Arcosa, Inc. Announces Completion of Cherry Companies Acquisition

January 06 2020 - 4:15PM

Business Wire

- Expands Aggregates Business into

Attractive Houston Region and Builds Leadership Position in Growing

Recycled Aggregates Market

- Provides Platform for Additional Growth

in Natural and Recycled Aggregates

- Accelerates Portfolio Shift into

Higher-Valued Construction Products Segment

Arcosa, Inc. (NYSE: ACA) (“Arcosa” or the “Company”), a provider

of infrastructure-related products and solutions, today announced

that it has closed the acquisition of Cherry Industries, Inc. and

affiliated entities (“Cherry” or “Cherry Companies”), a leading

producer of natural and recycled aggregates in the Houston, Texas

market.

As previously announced, on December 12, 2019, Arcosa entered

into a definitive agreement to acquire Cherry for $298 million.

With revenues and EBITDA of approximately $176 million and $37

million, respectively, for the trailing twelve-month period ended

September 30, 2019, Cherry adds 12 Houston locations to Arcosa’s

existing 19 active aggregate and specialty materials locations in

Texas, building out Arcosa’s footprint in a key Texas market with

healthy population growth, major highway investments, and positive

private demand drivers.

At closing, the purchase price was funded with a combination of

cash on-hand and advances under a new $150 million five-year term

loan provided by a syndicate of banks. The interest rate under the

facility, initially set at 3.4%, is variable based on LIBOR and

Arcosa’s leverage.

The acquisition is expected to be accretive to earnings in 2020.

The Company expects to provide guidance for full year 2020 when it

releases its fourth quarter and full year 2019 results in late

February 2020.

Antonio Carrillo, President and Chief Executive Officer,

commented, “We are excited to announce the completion of the Cherry

acquisition. Cherry accelerates the growth of our Construction

Products segment at an attractive price, broadens our geographic

presence into the Houston market, and provides us a new

complementary product line of recycled aggregates.

“Arcosa’s Construction Materials portfolio now includes natural

aggregates, recycled aggregates, and specialty materials, each of

which offers a platform for continued organic and acquisition

growth. We look forward to working with the experienced Cherry team

to grow in both natural and recycled aggregates, and we feel

well-positioned to benefit from continued investment in

infrastructure spending in Texas and nationwide.”

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider

of infrastructure-related products and solutions with leading

positions in construction, energy, and transportation markets.

Arcosa reports its financial results in three principal business

segments: the Construction Products Group, the Energy Equipment

Group, and the Transportation Products Group. For more information,

visit www.arcosa.com.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” and similar expressions to

identify these forward-looking statements. Forward-looking

statements speak only as of the date of this release, and Arcosa

expressly disclaims any obligation or undertaking to disseminate

any updates or revisions to any forward-looking statement contained

herein, except as required by federal securities laws.

Forward-looking statements are based on management’s current views

and assumptions and involve risks and uncertainties that could

cause actual results to differ materially from historical

experience or our present expectations, including but not limited

to assumptions, risks and uncertainties regarding achievement of

the expected benefits of Arcosa’s spin-off from Trinity; tax

treatment of the spin-off; failure to successfully integrate

Cherry, or failure to achieve the expected benefits of the

acquisition; market conditions and customer demand for Arcosa’s

business products and services; the cyclical nature of, and

seasonal or weather impact on, the industries in which Arcosa

competes; competition and other competitive factors; governmental

and regulatory factors; changing technologies; availability of

growth opportunities; market recovery; improving margins; and

Arcosa’s ability to execute its long-term strategy, and such

forward-looking statements are not guarantees of future

performance. For further discussion of such risks and

uncertainties, see "Risk Factors" and the "Forward-Looking

Statements" section of "Management's Discussion and Analysis of

Financial Condition and Results of Operations" in Arcosa's Form

10-K for the year-ended December 31, 2018, as may be revised and

updated by Arcosa's Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

Reconciliation of EBITDA for Cherry(in

millions)(unaudited)

“EBITDA” is defined as Cherry’s net income plus interest

expense, income taxes, and depreciation and amortization. EBITDA is

not a calculation based on generally accepted accounting

principles. The amounts included in the EBITDA calculation,

however, are derived from amounts included in the historical

statements of operations data. In addition, EBITDA should not be

considered as an alternative to net income or operating income as

an indicator of Cherry’s operating performance, or as an

alternative to operating cash flows as a measure of liquidity. We

believe EBITDA assists investors in comparing a company’s

performance on a consistent basis without regard to depreciation

and amortization and other expenses, which can vary significantly

depending upon many factors.

EBITDA for Cherry (For the Trailing Twelve Months Ended

September 30, 2019) Net income $ 28.5

Add: Interest expense 0.1 Provision for income taxes 1.2

Depreciation and amortization expense 7.1 EBITDA $ 36.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200106005872/en/

Scott C. BeasleyChief Financial Officer

Gail M. PeckSVP, Finance & Treasurer

T 972.942.6500InvestorResources@arcosa.com

David GoldADVISIRY Partners

T 212.661.2220David.Gold@advisiry.com

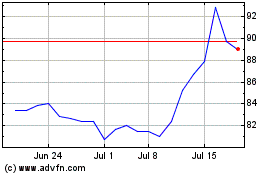

Arcosa (NYSE:ACA)

Historical Stock Chart

From Mar 2024 to Apr 2024

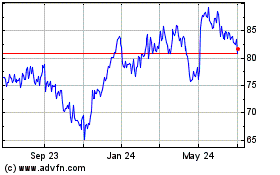

Arcosa (NYSE:ACA)

Historical Stock Chart

From Apr 2023 to Apr 2024