Current Report Filing (8-k)

February 06 2020 - 7:54AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): February 6, 2020

POWER

REIT

(Exact

name of registrant as specified in its charter)

Maryland

(State

or other jurisdiction of incorporation)

001-36312

(Commission

File Number)

45-3116572

(IRS

Employer Identification No.)

301

Winding Road

Old

Bethpage, NY 11804

(Address

of principal executive offices and Zip Code)

Registrant’s

telephone number, including area code: (212) 750-0371

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class

|

|

Trading

Symbol

|

|

Name

of Each Exchange on Which Registered

|

|

Common

Shares

|

|

PW

|

|

NYSE

(American)

|

|

|

|

|

|

|

|

7.75%

Series A Cumulative Redeemable

Perpetual

Preferred Stock, Liquidation

Preference

$25 per Share

|

|

PW.A

|

|

NYSE

(American)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01. Entry into a Material Definitive Agreement.

Power

REIT (“Power REIT” or the “Trust”) announces the acquisition of two properties located in southern Colorado

(the “Properties”) through two newly formed wholly owned subsidiaries of a wholly owned subsidiary of the Trust (each

a “PropCo”). Each Propco has entered into a triple-net lease with an operator such that the tenant is

responsible for paying all expenses related to the Properties, including maintenance expenses, insurance and taxes. The term of

each lease is 20 years and provides two options to extend for additional five-year periods. The

Leases also have financial guarantees from affiliates of the tenants. Each tenant intends to operate the Properties as

licensed cannabis cultivation and processing facilities.

The

rent for each of the Leases is structured whereby after a deferred-rent period, the rental payments provide Power REIT a full

return of invested capital over the next three years in equal monthly payments. The deferred-rent period for one of the leases

is six months and for the other lease is nine months. After the deferred-rent period, rent is structured to provide a 12.5% return

for one of the leases and a 12.9% return for the other lease based on the original invested capital amount with annual rent

increases of 3% rate per annum. At any time after year six, if cannabis is legalized at the federal level, the rent will be readjusted

down to an amount equal to a 9% return on the original invested capital amount and will increase at a 3% rate per annum based

on a starting date of the start of year seven.

The

Leases require each tenant to maintain a medical cannabis license and operate in accordance with all Colorado and

state and local regulations with respect to its operations. The Leases prohibit the retail sale of the Tenant’s cannabis

and cannabis-infused products from the Properties.

The

foregoing descriptions of the Leases does not purport to be complete and are qualified in their entirety by reference to the complete

text of the Leases, copies of which are attached hereto as Exhibits 10.1 and 10.2 and is incorporated into this Current Report

on Form 8-K by reference.

Item

2.01 Completion of Acquisition or Disposition of Assets.

On

February 2, 2020, the Trust, through each PropCo, completed the acquisition of two Properties.

Power

REIT acquired “Maverick 14” for $850,000 which is 5.54 acres with an existing greenhouse and processing facility totaling

8,300 square feet. As part of the transaction, the Trust has agreed to fund the immediate expansion of 15,120 square feet of greenhouse

space for $1,058,400 and the tenant has agreed to fund the construction of an additional 2,520 square feet of head-house/processing

space on the property. Accordingly, Power REIT’s total capital commitment totals $1,908,400.

Power

REIT acquired “Sherman 6” for $150,000 which is 5.0 acres of vacant land approved for cannabis cultivation. As part

of the transaction, the Trust has agreed to fund the immediate construction of 15,120 square feet of greenhouse space and 7,520

square feet of head-house/processing space on the property for $1,693,800. Accordingly, Power REIT’s total capital commitment

totals $1,843,800.

The

total combined investment across all three properties will be approximately $3,752,200 plus acquisition expenses. The acquisitions

and commitments to fund construction are being funded from existing working capital.

Item

7.01 Regulation FD Disclosure.

On

February 6, 2020, the Trust issued a press release regarding the acquisition of the Properties.

A copy of the press release is attached hereto as Exhibit 99.1. The information contained in Item 7.01 of this report, including

Exhibit 99.1, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended, or otherwise subject to the liabilities of that section. Such information shall not be incorporated by

reference into any filing of the Trust, whether made before or after the date hereof, regardless of any general incorporation

language in such filing.

Item

8.01 Other Events.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

Forward-Looking

Statements

Some

of the information in this press release contains forward-looking statements and within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. When used in this press release,

words such as “believe,” “expect,” “anticipate,” “estimate,” “plan,”

“continue,” “intend,” “should,” “may,” “target,” or similar expressions,

are intended to identify such forward-looking statements. Forward-looking statements are subject to significant risks and uncertainties.

Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set

forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in

the forward-looking statements include those discussed under the caption “Risk Factors” included in our Annual Report

on Form 10-K for our fiscal year ended December 31, 2018, which was filed with the U.S. Securities and Exchange Commission (“SEC”),

as well as in other reports that we file with the SEC.

Forward-looking

statements are based on beliefs, assumptions and expectations as of the date of this press release. We disclaim any obligation

to publicly release the results of any revisions to these forward-looking statements reflecting new estimates, events or circumstances

after the date of this press release.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

POWER REIT

|

|

|

|

|

|

Date:

February 6, 2020

|

By

|

/s/

David H. Lesser

|

|

|

|

David

H. Lesser

Chairman

of the Board and Chief Executive Officer

|

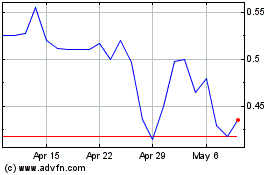

Power REIT (AMEX:PW)

Historical Stock Chart

From Mar 2024 to Apr 2024

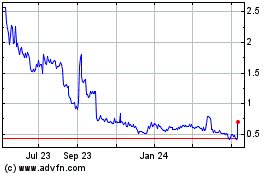

Power REIT (AMEX:PW)

Historical Stock Chart

From Apr 2023 to Apr 2024