Power REIT (NYSE American: PW) announces that it has completed the

acquisition of two greenhouse properties in southern Colorado

through two wholly owned subsidiaries for $3.75 million. The

acquisitions represent combined straight-line annual rent estimated

to be approximately $700 thousand, which translates to an

approximate 18.7% yield.

The acquisitions complement Power REIT’s

existing high-quality real estate related to transportation

infrastructure, alternative energy and Controlled Environment

Agriculture (“CEA”). CEA uses innovative methods to grow plants in

optimized indoor growing environments for a given crop. Power REIT

intends to focus on CEA related real estate for growing various

crops, including cannabis.

David Lesser, Power REIT’s Chairman and

CEO, commented, “These acquisitions represent an expansion

of our new focus on investing in CEA greenhouse properties and are

immediately accretive to FFO. On a run-rate basis, and omitting

future available capital deployments, these acquisitions, along

with the other recently announced CEA related transactions should

increase FFO by over 43%, relative to our stabilized FFO

expectations prior to embarking on our improved business plan in

July 2019. Assuming we are able to deploy the remaining capital

equally over the next three quarters, our year end “run-rate” FFO

per share should exceed $1.50 per share based on deploying capital

at a 12.5% yield relative to the more than 18% yield we have been

investing at. This is approximately triple our Stabilized FFO prior

to embarking on our new business plan.”

Mr. Lesser continued, “Both

properties are well positioned for near-term expansions of

greenhouse growing and processing space. The leases provide that we

have the option to fund expansions on comparable terms to the

original leases with a built-in option that allows us to

accretively deploy additional capital on attractive risk adjusted

terms.” Mr. Lesser concluded, “With an extensive

acquisition pipeline, we should be able to deploy the remainder of

the capital currently available for investment in the near

term.”

As previously disclosed, Power REIT recently

completed a $15.5 million debt financing at a rate of 4.62% which

fully amortizes over a 35-year term. A portion of the funds were

utilized to acquire the two aforementioned assets. In addition to

these acquisitions, Power REIT has an extensive pipeline of CEA

projects and is actively working to deploy the remainder of the

capital available for investment.

Concurrent with the closings on the

acquisitions, Power REIT entered into “triple-net” leases that

require each tenant to pay all property related expenses including

maintenance, insurance and taxes. Each lease has a term of 20 years

and provides two 5-year renewal options for the tenant with

financial guarantees from affiliates of the tenant. The leases

require each tenant to maintain a valid medical marijuana license

and to operate in accordance with all Colorado and municipal

regulations while prohibiting the retail sale of its products from

the properties.

ACQUIRED PROPERTIES

- Maverick 14 was acquired for $850 thousand.

The 5.54-acre property has an existing greenhouse and processing

facility totaling 8,300 square feet. As part of the transaction,

Power REIT has agreed to fund the immediate expansion of 15,120

square feet of greenhouse space for approximately $1.1 million. The

tenant has also agreed to fund the construction of an additional

2,520 square feet of processing space. Power REIT’s total capital

commitment is approximately $1.9 million.

The property is

located in the subdivision, which has been developed through an

alliance with the existing tenant and developer who have extensive

experience constructing greenhouses. An affiliate of the tenant has

also received preliminary approval to operate a dispensary in the

town where the properties are located.

- Sherman 6 was acquired for $150,000. The

vacant land parcel is comprised of 5.0 acres, which has been

approved for cannabis cultivation. As part of this transaction, the

Trust has agreed to fund the immediate construction of 15,120

square feet of greenhouse space and 7,520 square feet of processing

space on the property for approximately $1.7 million. Power REIT’s

total capital commitment is approximately $1.8 million.

The Sherman

6 tenant is owned by an affiliate of a company that

currently has three retail dispensaries in southern Colorado and

operates an 18,000 square foot indoor cannabis growing facility

that is on a short-term lease. Given current conditions, it is

anticipated that product demand will far exceed its current

production capacity.

STATEMENT ON SUSTAINABILITY

Power REIT owns real estate related to

infrastructure assets including properties for Controlled

Environment Agriculture (CEA Facilities), Renewable Energy and

Transportation.

CEA Facilities, such as

greenhouses, provide an extremely environmentally friendly

solution, which consume approximately 70% less energy than indoor

growing operations that do not benefit from “free” sunlight. CEA

facilities use 90% less water than field grown plants, and all of

Power REIT’s greenhouse properties operate without the use of

pesticides and avoid agricultural runoff of fertilizers and

pesticides. These facilities cultivate medical Cannabis, which has

been recommended to help manage a myriad of medical symptoms,

including seizures and spasms, multiple sclerosis, post-traumatic

stress disorder, migraines, arthritis, Parkinson's disease, and

Alzheimer’s.

Renewable Energy assets are

comprised of land and infrastructure associated with utility scale

solar farms. These projects produce power without the use of fossil

fuels thereby lowering carbon emissions. The solar farms produce

approximately 50,000,000 kWh of electricity annually which is

enough to power approximately 4,600 home on a carbon free

basis.

Transportation assets are

comprised of land associated with a railroad, an environmentally

friendly mode of bulk transportation.

UPDATED INVESTOR

PRESENTATION

In conjunction with these transactions, Power

REIT has updated its investor presentation to communicate the

company’s strategic business plan and recent activities. A copy of

the presentation can be found in the investors section of the Power

REIT website: www.pwreit.com

ABOUT POWER REIT

Power REIT is a real estate investment trust

(REIT) that owns real estate related to infrastructure assets

including properties for Controlled Environment Agriculture,

Renewable Energy and Transportation. Power REIT is actively seeking

to expand its real estate portfolio related to Controlled

Environment Agriculture and Renewable Energy. Additional

information on Power REIT can be found on its website at

www.pwreit.com

CAUTIONARY STATEMENT ABOUT

FORWARD-LOOKING STATEMENTS

This document includes forward-looking

statements within the meaning of the U.S. securities laws.

Forward-looking statements are those that predict or describe

future events or trends and that do not relate solely to historical

matters. You can generally identify forward-looking statements as

statements containing the words "believe," "expect," "will,"

"anticipate," "intend," "estimate," "project," "plan," "assume",

"seek" or other similar expressions, or negatives of those

expressions, although not all forward-looking statements contain

these identifying words. All statements contained in this document

regarding our future strategy, future operations, future prospects,

the future of our industries and results that might be obtained by

pursuing management's current or future plans and objectives are

forward-looking statements. You should not place undue reliance on

any forward-looking statements because the matters they describe

are subject to known and unknown risks, uncertainties and other

unpredictable factors, many of which are beyond our control. Our

forward-looking statements are based on the information currently

available to us and speak only as of the date of the filing of this

document. Over time, our actual results, performance, financial

condition or achievements may differ from the anticipated results,

performance, financial condition or achievements that are expressed

or implied by our forward-looking statements, and such differences

may be significant and materially adverse to our security

holders.

CONACT:

David H. Lesser, Chairman & CEO (212) 750-0371

dlesser@pwreit.com

301 Winding Road Old Bethpage, NY 11804

212-750-0371www.pwreit.com

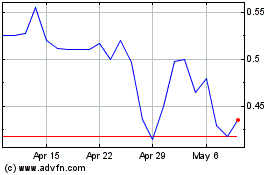

Power REIT (AMEX:PW)

Historical Stock Chart

From Mar 2024 to Apr 2024

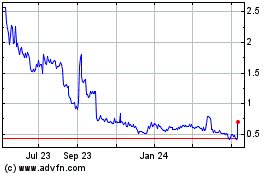

Power REIT (AMEX:PW)

Historical Stock Chart

From Apr 2023 to Apr 2024