By Suzanne McGee

Sometimes, winning simply means that you lose less ground than

everyone else.

That's certainly the definition of "outperformance" for those

actively managed U.S.-stock mutual funds in our quarterly survey at

the end of the first three months of 2020.

In a period that witness the global spread of the Covid-19

pandemic and the end of a long-lived U.S. bull market in stocks,

all of the top performers saw their returns for the rolling 12

months slashed. Chris Retzler, manager of Needham Small Cap Growth

fund (NESGX), watched his gains for the 12-month period ended March

31 plunge to 12.8%, after posting a return for the trailing 12

months ended Dec. 31 of 54.5%.

That performance, nevertheless, was good enough for Mr. Retzler

to win top place in the quarterly Wall Street Journal Winners'

Circle for the second time in a row. The contest measures the

rolling 12-month performance of actively managed, diversified

U.S.-stock funds with more than $50 million in assets and at least

a three-year record. (Index, leveraged and sector funds don't

qualify.) The funds tracked posted an average loss for the trailing

12-month period of 10.8%, according to data from Morningstar.

Mr. Retzler beat out his nearest rival, No. 2 finisher Baron

Opportunity fund (BIOPX), by almost 5 full percentage points in our

survey. Michael Lippert, manager of the Baron fund, generated a

gain of 7.8% for that 12-month period but managed to outperform Mr.

Retzler's fund for the first three months of the year by holding

losses to only 6.7%. The Needham fund recorded a first-quarter loss

of 15.0%.

Adjusting to tumult

Most of the funds in our survey that beat their peers and the

market itself amid the recent volatility and selloffs may not

impress investors by the size of their gains. As disappointed

shareholders often mutter during big downturns, it's tough to

celebrate relative outperformance, as opposed to big absolute

gains. Still, this quarter's winners shielded their investors from

at least part of the damage. They are also adjusting rapidly to the

market tumult.

"It's going to take time to get back to a new normal," says Mr.

Retzler, who admits the rapidity of the market's plunge caught him

off-guard. Still, he had been anticipating some kind of selloff

this year.

"At the end of 2019 we were overweight cash, and we didn't

deploy it," Mr. Retzler says. "We continued to sell in January,

because we felt the economy was likely to slow down," he adds.

"It's hard to sustain the level of activity we've seen, which told

us a correction was needed. Admittedly, this one was more

significant than we thought would occur."

Mr. Retzler believes the selling isn't over.

"It's a new quarter, sure, but I'm not sure it will be all that

much better," he says. He predicts the market will test lows

recorded in March.

"But we think this retest will be incredibly healthy for

creation of the next bull market," he argues. "In the second half

of 2020, we expect to see a significant snapback in global economic

activity, thanks in part to significant stimulus" in the shape of

rock-bottom interest rates and government programs.

That's why Mr. Retzler, like other top performers in this

quarter's survey, is "buying the dip," on a selective basis. He

says he has been adding to his stakes in favorite holdings since

February. In addition, he has established new positions in stocks

that suddenly have become much more affordable, thanks to the 20%

plunge in the S&P 500 index in the first quarter (the largest

since 2008) and the 18.7% dive in the Dow Jones Industrial Average

(the biggest recorded since 1987, before some of the managers in

our survey had even finished high school). "They are trading at

valuations we could never have expected."

Mr. Retzler says that internal compliance rules prevent him from

discussing details about recent trades. Most other managers face

similar constraints.

Looking ahead

In general, however, he says he thinks once the market recovers

it will boost the long-term outlook for companies like online

consumer-loan portal LendingTree, which has been part of his

portfolio off and on in recent years. "It has exposure to a

recovery in consumer spending, and we think when this is over,

consumers will be taking advantage of lower interest rates to

refinance, buy a house or use other LendingTree tools to evaluate

their financial position," he argues.

Mr. Retzler remains a fan of any companies that will benefit

from the rollout of 5G wireless technology and the software sales

business. That has led him, over time, to own stocks like Cohu

Inc., which designs and manufactures semiconductor-testing

equipment. He's also a fan of Limelight Networks Inc., which offers

customers streamed-content-delivery services.

Shares of Limelight, which operates in a segment that is

currently benefiting from the fact that three-quarters of the U.S.

population is indoors, have bounced back from a low of $3.66 in

mid-March to close on Friday at $5.47, near their high of $6.07

recorded in mid-February.

Many of the top-performing funds in the Winners' Circle contest

have continued to attract new inflows of cash from investors.

The market might look like some kind of theme-park terror ride,

but "even this morning, we had flows coming in," says Baron

Opportunity's Mr. Lippert.

Mr. Lippert is putting that money to work in businesses that he

believes will get through the storm not only intact, but with a

stronger market share or competitive edge, such as Zoom Video

Communications (an online platform that quarantined Americans are

using to hold video business meetings, take classes, discuss

book-club selections or virtually share a martini). Other favored

businesses include CrowdStrike Holdings Inc., a cybersecurity

company, and online retailer Amazon.com. He has been eyeing the

health-care area, looking for opportunities to invest in new drug

developments.

"The nature of my portfolio and investment strategy meant that I

didn't own any companies that had liquidity concerns," Mr. Lippert

says. "And since I had been emphasizing the digital transformation

of the economy, I didn't own hotels or cruise lines." Instead, he

had an array of "up and coming" technology businesses on his watch

list that have become more affordable in recent weeks, like Datadog

Inc., which monitors how a client's databases, servers and apps are

performing.

An emphasis on avoiding weak spots and focusing on businesses

that will remain fundamentally strong and recover more rapidly than

the broader economy also buoyed No. 4 finisher Virtus KAR Mid-Cap

Growth fund (PHSKX) for the first quarter of 2020 (it lost 8.3% in

the quarter, less than half the average loss in our survey group).

For the trailing 12 months, its 5.5% gain placed it just behind

another Virtus offering, No. 3 finisher Virtus Zevenbergen

Innovative Growth Stock fund (SAGAX), which recorded a 6.5%

advance.

Like his outperforming peers, Virtus KAR manager Doug Foreman,

the chief investment officer of Los Angeles-based Kayne Anderson

Rudnick (which manages the Virtus funds), continues to buy shares

of those companies he expects to profit most from a recovery. He

also continues to see inflows. "We've seen $200 million of inflows

so far this year," he says, adding that his fund now has about $800

million in assets under management.

Some of that new capital is being directed to businesses like

Domino's Pizza Inc., which has been in the fund for more than seven

years. "People are probably going to order plenty of pizzas, even

in this environment," says Mr. Foreman, who also likes Pool Corp.,

the largest wholesale supplier of swimming-pool supplies and parts.

"Its market share gives it pricing power, and most of its business

comes from people who already have pools, with only a small

percentage tied to new-home construction."

Looking for a sign

Uncertainty about the final toll the new coronavirus will take

might continue to overshadow financial markets. Nonetheless, each

of these three managers remains optimistic about the outlook for

the stock market, which they believe could begin its recovery just

as rapidly as it did in 2009.

"All the markets need at these levels is some kind of sign that

business will get back to normal in the future," says Mr.

Foreman.

When that will be, and what that "normal" will look like,

remains unclear. But the managers see one difference between what

is happening now and market crises of the recent past. This time,

the driving force is a public-health crisis, not market excesses

like a meltdown in subprime bonds, internet stocks in 2000, or even

junk bonds decades ago. Thus, the managers remain upbeat, at least

when they are talking about the long-term market outlook.

"I truly don't know whether we'll be OK in the fall," says Mr.

Lippert. But, he adds, that isn't the point. "We want to look from

point A, today, to a point B that is three to five years out and

not try to guess what's going to happen tomorrow."

Ms. McGee is a writer in New England. She can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

April 05, 2020 22:26 ET (02:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

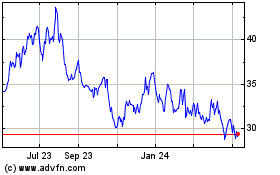

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Mar 2024 to Apr 2024

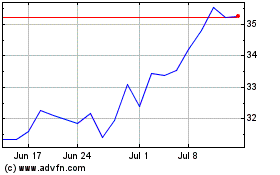

Cohu (NASDAQ:COHU)

Historical Stock Chart

From Apr 2023 to Apr 2024