- 2019 results in line with guidance

- Announces 2020 full year guidance

Green Dot Corporation (NYSE: GDOT) today reported financial

results for the quarter ended December 31, 2019.

For the fourth quarter of 2019, Green Dot reported total

operating revenues of $249.3 million and GAAP net income and GAAP

diluted earnings per common share of $1.7 million and $0.03,

respectively. Green Dot also reported non-GAAP total operating

revenues1 of $238.4 million, and adjusted EBITDA1 and non-GAAP

diluted earnings per common share1 of $21.8 million and $0.14,

respectively.

“Since becoming the interim CEO, I’ve been increasingly

impressed by the exceptional team at Green Dot. The Company has an

incredible foundation, with innovative products as well as strong

and growing customer relationships. I’m even more confident that

Green Dot is well positioned to continue to lead and transform the

financial services industry in the future,” said William I Jacobs,

Chairman and interim CEO.

GAAP financial results for the fourth quarter of 2019

compared to the fourth quarter of 2018:

- Total operating revenues on a generally accepted accounting

principles (GAAP) basis were $249.3 million for the fourth quarter

of 2019, up from $245.1 million for the fourth quarter of

2018.

- GAAP net income was $1.7 million for the fourth quarter of

2019, from net income of $14.3 million for the fourth quarter of

2018.

- GAAP diluted earnings per common share was $0.03 for the fourth

quarter of 2019, from diluted earnings per share of $0.26 for the

fourth quarter of 2018.

Non-GAAP financial results for the fourth quarter of 2019

compared to the fourth quarter of 2018:1

- Non-GAAP total operating revenues1 were $238.4 million for the

fourth quarter of 2019, up from $236.9 million for the fourth

quarter of 2018, representing a year-over-year increase of 1%.

- Adjusted EBITDA1 was $21.8 million, or 9.2% of non-GAAP total

operating revenues1 for the fourth quarter of 2019, down from $51.2

million, or 21.6% of non-GAAP total operating revenues1 for the

fourth quarter of 2018.

- Non-GAAP net income1 was $7.2 million for the fourth quarter of

2019, down from $30.9 million for the fourth quarter of 2018.

- Non-GAAP diluted earnings per share1 was $0.14 for the fourth

quarter of 2019, down from $0.56 for the fourth quarter of 2018.

1

Reconciliations of total operating

revenues to non-GAAP total operating revenues, net income to

non-GAAP net income, diluted earnings per share to non-GAAP diluted

earnings per share and net income to adjusted EBITDA, respectively,

are provided in the tables immediately following the consolidated

financial statements. Additional information about the Company's

non-GAAP financial measures can be found under the caption “About

Non-GAAP Financial Measures” below.

Key Metrics

The following table shows the Company's quarterly key business

metrics for each of the last eight calendar quarters. Please refer

to the Company’s latest Quarterly Report on Form 10-Q for a

description of the key business metrics.

2019

2018

Q4

Q3

Q2

Q1

Q4

Q3

Q2

Q1

(In millions)

Gross dollar volume

$

10,636

$

9,827

$

10,019

$

12,977

$

9,809

$

9,088

$

9,413

$

11,719

Gross dollar volume from direct deposit

sources

$

7,112

$

6,843

$

7,208

$

10,217

$

6,940

$

6,571

$

6,914

$

9,330

Active accounts at quarter end

5.04

5.18

5.66

6.05

5.34

5.43

5.86

6.01

Direct deposit active accounts at quarter

end

2.14

2.14

2.31

2.87

2.04

2.05

2.26

2.64

Purchase volume

$

6,287

$

6,047

$

6,470

$

8,200

$

6,276

$

5,918

$

6,325

$

7,470

Number of cash transfers

12.08

11.73

11.25

10.98

10.91

10.68

10.56

10.10

Number of tax refunds processed

0.07

0.11

2.52

9.39

0.07

0.10

2.79

8.75

Our financial guidance for 2020 reflects organic non-GAAP

revenue growth of 3% at the mid-point, driven by the strength of

our Platform Services business. As we stated on our Q3 2019

earnings call, we expect our Consumer business will continue to

face headwinds in 2020 and those headwinds will moderate over the

course of the year. That said, we are encouraged by customer

engagement in our Consumer business and our partner initiatives

across our Platform Services business,” said Jess Unruh, interim

CFO.

2020 Financial Guidance

FY Outlook

Green Dot has provided its outlook for 2020. Green Dot’s outlook

is based on a number of assumptions that management believes are

reasonable at the time of this earnings release. Information

regarding potential risks that could cause the actual results to

differ from these forward-looking statements is set forth below and

in Green Dot's filings with the Securities and Exchange

Commission.

Total Non-GAAP Operating Revenues2

- Green Dot expects its full year non-GAAP total operating

revenues2 to be between $1.080 billion to $1.100 billion,

representing a 3% year-over-year increase at the mid-point.

Adjusted EBITDA2

- Green Dot expects its full year adjusted EBITDA2 to be between

$175 million to $185 million.

Non-GAAP EPS2

- Green Dot expects its full year non-GAAP EPS2 to be between

$1.60 and $1.74.

The components of Green Dot's non-GAAP EPS2 guidance range are

as follows:

Range

Low

High

(In millions, except per share

data)

Adjusted EBITDA

$

175.0

$

185.0

Depreciation and amortization*

(63.0)

(63.0)

Net interest expense **

(0.5)

(0.5)

Non-GAAP pre-tax income

$

111.5

$

121.5

Tax impact***

(24.5)

(26.7)

Non-GAAP net income

$

87.0

$

94.8

Diluted weighted-average shares issued and

outstanding

54.5

54.5

Non-GAAP diluted earnings per share

$

1.60

$

1.74

*

Excludes the impact of amortization of

acquired intangible assets

**

Excludes the impact of amortization of

deferred financing costs

***

Assumes a non-GAAP effective tax rate of

approximately 22% for full year.

First Quarter 2020 Outlook

Green Dot experiences some seasonality and typically the first

quarter is the highest in terms of revenue and profit. First

quarter seasonality is impacted by a concentration of tax-related

transactions processed through Green Dot's ecosystem. Therefore,

Green Dot expects its first quarter 2020 non-GAAP revenues to be

approximately 30% to 31% and adjusted EBITDA approximately 48% of

its full year 2020 guidance at the mid-point.

2

For additional information, see

reconciliations of forward-looking guidance for these non-GAAP

financial measures to their respective, most directly comparable

projected GAAP financial measures provided in the tables

immediately following the reconciliation of Net Income to Adjusted

EBITDA.

Conference Call

The Company will host a conference call to discuss fourth

quarter 2019 financial results today at 5:00 p.m. ET. Hosting the

call will be William I Jacobs, Chairman and interim Chief Executive

Officer, and Jess Unruh, interim Chief Financial Officer. The

conference call can be accessed live over the phone by dialing

(888) 348-8307, or for international callers (412) 902-4242. A

replay will be available approximately two hours after the call

concludes and can be accessed by dialing (844) 512-2921, or for

international callers (412) 317-6671; and entering the conference

ID 10138996. The replay of the webcast will be available until

Wednesday, February 26, 2020. The call will be webcast live from

the Company's investor relations website at

http://ir.greendot.com/.

Forward-Looking Statements

This earnings release contains forward-looking statements, which

are subject to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements include, among

other things, statements regarding the Company's future performance

under "2020 Financial Outlook" and “First Quarter 2020 Outlook” and

in the quotes of its executive officers and other future events

that involve risks and uncertainties. Actual results may differ

materially from those contained in the forward-looking statements

contained in this earnings release, and reported results should not

be considered as an indication of future performance. The potential

risks and uncertainties that could cause actual results to differ

from those projected include, among other things, the timing and

impact of revenue growth activities, the Company's dependence on

revenues derived from Walmart, impact of competition, the Company's

reliance on retail distributors for the promotion of its products

and services, demand for the Company's new and existing products

and services, continued and improving returns from the Company's

investments in new growth initiatives, potential difficulties in

integrating operations of acquired entities and acquired

technologies, the Company's ability to operate in a highly

regulated environment, changes to existing laws or regulations

affecting the Company's operating methods or economics, the

Company's reliance on third-party vendors, changes in credit card

association or other network rules or standards, changes in card

association and debit network fees or products or interchange

rates, instances of fraud developments in the prepaid financial

services industry that impact prepaid debit card usage generally,

business interruption or systems failure, and the Company's

involvement litigation or investigations. These and other risks are

discussed in greater detail in the Company's Securities and

Exchange Commission filings, including its most recent annual

report on Form 10-K and quarterly report on Form 10-Q, which are

available on the Company's investor relations website at

ir.greendot.com and on the SEC website at www.sec.gov. All

information provided in this release and in the attachments is as

of February 19, 2020, and the Company assumes no obligation to

update this information as a result of future events or

developments.

About Non-GAAP Financial Measures

To supplement the Company's consolidated financial statements

presented in accordance with accounting principles generally

accepted in the United States of America (GAAP), the Company uses

measures of operating results that are adjusted to exclude, among

other things, non-operating net interest income and expense; income

tax benefit and expense; depreciation and amortization, including

amortization of acquired intangibles; certain legal settlement

charges; employee stock-based compensation and related employer

payroll taxes; change in the fair value of contingent

consideration; impairment charges; extraordinary severance and

related restructuring expenses; realized gains or losses on the

sale of investment securities; commissions and certain

processing-related costs associated with BaaS products and services

where the Company does not control customer acquisition, other

charges and income; and income tax effects. This earnings release

includes non-GAAP total operating revenues, adjusted EBITDA,

non-GAAP net income, and non-GAAP diluted earnings per share. It

also includes full-year 2020 guidance for non-GAAP total operating

revenues, adjusted EBITDA, non-GAAP net income and non-GAAP

earnings per share. These non-GAAP financial measures are not

calculated or presented in accordance with, and are not

alternatives or substitutes for, financial measures prepared in

accordance with GAAP, and should be read only in conjunction with

the Company's financial measures prepared in accordance with GAAP.

The Company's non-GAAP financial measures may be different from

similarly-titled non-GAAP financial measures used by other

companies. The Company believes that the presentation of non-GAAP

financial measures provides useful information to management and

investors regarding underlying trends in its consolidated financial

condition and results of operations. The Company's management

regularly uses these supplemental non-GAAP financial measures

internally to understand, manage and evaluate the Company's

business and make operating decisions. For additional information

regarding the Company's use of non-GAAP financial measures and the

items excluded by the Company from one or more of its historic and

projected non-GAAP financial measures, investors are encouraged to

review the reconciliations of the Company's historic and projected

non-GAAP financial measures to the comparable GAAP financial

measures, which are attached to this earnings release, and which

can be found by clicking on “Financial Information” in the Investor

Relations section of the Company's website at

http://ir.greendot.com/.

About Green Dot

Green Dot Corporation, [NYSE:GDOT], is a financial technology

leader and bank holding company with a mission to power the banking

industry’s branchless future. Enabled by proprietary technology and

Green Dot’s wholly-owned commercial bank charter, Green Dot’s

“Banking as a Service” platform is used by a growing list of

America’s most prominent consumer and technology companies to

design and deploy their own bespoke banking solutions to their

customers and partners, while Green Dot uses that same integrated

technology and banking platform to design and deploy its own

leading collection of banking and financial services products

directly to consumers through one of the largest retail banking

distribution platforms in America. Green Dot products are marketed

under brand names such as Green Dot, GoBank, MoneyPak, AccountNow,

RushCard and RapidPay, and can be acquired through more than

100,000 retailers nationwide, thousands of corporate paycard

partners, several “direct-2-consumer” branded websites, thousands

of tax return preparation offices and accounting firms, thousands

of neighborhood check cashing locations and both of the leading app

stores. Green Dot Corporation is headquartered in Pasadena,

California, with additional facilities throughout the United States

and in Shanghai, China.

GREEN DOT CORPORATION

CONSOLIDATED BALANCE

SHEETS

December 31, 2019

December 31, 2018

(unaudited)

Assets

(In thousands, except par

value)

Current assets:

Unrestricted cash and cash equivalents

$

1,063,426

$

1,094,728

Restricted cash

2,728

490

Investment securities available-for-sale,

at fair value

10,020

19,960

Settlement assets

239,222

153,992

Accounts receivable, net

59,543

40,942

Prepaid expenses and other assets

66,183

57,070

Income tax receivable

870

8,772

Total current assets

1,441,992

1,375,954

Investment securities available-for-sale,

at fair value

267,419

181,223

Loans to bank customers, net of allowance

for loan losses of $1,166 and $1,144 as of December 31, 2019 and

2018, respectively

21,417

21,363

Prepaid expenses and other assets

10,991

8,125

Property and equipment, net

145,476

120,269

Operating lease right-of-use assets

26,373

—

Deferred expenses

16,891

21,201

Net deferred tax assets

9,037

7,867

Goodwill and intangible assets

520,994

551,116

Total assets

$

2,460,590

$

2,287,118

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

37,876

$

38,631

Deposits

1,175,341

1,005,485

Obligations to customers

69,377

58,370

Settlement obligations

13,251

5,788

Amounts due to card issuing banks for

overdrawn accounts

380

1,681

Other accrued liabilities

107,842

134,000

Operating lease liabilities

8,764

—

Deferred revenue

28,355

34,607

Debt

35,000

58,705

Income tax payable

3,948

67

Total current liabilities

1,480,134

1,337,334

Other accrued liabilities

10,883

30,927

Operating lease liabilities

24,445

—

Net deferred tax liabilities

17,772

9,045

Total liabilities

1,533,234

1,377,306

Stockholders’ equity:

Class A common stock, $0.001 par value;

100,000 shares authorized as of December 31, 2019 and 2018; 51,807

and 52,917 shares issued and outstanding as of December 31, 2019

and 2018, respectively

52

53

Additional paid-in capital

296,224

380,753

Retained earnings

629,040

529,143

Accumulated other comprehensive income

(loss)

2,040

(137

)

Total stockholders’ equity

927,356

909,812

Total liabilities and stockholders’

equity

$

2,460,590

$

2,287,118

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(unaudited)

(unaudited)

(In thousands, except per

share data)

Operating revenues:

Card revenues and other fees

$

105,936

$

118,564

$

459,357

$

482,881

Processing and settlement service

revenues

57,792

44,057

287,064

247,958

Interchange revenues

79,278

75,213

330,233

310,919

Interest income, net

6,301

7,274

31,941

23,817

Total operating revenues

249,307

245,108

1,108,595

1,065,575

Operating expenses:

Sales and marketing expenses

102,355

79,142

386,840

326,333

Compensation and benefits expenses

41,961

55,572

198,412

221,627

Processing expenses

50,810

42,718

200,674

181,160

Other general and administrative

expenses

54,424

52,280

199,751

206,040

Total operating expenses

249,550

229,712

985,677

935,160

Operating (loss) income

(243

)

15,396

122,918

130,415

Interest expense, net

89

3,067

1,837

6,598

(Loss) income before income taxes

(332

)

12,329

121,081

123,817

Income tax (benefit) expense

(2,025

)

(1,943

)

21,184

5,114

Net income

$

1,693

$

14,272

$

99,897

$

118,703

Basic earnings per common share:

$

0.03

$

0.27

$

1.91

$

2.27

Diluted earnings per common share:

$

0.03

$

0.26

$

1.88

$

2.18

Basic weighted-average common shares

issued and outstanding:

51,572

52,745

52,195

52,222

Diluted weighted-average common shares

issued and outstanding:

52,279

54,840

53,138

54,481

GREEN DOT CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

Year Ended December

31,

2019

2018

(unaudited)

(In thousands)

Operating activities

Net income

$

99,897

$

118,703

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of property,

equipment and internal-use software

49,489

38,581

Amortization of intangible assets

32,616

32,761

Provision for uncollectible overdrawn

accounts

86,451

79,790

Employee stock-based compensation

29,583

50,093

Amortization of (discount) premium on

available-for-sale investment securities

(117

)

1,042

Change in fair value of contingent

consideration

(1,866

)

3,298

Amortization of deferred financing

costs

1,334

1,594

Impairment of capitalized software

578

922

Deferred income tax expense (benefit)

6,876

(234

)

Changes in operating assets and

liabilities:

Accounts receivable, net

(105,052

)

(85,455

)

Prepaid expenses and other assets

(12,032

)

(9,930

)

Deferred expenses

4,310

590

Accounts payable and other accrued

liabilities

(8,145

)

12,471

Deferred revenue

(6,711

)

4,675

Income tax receivable/payable

11,682

(1,253

)

Other, net

1,021

3,403

Net cash provided by operating

activities

189,914

251,051

Investing activities

Purchases of available-for-sale investment

securities

(189,066

)

(186,884

)

Proceeds from maturities of

available-for-sale securities

110,971

60,449

Proceeds from sales of available-for-sale

securities

4,915

78,385

Payments for acquisition of property and

equipment

(78,214

)

(61,030

)

Net increase in loans

(2,459

)

(5,887

)

Net cash used in investing activities

(153,853

)

(114,967

)

Financing activities

Repayments of borrowings from notes

payable

(60,000

)

(22,500

)

Borrowings on revolving line of credit

35,000

—

Proceeds from exercise of options

7,226

21,880

Taxes paid related to net share settlement

of equity awards

(21,338

)

(46,007

)

Net increase (decrease) in deposits

146,100

(16,733

)

Net (decrease) increase in obligations to

customers

(66,760

)

17,255

Contingent consideration payments

(4,634

)

(4,856

)

Repurchase of Class A common stock

(100,000

)

—

Deferred financing costs

(719

)

—

Net cash used in financing activities

(65,125

)

(50,961

)

Net (decrease) increase in unrestricted

cash, cash equivalents and restricted cash

(29,064

)

85,123

Unrestricted cash, cash equivalents and

restricted cash, beginning of period

1,095,218

1,010,095

Unrestricted cash, cash equivalents and

restricted cash, end of period

$

1,066,154

$

1,095,218

Cash paid for interest

$

2,452

$

4,888

Cash paid for income taxes

$

1,921

$

6,233

Reconciliation of unrestricted cash,

cash equivalents and restricted cash at end of period:

Unrestricted cash and cash equivalents

$

1,063,426

$

1,094,728

Restricted cash

2,728

490

Total unrestricted cash, cash equivalents

and restricted cash, end of period

$

1,066,154

$

1,095,218

GREEN DOT CORPORATION

REPORTABLE SEGMENTS

Three Months Ended December

31, 2019

Account Services

Processing and Settlement

Services

Corporate and Other

Total

(In thousands;

unaudited)

Operating revenues

$

196,029

$

60,007

$

(6,729

)

$

249,307

Operating expenses

181,034

53,180

15,336

249,550

Operating income (loss)

$

14,995

$

6,827

$

(22,065

)

$

(243

)

Three Months Ended December

31, 2018

Account Services

Processing and Settlement

Services

Corporate and Other

Total

(In thousands;

unaudited)

Operating revenues

$

207,119

$

45,227

$

(7,238

)

$

245,108

Operating expenses

157,790

43,404

28,518

229,712

Operating income

$

49,329

$

1,823

$

(35,756

)

$

15,396

Year Ended December 31,

2019

Account Services

Processing and Settlement

Services

Corporate and Other

Total

(In thousands;

unaudited)

Operating revenues

$

842,967

$

296,721

$

(31,093

)

$

1,108,595

Operating expenses

696,409

202,713

86,555

985,677

Operating income

$

146,558

$

94,008

$

(117,648

)

$

122,918

Year Ended December 31,

2018

Account Services

Processing and Settlement

Services

Corporate and Other

Total

(In thousands)

Operating revenues

$

843,905

$

253,360

$

(31,690

)

$

1,065,575

Operating expenses

643,714

179,037

112,409

935,160

Operating income

$

200,191

$

74,323

$

(144,099

)

$

130,415

The Company's operations are comprised of two reportable

segments: 1) Account Services and 2) Processing and Settlement

Services. The Account Services segment consists of revenues and

expenses derived from the Company's deposit account programs, such

as prepaid cards, debit cards, consumer and small business checking

accounts, secured credit cards, payroll debit cards and gift cards.

These deposit account programs are marketed under several of the

Company's leading consumer brand names and under the brand names of

the Company's Banking as a Service, or "BaaS," partners. The

Processing and Settlement Services segment consists of revenues and

expenses derived from the Company's products and services that

specialize in facilitating the movement of cash on behalf of

consumers and businesses, such as consumer cash processing

services, wage disbursements and tax refund processing services.

The Corporate and Other segment primarily consists of eliminations

of intersegment revenues and expenses, unallocated corporate

expenses, depreciation and amortization, and other costs that are

not considered when management evaluates segment performance.

GREEN DOT CORPORATION

Reconciliation of Total

Operating Revenues to Non-GAAP Total Operating Revenues (1)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(In thousands)

Total operating revenues

$

249,307

$

245,108

$

1,108,595

$

1,065,575

Net revenue adjustments (8)

(10,909

)

(8,221

)

(50,271

)

(41,536

)

Non-GAAP total operating revenues

$

238,398

$

236,887

$

1,058,324

$

1,024,039

Reconciliation of Reportable

Segment Revenues to Non-GAAP Reportable Segment Revenues

(1)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(In thousands)

Account Services

Operating revenues

$

196,029

$

207,119

$

842,967

$

843,905

Net revenue adjustments (8)

(6,434

)

(4,804

)

(34,587

)

(26,402

)

Non-GAAP operating revenues

$

189,595

$

202,315

$

808,380

$

817,503

Processing and Settlement

Services

Operating revenues

$

60,007

$

45,227

$

296,721

$

253,360

Net revenue adjustments (8)

(4,475

)

(3,417

)

(15,684

)

(15,134

)

Non-GAAP operating revenues

$

55,532

$

41,810

$

281,037

$

238,226

Reconciliation of Net Income

to Non-GAAP Net Income (1)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(In thousands, except per

share data)

Net income

$

1,693

$

14,272

$

99,897

$

118,703

Employee stock-based compensation and

related employer payroll taxes (3)

(382

)

13,173

30,987

52,532

Amortization of acquired intangible assets

(4)

8,093

8,175

32,616

32,761

Change in fair value of contingent

consideration (4)

—

3,298

(1,866

)

16,798

Transaction costs (4)

—

—

—

(16

)

Amortization of deferred financing costs

(5)

81

399

1,334

1,594

Impairment charges (5)

457

570

578

922

Extraordinary severance and other

restructuring expenses (6)

1,083

116

6,352

1,781

Legal settlement expenses (5)

—

—

236

—

Realized loss on the sale of investment

securities (5)

—

1,537

—

1,537

Other (income) expense (5)

(729

)

—

(771

)

744

Income tax effect (7)

(3,129

)

(10,614

)

(21,060

)

(48,284

)

Non-GAAP net income

$

7,167

$

30,926

$

148,303

$

179,072

Diluted earnings per common share

GAAP

$

0.03

$

0.26

$

1.88

$

2.18

Non-GAAP

$

0.14

$

0.56

$

2.79

$

3.29

Diluted weighted-average common shares

issued and outstanding

52,279

54,840

53,138

54,481

GREEN DOT CORPORATION

Supplemental Detail on Diluted

Weighted-Average Common Shares Issued and Outstanding

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(unaudited)

(unaudited)

(In thousands)

Class A common stock outstanding as of

December 31:

51,807

52,917

51,807

52,917

Weighting adjustment

(235

)

(172

)

388

(695

)

Dilutive potential shares:

Stock options

42

186

114

327

Service based restricted stock units

123

837

361

1,135

Performance-based restricted stock

units

532

1,070

440

796

Employee stock purchase plan

10

2

28

1

Diluted weighted-average common shares

issued and outstanding

52,279

54,840

53,138

54,481

Reconciliation of Net Income

to Adjusted EBITDA (1)

(Unaudited)

Three Months Ended December

31,

Year Ended December

31,

2019

2018

2019

2018

(In thousands)

Net income

$

1,693

$

14,272

$

99,897

$

118,703

Interest expense, net (2)

89

3,067

1,837

6,598

Income tax (benefit) expense

(2,025

)

(1,943

)

21,184

5,114

Depreciation and amortization of property,

equipment and internal-use software (2)

13,560

10,427

49,489

38,581

Employee stock-based compensation and

related employer payroll taxes (2)(3)

(382

)

13,173

30,987

52,532

Amortization of acquired intangible assets

(2)(4)

8,093

8,175

32,616

32,761

Change in fair value of contingent

consideration (2)(4)

—

3,298

(1,866

)

16,798

Transaction costs (2)(4)

—

—

—

(16

)

Impairment charges (2)(5)

457

570

578

922

Extraordinary severance and other

restructuring expenses (2)(6)

1,083

116

6,352

1,781

Legal settlement expenses (2)(5)

—

—

236

—

Other (income) expense (2)(5)

(744

)

—

(744

)

744

Adjusted EBITDA

$

21,824

$

51,155

$

240,566

$

274,518

Non-GAAP total operating revenues

$

238,398

$

236,887

$

1,058,324

$

1,024,039

Adjusted EBITDA/Non-GAAP total operating

revenues (adjusted EBITDA margin)

9.2

%

21.6

%

22.7

%

26.8

%

GREEN DOT CORPORATION

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected Non-GAAP Total

Operating Revenues (1)

(Unaudited)

FY 2020

Range

Low

High

(In millions)

Total operating revenues

$

1,140

$

1,160

Net revenue adjustments (8)

(60

)

(60

)

Non-GAAP total operating revenues

$

1,080

$

1,100

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected Adjusted EBITDA

(1)

(Unaudited)

FY 2020

Range

Low

High

(In millions)

Net income

$

26.7

$

34.9

Adjustments (9)

148.4

150.2

Adjusted EBITDA

$

175.0

$

185.0

Non-GAAP total operating revenues

$

1,100

$

1,080

Adjusted EBITDA / Non-GAAP total operating

revenues (Adjusted EBITDA margin)

15.9

%

17.1

%

Reconciliation of Forward

Looking Guidance for Non-GAAP Financial Measures to

Projected Non-GAAP Net Income

(1)

(Unaudited)

FY 2020

Range

Low

High

(In millions, except per share

data)

Net income

$

26.7

$

34.9

Adjustments (9)

60.3

60.0

Non-GAAP net income

$

87.0

$

94.8

Diluted earnings per share

GAAP

$

0.49

$

0.64

Non-GAAP

$

1.60

$

1.74

Diluted weighted-average shares issued and

outstanding

54.5

54.5

(1)

To supplement the Company’s consolidated

financial statements presented in accordance with GAAP, the Company

uses measures of operating results that are adjusted to exclude

various, primarily non-cash, expenses and charges. These financial

measures are not calculated or presented in accordance with GAAP

and should not be considered as alternatives to or substitutes for

operating revenues, operating income, net income or any other

measure of financial performance calculated and presented in

accordance with GAAP. These financial measures may not be

comparable to similarly-titled measures of other organizations

because other organizations may not calculate their measures in the

same manner as the Company does. These financial measures are

adjusted to eliminate the impact of items that the Company does not

consider indicative of its core operating performance. You are

encouraged to evaluate these adjustments and the reasons the

Company considers them appropriate.

The Company believes that the non-GAAP

financial measures it presents are useful to investors in

evaluating the Company’s operating performance for the following

reasons:

- the Company records employee stock-based compensation from

period to period, and recorded employee stock-based compensation

expenses and related employer payroll taxes, net of forfeitures, of

approximately $(0.4) million and $13.2 million for the three months

ended December 31, 2019 and 2018, respectively. By comparing the

Company’s adjusted EBITDA, non-GAAP net income and non-GAAP diluted

earnings per share in different historical periods, investors can

evaluate the Company’s operating results without the additional

variations caused by employee stock-based compensation expense and

related employer payroll taxes, which may not be comparable from

period to period due to changes in the fair market value of the

Company’s Class A common stock (which is influenced by external

factors like the volatility of public markets and the financial

performance of the Company’s peers) and is not a key measure of the

Company’s operations;

- adjusted EBITDA is widely used by investors to measure a

company’s operating performance without regard to items, such as

non-operating net interest income and expense, income tax benefit

and expense, depreciation and amortization, employee stock-based

compensation and related employer payroll taxes, changes in the

fair value of contingent consideration, impairment charges,

severance costs related to extraordinary personnel reductions,

certain legal settlement charges and other charges and income that

can vary substantially from company to company depending upon their

respective financing structures and accounting policies, the book

values of their assets, their capital structures and the methods by

which their assets were acquired; and

- securities analysts use adjusted EBITDA as a supplemental

measure to evaluate the overall operating performance of

companies.

The Company’s management uses the non-GAAP

financial measures:

- as measures of operating performance, because they exclude the

impact of items not directly resulting from the Company’s core

operations;

- for planning purposes, including the preparation of the

Company’s annual operating budget;

- to allocate resources to enhance the financial performance of

the Company’s business;

- to evaluate the effectiveness of the Company’s business

strategies;

- to establish metrics for variable compensation; and

- in communications with the Company’s

board of directors concerning the Company’s financial

performance.

The Company understands that, although

adjusted EBITDA and other non-GAAP financial measures are

frequently used by investors and securities analysts in their

evaluations of companies, these measures have limitations as an

analytical tool, and you should not consider them in isolation or

as substitutes for analysis of the Company’s results of operations

as reported under GAAP. Some of these limitations are:

- that these measures do not reflect the Company’s capital

expenditures or future requirements for capital expenditures or

other contractual commitments;

- that these measures do not reflect changes in, or cash

requirements for, the Company’s working capital needs;

- that these measures do not reflect non-operating interest

expense or interest income;

- that these measures do not reflect cash requirements for income

taxes;

- that, although depreciation and amortization are non-cash

charges, the assets being depreciated or amortized will often have

to be replaced in the future, and these measures do not reflect any

cash requirements for these replacements; and

- that other companies in the Company’s industry may calculate

these measures differently than the Company does, limiting their

usefulness as comparative measures.

(2)

The Company does not include any income

tax impact of the associated non-GAAP adjustment to adjusted

EBITDA, as the case may be, because each of these non-GAAP

financial measures is provided before income tax expense.

(3)

This expense consists primarily of

expenses for restricted stock units (including performance-based

restricted stock units) and related employer payroll taxes.

Employee stock-based compensation expense is not comparable from

period to period due to changes in the fair market value of the

Company’s Class A common stock (which is influenced by external

factors like the volatility of public markets and the financial

performance of the Company’s peers) and is not a key measure of the

Company’s operations. The Company excludes employee stock-based

compensation expense from its non-GAAP financial measures primarily

because it consists of non-cash expenses that the Company does not

believe are reflective of ongoing operating results. The Company

also believes that it is not useful to investors to understand the

impact of employee stock-based compensation to its results of

operations. Further, the related employer payroll taxes are

dependent upon volatility in the Company's stock price, as well as

the timing and size of option exercises and vesting of restricted

stock units, over which the Company has limited to no control. This

expense is included as a component of compensation and benefits

expenses on the Company's consolidated statements of

operations.

(4)

The Company excludes certain income and

expenses that are the result of acquisitions. These

acquisition-related adjustments include items such as the

amortization of acquired intangible assets, changes in the fair

value of contingent consideration, settlements of contingencies

established at time of acquisition and other acquisition related

charges, such as integration charges and professional and legal

fees, which result in the Company recording expenses or fair value

adjustments in its GAAP financial statements. The Company analyzes

the performance of its operations without regard to these

adjustments. In determining whether any acquisition-related

adjustment is appropriate, the Company takes into consideration,

among other things, how such adjustments would or would not aid in

the understanding of the performance of its operations. These items

are included as a component of other general and administrative

expenses on the Company's consolidated statements of operations, as

applicable for the periods presented.

(5)

The Company excludes certain income and

expenses that are not reflective of ongoing operating results. It

is difficult to estimate the amount or timing of these items in

advance. Although these events are reflected in the Company's GAAP

financial statements, the Company excludes them in its non-GAAP

financial measures because the Company believes these items may

limit the comparability of ongoing operations with prior and future

periods. These adjustments include items such as amortization

attributable to deferred financing costs, impairment charges

related to internal-use software, realized gains or losses on the

sale of investment securities, legal settlement expenses and other

income and expenses, as applicable for the periods presented. In

determining whether any such adjustment is appropriate, the Company

takes into consideration, among other things, how such adjustments

would or would not aid in the understanding of the performance of

its operations. Each of these adjustments, except for amortization

of deferred financing costs and realized gains and losses on the

sale of investment securities, which are included as a component of

non-operating interest income/expense, are included within other

general and administrative expenses on the Company's consolidated

statements of operations.

(6)

During the three and twelve months ended

December 31, 2019, the Company recorded charges of $1.1 million and

$6.4 million, respectively, for severance costs related to

extraordinary personnel reductions. Although severance expenses are

an ordinary part of its operations, the magnitude and scale of this

ongoing reduction in workforce for redundancies is not expected to

be repeated. This expense is included as a component of

compensation and benefits expenses on the Company's consolidated

statements of operations.

(7)

Represents the tax effect for the related

non-GAAP measure adjustments using the Company's year to date

non-GAAP effective tax rate. It also excludes both the impact of

excess tax benefits related to stock-based compensation and the

GAAP IRC §162(m) limitation that applies to performance-based

restricted stock units expense as of December 31, 2019.

(8)

Represents commissions and certain

processing-related costs associated with Banking as a Service

("BaaS") products and services where Green Dot does not control

customer acquisition.

(9)

These amounts represent estimated

adjustments for non-operating net interest income, income taxes,

depreciation and amortization, employee stock-based compensation

and related employer taxes, contingent consideration, impairment

charges, severance costs related to extraordinary personnel

reductions, and other income and expenses. Employee stock-based

compensation expense includes assumptions about the future fair

value of the Company’s Class A common stock (which is influenced by

external factors like the volatility of public markets and the

financial performance of the Company’s peers).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200219005979/en/

Investor Relations IR@greendot.com

Media Relations Brian Ruby, 203-682-8286

Brian.Ruby@icrinc.com

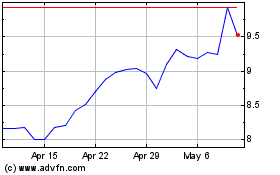

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Green Dot (NYSE:GDOT)

Historical Stock Chart

From Apr 2023 to Apr 2024