UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 6)*

STRYKER CORPORATION

(Name of Issuer)

Common Stock, $0.10 par value

(Title of Class of Securities)

863667 10 1

(CUSIP Number)

Ronda E. Stryker

Greenleaf Trust

211 South Rose Street

Kalamazoo, Michigan 49007

(269) 553-6948

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

January 31, 2020

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report

the acquisition that is the subject of this Schedule 13D, and is filing this

Schedule because of SS240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the

following box.

Note: Schedules filed in paper format shall include a signed original and

five copies of the schedule, including all exhibits. See S240.13d-7 for other

parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person's

initial filing on this form with respect to the subject class of securities,

and for any subsequent amendment containing information which would alter the

disclosures provided in a prior cover page.

The information required in the remainder of this cover page shall not be

deemed to be "filed" for the purpose of Section 18 of the Securities Exchange

Act of 1934 ("Act") or otherwise subject to the liabilities of that section of

the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

1.Names of Reporting Persons.Ronda E. Stryker

2.Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b)

3.SEC Use Only

4.Source of Funds (See Instructions)N/A

5.Check if Disclosure of Legal Proceedings is Required Pursuant to Items

2(d) or 2(e)

6.Citizenship or Place of OrganizationUnited States of America

7.Sole Voting Power7,023,823

Number of

Shares Bene-8.Shared Voting Power16,316,995

ficially

Owned by Each9.Sole Dispositive Power7,023,823

Reporting

Person With:10.Shared Dispositive Power16,316,995

11.Aggregate Amount Beneficially Owned by Each Reporting Person23,340,788

12.Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions)

13.Percent of Class Represented by Amount in Row (11)6.2%

14.Type of Reporting Person (See Instructions)IN

Item 1. Security and Issuer

The title of the class of equity securities to which this statement relates is

common stock, par value $0.10 per share ("Common Shares"), of Stryker

Corporation, a Michigan corporation ("Company"). The address of the principal

executive office of the Company is 2825 Airview Boulevard, Kalamazoo, Michigan

49002.

Item 2. Identity and Background

(a)-(c)This statement is being filed by Ronda E. Stryker. Ronda E. Stryker's

business address is c/o Greenleaf Trust, 211 South Rose Street, Kalamazoo,

Michigan 49007. Ronda E. Stryker's present principal occupation or employment

is Vice Chair and a Director of Greenleaf Trust, a bank, and Fellow of Harvard

Medical School. She is also a director of the Company, the granddaughter of

the founder of the Company and the daughter of a former President of the

Company.

(d)-(e)During the past five years, Ronda E. Striker (i) has not been

convicted in a criminal proceeding (excluding traffic violations or similar

misdemeanors) and (ii) has not been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction and as a result of

such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violation with

respect to such laws.

(f)Ronda E. Stryker is a citizen of the United States of America.

Item 3. Source and Amount of Funds or Other Consideration

This Schedule is being amended to report a 1% change in the share ownership

of the Company as previously reported on an amended 13D dated May 8, 2015.

No funds were used in making the acquisitions giving rise to this amendment

to Schedule 13D.

Item 4. Purpose of Transaction

This Schedule is being amended to report a 1% change in the share ownership

of the Company as previously reported on an amended 13d dated May 8, 2015.

Ronda E. Stryker intends to evaluate on an ongoing basis her investment in

the Company and her options with respect to such investment. Ronda E.

Stryker and her husband may, from time to time, acquire additional Common

Shares (1) by the exercise or additional vesting of options, (2) by the

grant of additional options or other equity awards by the Company or (3)

from time to time for investment purposes if market conditions are favorable,

in the open market, in privately negotiated transactions or otherwise. Ronda

E. Stryker and her husband may also dispose of some or all of the Company's

Common Shares that they beneficially own, periodically, by public or private

sale (registered or unregistered and with or without the simultaneous sale of

newly-issued Common Shares by the Company), gift, expiration of options,

forfeiture of restricted shares or otherwise, including, without limitation,

sales of Common Shares pursuant to Rule 144 under the Securities Act of 1933,

as amended, or otherwise. Ronda E. Stryker and her husband reserve the right

not to acquire Common Shares at any given time and not to dispose of all or

part of Common Shares they may own at any given time if they determine such

acquisition or disposal is not in their best interests at the time in question.

Other than as described above, Ronda E. Stryker does not have any current

plans or proposals which relate to, or would result in, (a) any acquisition

or disposition of securities of the Company, (b) any extraordinary corporate

transaction, such as a merger, reorganization or liquidation, involving the

Company or any of its subsidiaries, (c) any sale or transfer of a material

amount of assets of the Company or any of its subsidiaries, (d) any change

in the present board of directors or management of the Company, including

any plans or proposals to change the number or term of directors or to fill

any existing vacancies on the Board, (e) any material change in the Company's

present capitalization or dividend policy, (f) any other material change in

the Company's business or corporate structure, (g) any change in the Company's

articles of incorporation or bylaws or other actions which may impede the

acquisition of control of the Company by any person, (h) causing a class of

securities of the Company to be delisted from a national securities exchange

or to cease to be authorized to be quoted in an inter-dealer quotation system

of a registered national securities association, (i) a class of the Company's

equity securities becoming eligible for termination of registration pursuant

to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended, or (j)

any action similar to those enumerated above.

Item 5. Interest in Securities of the Issuer

(a)The aggregate number and percentage of Common Shares beneficially owned by

Ronda E. Stryker as 1/31/2020 are as follows:

NumberPercent

Ronda E. Stryker23,340,788 (1) 6.2% (2)

(1)The shares shown above as beneficially owned by Ronda E. Stryker

comprise (1) 85,995 Common Shares owned directly by Ronda E.

Stryker, (2) 28,760 Common Shares that Ronda E. Stryker has the right to

acquire within 60 days of February 7, 2020 upon the exercise of options

granted to her by the Company, as more specifically described below ("Option

Shares") as well as RSUs granted, (3) 6,909,068 shares held by her in her

revocable trust, of which trust she is the sole trustee and beneficiary during

her lifetime, (4) 40,000 Common Shares owned by her husband, William D.

Johnston, and over which she may be deemed to share voting and investment

power, (5) 15,843,970 Common Shares held in the separate subtrust of the L.

Lee Stryker Trust dated September 10, 1974 created for the benefit of Ronda

E. Stryker and her issue ("LLS Subtrust"), over which Subtrust Ronda E.

Stryker may be deemed to share voting and investment power, as described

below, and (6) 432,995 Common Shares owned by the Stryker Johnston Foundation,

a Michigan non-profit corporation ("Foundation"), of which Ronda E. Stryker,

her husband and her children are the trustees.

(2)Based on the 374,580,000 Common Shares reported as outstanding as January

31, 2020 in the Company's Form 10-K dated February 7, 2020.

Ronda E. Stryker has been granted the following options to purchase Common

Shares under the Company's stock option plans:

Percent

Vested at

Date ofNumber ofExercise

February 7,NumberVesting

GrantSharesPrice2020

VestedSchedule

02/09/114,735$59.70100%4,735One-fifth a year

starting 02/09/12

02/21/124,945$53.60100%4,945One-fifth a year

starting 02/21/13

02/13/135,520$64.01100%5,520One-fifth a year

starting 02/13/14

02/12/144,355$81.14100%4,355One-fifth a year

starting 02/12/15

02/11/153,795$93.0680%3,036One-fifth a year

starting 02/11/16

02/10/16 4,570$96.6460% 2,742One-fifth a year

starting 02/10/17

02/08/173,605$122.5120%1,442One-fifth a year

starting 02/08/18

05/02/181,048RSUs100%1,048

05/01/19937RSUs100%937

Total33,51028,760

The vesting of the unvested options described above will increase Ronda E.

Stryker's beneficial ownership of Common Shares. If the above options were

fully vested, Ronda E. Stryker would beneficially own 23,340,788 Common

Shares, or 6.2% of the outstanding Common Shares.

(b)Ronda E. Stryker has sole voting and investment power over 7,023,823

Common Shares reported above as beneficially owned by her and held by her

either directly, in her revocable trust or subject to options exercisable

by her.

William D. Johnston is Ronda E. Stryker's husband. As a result, Ronda E.

Stryker may be deemed to share voting and investment power over the Common

Shares held by William D. Johnston.

Ronda E. Stryker has a special power of appointment over the Company's Common

Shares held in the LLS Subtrust and the power to change the trustee of that

Subtrust. As a result she may be deemed to share voting and dispositive power

over the Common Shares held in the LLS Subtrust. The LLS Subtrust is

administered by Greenleaf Trust, a state chartered bank marketing fiduciary

services to the general public. Ronda E. Stryker is a shareholder and

director of Greenleaf Trust. Ronda E. Stryker's husband, William D. Johnston,

is the controlling shareholder of Greenleaf Trust.

Greenleaf Trust holds Common Shares in its fiduciary capacity on behalf of

various trust and investment management customers, some of whom have the right

to receive, or the power to direct the receipt of, dividends from or the

proceeds from the sale of these securities. Including the shares held in the

LLS Subtrust, Greenleaf Trust has sole voting and dispositive power over

116,301 Common Shares held in accounts over which it has discretionary

management power, and 21,627,174 Common Shares held in trusts over which it

shares voting or dispositive power with co-trustees or beneficiaries, for a

total of 21,743,475 Common Shares, or 5.8% of the outstanding Common Shares.

Except for the Common Shares held in the LLS Subtrust, Ronda E. Stryker

specifically disclaims beneficial ownership of, and this Schedule 13D does not

report, shares held by Greenleaf Trust in accounts over which Ronda E. Stryker

possesses neither fiduciary discretion nor powers or privileges as a

beneficiary. Ronda E. Stryker also expressly disclaims status as a "group"

with Greenleaf Trust or William D. Johnston for purposes of this Schedule 13D.

Ronda E. Stryker, her husband, William D. Johnston, and their adult children

are trustees of the Foundation. Decisions of the Foundation are controlled

by majority vote of the trustees. As a result, Ronda E. Stryker may be deemed

to share voting and investment power over the Common Shares held in the

Foundation. Ronda E. Stryker expressly disclaims status as a "group" with the

Foundation, William D. Johnston or their adult children who are trustees of

the Foundation for purposes of this Schedule 13D.

William D. Johnston's and Greenleaf Trust's principal business address is c/o

Greenleaf Trust, 211 South Rose Street, Kalamazoo, Michigan 49007. William

D. Johnston's principal occupation or employment is Chairman of Greenleaf

Trust, a Michigan state chartered bank marketing fiduciary services to the

general public.

Neither William D. Johnston nor Greenleaf Trust has, during the last five

years, been convicted in a criminal proceeding (excluding traffic violations

or similar misdemeanors). Neither William D. Johnston nor Greenleaf Trust

has, during the last five years, been a party to a civil proceeding of a

judicial or administrative body of competent jurisdiction and as a result of

such proceeding was or is subject to a judgment, decree or final order

enjoining future violations of, or prohibiting or mandating activities subject

to, federal or state securities laws or finding any violation with respect to

such laws. William D. Johnston is a citizen of the United States of America.

(c)No transactions in the Common Shares were effected by Ronda E. Stryker

during the 60 days prior to January 30, 2020: the following transactions

occurred on or after 1/31/2020 (1) 9,995 options were exercised on February 3,

2020; (2) a gift of 465,000 shares of the Company was initiated on

1/31/2020; (3) a gift of 75,000 shares of the Company was initiated on

1/31/2020; (4) a gift of 46,000 shares of the Company was initiated on

1/31/2020 and (5) a gift of 19,000 shares of the Company was initiated on

1/31/2020.

(d)Other than (1) Greenleaf Trust, with respect to the Common Shares in the

LLS Subtrust, (2) the Foundation and its trustees, with respect to the Common

Shares held by the Foundation, (3) William D. Johnston with respect to the

Common Shares held by him, and (4) the beneficiaries of the LLS Subtrust,

namely Ronda E. Stryker and her issue, no person is known to have the right to

receive, or the power to direct the receipt of, dividends from, or the

proceeds from the sale of, the Common Shares beneficially owned by Ronda E.

Stryker.

(e)Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect

to Securities of the Issuer

Other than (1) those relationships with other trustees of the Foundation and

the other owners and directors of Greenleaf Trust, (2) Ronda E. Stryker's

oversight responsibilities for the Foundation, which are shared with the other

trustees of the Foundation, (3) Ronda E. Stryker's rights and privileges under

the governing instrument of the LLS Subtrust, some of which are shared with

the trustee of that Subtrust, (4) Ronda E. Stryker's rights and privileges

under her revocable trust instrument with respect to the Common Shares held in

her revocable trust, and (5) the option agreements between Ronda E. Stryker

and the Company and the related stock option plan with respect to the shares

underlying stock options beneficially owned by Ronda E. Stryker, Ronda E.

Stryker does not have any contracts, arrangements, understandings or

relationships (legal or otherwise) with any person with respect to any Common

Shares or any other securities of the Company, including, but not limited to,

transfer or voting of any of the securities, finder's fees, joint ventures,

loan or option agreements, puts or calls, guarantees of profits or loss,

division of profits or loss, or the giving or withholding of proxies.

Item 7. Material to be Filed as Exhibits

1.2006 Long-Term Incentive Plan (as amended effective February 27, 2017),

incorporated by reference to Exhibit 10.2 to the Company's Form 10 Kfor the

year ended December 31, 2017 (Commission File No. 000 09165)

2.2011 Long-Term Incentive Plan (as amended effective February 4, 2020),

incorporated by reference to Exhibit 10.1 to the Company's Form 10 K for the

year ended December 31, 2019 (Commission File No. 001 13149)

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify

that the information set forth in this statement is true, complete and correct.

Dated: February 13, 2020

/s/ Ronda E Stryker

Ronda E. Stryker

|

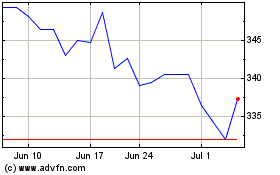

Stryker (NYSE:SYK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Stryker (NYSE:SYK)

Historical Stock Chart

From Apr 2023 to Apr 2024