12th consecutive move of at least 1%

higher or lower, the longest such streak since March 2009, and its

28th consecutive move up or down at least 0.5%, according to Dow

Jones Market Data. That streak occurred in October 1931 during the

Great Depression when the Dow rose or fell at least 0.5% on 33

consecutive trading days.

The S&P 500 climbed 5.6%, led by the utilities sector, which

rose 8.1%, followed by the materials and consumer-discretionary

groups, both up nearly 7%.

Among the stocks posting some of the biggest gains, Kohl's rose

26%, while Nordstrom climbed 23%. Carnival added 26% and Marriott

International increased 18%. All four stocks are still down more

than 50% for the year.

Whatever path the pandemic takes, the damage on economic growth

is going to be significant, said Fred Cannon, the director of

research at Keefe Bruyette & Woods. He expects a slow recovery,

with growth at the end of 2021 still about 5% below its level from

before the downturn.

As for the market, "I tend to not believe a bottom's been hit,"

he said, "because we don't know what the end point of the economy

is."

At least one-quarter of the U.S. economy has gone idle as

authorities curtailed travel and activity, an analysis conducted

for The Wall Street Journal showed.

JPMorgan Chase Chief Executive James Dimon said in his annual

letter that he expects "a bad recession." The country wasn't

prepared for a pandemic, but "we can and should be more prepared

for what comes next."

The pandemic has brought some businesses to a standstill.

Airlines, for example, are cutting flight schedules, putting

expansion plans on hold and looking for places to park their idle

planes.

Most recently, they have significantly cut travel to New York as

the crisis there worsens; United Airlines, for one, cut 90% of its

flights to New York. Its shares rallied Monday. United climbed

6.2%, while American Airlines rose 0.8%.

Some investors remain cautious about the prospects of a

sustained market rally. Volatility remains high and cross-asset

correlations -- the typical relationship between the price of

different assets -- has broken down, suggesting the market is still

under stress, according to Dwyfor Evans, head of macro-strategy for

the Asia-Pacific region at State Street Global Markets in Hong

Kong.

"We have good days and bad days. Sometimes they follow each

other," Mr. Evans said.

The yield on 10-year Treasurys rose to 0.671%, up from 0.587%

Friday. The market for U.S. government debt, normally the most

liquid and actively traded bond market in the world, has calmed in

recent weeks following a string of extraordinary measures by the

Federal Reserve. Yields rise when bond prices drop.

Oil markets struggled to find their footing. Major oil-producing

nations are preparing to meet Thursday to discuss how to address

the global glut in supply.

West Texas Intermediate crude, the U.S. oil benchmark, fell 6.5%

to $26.51 a barrel. An emergency summit to discuss global

production cuts was pushed back from Monday to later in the week

amid continued tensions between Saudi Arabia and Russia. Investors

are growing increasingly concerned that a failure to cut output may

result in the world running out of storage space for excess crude.

Limiting production may also not be enough to offset the drop in

demand.

"Even if they sort out something on the supply side, it probably

won't be big enough to offset what's happening on the demand side,"

said Lyn Graham-Taylor, a strategist at Rabobank.

Strict containment measures also showed signs of helping slow

the spread of the virus in parts of Europe, including Italy and

Spain. Both countries are now recording fewer daily deaths than

they have in over a week, and the pressure on hospitals in Italy is

beginning to ease, officials said.

The pan-continental Stoxx Europe 600 index gained 3.7%. In

Asia-Pacific markets, Australia's benchmark S&P/ASX 200 index

closed up 4.3%. Japan's Nikkei 225 rose 4.2%. Markets in mainland

China were closed for a holiday.

Write to Xie Yu at Yu.Xie@wsj.com, Avantika Chilkoti at

Avantika.Chilkoti@wsj.com and Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

April 06, 2020 15:40 ET (19:40 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

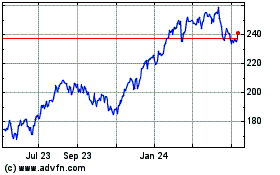

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

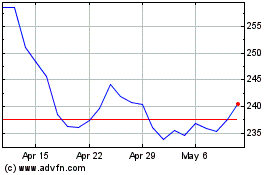

Marriott (NASDAQ:MAR)

Historical Stock Chart

From Apr 2023 to Apr 2024