Airlines Apply for Government Aid but Say Outlook Is Dire

April 03 2020 - 7:40PM

Dow Jones News

By Alison Sider and Doug Cameron

Several U.S. airlines on Friday applied for government funds to

keep paying workers, but say they still need more cash as they face

an existential crisis that doesn't look likely to abate soon.

American Airlines Group Inc., Delta Air Lines Inc., United

Airlines Holdings Inc., and JetBlue Airways Corp. submitted

applications for the government grants authorized under the $2

trillion stimulus package passed last week. Southwest Airlines Co.

has previously said it would apply.

However, carriers cautioned on Friday that the government help

won't be enough to see them through what several have described as

the most serious crisis they have faced.

The carriers that applied for the grants didn't detail the terms

they proposed. The Treasury Department had encouraged airlines to

apply by April 3 for the best chance at securing funding quickly.

It will continue accepting applications until April 27.

Demand for travel has all but evaporated as the new coronavirus

has spread and governments have restricted international travel and

urged people to stay home.

Delta Chief Executive Ed Bastian wrote in a message to employees

Friday: "We know we still haven't seen the bottom."

Delta said it is burning through $60 million cash a day and

projected the government funds would only last until June without

other spending cuts. It has asked employees to take unpaid leaves

and said some 30,000 have volunteered. The airline expects

second-quarter revenue to be down $90 million from a year ago.

JetBlue said workers will likely see smaller paychecks as the

funds, which are tied to last year's staffing levels, won't fully

cover what its employees are used to earning when the airline is

flying a full schedule. The airline said it is in talks with the

government and private lenders.

"We are leaving no stone unturned," Chief Executive Robin Hayes

told employees Friday. "The good news is this law keeps paychecks

coming and it buys us time."

United said it plans to cut 80% of its capacity for this month

and to make even larger capacity cuts in May. The airline estimated

that it lost $100 million in revenue a day in March.

Airlines and their labor unions had lobbied for that package to

include $25 billion in direct grants they could use to continue

paying staff. The funds come with strings attached, including a

promise not to conduct involuntary layoffs or furloughs until

October.

The law also allows the government to ask for equity, stock

warrants, or other financial instruments in exchange for the

grants. Some carriers have been asking Treasury Secretary Steven

Mnuchin to go easy on requests for equity stakes, fearing

shareholder dilution, people familiar with the talks have said.

Union leaders, including heads of major flight attendant unions

and three former leaders of the Air Line Pilots Association, have

said the government could put jobs at risk if it insists on terms

that the airlines won't accept.

The stimulus package also set aside another $25 billion for

loans to passenger airlines, as well as additional funds for cargo

carriers and airline contractors.

Airlines expect to continue talks with the administration about

the tentative rules laid down to access the grants, which include

minimum domestic flying requirements, as well as how the government

would be compensated through equity, warrants or other financial

instruments

Most big network carriers backed the Transportation Department's

proposals issued earlier this week, though asked for more

flexibility to avoid having to operate some seasonal services,

according to regulatory filings.

Low-cost carriers including Allegiant Travel Co. want far more

flexibility and warned the requirements could force them to fly

empty planes and risked unwinding 45 years of industry

deregulation.

Airlines have continued to raise bank and capital-market funding

through the crisis, drawing down existing loans and increasing

emergency facilities. Analysts said these would provide an

important benchmark for the security sought by the Treasury as

airline share prices have fallen by 80% since late February.

Airline shares have tumbled in recent weeks. American's shares

closed at a record low Friday, and lost most of the gains they made

since the stimulus package was announced last week.

Warren Buffett's Berkshire Hathaway sold nearly 13 million

shares of Delta this week, around 18% of its holdings, according to

a securities filing. Berkshire also sold over 2 million Southwest

shares.

While the Transportation Department prepared to analyze

potential payouts to airlines, it also told carriers on Friday to

abide by existing regulations governing cash refunds to customers.

It cited an increasing number of complaints that vouchers and

credits being offered instead of cash for canceled flights were

"not readily usable."

(END) Dow Jones Newswires

April 03, 2020 19:25 ET (23:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

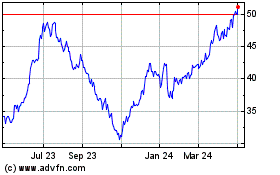

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

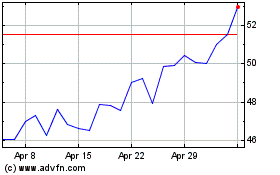

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Apr 2023 to Apr 2024