UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 1-SA

x SEMIANNUAL REPORT PURSUANT TO REGULATION A

or

¨ SPECIAL FINANCIAL REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended: August 31, 2019

|

VORTEX BRANDS CO.

|

|

(Exact name of registrant as specified in its charter)

|

|

Colorado

|

|

81-1007448

|

|

(State or other jurisdiction of

|

|

(I.R.S. Employer

|

|

incorporation or organization)

|

|

Identification No.)

|

3511 Del Paso Road, STE 160 PMB 208

Sacramento, CA 95835

(Mailing Address of principal executive offices)

213-260-0321

(Issuer’s telephone number, including area code)

Item 1. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “Vortex Brands”, “the Company”, “our Company”, “we,”, “Vortex”, “VTXB”, “Vortex Green Energy”, “us”, and “our”, refer to Vortex Brands Co., a Colorado corporation.

Special Note Regarding Forward Looking Statements

Certain information contained in this report includes forward-looking statements. The statements herein which are not historical reflect our current expectations and projections about our company’s future results, performance, liquidity, financial condition, prospects and opportunities and are based upon information currently available to our company and our management and our interpretation of what is believed to be significant factors affecting the businesses, including many assumptions regarding future events.

Forward-looking statements, which involve assumptions and describe our future plans, strategies, and expectations, are generally identifiable by use of the words “may,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” or “project” or the negative of these words or other variations on these words or comparable terminology. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, these forward-looking statements as a result of various risks, uncertainties and other factors. Actual events or results may differ materially from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” included in our Offering Statement on Form 1-A, as amended and supplemented to date, and matters described in this report generally. There can be no assurance that the forward-looking statements contained in this report will in fact occur.

Potential investors should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

The specific discussions herein about our company include financial projections and future estimates and expectations about our company’s business. The projections, estimates and expectations are presented in this report only as a guide about future possibilities and do not represent actual amounts or assured events. All the projections and estimates are based exclusively on our management’s own assessment of our business, the industry in which we work and the economy at large and other operational factors, including capital resources and liquidity, financial condition, fulfillment of contracts and opportunities. The actual results may differ significantly from the projections.

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and the related notes. Some of the information contained in this discussion and analysis, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties.

The financial statements included in this filing are unaudited and may not include year-end adjustments necessary to make those financial statements comparable to audited results, although in the opinion of management all adjustments necessary to make the interim financial statements not misleading have been included.

Overview

Vortex Brands Co. (“Company”) was originally incorporated in the State of Colorado on May 6, 2005 under the name of Global Sunrise, Inc. On January 15, 2007 the Company changed its name to Zulu Energy Corp. On May 29, 2014, the Company changed its name to Vortex Brands Co. The Company trades on OTC Markets PINKS under the symbol “VTXB”.

On February 19, 2018, the Company executed a reverse merger with Blockchain Energy, Inc. For accounting purposes, this transaction is being accounted for as a reverse merger and has been treated as a recapitalization of the Company with Blockchain being considered the accounting acquirer, and the financial statements of the accounting acquirer became the financial statements of the registrant. The Company did not recognize goodwill or any intangible assets in connection with the transaction. The shares issued to the shareholders of Blockchain in conjunction with the share exchange transaction have been presented as outstanding for all periods. The historical consolidated financial statements include the operations of the accounting acquirer for all periods presented.

Blockchain Energy was incorporated in the State of Colorado on December 28, 2017. Blockchain Energy was intended to be the surviving Company and became a wholly owned subsidiary of Vortex Brands. Vortex Brands had no operations, assets or liabilities prior to the reverse merger. Vortex Brands established a trade name of Vortex Green Energy and will maintain the name Blockchain Energy for specific purposes under the business plan.

Our corporate business address is: 3511 Del Paso Rd., Ste. 160 PMB 208, Sacramento, CA 95835 and our registered office is located at 1942 Broadway Street, Suite 314C, Boulder, CO 80302. Our telephone number is 213-260-0321. Our E-Mail address is info@vortexbrands.us.

The address of our web site is www.vortexgreenenergy.com. The information at our web site is for general information and marketing purposes and is not part of this report for purposes of liability for disclosures under the federal securities laws.

Our Company will provide as a service multi-purpose Phase Angle Synchronization (PAS) equipment to electric utilities worldwide. PAS is a one-of-a-kind technology designed to address a one-hundred-year-old inherent problem that was thought to be unsolvable: the inefficient power consumption caused by electric motors. The solution will extend the life of the grid by protecting it from excessive wear and damage, improve grid reliability by reducing line congestion and increasing reserve margin, while creating true cost savings for the utility. Poor power efficiency has been the unsolvable issue in every facility that operates electric motors. PAS is designed to address industrial and commercial use applications in a scalable solution. Revenues will be generated from a service fee we will charge that shares a portion of the savings for the electric utility created by each PAS service installation.

Our company holds the irrevocable right to purchase all components necessary to effectuate the PAS system from Tripac Systems, who has done the research and development of PAS equipment over more than 25 years. Their capabilities include experience at assembling the equipment from off-the-shelf components and designing the plans and schematics for PAS equipment. Our Company, together with Tripac Systems, will effectuate the service program and we are likely to have multiple pilot program PAS units operating in Detroit, Michigan and potentially other locations, to collect initial data on performance prior to a full roll-out. Current efforts are focused on site selection for PAS installations as well as stakeholder and industry support of the pilot program.

Business Progress

To date, our operations have consisted of raising capital to fully implement our business plan, creating marketing and product explanation materials, developing our website, and giving product demonstrations of the PAS. We expect to experience negative working capital until a pilot program consisting of multiple PAS units is in operation for at least two months, as the data generated by the pilot program will likely propel the electric utilities to adopt the PAS service installations.

The demonstration unit has been moved from Sacramento to Tripac Systems’ facility in Burlington, Washington, where it has been used in demonstrations to stakeholders and investors. Tripac Systems has made additional improvements to the PAS design and manufactured the first PAS production unit ready for field installation training.

Recent Developments

On February 25, 2019 an offering statement submitted by the Company became qualified by the Securities and Exchange Commission (“SEC”). The Company was offering, on a best-efforts, self-underwritten basis, a number of shares of our common stock at a fixed priced per share at $0.005 with no minimum amount to be sold up to a maximum of 1,000,000,000 shares, not to exceed $5,000,000 in gross proceeds. On October 18, 2019 a post-effective amendment was filed to reset the price per share to $0.004. The shares are intended to be sold directly through the efforts of our officer and director. We have authorized capital stock consisting of 3,000,000,000 shares of common stock, $0.0001 par value per share (“Common Stock”) and 20,000,000 shares of preferred stock, $0.0001 par value per share (“Preferred Stock”). As of August 31, 2109, we have 241,300,000 shares of Common Stock, and 6,121,000 shares of Preferred Series C Stock issued and outstanding.

Going Concern

Our current financial condition raises substantial doubt regarding our ability to continue as a going concern. Our financial statements are prepared using U.S. generally accepted accounting principles, or GAAP, applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, as shown in the accompanying financial statements, the Company has a loss from operations, an accumulated deficit, no revenue, and a working capital deficiency. The Company intends to fund operations through equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements.

Results of Operations

Six Months ended August 31, 2019

For the six months ending August 31, 2019, we recorded no revenues, as we have focused on raising sufficient capital to roll out a pilot program consisting of multiple Phase Angle Synchronization (PAS) systems. At this same time last year, we also recorded no revenues, as we were still in the process of getting the Regulation A+ qualified with the Securities and Exchange Commission.

Our loss from operations over the period covered by this semi-annual report was ($251,917), a 22% increase from loss from operations of ($205,923) in the same period of 2018.

The Company’s operating expenses consist of research and development, technology, professional services, and general & administrative costs. Operating expenses for the six months ending August 31, 2019 were $143,775 compared with $101,457 over the six-month period ending August 31, 2018. The difference was largely due to increased administration costs associated with professional services, as well as an increase in research and development costs with the vendor as they made improvements to streamline and enhance production of the PAS system.

We have two employees, Todd Higley our Chief Executive Officer and Cecilia Widner-White, a director, Mr. Higley and Ms. Widner-White each have an employment agreement with our company, and both have deferred payment of their salaries of $100,000 each until such time as sufficient operating capital has been raised. Currently, both Mr. Higley and Ms. Widner-White have the flexibility to work on our business when required. Our other directors, Mr. John Nunley III and Alfredo Forte are serving as directors without compensation. We will consider compensating other directors in the future. We do not presently have pension, health, annuity, insurance, stock options, profit sharing, or similar benefit plans; however, we may adopt plans in the future. There are presently no personal benefits available to our officer and directors. During the initial implementation of our business plan, we intend to hire independent consultants to assist in the development and execution of our business operations.

Liquidity and Capital Resources

As of August 31, 2019, the Company held $2,406 in cash compared with $5,760 in cash held as of August 31, 2018.

Regulation A+ Financing

On February 25, 2019, the Company’s Regulation A was qualified by the SEC (File number 024-10875) with gross proceeds of $145,000 raised through the sale of common stock.

We will have additional capital requirements during fiscal 2020. We do not expect to be able to satisfy our anticipated cash requirements through sales activity, and therefore we will attempt to raise additional capital through the sale of our common stock pursuant to our offering circular which has been qualified by the SEC.

We cannot assure that we will have sufficient capital to finance our growth and business operations or that such capital will be available on terms that are favorable to us or at all.

Off-Balance Sheet Arrangements

As of August 31, 2019, we did not have any off-balance sheet arrangements.

Trend Information

Our vendor Tripac Systems established a location in Burlington, Washington, which allowed us to install the Phase Angle Synchronization (PAS) system for demonstration purposes. This provided our key supporters and industry participants to have live demonstrations of the technology, ask questions, and further understand the money-saving impact this technology will have on the electric utility industry. We believe these demonstrations and interaction with the vendor will continue as the solution becomes more widely known.

We believe our current efforts to secure the financing of a pilot program will be successful. Further, as multiple PAS systems are operating in multiple installation environments, we believe the resulting energy and cost savings to the utility will be undisputable. Finally, since we are offering the energy and cost savings at no cost to the utility and will instead charge a monthly service fee as a portion of the savings it creates, meaning it will not be a capital expenditure for the utility nor will it require a budget approval, we believe there will be multiple orders for the service after just a few months of pilot program data is collected and shown.

Item 2. Other Information

None.

Item 3. Financial Statements

VORTEX BRANDS CO.

August 31, 2019

INDEX TO THE UNAUDITED INTERIM CONSOLIDATED FINANCIAL STATEMENTS

TABLE OF CONTENTS

NOTICE OF NO INDEPENDENT AUDITOR REVIEW

The accompanying unaudited consolidated financial statements of the Company have been prepared by and are the responsibility of the Company’s management. The Company’s independent auditor has not performed a review of these financial statements.

VORTEX BRANDS CO.

Consolidated Balance Sheets

(Unaudited)

|

|

|

As of

|

|

|

As of

|

|

|

|

|

August 31,

|

|

|

February 28,

|

|

|

|

|

2019

|

|

|

2019

|

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

2,406

|

|

|

$

|

1,181

|

|

|

Total current assets

|

|

|

2,406

|

|

|

|

1,181

|

|

|

|

|

|

|

|

|

|

|

|

|

Property and equipment, net

|

|

|

81,741

|

|

|

|

86,049

|

|

|

Total Assets

|

|

$

|

84,147

|

|

|

|

87,230

|

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Deficit

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

57,039

|

|

|

$

|

53,143

|

|

|

Accrued management fees

|

|

|

300,000

|

|

|

|

200,000

|

|

|

Due to related parties

|

|

|

2,200

|

|

|

|

2,262

|

|

|

Total liabilities

|

|

|

359,239

|

|

|

|

255,405

|

|

|

|

|

|

|

|

|

|

|

|

|

Commitments and Contingencies

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders’ deficit

|

|

|

|

|

|

|

|

|

|

Preferred stock: 20,000,000 authorized; $0.0001 par value Series C Preferred Stock, 9,996,000 shares designated; $0.0001 par value; 6,121,000 shares issued and outstanding

|

|

|

612

|

|

|

|

612

|

|

|

Common stock: 3,000,000,000 shares authorized; $0.0001 par value 241,300,000 and 207,050,000 shares issued and outstanding

|

|

|

24,130

|

|

|

|

20,705

|

|

|

Additional paid-in capital

|

|

|

380,258

|

|

|

|

238,683

|

|

|

Accumulated deficit

|

|

|

(680,092

|

)

|

|

|

(428,175

|

)

|

|

Total stockholders’ deficit

|

|

|

(275,092

|

)

|

|

|

(168,175

|

)

|

|

Total Liabilities and Stockholders’ Deficit

|

|

$

|

84,147

|

|

|

$

|

87,230

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

VORTEX BRANDS CO.

Consolidated Statements of Operations

(Unaudited)

|

|

|

Six Months Ended

|

|

|

|

|

August 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$

|

-

|

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses

|

|

|

|

|

|

|

|

|

|

General and administrative

|

|

|

107,798

|

|

|

|

116,552

|

|

|

Research and development

|

|

|

71,000

|

|

|

|

41,027

|

|

|

Professional fees

|

|

|

73,119

|

|

|

|

48,344

|

|

|

Total operating expenses

|

|

|

251,917

|

|

|

|

205,923

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Loss

|

|

|

(251,917

|

)

|

|

|

(205,923

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Loss Before Income Taxes

|

|

|

(251,917

|

)

|

|

|

(205,923

|

)

|

|

Provision for income taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(251,917

|

)

|

|

$

|

(205,923

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per common share

|

|

$

|

(0.00

|

)

|

|

$

|

(0.00

|

)

|

|

Basic and diluted weighted average common shares outstanding

|

|

|

228,579,730

|

|

|

|

207,050,000

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

VORTEX BRANDS CO.

Consolidated Statements of Changes in Stockholders’ Equity (Deficit)

(Unaudited)

For the Six Months Ended August 31, 2019

|

|

|

Series C Preferred Stock

|

|

|

Common Stock

|

|

|

Additional

|

|

|

|

|

|

Total

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Number of shares

|

|

|

Amount

|

|

|

Paid in

Capital

|

|

|

Accumulated

Deficit

|

|

|

Shareholders’

Deficit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, February 28, 2019

|

|

|

6,121,000

|

|

|

$

|

612

|

|

|

$

|

207,050,000

|

|

|

$

|

20,705

|

|

|

$

|

238,683

|

|

|

$

|

(428,175

|

)

|

|

$

|

(168,175

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common shares

|

|

|

-

|

|

|

|

-

|

|

|

|

34,250,000

|

|

|

|

3,425

|

|

|

|

141,575

|

|

|

|

-

|

|

|

|

145,000

|

|

|

Net loss

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(251,917

|

)

|

|

|

(251,917

|

)

|

|

Balance, August 31, 2019

|

|

|

6,121,000

|

|

|

$

|

612

|

|

|

$

|

241,300,000

|

|

|

$

|

24,130

|

|

|

$

|

380,258

|

|

|

$

|

(680,092

|

)

|

|

$

|

(275,092

|

)

|

For the Six Months Ended August 31, 2018

|

|

|

Series C Preferred Stock

|

|

|

Common Stock

|

|

|

Additional

|

|

|

|

|

|

Total

Shareholders'

|

|

|

|

|

Shares

|

|

|

Amount

|

|

|

Number of shares

|

|

|

Amount

|

|

|

Paid in

Capital

|

|

|

Accumulated

Deficit

|

|

|

Equity

(Deficit)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, February 28, 2018

|

|

|

9,996,000

|

|

|

$

|

1,000

|

|

|

$

|

207,050,000

|

|

|

$

|

20,705

|

|

|

$

|

213,295

|

|

|

$

|

(33,192

|

)

|

|

$

|

201,808

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for the period

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(205,923

|

)

|

|

|

(205,923

|

)

|

|

Balance, August 31, 2018

|

|

|

9,996,000

|

|

|

$

|

1,000

|

|

|

$

|

207,050,000

|

|

|

$

|

20,705

|

|

|

$

|

213,295

|

|

|

$

|

(239,115

|

)

|

|

$

|

(4,115

|

)

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

VORTEX BRANDS CO.

Consolidated Statement of Cash Flows

(Unaudited)

|

|

|

Six Months

Ended

|

|

|

|

|

August 31,

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

Cash Used in Operating Activities

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(251,917

|

)

|

|

$

|

(205,923

|

)

|

|

Adjustments to reconcile net loss to net cash used in operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

4,308

|

|

|

|

4,306

|

|

|

Changes in non-cash working capital balances:

|

|

|

|

|

|

|

|

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

(3,000

|

)

|

|

Accounts payable

|

|

|

3,896

|

|

|

|

3,160

|

|

|

Accrued management fees

|

|

|

100,000

|

|

|

|

100,000

|

|

|

Due to related parties

|

|

|

(62

|

)

|

|

|

-

|

|

|

Net Cash Used in Operating Activities

|

|

|

(143,775

|

)

|

|

|

(101,457

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Cash Provided by Financing Activities

|

|

|

|

|

|

|

|

|

|

Proceeds from issuance of common shares

|

|

|

145,000

|

|

|

|

-

|

|

|

Net Cash Provided by Financing Activities

|

|

|

145,000

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

Net change in cash for the period

|

|

|

1,225

|

|

|

|

(101,457

|

)

|

|

Cash at beginning of period

|

|

|

1,181

|

|

|

|

107,217

|

|

|

Cash at end of period

|

|

$

|

2,406

|

|

|

$

|

5,760

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Cash Flow Information:

|

|

|

|

|

|

|

|

|

|

Cash paid for income taxes

|

|

$

|

-

|

|

|

$

|

-

|

|

|

Cash paid for interest

|

|

$

|

-

|

|

|

$

|

-

|

|

The accompanying notes are an integral part of these unaudited consolidated financial statements.

VORTEX BRANDS CO.

Notes to the Unaudited Consolidated Financial Statements

August 31, 2019

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

Vortex Brands Co., (“Vortex”, the “Company”) is a Colorado corporation incorporated on May 6, 2005. It is based in Sacramento, California. The accounting and reporting policies of the Company conform to accounting principles generally accepted in the United States of America, and the Company’s fiscal year end is February 28 (February 29 in leap years).

The Company has no operations prior to the reverse merger with Blockchain Energy, Inc.

The Company distributes and provides as a service multi-purpose Phase Angle Synchronization (PAS) equipment to electric utilities nationwide. PAS is the only technology designed to address a one-hundred-year-old problem that was thought of as inherent and “unsolvable”: the inefficient power consumption caused by electric motors. The solution will extend the life of the grid by protecting it from excessive wear and damage, improve grid reliability by reducing line congestion and increasing reserve margin while creating true cost savings for the utility. Poor power efficiency has been the unsolvable issue in every facility that operates electric motors. PAS is designed to address industrial and commercial use applications in a scalable solution. Operations initially are focused in California before expanding nationwide.

Share Exchange and Reorganization

On February 25, 2018, the Share Exchange Agreement was closed with Blockchain Energy, Inc. (“Blockchain Energy”), and as such Blockchain Energy has become a wholly-owned subsidiary of the Company. As per the Share Exchange Agreement, the Company acquired 235,000 common shares and 9,996,000 preferred shares of Blockchain Energy, representing 100% of the issued and outstanding equity of Blockchain Energy and in exchange the Company issued 117,000,000 shares of common stock and 9,996,000 shares of Series C Preferred Stock.

For financial accounting purposes, this transaction was treated as a reverse acquisition by Blockchain Energy and resulted in a recapitalization with Blockchain Energy being the accounting acquirer and Vortex as the acquired company.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The consolidated financial statements have been prepared using the accrual basis of accounting in accordance with Generally Accepted Accounting Principles (“GAAP”) of the United States.

Principles of Consolidation

The consolidated financial statements of the Company include the accounts of the Company and its wholly owned subsidiary, Blockchain Energy, Inc. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. The estimates and judgments will also affect the reported amounts for certain revenues and expenses during the reporting period. Actual results could differ from these good faith estimates and judgments.

Cash and Cash Equivalents

The Company considers all highly liquid investments with original maturity of three months or less to be cash equivalents. The Company had $2,406 and $1,181 in cash as of August 31, 2019 and February 28, 2019, respectively.

Financial Instruments

The Company’s financial instruments consist primarily of cash, prepaid expenses, deposits, and accounts payable. The carrying amounts of such financial instruments approximate their respective estimated fair value due to the short-term maturities and approximate market interest rates of these instruments.

Concentrations of Credit Risks

The Company’s financial instruments that are exposed to concentrations of credit risk primarily consist of its cash and cash equivalents. The Company places its cash and cash equivalents with financial institutions of high credit worthiness. At times, its cash with a particular financial institution may exceed any applicable government insurance limits. The Company’s management plans to assess the financial strength and credit worthiness of any parties to which it extends funds, and as such, it believes that any associated credit risk exposures are limited.

Related Parties

We follow ASC 850, ”Related Party Disclosures,” for the identification of related parties and disclosure of related party transactions (see Note 6).

Research and Development Expenses

We follow ASC 730, ”Research and Development,” and expense research and development costs when incurred. Accordingly, third-party research and development costs, including designing, prototyping and testing of product, are expensed when the contracted work has been performed or milestone results have been achieved. Indirect costs are allocated based on percentage usage related to the research and development. Research and development costs of $71,000 and $41,027 were incurred for the period ended August 31, 2019 and 2018, respectively.

Share-based Expenses

ASC 718 “Compensation – Stock Compensation” prescribes accounting and reporting standards for all share-based payment transactions in which employee services are acquired. Transactions include incurring liabilities, or issuing or offering to issue shares, options, and other equity instruments such as employee stock ownership plans and stock appreciation rights. Share-based payments to employees, including grants of employee stock options, are recognized as compensation expense in the financial statements based on their fair values. That expense is recognized over the period during which an employee is required to provide services in exchange for the award, known as the requisite service period (usually the vesting period).

The Company accounts for stock-based compensation issued to non-employees and consultants in accordance with the provisions of ASC 505-50, “Equity – Based Payments to Non-Employees.” Measurement of share-based payment transactions with non-employees is based on the fair value of whichever is more reliably measurable: (a) the goods or services received; or (b) the equity instruments issued. The fair value of the share-based payment transaction is determined at the earlier of performance commitment date or performance completion date.

Impairment of long-lived assets

We evaluate carrying value of long-lived assets whenever events or changes in circumstances would indicate that it is more likely than not their carrying values may exceed their realizable values, and records impairment charges when considered necessary. When circumstances indicate that impairment may have occurred, the Company tests such assets for recoverability by comparing the estimated undiscounted future cash flows expected to result from the use of such assets and their eventual disposition to their carrying amount. In estimating these future cash flows, assets and liabilities are grouped at a lowest level for which there are identifiable cash flows that are largely independent of the ash flows generated by other such groups. If the undiscounted future cash flows are less than the carrying amount of the asset, an impairment loss, measured as the excess of the carrying value of the asset over its estimated fair value, is recognized. Fair values are determined based on discounted cash flows, quoted market values or external appraisals as applicable.

Fixed Assets

Property and equipment are carried at cost less accumulated depreciation. Cost includes all direct costs necessary to acquire and prepare assets for use. The costs of repairs and maintenance are expensed when incurred, while expenditures for refurbishments and improvements that significantly add to the productive capacity or extend the useful life of an asset are capitalized. When assets are retired or sold, the asset cost and related accumulated depreciation are eliminated with any remaining gain or loss recognized in net earnings.

Depreciation is recorded on the straight-line method over estimated useful lives, generally as follows:

Income Taxes

The Company accounts for income taxes using the asset and liability method in accordance with ASC 740, ”Accounting for Income Taxes.” The asset and liability method provides that deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities and for operating loss and tax credit carry forwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. The Company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized. As of August 31, 2019, the Company did not have any amounts recorded pertaining to uncertain tax positions.

Uncertain Tax Positions

The Company follows guidance issued by the FASB regarding accounting for uncertainty in income taxes. This guidance clarifies the accounting for income taxes by prescribing the minimum recognition threshold an income tax position is required to meet before being recognized in the financial statements and applies to all income tax positions. Each income tax position is assessed using a two-step process. A determination is first made as to whether it is more likely than not that the income tax position will be sustained, based upon technical merits, upon examination by the taxing authorities. If the income tax position is expected to meet the more likely than not criteria, the benefit recorded in the financial statements equals the largest amount that is greater than 50% likely to be realized upon its ultimate settlement.

The Company records income tax related interest and penalties as a component of the provision for income tax expense. As of August 31, 2019, the Company determined there were no uncertain tax provisions.

Basic and Diluted Net Loss Per Common Share

The Company follows ASC 260, “Earnings per Share” (“EPS”), which requires presentation of basic EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation. In the accompanying financial statements, basic earnings (loss) per share are computed by dividing net loss by the weighted average number of shares of common stock outstanding during the period.

Diluted earnings per share reflects the potential dilution that could occur if securities were exercised or converted into common stock or other contracts to issue common stock resulting in the issuance of common stock that would then share in the Company’s earnings subject to anti-dilution limitations. In a period in which the Company has a net loss, all potentially dilutive securities are excluded from the computation of diluted shares outstanding as they would have an anti-dilutive impact. For the period ended August 31, 2019 and 2018, potentially dilutive common shares consist of common stock issuable upon the conversion of 6,121,000 and 9,996,000 shares of Series C Preferred Stock (using the if converted method), respectively. Each share of Series C Preferred Stock may be converted into a 100 of fully paid and non-assessable shares of Common Stock

Commitments and Contingencies

The Company follows ASC 450-20, “Loss Contingencies,” to report accounting for contingencies. Liabilities for loss contingencies arising from claims, assessments, litigation, fines and penalties and other sources are recorded when it is probable that a liability has been incurred and the amount of the assessment can be reasonably estimated. There were no commitments or contingencies as of August 31, 2019.

Recent Accounting Pronouncements

Management does not believe that any recently issued, but not yet effective, accounting standards could have a material effect on the accompanying financial statements. As new accounting pronouncements are issued, the Company will adopt those that are applicable under the circumstances.

NOTE 3 – GOING CONCERN

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern, which contemplates the realization of assets and the liquidation of liabilities in the normal course of business. As of August 31, 2019, the Company has a loss from operations, an accumulated deficit, no revenue, and a working capital deficiency. The Company intends to fund operations through equity financing arrangements, which may be insufficient to fund its capital expenditures, working capital and other cash requirements for the year ended February 29, 2020.

Management intends to raise additional funds through public or private placement offerings.

These factors, among others, raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying financial statements do not include any adjustments that might result from the outcome of this uncertainty.

NOTE 4 – FIXED ASSETS, NET

Fixed assets, net at August 31, 2019 and February 28, 2019 consist of the following:

|

|

|

August 31,

|

|

|

February 28,

|

|

|

|

|

2019

|

|

|

2019

|

|

|

|

|

|

|

|

|

|

|

Technical equipment

|

|

$

|

95,477

|

|

|

$

|

95,477

|

|

|

Less: accumulated depreciation

|

|

|

(13,736

|

)

|

|

|

(9,428

|

)

|

|

Equipment

|

|

$

|

81,741

|

|

|

$

|

86,049

|

|

NOTE 5 – RELATED PARTY TRANSACTIONS

Other

The officer and directors of the Company may be involved in other business activities and may, in the future, become involved in other business opportunities that become available. They may face a conflict in selecting between the Company and other business interests. The Company has not formulated a policy for the resolution of such conflicts.

Our office space needs are limited at the current time. From January 1, 2018 through October 1, 2018 our prior directors, Mr. Kirkland and Mr. Jones had provided space, and were compensated in the form of partial rent payments. As of October 29, 2018, Mr. Kirkland and Mr. Jones resigned from the company under a termination agreement wherein their company will receive remuneration under that agreement. As of October 1, 2018, we have moved our demonstration unit to Tripac’s Washington State location to standardize unit design and assembly for the upcoming pilot program. Our corporate business address is: 3511 Del Paso Rd., Ste. 160 PMB 208, Sacramento, CA 95835.

The officer and directors have agreed to receive stock as compensation for their employment. Mr. Higley and Mrs. Widner-White have agreed to $100,000 each in annual deferred compensation, until such time as sufficient operating capital has been raised. As of August 31, 2019, the Company recorded accrued salary of $300,000.

NOTE 6 – EQUITY

Series C Preferred Stock

The Company designated 9,996,000 shares of Series C Convertible Preferred Stock with a par value of $0.0001 per share.

As at August 31, 2019 and February 28, 2019, 6,121,000 shares of Series C Preferred Stock were issued and outstanding, respectively.

Common Stock

The Company is authorized to issue 3,000,000,000 shares of common stock at a par value of $0.0001. The holders of outstanding shares of Common Stock are entitled to receive dividends out of assets or funds legally available for the payment of dividends of such times and in such amounts as the board from time to time may determine. Holders of Common Stock are entitled to one vote for each share held on all matters submitted to a vote of shareholders. There is no cumulative voting of the election of directors then standing for election. The Common Stock is not entitled to pre-emptive rights and is not subject to conversion or redemption. Upon liquidation, dissolution or winding up of our company, the assets legally available for distribution to stockholders are distributable ratably among the holders of the Common Stock after payment of liquidation preferences, if any, on any outstanding payment of other claims of creditors.

On March 18, 2019, the Company issued 1,000,000 shares of common stock for cash proceeds of $4,000.

On April 2, 2019, the Company issued 4,000,000 shares of common stock for cash proceeds of $20,000.

On May 3, 2019, the Company issued 21,500,000 shares of common stock for cash proceeds of $86,000.

On May 6, 2019, the Company issued 3,750,000 shares of common stock for cash proceeds of $15,000.

On July 22, 2019, the Company issued 4,000,000 shares of common stock for cash proceeds of $20,000.

As at August 31, 2019 and February 28, 2019, 241,300,000 and 207,050,000 shares of common stock were issued and outstanding.

NOTE 7 – SUBSEQUENT EVENTS

Subsequent to August 31, 2019 through the date these financial statements were issued, the Company issued 13,200,000 shares of Common Stock for $55,000.

Item 4. Exhibits

The documents listed in the Exhibit Index of this report are incorporated by reference or are filed with this report, in each case as indicated below.

|

|

|

|

Incorporated by Reference

|

|

|

|

Exhibit No.

|

|

Description

|

|

Form

|

|

Exhibit

|

|

Filing Date

|

|

|

|

|

|

|

|

|

|

|

|

2.1

|

|

Articles of Incorporation, as filed with the Colorado Secretary of State

|

|

SB-2

|

|

3.1

|

|

09/01/2006

|

|

2.2

|

|

Amended Articles of Incorporation, as filed on January 15, 2007

|

|

10-Q

|

|

3.2

|

|

05/20/2008

|

|

2.3

|

|

Amended Articles of Incorporation, as filed on July 10, 2007

|

|

8-K

|

|

3.1

|

|

12/27/2007

|

|

2.4

|

|

Statement of Correction of Articles of Incorporation, as filed on May 2, 2008

|

|

10-Q

|

|

3.3

|

|

05/20/2008

|

|

2.5

|

|

Statement of Correction of Articles of Incorporation, as filed on June 5, 2008

|

|

1-A/A

|

|

2.5

|

|

02/22/2019

|

|

2.6

|

|

Amended Articles of Incorporation, as filed on May 28, 2014

|

|

1-A/A

|

|

2.6

|

|

02/22/2019

|

|

2.7

|

|

Amended Articles of Incorporation, as filed on June 11, 2014

|

|

1-A/A

|

|

2.7

|

|

02/22/2019

|

|

2.8

|

|

Amended and Restated Articles of Incorporation, as filed on February 26, 2018

|

|

1-A/A

|

|

2.8

|

|

02/22/2019

|

|

2.9

|

|

Amended and Restated Articles of Incorporation, as filed on July 25, 2018

|

|

1-A/A

|

|

2.9

|

|

02/22/2019

|

|

2.10

|

|

Amended and Restated Articles of Incorporation, as filed on August 24, 2018

|

|

1-A/A

|

|

2.10

|

|

02/22/2019

|

|

2.11

|

|

Series C Preferred Stock, as filed with the Colorado Secretary of State

|

|

1-A/A

|

|

2.11

|

|

02/22/2019

|

|

2.12

|

|

Amended and Restated Articles of Incorporation, as filed on January 29, 2019

|

|

1-A/A

|

|

2.12

|

|

02/22/2019

|

|

2.13

|

|

By-Laws of the Company

|

|

1-A/A

|

|

2.13

|

|

02/22/2019

|

|

6.1

|

|

Termination Agreement

|

|

1-A/A

|

|

6.1

|

|

02/22/2019

|

|

6.2

|

|

Memorandum of Understanding

|

|

1-A/A

|

|

6.2

|

|

02/22/2019

|

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

VORTEX BRANDS, INC.

|

|

|

|

|

|

|

|

/s/ Todd Higley

|

|

January 21, 2020

|

|

Todd Higley

|

|

|

|

President, Chief Executive Officer and Director

|

|

|

|

(Principal Executive Officer, Principal Accounting and Financial Officer)

|

|

|

Pursuant to the requirements of Regulation A, this report has been signed by the following persons on behalf of the issuer and in the capacities and on the dates indicated.

|

/s/ Todd Higley

|

|

January 21, 2020

|

|

Todd Higley

|

|

|

|

President, Chief Executive Officer and Director

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Cecilia Widner-White

|

|

January 21, 2020

|

|

Cecilia Widner-White

Director

|

|

|

|

|

|

|

|

/s/ John F. Nunley, III

|

|

January 21, 2020

|

|

John F. Nunley, III

Director

|

|

|

|

|

|

|

|

/s/ Alfredo Forte

|

|

January 21, 2020

|

|

Alfredo Forte

Director

|

|

|

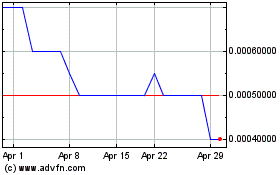

Vortex Brands (PK) (USOTC:VTXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vortex Brands (PK) (USOTC:VTXB)

Historical Stock Chart

From Apr 2023 to Apr 2024