Current Report Filing (8-k)

February 20 2020 - 5:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 20, 2020 (February 13, 2020)

ASSERTIO THERAPEUTICS, INC.

(Exact name of registrant as specified in

its charter)

001-13111

(Commission File Number)

|

Delaware

|

|

94-3229046

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer Identification No.)

|

|

incorporation)

|

|

|

100 S. Saunders Road, Suite 300, Lake

Forest, IL 60045

(Address of principal executive offices,

with zip code)

(224) 419-7106

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class:

|

|

Trading

Symbol(s):

|

|

Name of each exchange

on which registered:

|

|

Common Stock, $0.0001 par value

|

|

ASRT

|

|

The Nasdaq Stock Market LLC

|

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

( see General Instruction A.2. below):

¨ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

Item 1.02

|

Termination of a Material Definitive Agreement

|

The information set

forth under Item 2.01 of this Current Report on Form 8-K regarding the termination of the Commercialization Agreement

and the Deerfield Note Purchase Agreement is incorporated herein by reference.

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

On

February 13, 2020, Assertio Therapeutics, Inc. (the “Company”), consummated the transaction (the “Transaction”)

contemplated by the previously announced Asset Purchase Agreement dated February 6, 2020 (the “Asset Purchase Agreement”)

with Collegium Pharmaceutical, Inc. (“Collegium”). Pursuant to the Asset Purchase Agreement, the Company

divested its remaining rights, title and interest in and to the NUCYNTA® franchise of products (the “Products”)

to Collegium. Under the terms of the Asset Purchase Agreement, Collegium paid the Company at closing (the “Closing”)

$375.0 million in cash, less royalties paid to the Company by Collegium between January 1, 2020 and February 11, 2020. Collegium

also paid the Company for certain inventory and equipment relating to the Products.

Pursuant to the terms of the Asset Purchase

Agreement, Collegium also assumed certain contracts, liabilities and obligations of the Company relating to the Products, including

those related to manufacturing and supply, post-market commitments and clinical development costs.

From January 9, 2018 (i) through the closing

date, Collegium was responsible for the commercialization of the Products in the United States, including sales and marketing,

and (ii) through February 11, 2020, the Company received royalties on all of Collegium’s Product revenues based on certain

net sales thresholds, in accordance with the commercialization agreement by and among the Company, Collegium and Collegium NF,

LLC, dated as of December 4, 2017 (as amended, the “Commercialization Agreement”). The Commercialization Agreement

was terminated at Closing with certain specified provisions of the Commercialization Agreement surviving in accordance with the

terms of the Asset Purchase Agreement.

On

February 13, 2020, the Company also repaid in full all outstanding indebtedness,

and terminated all commitments and obligations, under its Note Purchase Agreement, dated

as of March 12, 2015 (as amended, the “Deerfield Note Purchase Agreement”),

by and among the Company, the noteholders party thereto and Deerfield Private Design Fund III, L.P., as collateral agent.

The Company’s payments to the noteholders under the Deerfield Note Purchase Agreement were approximately $110.9 million,

including $3.1 million and $4.4 million of prepayment premiums and exit fees, respectively. In connection with the termination

of the Deerfield Note Purchase Agreement, the Company was released from all security interests, liens and encumbrances under the

Deerfield Note Purchase Agreement.

The foregoing description of the Transaction

contained in this Item 2.01 does not purport to be complete and is qualified in its entirety by reference to the Asset Purchase

Agreement, a copy of which is attached as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On

February 19, 2020, the Company announced it has entered into separate, privately negotiated purchase agreements (the “Purchase

Agreements”) with a limited number of holders of the Company’s currently outstanding 2.50% Convertible Senior

Notes due 2021 and 5.00% Convertible Senior Notes due 2024 (the “Purchased Notes”). Pursuant to the Purchase

Agreements, the Company repurchased approximately $188 million aggregate principal amount of Purchased Notes for a cash payment

plus accrued but unpaid interest on the Purchased Notes.

This Current Report on Form 8-K contains

certain forward-looking statements within the meaning of the federal securities laws that involve material risks, assumptions and

uncertainties. Many possible events or factors could affect our future results and performance, such that our actual results and

performance may differ materially from those that may be described or implied in the forward-looking statements. As such, no forward-looking

statement can be guaranteed. The factors that could cause actual results to differ from what is described herein, include any failure

of the purchase transactions to close due to failure of conditions to closing, financial market conditions or otherwise. The Company

is subject to additional risks and uncertainties described in the Company’s annual report on Form 10-K and subsequent quarterly

reports on Form 10-Q. You are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s

analysis and expectations only as of the date of this Form 8-K. Except as required by law, we undertake no obligation to publicly

release the results of any revision or update of these forward-looking statements, whether as a result of new information, future

events or otherwise.

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(b) Pro Forma Financial Information

Attached as Exhibit 99.1 hereto and incorporated

by reference is the unaudited pro forma financial information of the Company giving effect to the Transaction.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ASSERTIO THERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

Date: February 20, 2020

|

By:

|

/s/ Daniel A. Peisert

|

|

|

|

Daniel A. Peisert

|

|

|

|

Senior Vice President and Chief Financial Officer

|

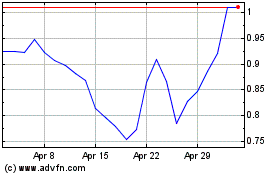

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Assertio (NASDAQ:ASRT)

Historical Stock Chart

From Apr 2023 to Apr 2024