Additional Proxy Soliciting Materials - Non-management (definitive) (dfan14a)

January 02 2020 - 8:40AM

Edgar (US Regulatory)

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant o

Filed

by a Party other than the Registrant x

Check the appropriate

box:

|

|

o

|

Preliminary Proxy Statement

|

|

|

o

|

Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2))

|

|

|

o

|

Definitive Proxy Statement

|

|

|

o

|

Definitive Additional Materials

|

|

|

x

|

Soliciting Material Pursuant to Rule 14a-12

|

BARNWELL

INDUSTRIES, INC.

(Name

of Registrant as Specified in its Charter)

|

NED L. SHERWOOD

NLS ADVISORY GROUP, INC.

MRMP-MANAGERS LLC

BRADLEY M. TIRPAK

SCOTT D. KEPNER

DOUGLAS N. WOODRUM

PHILLIP J. MCPHERSON

|

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing

Fee (Check the appropriate box):

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1)

and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction

applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction

applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it

was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

|

o

|

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous

filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

MRMP-Managers LLC and Barnwell Industries’

Largest Independent Shareholder Group Increases Position in the Company

Group Nominates Five New Directors

to the Board for the 2020 Annual Meeting

Group Buys More Shares, Increases

Commitment to Fix Barnwell

Company’s Recent Annual Report

Highlights Need for Drastic Change

January 2, 2020 -- MRMP-Managers LLC, NLS

Advisory Group, Inc., Ned L. Sherwood, and Bradley M. Tirpak announced today that they have sent the following press release and

announcement to shareholders of Barnwell Industries, Inc. (NYSE American: BRN) (“Barnwell”).

Dear Fellow Owner,

In March of 2020, Barnwell will hold its

annual meeting of stockholders. For the first time ever, shareholders will have a choice between the incumbent board that has failed

to deliver for shareholders and a new board that we believe is qualified to turn the company around. We believe drastic change

is needed to revive the company.

Since our last announcement, when we nominated

five new, highly qualified individuals to the board, we have heard from many shareholders who share our sentiments and support

our effort. To make sure that we can contact you with a ballot and communicate with you before the annual meeting, we would like

to hear from every shareholder.

Please call us at (646) 921-2080 or contact

us via mandriasova@SherwoodFamilyOffice.com

Barnwell recently announced dismal results

for fiscal year 2019. The results show that Barnwell recorded its biggest loss of the decade. On almost every metric, we believe

the latest annual report highlighted the current management teams’ ineptitude and failures:

|

|

·

|

The company reported a net loss for fiscal year 2019 of $12.4 million.

|

|

|

·

|

Using the Standardized Method of Cash Flows, the Company reported the value of the Oil and Gas division has dropped from $13.8

million to $2.3 million during the 2019 fiscal year, a staggering drop of 83%. This occurred despite the Company investing $13

million in the Twining acquisition within that division during the previous 2018 fiscal year.

|

|

|

·

|

The Company reported revenues in the real estate segment dropped from $1.64 million to just $165 thousand, a decrease of 90%

during the 2019 fiscal year.

|

|

|

·

|

With this report, this brings the cumulative loss for the decade consisting of the fiscal years 2009-2019 to over $34.0 million.

|

|

|

·

|

During this same decade, the stock declined from $4.35 at the end of fiscal year 2009 to $.52 at the end of fiscal year 2019—a

loss of 87%.

|

|

|

·

|

Finally, over this same decade, the executives Morton Kinzler, his son Alex Kinzler, the CFO Russ Gifford, and the board received

over $19 million in remuneration!

|

Obviously, change is long overdue and urgently needed, and,

if it is not too late, the five new individuals we have nominated to the board will bring the changes needed to salvage the company.

We recently bought over 275,000 shares in the company because

we remain firmly committed to fixing Barnwell. The five individuals we have nominated have the skills, experience, and the ethics

to implement the changes needed and offer the best chance for a turnaround.

If you own shares of Barnwell, we want to be able to communicate

our turnaround plans with you before the annual meeting.

Please call us at (646) 921-2080 or contact

us via mandriasova@SherwoodFamilyOffice.com

Sincerely,

Ned L. Sherwood and Bradley M. Tirpak

Ned L.

Sherwood, Bradley M. Tirpak, NLS Advisory Group, Inc., and MRMP-Managers LLC intend to make a filing with the SEC of a proxy statement

and accompanying proxy card to solicit votes for the election of director nominees at the 2020 annual meeting of shareholders of

Barnwell Industries, Inc. Ned L. Sherwood Revocable Trust, of which Ned L. Sherwood is the beneficiary and the trustee, holds 238,038

shares of common stock of Barnwell, and MRMP-Managers LLC, of which Mr. Sherwood is the Chief Investment Officer, holds 948,402.138

shares of common stock of Barnwell. Mr. Sherwood is deemed to beneficially own all of these shares. Bradley M. Tirpak holds

34,127 shares of common stock of Barnwell. Ned L. Sherwood, Bradley M. Tirpak, NLS Advisory Group, Inc., and MRMP-Managers LLC,

and their nominees to the Barnwell board are the participants in this proxy solicitation. Information regarding the participants

and their interests in the solicitation will be included in their proxy statement and other materials filed with the SEC.

SHAREHOLDERS

OF BARNWELL SHOULD READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY BECOME AVAILABLE

AS THEY WILL CONTAIN IMPORTANT INFORMATION RELATING TO THE ANNUAL MEETING, THE NOMINEES TO THE BOARD, AND SOLICITATION OF PROXIES.

THESE PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV.

Contact:

Maria Andriasova

NLS Advisory Group, Inc.

(646) 921-2080

mandriasova@SherwoodFamilyOffice.com

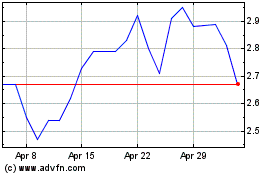

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

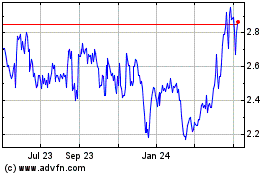

Barnwell Industries (AMEX:BRN)

Historical Stock Chart

From Apr 2023 to Apr 2024