Filed Pursuant to Rule 424(b)(5)

Registration No. 333-233774

Registration No. 333-236504

PROSPECTUS SUPPLEMENT

(To Prospectus dated October 28, 2019)

GENPREX, INC.

5,000,000 Shares of Common Stock

We are offering 5,000,000 shares of our common stock, par value $0.001 per share, pursuant to this prospectus supplement and the accompanying prospectus and a securities purchase agreement at a price of $3.50 per share.

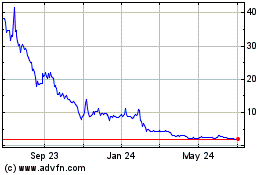

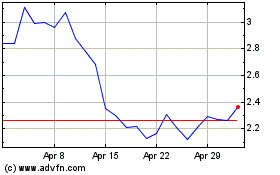

Our common stock is listed on The Nasdaq Capital Market under the symbol “GNPX”. On February 18, 2020, the last reported sale price of our common stock on The Nasdaq Capital Market was $4.90 per share.

We have retained A.G.P./Alliance Global Partners as lead placement agent and Joseph Gunnar & Company, LLC to act as co-placement agent (the "placement agents") in connection with this offering. The placement agents have agreed to use their reasonable best efforts to sell the securities offered by this prospectus supplement and the accompanying prospectus. The placement agents are not purchasing or selling any shares offered by this prospectus supplement and the accompanying base prospectus. See "Plan of Distribution" beginning on page S-15 of this prospectus supplement for more information regarding these arrangements.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Total(1)

|

|

|

Public offering price

|

|

$

|

3.50

|

|

|

$

|

17,500,000

|

|

|

Placement agent's fees

|

|

$

|

0.2625

|

|

|

$

|

1,312,500

|

|

|

Proceeds to us, before expenses

|

|

$

|

3.2375

|

|

|

$

|

16,187,500

|

|

|

(1)

|

We have agreed to pay the placement agents an aggregate cash placement fee equal to 7.5% of the gross proceeds in this offering. We have also agreed to reimburse the placement agent for certain expenses incurred in connection with this offering. For additional information on the placement agent's fees and expense reimbursement, see "Plan of Distribution" beginning on page S-15 of this prospectus supplement.

|

Delivery of the shares of common stock to investors is expected on or about February 21, 2020.

________________________

Lead Placement Agent

A.G.P.

Co-Placement Agent

Joseph Gunnar & Co.

The date of this prospectus supplement is February 19, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

You should rely only on the information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein. We have not authorized, and the placement agents have not authorized, anyone to provide you with information that is different. The information contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein, is accurate only as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our securities. It is important for you to read and consider all information contained in this prospectus supplement and the accompanying prospectus, including the documents incorporated by reference herein, in making your investment decision. You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus supplement and in the accompanying prospectus.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the accompanying prospectus and the offering of our securities in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

Unless otherwise mentioned or unless the context requires otherwise, all references in this prospectus supplement to the “Company,” “we,” “us,” “our” and “Genprex” refer to Genprex, Inc., a Delaware corporation, and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS AND INDUSTRY DATA

This prospectus supplement, the accompanying prospectus and the documents we incorporate by reference herein and therein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. Any statement contained in this prospectus supplement, the accompanying prospectus or in the documents we incorporate by reference herein and therein other than a statement of historical fact, may be a forward-looking statement, including statements regarding our future discovery, development and commercialization efforts, strategy, future operations, future financial position, future revenue, projected costs, prospects, plans and objectives of management. In some cases, you can identify forward-looking statements by such terms as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “might,” “may,” “plan,” “project,” “should,” “target,” “will,” “would” or other words that convey uncertainty of future events or outcomes to identify these forward-looking statements. Forward-looking statements may include, but are not limited to, statements about:

|

|

●

|

our ability to obtain additional funding to develop our current and potential product candidates;

|

|

|

●

|

the need to obtain regulatory approval of our current and potential product candidates;

|

|

|

●

|

the success of our clinical trials through all phases of clinical development;

|

|

|

●

|

compliance with obligations under intellectual property licenses with third parties;

|

|

|

●

|

any delays in regulatory review and approval of product candidates in clinical development;

|

|

|

●

|

our ability to commercialize our current and potential product candidates;

|

|

|

●

|

market acceptance of our current and potential product candidates;

|

|

|

●

|

competition from existing products or new products that may emerge;

|

|

|

●

|

potential product liability claims;

|

|

|

●

|

our dependence on third-party manufacturers to supply or manufacture our products;

|

|

|

●

|

our ability to establish or maintain collaborations, licensing or other arrangements;

|

|

|

●

|

our ability and third parties’ ability to protect intellectual property rights;

|

|

|

●

|

our ability to adequately support future growth; and

|

|

|

●

|

our ability to attract and retain key personnel to manage our business effectively.

|

If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements.

You should consider these factors and the other cautionary statements made in this prospectus supplement, the accompanying prospectus and the documents we incorporate by reference herein and therein as being applicable to all related forward-looking statements wherever they appear in this prospectus supplement, the accompanying prospectus, or the documents incorporated by reference. While we may elect to update forward-looking statements wherever they appear in this prospectus supplement, the accompanying prospectus, or the documents incorporated by reference herein and therein, we do not assume, and specifically disclaim, any obligation to do so, whether as a result of new information, future events or otherwise, unless required by law.

This prospectus summary also includes statistical and other industry and market data that we obtained from industry publications and research, surveys and studies conducted by third parties. All of the market data used in this report involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such data. We believe that the information from these industry publications, surveys and studies is reliable. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of important factors, including those risks discussed (i) under the heading “Risk Factors” on page S-9 of this prospectus supplement, (ii) in the section titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2018, as filed with the SEC on April 1, 2019, as amended on October 16, 2019 (the “Annual Report”), as updated in our quarterly reports on Form 10-Q and (iii) in other filings we make with the SEC from time to time. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

PROSPECTUS SUPPLEMENT SUMMARY

This summary does not contain all of the information that you should consider before investing in our securities. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the financial statements and other information incorporated by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision. In addition, please read the “Risk Factors” section of this prospectus supplement beginning on page S-9 and the risk factors contained in our Annual Report.

Company Overview

Genprex™ is a clinical stage gene therapy company developing a new approach to treating cancer, based upon our novel proprietary technology platform, including our initial product candidate, Oncoprex™ immunogene therapy, or Oncoprex, for non-small cell lung cancer ("NSCLC"). Our platform technologies are designed to administer cancer fighting genes by encapsulating them into nanoscale hollow spheres called nanovesicles, which are then administered intravenously and taken up by tumor cells where they express proteins that are missing or found in low quantities. Oncoprex has a multimodal mechanism of action whereby it interrupts cell signaling pathways that cause replication and proliferation of cancer cells, re-establishes pathways for apoptosis, or programmed cell death, in cancer cells, and modulates the immune response against cancer cells. Oncoprex has also been shown to block mechanisms that create drug resistance.

In January, 2020, we received a United States FDA Fast Track Designation for use of Oncoprex™ in combination with EGFR inhibitor osimertinib (AstraZeneca’s Tagrisso®) for the treatment of NSCLC patients with EFGR mutations that progressed after treatment with osimertinib alone. The FDA may award Fast Track Designation if it determines that a product either alone or in combination with one or more products demonstrates the potential to address unmet medical needs for a serious or life-threatening disease or condition. The Fast Track Designation is intended to facilitate the development of and to expedite the review of products that may treat serious and life-threatening conditions so that such product can reach the market expeditiously.

Fast Track drug candidates must show advantages over available therapies, such as superior effectiveness, avoiding serious side effects, improving diagnosis and outcome, decreasing significant toxicity, and the ability to address public health needs. Fast Track Designation recipients may also be eligible for accelerated approval or rolling review of the recipient’s Biologics License Application (BLA). In addition, Fast Track product candidates could be eligible for priority review if supported by clinical data at the time of BLA submission.

We hold an exclusive worldwide license from The University of Texas MD Anderson Cancer Center, or MD Anderson, to patents covering the therapeutic use of a series of genes that have been shown in preclinical and clinical research to have cancer fighting properties.

With Oncoprex, we are initially targeting NSCLC. Researchers at MD Anderson have conducted two Phase I clinical trials and are currently conducting an ongoing Phase II clinical trial of Oncoprex plus erlotinib in NSCLC. According to the World Health Organization ("WHO"), lung cancer is the leading cause of cancer deaths worldwide in 2018, killing more people than colorectal, liver, stomach, and breast cancers, and is the second most common type of cancer. According to WHO, in 2018, there were over 2 million new lung cancer cases and over 1.7 million deaths from lung cancer worldwide, and the National Cancer Institute estimated that in 2019 there would be over 228,000 new cases and more than 142,000 deaths from lung cancer in the United States. According to the American Society of Clinical Oncology, NSCLC represents 84% of all lung cancers. According to NCI, the five-year survival rate for Stage IV (metastatic) NSCLC is approximately 5%, and overall survival for lung cancer has not improved appreciably in the last 25 years. We believe that there is a significant unmet medical need for new treatments for NSCLC in the United States and globally, and we believe that Oncoprex may be suitable for a majority of NSCLC patients.

We believe that our platform technologies could allow delivery of a number of cancer fighting genes, alone or in combination with other cancer therapies, to combat multiple types of cancer. Our research and development pipeline, discussed in “Our Pipeline” below, demonstrates our clinical and preclinical progress to date.

Cancer results from genetic mutations. Mutations that lead to cancer are usually present in two major classes of genes: oncogenes, which are involved in functions such as signal transduction and transcription; and tumor suppressor genes, which play a role in governing cell proliferation by regulating transcription. Transduction is the process by which chemical and physical signals are transmitted through cells. Transcription is the process by which a cell’s DNA sequence is copied to make RNA molecules, which then play a role in protein expression. In normal cells, mutations in oncogenes are discovered and targeted for elimination by tumor suppressor genes. In cancer cells, the oncogene mutations may overwhelm the natural tumor suppression processes, or those tumor suppression processes may be impaired or absent. Functional alterations due to mutations in oncogenes or tumor suppressor genes may result in the abnormal and uncontrolled growth patterns characteristic of cancer. These genetic alterations facilitate such malignant growth by affecting signal transduction pathways and transcription, thus inhibiting normal growth signaling in the cell, circumventing the natural process of apoptosis, evading the immune system’s response to cancer, and inducing angiogenesis, which is the formation of new blood vessels that supply cancer cells.

The most common genetic alterations present in NSCLC are in tumor suppressor genes, against which few targeted small molecule drugs have been developed. Each of the two sets of chromosomes in the cell nucleus includes two copies of each gene, called alleles, which may be identical or may show differences. In most situations, tumor suppressor genes require both alleles of a gene to be deleted or inactivated to impair tumor suppression activity and lead to tumor growth. The replacement of just one functional allele may therefore be enough to restore the normal cellular functions of growth regulation and apoptosis.

Among the genetic conditions associated with lung cancer are the overexpression of epidermal growth factor receptors, or EGFRs, and mutations of kinases. Kinases are enzymes that play an important role in signal transduction through the modification of proteins by adding or taking away phosphate groups, a process called (de-)phosphorylation, to change the proteins’ function. When two EGFR transmembrane proteins are brought to proximity on the cell membrane surface, or dimerize, either through a ligand, or binding molecule, that binds to the extracellular receptor, or through some other process, the intracellular protein-kinase domains can autophosphorylate, and activate downstream processes, including cell signaling pathways that can lead to either cell cycle arrest or cell growth and proliferation. EGFRs and kinases can act similarly to a switch that turns “on” and “off” when phosphate groups are either added or taken away. Mutated kinases can have a malfunctioning on/off switch, causing the switch to be stuck in the “on” position or failing to turn the switch “off,” leading to the loss of cell control.

A subset of NSCLC patients (approximately 7% of NSCLC patients of North American and European descent and approximately 30% to 50% of NSCLC patients of Asian descent) carry an EGFR mutation that makes their tumors sensitive to tyrosine kinase inhibitors, or TKIs, such as erlotinib or osimertinib. However, even for these patients, tumor resistance to TKIs frequently develops within two to three years, resulting in eventual disease progression. Erlotinib or osimertinib generally do not benefit NSCLC patients who do not have this activating EGFR mutation. However, our clinical and preclinical data have shown that the combination of Oncoprex and erlotinib can increase anti-tumor activity even in cancers without the EGFR mutations, as well as in cancers that have become resistant to erlotinib. For this reason, we believe Oncoprex may be suitable for the majority of NSCLC patients.

Cancer can spread when cells’ natural cancer suppression functions are impaired. The tumor suppressor gene called Tumor Suppressor Candidate 2, or TUSC2 (which was formerly known as FUS1) has been shown to affect both cell proliferation and apoptosis. TUSC2 is a pan-kinase inhibitor, which means that it has the ability to inhibit multiple kinase receptors, such as EGFR and platelet-derived growth factor receptor, or PDGFR. TUSC2 is frequently inactivated early in the development of lung cancer, and loss of TUSC2 expression in NSCLC is associated with significantly worse overall survival compared to patients with normal TUSC2 expression. Many types of cancer cells, including approximately 80% of NSCLC cells, lack expression of TUSC2.

Cancer can also spread when the body’s natural immune functions are impaired, including by the cancer cells themselves. PD-1, or Programmed Death-1, is a receptor expressed on the surface of activated T cells, which are part of the body’s immune system. PD-L1, or Programmed Death Ligand-1, is a protein/receptor expressed on the surface of cancer and other cells. The binding of PD-1 to PD-L1 has been speculated to contribute to cancer cells’ ability to evade the body’s immune response. PD-1 and molecules like it are called immune checkpoints, because they can impede the normal immune response, for example by blocking the T cells from attacking the cancer cells. In many cancers, PD-L1 receptors are up-regulated, and substantial research is now being performed in the emerging field of immuno-oncology to discover drugs or antibodies that could block PD-L1 and similar receptors. It is believed that blocking the PD-1/PD-L1 interaction pathway and other similar checkpoints, such as cytotoxic T-lymphocyte-associated protein 4, or CTLA-4, with drugs called checkpoint inhibitors can prevent cancer cells from inactivating T cells.

Our Oncoprex immunogene therapy is designed to interrupt cell signaling pathways that cause replication and proliferation of cancer cells, and to target and kill cancer cells via receptor pathways, and also to stimulate the natural immune responses against cancer. Oncoprex combines features of gene therapy and immunotherapy in that it up-regulates TUSC2 expression in the cell, and also increases the anti-tumor immune cell population and down-regulates PD-L1 receptors, thereby potentially boosting the immune response to cancer.

Oncoprex consists of a TUSC2 gene encapsulated in a nanovesicle made from lipid molecules with a positive electrical charge. Oncoprex is injected intravenously and can specifically target cancer cells, which generally have a negative electrical charge. Once Oncoprex is taken up into a cancer cell, the TUSC2 gene is expressed into a protein that is capable of restoring certain defective functions arising in the cancer cell. Oncoprex nanovesicles are designed to deliver the functioning TUSC2 gene to cancer cells while minimizing their uptake by normal tissue. Tumor biopsy studies conducted at MD Anderson show that, in three patients, the uptake of TUSC2 in tumor cells after Oncoprex treatment was 10 to 25 times the uptake in normal cells. We believe that Oncoprex, unlike other gene therapies, which either need to be delivered directly into tumors or require cells to be removed from the body, re-engineered and then reinserted into the body, is the first systemic gene therapy to be used for cancer in humans.

Clinical data from the evaluation of 25 patients in our Phase I/II clinical trial, as well as our preclinical data, indicate that Oncoprex can be combined with the widely used anti-cancer drug erlotinib (marketed as Tarceva® by Genentech, Inc.) in humans. Erlotinib is a tyrosine kinase inhibitor, or TKI, which uses a mechanism of action similar to that of pan-kinase inhibitors to block the action of tyrosine kinases, which are a type of kinase involved in many cell functions, including cell signaling, growth and division. In addition, MD Anderson researchers have conducted preclinical studies combining Oncoprex with:

|

|

●

|

the TKI gefitinib (marketed as Iressa® by AstraZeneca Pharmaceuticals) in animals and in human NSCLC cells;

|

|

|

●

|

third generation TKIs such as osimertinib (marketed as Tagrisso® by AstraZeneca Pharmaceuticals);

|

|

|

●

|

MK2206 in animals (MK2206 is an inhibitor of AKT kinases, which affect cell signaling pathways downstream from tyrosine kinases);

|

|

|

●

|

an anti-PD-1 antibody equivalent to the checkpoint inhibitor pembrolizumab (marketed as Keytruda® by Merck & Co. ) in animals;

|

|

|

●

|

an anti-PD-1 antibody equivalent to the checkpoint inhibitor nivolumab (marketed as Opdivo® by Bristol-Myers Squibb Company) in animals; and

|

|

|

●

|

an anti-CTLA4 antibody equivalent to ipilimumab (marketed as Yervoy® by Bristol-Myers Squibb Company) in animals.

|

The manufacturers of the marketed drugs were not involved in any of our clinical or preclinical studies. In studies involving marketed drugs, the drugs were administered concurrently with Oncoprex without being modified in any way, and the antibodies used in our preclinical studies that did not use the marketed drugs were the non-humanized equivalent to marketed drugs.

Data from these clinical and preclinical studies indicate that combining Oncoprex with these other therapies yields results more favorable than either these therapies or Oncoprex alone, with minimal side effects relative to other lung cancer drugs, thereby potentially making Oncoprex a therapy complementary to these cancer treatments. In addition, based on our clinical and preclinical studies and on preclinical studies conducted by others, we believe that Oncoprex could be combined with other lung cancer drugs that have similar mechanisms of action to the drugs mentioned above, such as nivolumab (marketed as Opdivo® by Bristol-Myers Squibb Company) and atezolizumab (marketed as Tecentriq® by Genentech/Roche). We have not conducted any preclinical or clinical studies combining Oncoprex with atezolizumab.

Researchers at MD Anderson have collaborated with other researchers to identify other genes, such as those in the 3p21.3 chromosomal region, that may act as tumor suppressors or have other cancer fighting functions. We hold rights to certain of these genes under license agreements with MD Anderson. Data from preclinical studies performed by others suggest that product candidates that could be derived from our technology platform could be effective against other types of cancer, including glioblastoma, head and neck, breast, renal cell (kidney), and soft tissue sarcoma, as well as NSCLC. Therefore, our platform technologies may allow delivery of a number of cancer fighting genes, alone or in combination with other cancer therapies, to combat multiple types of cancer.

In 2012, MD Anderson researchers completed a Phase I clinical trial of Oncoprex as a monotherapy. The primary objective of this Phase I trial was to assess the toxicity of Oncoprex administered intravenously and to determine the maximum tolerated dose, or MTD, and recommended Phase II dose of Oncoprex alone. Secondary objectives were to assess the expression of TUSC2 following intravenous delivery of Oncoprex in tumor biopsies and also to assess the anticancer activity of Oncoprex. This trial demonstrated that Oncoprex was well tolerated and established the MTD and the therapeutic dosage for Oncoprex at 0.06 mg/kg administered every 21 days. Although this trial was not designed to show changes in outcomes, a halt in cancer growth was observed in a number of patients, and tumor regressions occurred in primary lung tumors and metastatic cancers in the liver, pancreas, and lymph nodes. In addition, pre- and post-treatment patient biopsies demonstrated that intravenous Oncoprex selectively and preferentially targeted patients’ cancer cells, and suggested that clinical anti-cancer activity was mediated by TUSC2.

We believe that Oncoprex’ combination of pan-kinase inhibition, direct induction of apoptosis, anti-cancer immune modulation and complementary action with targeted drugs and immunotherapies is unique, and positions Oncoprex to provide treatment for patients with NSCLC and possibly other cancers, who are not benefitting from currently offered therapies.

MD Anderson researchers have completed the first phase of a Phase I/II clinical trial of Oncoprex in combination with erlotinib in patients with Stage IV (metastatic) or recurrent NSCLC that is not potentially curable by radiotherapy or surgery, whether or not they have received prior chemotherapy, and whether or not they have an activating EGFR mutation. The Phase I portion of the trial was a dose-escalating study with primary endpoints of establishing the safety and tolerability of the combination of Oncoprex and erlotinib, and establishing the MTD. The secondary endpoint of the Phase I portion of the trial was to assess the toxicity of the combination of Oncoprex with erlotinib. In the Phase I portion of the trial, which began in 2014, 18 subjects were treated, and the MTD was determined to be the highest tested dose: 0.06 mg/kg of Oncoprex administered every 21 days and 150 mg of erlotinib per day. Toxicities were found to compare favorably with those of other lung cancer drugs.

The Phase II portion of the trial was designed to include subjects treated with the combination of Oncoprex and erlotinib at the MTD with the primary goal of measuring the response rate, and secondary endpoints of stable disease, time to progression and overall survival. The response rate for cancer therapies is defined under the Response Evaluation Criteria in Solid Tumors, or RECIST, as Complete Response (CR) + Partial Response (PR); disease control rate is defined under the RECIST criteria as Complete Response (CR) + Partial Response (PR) + Stable Disease (SD)>8weeks.

Enrollment criteria for the second phase of the Phase I/II clinical trial are identical to those in the first phase. The Phase II portion of the trial began in June 2015 and is ongoing at MD Anderson. Of the 39 patients allowed in the protocol for the Phase II portion of the trial, ten have been enrolled and nine are evaluable for response under the trial protocol, because they have received two or more cycles of treatment. Interim results show that four of the patients had tumor regression and one patient had a Complete Response, or CR under the RECIST criteria. The patient with the CR had disappearance of the lung primary tumor, as well as lung, liver, and lymph node metastases. The median response duration for all patients, which is defined as the median time between when response is first noted to the time when cancer progression is observed, was three months. The response rate for the nine patients evaluated to date was 11% and the disease control rate for the nine patients was 78%.

The response rate and disease control rate to date in the Phase II portion of our Phase I/II clinical trial substantially exceeds the response rate of 7% (with no CRs) and disease control rate of 58% reported for a clinical trial of the TKI afatinib (marketed as Gilotrif® by Boehringer Ingelheim Pharmaceuticals, Inc.) in a study referred to as the LUX-Lung 1 clinical trial. A total of 585 patients were enrolled in that Phase IIB/III clinical trial, whose primary endpoint was overall survival and whose secondary endpoints were progression-free survival, RECIST response, quality of life and safety. The LUX-Lung 1 clinical trial was a randomized, double blinded Phase IIB/III clinical trial treating subjects with Stage IIIB or IV adenocarcinoma, a type of NSCLC. The Phase II portion of our Phase I/II trial is not blinded, and is designed to treat NSCLC subjects regardless of EGFR status.

Preliminary analysis of the early data from the Phase II portion of our Phase I/II trial supports our belief that Oncoprex may provide medical benefit in several subpopulations of NSCLC patients for which there is an unmet medical need, and may provide pathways for accelerated approval by the US Food and Drug Administration, or FDA. As a result of these initial findings, in April 2016, we suspended enrollment of new patients in the Phase II portion of the trial to collect additional trial data and have it analyzed in order to seek FDA guidance as to whether the protocol for this clinical trial could be modified to expand enrollment and also to divide the patients into cohorts with a view toward seeking accelerated approval in one or more of these cohort populations. We subsequently decided not to modify the trial, but to continue it as originally designed. Although this clinical trial is currently closed to new patient enrollment, it is not terminated, and is considered “ongoing” because activities such as patient follow-up and further data collection and analysis continue.

We now plan to reopen enrollment in the current version of the Phase II portion of the trial. We have encountered delays in reopening this trial at MD Anderson and will likely reopen the trial at one or more other clinical trial sites. We intend to use a portion of our available funds to add additional clinical trial sites.

Our Oncoprex immunogene therapy technology was discovered through a lung cancer research consortium from MD Anderson and The University of Texas Southwestern Medical Center along with the National Cancer Institute. The TUSC2 discovery teams included Jack A. Roth, MD, FACS, chairman of our Scientific and Medical Advisory Board. We have assembled a team of experts in clinical and translational research, including laboratory scientists, medical oncologists and biostatisticians, to pursue the development and commercialization of Oncoprex and other potential product candidates.

Our technology discoveries and research and development programs have been the subjects of numerous peer-reviewed publications and have been supported by Small Business Innovation Research grants and grants from the National Institutes of Health, the United States Department of Treasury, and the State of Texas. We hold a worldwide, exclusive license from MD Anderson to patents covering the therapeutic use of TUSC2 and other genes that have been shown to have cancer fighting properties, as well as a number of related technologies, including 33 issued patents, and two pending patent applications. The rights we have obtained pursuant to our license agreement with MD Anderson are made subject to the rights of the U.S. government to the extent that the technology covered by the licensed intellectual property was developed under a funding agreement between MD Anderson and the U.S. government.

Our Pipeline

We are developing Oncoprex, our lead product candidate, to be administered with EGFR inhibitors such as erlotinib and osimertinib for NSCLC. We are also conducting preclinical research with the goal of developing Oncoprex to be administered with immunotherapies in NSCLC. In addition, we have conducted research into other tumor suppressor genes associated with chromosome 3p21.3. Our research and development pipeline is shown below:

Our Strategy

We intend to develop and commercialize treatments for cancer based on our proprietary gene therapy platform, alone or in combination with other cancer therapies. Key elements of our strategy include:

|

|

●

|

Conduct Ongoing and New Clinical Trials. We plan to continue clinical trials of Oncoprex immunogene therapy in combination with EGFR TKIs, such as erlotinib or osimertinib, and/or in combination with immunotherapies, such as anti-PD-1 immunotherapy, for treatment of NSCLC, while exploring pathways to accelerated FDA approval of this combination in NSCLC patients. We also may pursue clinical trials using multi-drug combinations of Oncoprex with additional targeted therapies and immunotherapies.

|

|

|

●

|

Investigate the Effectiveness of Oncoprex in Other Cancers. We may also explore the combination of Oncoprex and other therapies in other cancers such as soft tissue, kidney, head and neck, and/or breast cancer. We may also pursue development of additional proprietary genes, alone or in combination with EGFR TKIs such as erlotinib or osimertinib and/or with immunotherapies.

|

|

|

●

|

Prepare to Commercialize Oncoprex. We plan to continue to develop the manufacturing, process development and other capabilities needed to commercialize Oncoprex.

|

|

|

●

|

Pursue Strategic Partnerships. As we gather additional clinical data, we plan to pursue strategic partnerships with other developers and providers of anti-cancer drugs to investigate possible therapeutic combinations of Oncoprex with drugs manufactured by others, to accelerate the development of our current and potential product candidates through co-development and to increase the commercial opportunities for our current and potential product candidates.

|

|

|

●

|

Develop Our Platform Technology. We plan to investigate the applicability of our platform technology with additional anti-cancer drugs.

|

|

|

●

|

Acquire Additional Technologies. We are investigating other technologies for possible acquisition, and plan to add additional technologies to our pipeline should we have the opportunity to do so on acceptable financial terms.

|

Recent Development

On February 11, 2020, we and the University of Pittsburgh - Of the Commonwealth System of Higher Education (“UP”) entered into an Exclusive License Agreement (the “UP License Agreement”), pursuant to which UP granted to the Company a worldwide, exclusive license under certain patents and related technology, referred to collectively as the licensed technology, and a worldwide, non-exclusive license to use certain related know-how, all related to diabetes therapy. UP has reserved the royalty-free, nonexclusive right to practice the patent rights and know-how and to use the licensed technology for non-commercial education and research purposes, and the Company has agreed to sell licensed technology to UP and its affiliates upon request at the price and terms as are made available to the Company’s most favored customer. The licenses granted to Genprex under the UP License Agreement are subject to the rights of the U.S. government, which may have acquired a nonexclusive, nontransferable, paid up license to practice or have practiced for or on behalf of the United States the inventions described in the patent rights throughout the world. As consideration for the UP License Agreement, Genprex agreed to pay UP an initial license fee, annual maintenance fees, running royalties, minimum annual royalties, a share of non-royalty sublicense income, and certain milestone payments, as well as patent prosecution expenses incurred prior to and after the effective date of the UP License Agreement. The UP License Agreement remains in effect until the later of 20 years after the first commercial sale of the licensed technology or the expiration of the last valid claim of the patents licensed under the UP License Agreement unless such agreement is earlier terminated pursuant to its terms.

Corporate Information

We were incorporated in Delaware in April 2009. Our principal executive offices are located at 1601 Trinity Street, Bldg. B, Suite 3.322, Austin, TX 78712, and our telephone number is (512) 537-7997. Our corporate website address is www.genprex.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our securities.

THE OFFERING

|

Common stock offered by us

|

|

5,000,000 shares.

|

|

|

|

|

|

Common stock to be outstanding immediately after this offering

|

|

32,849,841 shares.

|

|

|

|

|

|

Public offering price

|

|

$3.50 per share.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate the net proceeds from this offering will be approximately $16 million, after deducting the placement agent's fees and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for working capital and other general corporate purposes. See "Use of Proceeds" beginning on page S-12 of this prospectus supplement for additional detail.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page S-9 this prospectus supplement and other information included or incorporated by reference into this prospectus supplement before deciding to invest in our securities.

|

|

|

|

|

|

Trading symbol

|

|

Our common stock is listed on The Nasdaq Capital Market under the symbol "GNPX.”

|

The number of shares of common stock to be outstanding immediately after this offering is based on 27,849,841 shares of common stock outstanding as of February 18, 2020, and excludes as of that date:

|

|

●

|

7,476,056 shares of common stock underlying warrants to purchase shares of our common stock at a weighted average exercise price of $1.45 per share;

|

|

|

●

|

6,022,923 shares of common stock underlying options to purchase shares of our common stock at a weighted average exercise price of $2.65 per share;

|

|

|

●

|

208,050 shares of common stock reserved for issuance under our 2018 Employee Stock Purchase Plan; and

|

|

|

●

|

2,490,975 shares of common stock reserved for issuance under our 2018 Equity Incentive Plan.

|

RISK FACTORS

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below and the risk factors contained in our Annual Report, together with other information in this prospectus supplement, and the accompanying prospectus, and the information and documents incorporated by reference in this prospectus supplement and the accompanying prospectus, and in any free writing prospectus that we have authorized for use in connection with this offering. If any of these risks actually occurs, our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment.

Risks Related to This Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. The failure by our management to apply these funds effectively could result in financial losses, and these financial losses could have a material adverse effect on our business, cause the price of our common stock to decline and delay the development of our product candidates. We may invest the net proceeds from this offering, pending their use, in a manner that does not produce income or that loses value.

If you purchase securities in this offering, you will suffer immediate dilution of your investment.

The public offering price of our common stock is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase securities in this offering, you will pay an effective price per share of common stock that substantially exceeds our net tangible book value per share after giving effect to this offering. Based on a public offering price of $3.50 per share of common stock, if you purchase securities in this offering, you will experience immediate dilution of $2.65 per share, representing the difference between the public offering price of the securities and our pro forma as adjusted net tangible book value per share after giving effect to this offering. Furthermore, if any of our outstanding options or warrants are exercised at prices below the public offering price, we grant additional options or other awards under our equity incentive plans or issue additional warrants, you may experience further dilution of your investment. See the section entitled “Dilution” below for a more detailed illustration of the dilution you would incur if you participate in this offering.

If you purchase securities in this offering, you may also experience future dilution as a result of future equity offerings.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price paid by investors in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price paid by investors in this offering.

We have no intention of declaring dividends in the foreseeable future.

The decision to pay cash dividends on our common stock rests with our board of directors and will depend on our earnings, unencumbered cash, capital requirements and financial condition. We do not anticipate declaring any dividends in the foreseeable future, as we intend to use any excess cash for the development, operation and expansion of our business. Investors in our common stock should not expect to receive dividend income on their investment, and investors will be dependent on the appreciation of our common stock, if any, to earn a return on their investment.

If we are not able to comply with the applicable continued listing requirements or standards of The Nasdaq Capital Market (“Nasdaq”), Nasdaq could delist our common stock.

Our common stock is currently listed on Nasdaq. In order to maintain such listing, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’ equity, minimum share price, and certain corporate governance requirements.

On June 10, 2019, the Company notified Nasdaq that it was not in compliance with Nasdaq Listing Rule 5605(c)(2)(A) as a result of the resignation of a member of the Company’s board who was also a member of the Company’s Audit Committee. Nasdaq Listing Rule 5605(c)(2)(A) requires the Audit Committee to have at least three independent members (as defined by Nasdaq Listing Rule 5605(a)(2) and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934), at least one of whom is an audit committee financial expert. As a result of the resignation of Dr. Bonfiglio, the Company no longer has an Audit Committee comprised of three independent directors. The Nasdaq Listing Rules provide for a cure period during which the Company may regain compliance with Nasdaq Listing Rule 5605(c)(2)(A). Under Nasdaq Listing Rule 5605(c)(4), the Company shall have until the earlier of its next annual meeting of stockholders or one year from the occurrence of the event that caused the failure to comply with Nasdaq Listing Rule 5605(c)(2)(A); provided, however, that if the next annual meeting of stockholders occurs no later than 180 days following the event that caused the vacancy, the Company shall instead have 180 days from such event to regain compliance.

There can be no assurances that we will be able to regain compliance with Nasdaq’s listing standards or if we do later regain compliance with Nasdaq’s listing standards, will be able to continue to comply with the applicable listing standards. If we are unable to maintain compliance with these Nasdaq requirements, our common stock will be delisted from Nasdaq.

If Nasdaq delists our common stock, we could face significant material adverse consequences, including:

|

|

●

|

a limited availability of market quotations for our securities;

|

|

|

●

|

a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock;

|

|

|

●

|

a limited amount of news and analyst coverage for our company; and

|

|

|

●

|

a decreased ability to issue additional securities or obtain additional financing in the future.

|

If we are unable to secure contract manufacturers with capabilities to produce the products that we require, we could experience further delays in reopening enrollment of the second phase of our Phase I/II clinical trial.

As the second phase of a Phase I/II clinical trial, MD Anderson researchers are conducting a Phase II clinical trial evaluating Oncoprex in combination with erlotinib in NSCLC. The Phase II trial began in June 2015. We have encountered delays in reopening enrollment primarily because the GMP manufacturing facility at MD Anderson did not have the capacity to produce additional drug product, and requested that, with MD Anderson’s assistance, we transfer the portion of the process which such manufacturing facility had performed to a third party manufacturer. Although we have contracted with contract manufacturers with capabilities to produce the products that we require, no assurance can be given that such contract manufacturers will be able to, and receive all approvals to, produce product sufficient for our trials. In accordance with cGMPs, changing manufacturers may require the re-validation of manufacturing processes and procedures, and may require further preclinical studies or clinical trials to show comparability between the materials produced by different manufacturers. Changing our current or future contract manufacturers may be difficult and could be costly if we do make such a change, which could result in our inability to manufacture our clinical product candidate and a delay in the development of our clinical product candidate. Further, in order to maintain our development timelines in the event of a change in a third-party contract manufacturer, we may incur higher costs to manufacture our clinical product candidate. Furthermore, we may open enrollment at one or more other clinical trial sites prior to, or in lieu of, reopening enrollment at MD Anderson. Any additional clinical trial sites that we open will require approval of the Investigational Review Board, or IRB, and no assurance can be given the IRB will approve such sites in a timely manner, if at all.

Our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

Our financial statements as of December 31, 2018 have been prepared under the assumption that we will continue as a going concern for the next twelve months. Our independent registered public accounting firm included in its opinion for the year ended December 31, 2017 an explanatory paragraph referring to our recurring losses from operations and expressing substantial doubt in our ability to continue as a going concern without additional capital becoming available. Our ability to continue as a going concern is dependent upon our ability to obtain additional equity or debt financing, reduce expenditures and to generate significant revenue. Our financial statements as of December 31, 2018 did not include any adjustments that might result from the outcome of this uncertainty. The reaction of investors to the inclusion of a going concern statement by our auditors, and our potential inability to continue as a going concern, in future years could materially adversely affect our share price and our ability to raise new capital or enter into strategic alliances. Furthermore, we also could be required to seek funds through arrangements with collaborative partners or otherwise that may require us to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us.

Our executive officers, directors and principal stockholders, if they choose to act together, have the ability to control all matters submitted to stockholders for approval.

Upon the closing of this offering, the number of shares of our common stock beneficially owned by our executive officers, directors and principal stockholders and their respective affiliates who owned more than 5% of our outstanding shares of common stock before this offering, will, in the aggregate, represent approximately 25.03% of our outstanding common stock. As a result, if these stockholders were to choose to act together, they would be able to control all matters submitted to our stockholders for approval, as well as our management and affairs. For example, these persons, if they choose to act together, would control the election of directors and approval of any merger, consolidation or sale of all or substantially all of our assets.

This concentration of voting power may:

|

|

●

|

delay, defer or prevent a change in control;

|

|

|

●

|

entrench our management and the board of directors; or

|

|

|

●

|

delay or prevent a merger, consolidation, takeover or other business combination involving us on terms that other stockholders may desire.

|

Future sales of our common stock in the public market could cause our stock price to fall.

Sales of a substantial number of shares of our common stock in the public market, or the perception that these sales might occur, could depress the market price of our common stock and could impair our ability to raise capital through the sale of additional equity securities. As of February 18, 2020, we had 27,849,841 shares of common stock outstanding, all of which shares were, and continue to be, eligible for sale in the public market, subject in some cases to compliance with the requirements of Rule 144, including the volume limitations and manner of sale requirements. In addition, all of the shares offered under this prospectus supplement and the accompanying prospectus will be freely tradable without restriction or further registration upon issuance.

USE OF PROCEEDS

We estimate that the net proceeds from the sale of the common stock in this offering will be approximately $16 million, after deducting the placement agent's fees and estimated offering expenses payable by us.

We currently intend to use the net proceeds from this offering for working capital and other general corporate purposes.

This expected use of net proceeds from this offering and our existing cash and cash equivalents represents our intentions based upon our current plans and business conditions, which could change in the future as our plans and business conditions evolve. The amounts and timing of our actual expenditures may vary significantly depending on numerous factors. As a result, our management will retain broad discretion over the allocation of the net proceeds from this offering. We have no current agreements, commitments or understandings for any material acquisitions or licenses of any products, businesses or technologies.

As of the date of this prospectus supplement, we cannot predict with certainty all the uses for the net proceeds to be received upon the completion of this offering or the amounts we will spend on the uses set forth above. Pending our use of the net proceeds from this offering, we intend to invest a portion of the net proceeds in a variety of capital preservation investments, including short-term, interest-bearing instruments and U.S. government securities.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We currently intend to retain earnings, if any, to finance the growth and development of our business. We do not expect to pay any cash dividends on our common stock in the foreseeable future. Payment of future dividends, if any, will be at the discretion of our board of directors and will depend on our financial condition, results of operations, capital requirements, restrictions contained in any financing instruments, provisions of applicable law and other factors the board deems relevant.

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents, equity and total capitalization as of September 30, 2019:

|

|

●

|

on an actual basis;

|

|

|

|

|

|

|

●

|

on a pro forma basis to reflect (i) the sale of 3,167,986 shares of common stock at a price of $0.40 per share in November 2019, (ii) the sale of 961,000 shares of common stock at a price of $0.24 per share in January 2020, (iii) the sale of 7,620,000 shares of common stock at a price of $1.05 per share in January 2020, and (iv) the issuance of 258,000 shares of common stock issued in October 2019, December 2019, and January 2020 to consultants in consideration for services; and

|

|

|

●

|

on a pro forma as adjusted basis to give effect to the sale of 5,000,000 shares of our common stock in this offering and the application of the estimated net proceeds as described under "Use of Proceeds.”

|

You should read the data set forth in the table below in conjunction with the section of this prospectus supplement under the caption "Use of Proceeds" as well as our "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our financial statements and notes and other financial information included or incorporated by reference in this prospectus supplement.

|

|

|

At September 30, 2019

|

|

|

|

|

Actual

|

|

Pro Forma

|

|

Pro Forma

As Adjusted

|

|

|

Cash and cash equivalents

|

|

$

|

2,548,434

|

|

$

|

11,318,485

|

|

$

|

27,318,485

|

|

|

Preferred stock $0.001 par value: 10,000,000 shares authorized; no shares issued and outstanding

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Common stock $0.001 par value: 200,000,000 shares authorized;

15,842,855, 27,849,841, and 32,849,841 shares issued and outstanding, respectively

|

|

|

15,843

|

|

|

27,850

|

|

|

32,850

|

|

|

Additional paid-in capital

|

|

|

41,569,745

|

|

|

50,406,495

|

|

|

66,401,495

|

|

|

Accumulated deficit

|

|

|

(38,054,490)

|

|

|

(38,054,490)

|

|

|

(38,054,490)

|

|

|

Total stockholders' equity

|

|

|

3,531,098

|

|

|

12,379,855

|

|

|

28,379,855

|

|

|

Total capitalization

|

|

$

|

3,531,098

|

|

$

|

12,379,855

|

|

$

|

28,379,855

|

|

The number of shares of our common stock outstanding after this offering is based on 15,842,855 shares of our common stock outstanding as of September 30, 2019 and excludes as of that date:

|

|

●

|

3,864,552 shares of common stock underlying warrants to purchase shares of our common stock at a weighted average exercise price of $4.60 per share;

|

|

|

●

|

5,700,338 shares of common stock underlying options to purchase shares of our common stock at a weighted average exercise price of $2.75 per share;

|

|

|

●

|

208,050 shares of common stock reserved for issuance under our 2018 Employee Stock Purchase Plan; and

|

|

|

●

|

1,850,368 shares of common stock reserved for issuance under our 2018 Equity Incentive Plan.

|

DILUTION

Purchasers of common stock in this offering will experience immediate dilution to the extent of the difference between the public offering price per share of common stock and the net tangible book value per share of common stock immediately after this offering.

Our net tangible book value as of September 30, 2019 was approximately $3.1 million, or $0.20 per share of common stock. Net tangible book value per share is determined by dividing the net of total tangible assets less total liabilities, by the aggregate number of shares of common stock outstanding as of September 30, 2019.

Our pro forma net tangible book value as of September 30, 2019 was approximately $11.6 million, or $0.42 per share after giving effect to (i) our receipt of net proceeds of $1,093,491 from our November 2019 offering and the issuance of 3,167,986 shares of common stock, (ii) our receipt of net proceeds of $200,000 from our January 2020 offering and the issuance of 961,000 shares of common stock, and (iii) our receipt of net proceeds of $7,190,920 from our January 2020 offering and issuance of 7,620,000 shares of common stock.

After giving effect to the sale by us of 5,000,000 shares of common stock at the public offering price of $3.50 per share of common stock, and after deducting the placement agent's fees and estimated offering expenses, our pro forma as adjusted net tangible book value as of September 30, 2019 would have been approximately $27.5 million, or $0.85 per share of common stock. This represents an immediate increase in pro forma net tangible book value of $0.43 per share to our existing stockholders and an immediate dilution of $2.65 per share of common stock issued to the investors participating in this offering.

The following table illustrates this per share dilution:

|

|

|

|

|

|

|

Amount

|

|

|

Public offering price per share

|

|

|

|

|

|

$

|

3.50

|

|

|

Pro forma net tangible book value per share at September 30, 2019

|

|

$

|

0.42

|

|

|

|

|

|

|

Increase in pro forma net tangible book value per share to the existing stockholders attributable to this offering

|

|

$

|

0.43

|

|

|

|

|

|

|

Pro forma as adjusted net tangible book value per share attributable to this offering

|

|

|

|

|

|

$

|

0.85

|

|

|

Dilution per share to investors participating in this offering

|

|

|

|

|

|

$

|

2.65

|

|

The number of shares of our common stock outstanding to be outstanding after this offering is based on 15,842,855 shares of our common stock outstanding as of September 30, 2019 and excludes as of that date:

|

|

●

|

3,864,552 shares of common stock underlying warrants to purchase shares of our common stock at a weighted average exercise price of $4.60 per share;

|

|

|

●

|

5,700,338 shares of common stock underlying options to purchase shares of our common stock at a weighted average exercise price of $2.75 per share;

|

|

|

●

|

208,050 shares of common stock reserved for issuance under our 2018 Employee Stock Purchase Plan;

|

|

|

●

|

1,850,368 shares of common stock reserved for issuance under our 2018 Equity Incentive Plan;

|

DESCRIPTION OF COMMON STOCK

Our authorized capital stock consists of 200,000,000 shares of common stock, $0.001 par value per share, and 10,000,000 shares of preferred stock, $0.001 par value per share. Our board of directors may establish the rights and preferences of the preferred stock from time to time. As of February 18, 2020, there were 27,849,841 shares of our common stock issued and outstanding and no shares of preferred stock issued and outstanding.

Our common stock is traded on The Nasdaq Capital Market under the symbol "GNPX". On February 18, 2020, the last reported sale price of our common stock on The Nasdaq Capital Market was $4.90 per share.

The material terms of our common stock are described under the heading "Description of Capital Stock" in the accompanying prospectus beginning on page S-15.

PLAN OF DISTRIBUTION

A.G.P./Alliance Global Partners has agreed to act as lead placement agent and Joseph Gunnar & Company, LLC, has agreed to act as co-placement agent which we refer to as the placement agents, in connection with this offering. The placement agents are not purchasing or selling any of the shares of our common stock offered by this prospectus supplement, but will use their reasonable best efforts to arrange for the sale of the securities offered by this prospectus supplement. We have entered into a securities purchase agreement directly with investors in connection with this offering. We will make offers only to a limited number of accredited investors. The offering is expected to close on or about February 21, 2020, subject to customary closing conditions, without further notice to you.

Fees and Expenses

We have agreed to pay the placement agents a placement agents’ fee equal to 7.5% of the aggregate purchase price of the shares of our common stock sold in this offering. The following table shows the per share and total cash placement agents’ fees we will pay to the placement agents in connection with the sale of the shares of our common stock offered pursuant to this prospectus supplement and the accompanying prospectus.

|

|

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

3.50

|

|

|

$

|

17,500,000

|

|

|

Placement agents’ fees(1)

|

|

$

|

0.2625

|

|

|

$

|

1,312,500

|

|

|

Proceeds to us before expenses

|

|

$

|

3.2375

|

|

|

$

|

16,187,500

|

|

(1) We have also agreed to reimburse the placement agent for certain expenses. See below.

In addition, we have agreed to reimburse the placement agent's expenses up to $100,000 upon closing the offering. We estimate that the total expenses of the offering payable by us will be approximately $187,500.

Regulation M

The placement agents may be deemed to be underwriters within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by them and any profit realized on the resale of the shares sold by them while acting as principals might be deemed to be underwriting discounts or commissions under the Securities Act. As an underwriter, each placement agent would be required to comply with the requirements of the Securities Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares by the placement agents acting as principals. Under these rules and regulations, the placement agents:

|

|

●

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

●

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until they have completed their participation in the distribution.

|

Nasdaq Listing

Our common stock is listed on The Nasdaq Capital Market under the symbol "GNPX." On February 18, 2020, the last reported sale price of our common stock on the Nasdaq Capital Market was $4.90 per share.

Indemnification

We have agreed to indemnify the placement agents and other specified persons against certain civil liabilities, including liabilities under the Securities Act and the Exchange Act, and to contribute to payments that the placement agents may be required to make in respect of such liabilities.

Other Relationships

The placement agents or their affiliates may in the future engage in transactions with, and may perform, from time to time, investment banking and advisory services for us in the ordinary course of their business and for which they would receive customary fees and expenses. In addition, in the ordinary course of their business activities, the placement agents and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities activities may involve securities and/or instruments of ours or our affiliates.

Specifically, on November 22, 2019, we sold an aggregate of 3,167,986 shares of our common stock in a registered direct offering to certain accredited investors. In a concurrent private placement, we sold to the purchasers in the registered direct offering a warrant to purchase one share of common stock for each share of common stock purchased by such purchaser in the registered direct offering. Joseph Gunnar & Co., LLC acted as placement agent for the offerings. In connection with the offerings, we issued Joseph Gunnar & Co., LLC warrants to purchase an aggregate of 443,518 shares of common stock. In addition, we paid Joseph Gunnar & Co., LLC approximately $93,704 for commissions and expense reimbursement. Furthermore, in connection with the November 2019 registered direct offering and concurrent private placement pursuant to which we entered into an engagement agreement with Joseph Gunnar & Co., LLC, we granted Joseph Gunnar & Co., LLC a right of first refusal on all public offerings for a period of six months after the expiration of such engagement agreement.

In addition, on January 27, 2020, we sold an aggregate of 7,620,000 shares of our common stock in a registered direct offering to certain accredited investors. A.G.P./Alliance Global Partners and Joseph Gunnar & Co., LLC acted as co-placement agents for the offering. In connection with the offering, we paid the placement agents $720,080 for commissions and expense reimbursement.

LEGAL MATTERS

The validity of the shares of common stock offered hereby will be passed upon for us by Sheppard, Mullin, Richter & Hampton LLP, New York, New York. Gracin & Marlow, LLP, New York, New York, has acted as counsel for the placement agents in connection with certain matters relating to this offering.

EXPERTS

Daszkal Bolton LLP, an independent registered public accounting firm, has audited our financial statements included in our Annual Report on Form 10-K and 10-K/A for the year ended December 31, 2018, as set forth in its report, which is incorporated by reference in this prospectus supplement and elsewhere in the registration statement. Our financial statements are incorporated by reference in reliance on Daszkal Bolton LLP’s report, given on their authority as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Copies of certain information filed by us with the SEC are also available on our website at https://www.genprex.com. Our website is not a part of this prospectus supplement and is not incorporated by reference in this prospectus.

This prospectus supplement is part of a registration statement we filed with the SEC. This prospectus supplement and the accompanying prospectus omit some information contained in the registration statement in accordance with SEC rules and regulations. You should review the information and exhibits in the registration statement for further information about us and our consolidated subsidiaries and the securities we are offering. Statements in this prospectus supplement and in the accompanying prospectus concerning any document we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive and are qualified by reference to these filings. You should review the complete document to evaluate these statements.

INCORPORATION BY REFERENCE

The SEC allows us to incorporate by reference into this prospectus supplement much of the information we file with the SEC, which means that we can disclose important information to you by referring you to those publicly available documents. The information that we incorporate by reference is considered to be part of this prospectus supplement and the accompanying prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus supplement and the accompanying prospectus are continually updated and those future filings may modify or supersede some of the information included or incorporated in this prospectus supplement and the accompanying prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the statements in this prospectus supplement or the accompanying prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus supplement and the accompanying prospectus incorporate by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those documents not deemed to be filed) until the offering of the securities under the registration statement is terminated or completed:

|

|

●

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2018 filed with the SEC on April 1, 2019, as amended on October 16, 2019;

|

|

|

●

|

our Quarterly Report on Form 10-Q for the quarter ended March 31, 2019 filed with the SEC on May 15, 2019, as amended on May 20, 2019 and October 16, 2019, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019 filed with the SEC on August 13, 2019, as amended on October 16, 2019 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2019 as filed with the SEC on November 14, 2019;

|

|

|

●

|

our Current Reports on Form 8-K filed with the SEC on January 31, 2019, February 19, 2019, June 11, 2019, September 13, 2019, November 22, 2019, January 6, 2020, January 9, 2020, January 17, 2020, January 21, 2020, January 24, 2020, January 31, 2020, February 5, 2020 (two on this date), February 6, 2020 and February 18, 2020;

|

|

|

●

|

our definitive proxy statement on Schedule 14A for our 2019 Annual Meeting of Stockholders filed with the SEC on April 30, 2019;

|

|

|

●

|

our definitive proxy statement on Schedule 14A for our 2020 Special Meeting of Stockholders filed with the SEC on December 23, 2019; and

|

|

|

●

|

the description of our capital stock contained in our Registration Statement on Form 8-A filed with the SEC on October 13, 2017.

|

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Genprex, Inc.

1601 Trinity Street, Bldg. B, Suite 3.322

Austin, Texas 78712

Attention: Investor Relations

Telephone: (512) 537-7997

PROSPECTUS

$25,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

From time to time, we may offer up to $25,000,000 of any combination of the securities described in this prospectus in one or more offerings. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities registered hereunder, including any applicable anti-dilution provisions.