Table of Contents

Unlock the value created by the

convergence of the physical

and digital worlds...

Table of Contents

Notice of 2020 Annual Meeting of Stockholders

Wednesday, February 12, 2020

8:00 a.m.

Eastern Standard Time |

PTC Inc.

121 Seaport Boulevard

Boston, MA 02210 |

|

| Important Notice of the Internet Availability of Proxy Materials |

| The Proxy Statement and our 2019 Annual Report are available to stockholders at www.proxyvote.com. |

Proposals to be Voted on at the

Annual Meeting |

|

Board

Recommendation |

| Elect eight directors to serve until the 2021 Annual Meeting of Stockholders. |

|

✓ FOR |

| Advisory vote to approve the compensation of our named executive officers (say-on-pay). |

|

✓ FOR |

| Advisory vote to confirm the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current fiscal year. |

|

✓ FOR |

Other matters that are properly brought before the meeting may also be considered.

Stockholders at the close of business on December 9, 2019 are entitled to vote.

Please vote your shares before the meeting, even if you plan to attend the meeting.

Your broker will not be able to vote your shares on the election of directors or the say-on-pay proposal unless you have given your broker specific instructions to do so.

By Order of the Board of Directors

AARON C. VON STAATS

Secretary

Boston, Massachusetts

December 31, 2019

2 www.ptc.com

Table of Contents

|

Over the past year we again executed well against our strategic initiatives, establishing a solid foundation for the future. |

Dear Fellow Stockholders,

A few highlights from the year,

Our total annual subscription contract value (ARR) at the end of 2019 was $1,116 million, 10% higher than 2018, reflecting growth across all our businesses, particularly our IoT and AR businesses.

We saw strong revenue growth in 2019, with recurring software revenue growing 10% over 2018 to $1,079 million.*

Operating margins increased in 2019, reflecting increases in recurring revenue and continued expense discipline.*

Operating cash flow increased 15% over 2018 to $285 million in 2019.

We continued to gain traction in our strategic alliances with Rockwell Automation, Microsoft and ANSYS, extending our market reach and further differentiating our technology.

Finally, we acquired a number of companies in 2019 to support our strategic vision, the most notable of which was Onshape. Onshape is a SaaS product development platform that unites CAD, data management and collaboration tools in a next generation package. Onshape enables us to both participate in and disrupt portions of the market and to offer companies of all sizes a SaaS product development solution that differs from the traditional on-premise solutions in the market.

Given our execution in 2019, we believe the company is well-positioned for the future.

You can find additional information about our business performance for the year in the proxy statement summary and in our Annual Report to Stockholders, which accompanies this proxy statement.

We thank you for your continued support of PTC.

Sincerely,

ROBERT SCHECHTER

Chairman of the Board

| +10% |

| ARR over 2018 |

| 85% |

| Subscription Mix |

| +10% |

Recurring Revenue

over 2018* |

| +15% |

Operating Cash Flow

over 2018 |

| +33% |

Operating Margin

over 2018* |

| +85% |

| 5-Year TSR |

| +54% |

| 3-Year TSR |

| * |

Under the ASC 605 accounting standard in effect through 2018 and reported for 2019 for comparability purposes. Amounts under the ASC 606 accounting standard in effect for 2019 differ. See Appendix B. |

2020 Proxy Statement 3

Table of Contents

Proxy Statement Summary

This summary highlights information contained elsewhere in this proxy statement and does not contain all the information you should consider. You should read the entire proxy statement before voting. For more complete information regarding PTC’s 2019 performance, you should read our Annual Report to Stockholders, which accompanies this proxy statement.

(All references to 2019 and 2018 refer to PTC’s fiscal years ended September 30, 2019 and 2018, respectively, unless otherwise indicated.)

Matters to be Voted on at the Meeting

|

Elect eight directors to serve until the 2021 Annual Meeting of Stockholders. |

| ✓ |

The Board of Directors recommends a vote FOR All Nominees |

|

Advisory vote to approve the compensation of our named executive officers (say-on-pay). |

| ✓ |

The Board of Directors recommends that you vote FOR the approval of the compensation of our named executive officers as disclosed

in COMPENSATION DISCUSSION AND ANALYSIS and the tables and related disclosures contained in EXECUTIVE COMPENSATION. |

|

Advisory vote to confirm the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current fiscal year. |

| ✓ |

The Board of Directors recommends that you vote FOR the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020. |

4 www.ptc.com

Table of Contents

Proxy Statement Summary

Director Nominees

|

|

|

Committees |

| Nominee |

Director

Since |

Audit |

Compensation |

Corporate

Governance |

Nominating |

Strategic

Partnerships

Oversight |

|

Robert Schechter,

Chairman of the Board

INDEPENDENT |

2009 |

✓ |

✓ |

|

|

✓ |

|

Janice Chaffin

INDEPENDENT |

2013 |

|

✓ |

C |

C |

✓ |

|

Phillip Fernandez

INDEPENDENT |

2016 |

✓ |

|

|

|

|

|

James Heppelmann

President and CEO, PTC |

2008 |

|

|

|

|

|

|

Klaus Hoehn

INDEPENDENT |

2015 |

|

|

✓ |

✓ |

|

|

Paul Lacy

INDEPENDENT |

2009 |

C |

✓ |

✓ |

✓ |

|

|

Corinna Lathan

INDEPENDENT |

2017 |

✓ |

|

|

|

|

|

Blake Moret

INDEPENDENT |

2018 |

|

|

✓ |

|

✓ |

|

|

|

|

C Chairman |

✓ Member |

All director nominees attended at least 75% of the meetings of the Board and of the committees on which they serve that were held in the past year.

2020 Proxy Statement 5

Table of Contents

Proxy Statement Summary

Corporate Governance Highlights

|

Board Independence |

|

|

Board and Committee Practices |

|

●Independent and Diverse Board of Directors

●Independent Board Chair

●Independent Audit, Compensation, Governance, and Nominating Committee Chairs

●Independent Audit, Compensation, Governance and Nominating Committees |

|

●Regular Executive Sessions of Independent Directors

●Annual Board and Director Evaluations

●Comprehensive Risk Management Oversight

●CEO and Management Succession Planning |

| |

|

|

|

|

|

Stockholder Rights |

|

|

Stock Governance |

|

●Annual Election of All Directors

●Annual Say-on-Pay Vote

●No Supermajority Voting Requirements

●Stockholder Right to Call a Special Meeting

●Majority Voting Policy for Uncontested Director Elections

●No Poison Pill |

|

●Robust Stock Ownership Requirements for Directors and Executive Officers

●No Hedging or Pledging of Stock by Directors, Executives or Employees

●No Payment or Accumulation of Dividends or Dividend Equivalents on Options or Unvested Shares

|

|

Compensation Practices |

|

●Pay-for-Performance Compensation

●Half Our Executives’ Annual Target Compensation is Performance-Based

●Independent Compensation Consultant

●All Executives are Employed “At Will”

●“Double-Trigger” Change in Control Agreements

●No Excise Tax Gross-Ups

●Compensation Clawback Policy

●No Perquisites or Supplemental Retirement Benefits

●Performance-Based Incentive Plan Earnings are Capped

●Tally Sheets Reviewed Annually

●Annual Risk Assessment of Pay Programs

|

6 www.ptc.com

Table of Contents

Proxy Statement Summary

Executive Compensation Highlights

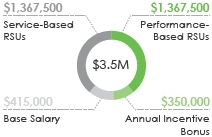

2019 Total Target Compensation

| CEO Target Compensation |

NEO Target Compensation |

|

Base Salary |

|

| |

|

|

|

Annual Incentive Plan

Focus executives on achieving specific performance goals tied to annual business plan. |

|

| Performance Measure |

| FY19 Ending Total |

FY19 Non-GAAP |

| Recurring ACV |

Operating Expense |

| % Weight: 2/3 |

% Weight: 1/3 |

|

Long-Term Incentives

Discourages short-term risk taking and aligns long-term management goals with long-term interests of stockholders. |

|

| |

|

|

| PSUs (50%) |

RSUs (50%) |

| Adjusted Free Cash |

Vest in three equal |

| Flow over 2018 for |

installments in |

| each of 2019, 2020 |

November 2019, 2020 |

| and 2021. |

and 2021. |

| Ultimate realized value depends on stock price performance. |

| |

Annual Upside PSUs

Upside earning opportunity for exceptional performance above our annual business plan.

Rigorous performance goal tied to New License and Subscription Bookings. |

|

2020 Proxy Statement 7

Table of Contents

Proxy Statement Summary

Alignment of Pay and Performance

Five-Year CEO Total Realized Pay

vs Relative TSR |

|

Five-Year NEO Total Realized Pay

vs Relative TSR |

|

|

|

Alignment of Executives and Stockholders

THREE-YEAR

VESTING OF RSUs |

+ |

SUBSTANTIAL

STOCK OWNERSHIP

REQUIREMENTS |

+ |

CLAWBACK

PROVISIONS |

= |

ALIGNED INTERESTS

BETWEEN OUR

EXECUTIVES AND

STOCKHOLDERS |

2019 Stockholder Engagement

|

|

|

We engaged with stockholders during and after the 2019 proxy season to discuss our executive pay program and other corporate governance matters. Our chairman of the Board, Robert Schechter, participated in many of these discussions. Other participants from the company included our Vice President of Investor Relations, our General Counsel and/or our Corporate & Securities Counsel. We targeted all investors that held at least 1% of our outstanding stock. |

Investors

Contacted |

Discussions

Held |

|

|

|

|

| 26 |

14 |

|

Number of

Investors |

Number of

Investors |

|

| 45.6% |

27% |

|

% Outstanding

Shares |

% Outstanding

Shares |

|

Most investors we spoke with focused on board composition and refreshment and executive compensation. Investors also discussed environmental and social issues, such as human capital management, and reporting on our ESG initiatives and profile.

Board Composition and Refreshment. Investors were generally comfortable with our board composition and refreshment initiatives and were mainly seeking to understand how we think about those topics.

Executive Compensation. Our discussions about our executive pay program and the actions we took for our 2020 pay program are described below in “Compensation Discussion and Analysis.”

8 www.ptc.com

Table of Contents

Proxy Statement Summary

Environmental and Social Issues and Reporting. Investors are more focused on environmental and social issues and related reporting than they have been in the past. Some investors wanted to hear about our environmental and social initiatives in more detail, particularly human capital management, while others asked that we provide more reporting with respect to those initiatives and, particularly, performance against a reporting standard.

2019 PricewaterhouseCoopers LLP Services and Fees

| Type of Professional Service |

|

2019 |

|

2018 |

| Audit Fees |

|

$ |

2,511,658 |

|

$ |

2,546,354 |

| Audit-Related Fees(1) |

|

$ |

174,811 |

|

$ |

416,971 |

| Tax Fees(2) |

|

$ |

1,442,067 |

|

$ |

2,185,977 |

| All Other Fees(3) |

|

$ |

2,700 |

|

$ |

2,700 |

| (1) |

Consists principally of fees for consultations concerning financial accounting and reporting standards. |

| (2) |

Consists principally of fees related to tax compliance, tax planning and tax advice services, and tax compliance services related to PTC’s expatriate employees (including assistance with individual tax compliance that PTC provides as a benefit to these employees) as follows: |

| |

Type of Tax Service |

|

2019 |

|

2018 |

|

Tax compliance and preparation services (comprised of preparation of original and amended tax returns, claims for refunds, and tax payment planning services) |

|

$ |

486,300 |

|

$ |

575,888 |

|

Tax compliance services related to PTC’s expatriate employees |

|

$ |

— |

|

$ |

350,000 |

|

Other tax

services, including tax planning and advice services and assistance with tax audits |

|

$ |

955,707 |

|

$ |

1,260,089 |

|

Total |

|

$ |

1,442,067 |

|

$ |

2,185,977 |

| (3) |

Consists of fees for accounting research and compliance software. |

|

See Proposal 3 for more information about PricewaterhouseCoopers LLP’s services. |

2020 Proxy Statement 9

Table of Contents

Proxy Statement Summary

Corporate Responsibility

We recognize the close connection between our success and our ability to make a positive impact on our customers, our employees and the planet. Giving back to communities, embracing a culture of diversity and inclusion, sustaining the environment, and practicing sound ethics aren’t just the right thing to do. These efforts help make us an employer of choice, differentiate our brand, and support profitable and responsible growth. We published our first Corporate Social Report in early 2019. You can read that report and about our Corporate Social Responsibility initiatives at ptc.com/en/about/corporate-social-responsibility. The reference to our Corporate Social Responsibility Report and our website are not intended to incorporate information in that report or on our website into this Proxy Statement by reference.

|

|

Community Engagement

We engage in the global community and support our employees that do so as well.

In 2018, we founded the PTC Charitable Foundation to bring together our giving initiatives under one umbrella. The Foundation supports important educational initiatives, including the For Inspiration and Recognition of Technology (FIRST) program, which engages children from kindergarten through high school worldwide in research and robotics programs, the City Year program in Boston, which pairs Americorps members to support local middle and high school students, and Citizen Schools, which partners with underserved middle schools that need additional support and resources.

We support other educational institutions with in-kind software donations.

Finally, we support our employees’ engagement by matching our employees’ charitable donations through the Foundation and providing our employees with paid time off to volunteer with charitable organizations and community initiatives. |

| |

|

|

Diversity & Inclusion

Inclusion and diversity are key to our success. We seek employees with diverse backgrounds and insights and are committed to creating a culture of innovation and inspiration where all employees feel a sense of ownership and pride in our success.

PTC was named a Top Place to Work in Massachusetts by The Boston Globe in 2019, 2018 and 2017. |

| |

|

|

Sustainability

As a company that operates globally, we seek to reduce and mitigate our environmental impact through our sustainability initiatives.

Our sustainability initiatives include recycling programs, energy and resource conservation programs, and public transportation support programs.

Our new world headquarters building in the Boston Seaport has received LEED Gold certification. |

10 www.ptc.com

Table of Contents

Table of Contents

2020 Proxy Statement 11

Table of Contents

Information about the Annual Meeting and Voting

2020 Annual Meeting of Stockholders

Date and Time

Wednesday, February 12, 2020

8:00 a.m.

Eastern Standard Time |

Place

PTC Inc.

121 Seaport Boulevard

Boston, MA 02210 |

| Proposals to be Voted On at the Meeting |

| |

|

|

| Proposal |

|

Board

Recommendation |

| Elect eight directors to serve until the 2021 Annual Meeting of Stockholders. |

|

✓ FOR |

| Advisory vote to approve the compensation of our named executive officers (Say-on-Pay). |

|

✓ FOR |

| Advisory vote to confirm the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the current fiscal year. |

|

✓ FOR |

How You May Vote

All stockholders as of December 9, 2019 have the right to attend and vote at the Annual Meeting of Stockholders. You may vote by proxy in advance of the meeting. You may attend the meeting even if you have voted by proxy before the meeting. In order to establish a quorum and to facilitate the tabulation of votes, please vote before the meeting, even if you plan to attend the meeting.

|

VOTING BY PROXY

To vote, you should follow the voting instructions in the notice or proxy card sent to you.

You may vote by Internet or, if you received a proxy card, by telephone or mail.

If you vote by proxy, your shares will be voted at the meeting as you instruct. If you submit your proxy but do not provide instructions, your shares will be voted in accordance with the Board’s recommendations as set forth above. If any matter not listed in the Notice of Meeting is properly presented at the Annual Meeting, your shares will be voted in accordance with the designated proxies’ best judgment. |

|

VOTING IN PERSON

If you wish to vote in person, you must have the required documentation described below with you.

If you are a record holder (that is, you hold your shares directly and not through a brokerage account), you should bring a government issued document that identifies you (such as a Driver’s License or Passport).

If you are a beneficial holder (that is, you hold your shares through a brokerage account), you will need to obtain a legal proxy from the brokerage firm to enable you to vote at the meeting. You should also bring a government issued document that identifies you. |

You have one vote for each share of common stock that you owned at the close of business on December 9, 2019. On that date, there were 115,493,203 shares outstanding. See ADDITIONAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING for additional information about voting and other administrative matters.

We made this proxy statement available to stockholders on December 31, 2019.

12 www.ptc.com

Table of Contents

| |

Proposal 1 |

|

| |

|

|

Election of Directors |

The Board is elected by the stockholders to represent and protect their interest in PTC. The Board selects and oversees the members of senior management, who are responsible for conducting the business of PTC.

All director nominees are current directors of the company. Information about each of the director nominees, including their qualifications, skills and experience that led the Nominating Committee and the Board to conclude that the director should serve as a director of the company, is discussed below. Information about their PTC stock ownership is set forth in INFORMATION ABOUT PTC COMMON STOCK OWNERSHIP – Stock Owned by Directors and Officers.

| ✓ |

The Board of Directors recommends that you vote FOR the election of all director nominees. |

Summary of Qualifications

Qualifications, Skills and Experience

The Nominees have a good balance of the qualifications, skills and experience that the Nominating Committee and the Board have identified as contributing to the effectiveness of the Board.

| |

| Leadership |

Strategy |

Global |

Financial |

Software

Industry |

Manufacturing |

Marketing |

Research &

Development |

|

|

|

|

|

|

|

|

| 8/8 |

8/8 |

8/8 |

7/8 |

6/8 |

5/8 |

5/8 |

5/8 |

| |

|

| Supermajority is Independent |

Tenure is Well Balanced |

|

|

Independent - 7

Not Independent - 1 |

Newer Directors (0 to 5 years) - 4

Medium Tenured Directors (6 to 12 years) - 3

Longer-Tenured Directors (over 12 years) - 1 |

|

|

Stockholder Interests are Protected

Seven of the eight director nominees, including our Board chairman, are independent. Our President and CEO is not independent.

An independent board ensures that the directors exercise independent judgment, are willing to question management and are best suited to represent and protect the interests of stockholders. |

Stockholders Benefit from Effective Board Refreshment

The Nominating Committee and the Board strive to achieve a balance of service on the Board through a mix of new members and perspectives and members with longer tenure with institutional knowledge. |

2020 Proxy Statement 13

Table of Contents

Proposal 1: Election of Directors

Specific Qualifications, Skills and Experience of the Board

The Committee believes that certain qualifications, skills and experience should be represented on the Board, as described below, although not every member of the Board must possess all such qualifications, skills and experience to be considered capable of making valuable contributions to the Board.

|

|

Leadership

Our business is complex and evolving rapidly. Individuals who have led companies or operating business units of significant size have proven leadership experience in developing and advancing a vision and making executive-level decisions. |

|

|

Strategy

Our success depends on successful development and execution of our corporate strategy, including successful selection and execution of strategic alliances and acquisitions. |

|

|

Global

We are a global company, with approximately 40% of our revenue coming from the Americas, 40% from Europe and 20% from the Asia-Pacific region. Global experience enhances understanding of the complexities and issues associated with running a global business and the challenges we face. |

|

|

Financial

Our business and financial model is complex and multinational. Individuals with financial expertise are able to identify and understand the issues associated with our business and financial model. |

|

|

Software Industry

We are an enterprise software company. Those with enterprise software experience are better able to understand the risks and opportunities facing our business. |

|

|

Manufacturing

We primarily serve companies in the manufacturing industry. Understanding of this industry enhances understanding of how we can best address the needs of our customers. |

|

|

Marketing

Our business depends on successfully creating awareness of our products and entering new markets. Persons with marketing experience can help us identify ways to do so successfully. |

|

|

Research and Development

Our business depends on the success of our research and development efforts to develop our products and expand our offerings. Experience in this area enhances understanding of the challenges we face and best practices. |

14 www.ptc.com

Table of Contents

Proposal 1: Election of Directors

Director Nominees

Independence of Our Directors. Our Board of Directors has determined that all the director nominees, other than Mr. Heppelmann, our President and Chief Executive Officer, are independent under applicable Nasdaq rules. None of the independent directors, to our knowledge, has any business, financial, family or other type of relationship with PTC or its management that would impact the director’s independence.

|

Janice Chaffin |

Director since: 2013 |

Age: 65 |

|

Board Committees: Corporate Governance (Chair), Nominating (Chair), Compensation, Strategic Partnerships Oversight |

|

Other Public Company Boards:

Synopsys, Inc.

Electronics for Imaging Inc.

(2018-2019)

International Game Technology

(2010-2015)

Informatica Corporation

(2001-2008)

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Marketing Marketing |

Ms. Chaffin served as Group President, Consumer Business Unit of Symantec, a global leader in providing cybersecurity solutions, from April 2007 until her retirement in March 2013 and as Chief Marketing Officer of Symantec from 2003 to 2007. Before that, she spent over twenty years at Hewlett-Packard Company, in management and marketing leadership positions.

Ms. Chaffin brings to the Board significant leadership experience with large global technology companies. Ms. Chaffin’s skills include financial and accounting expertise as a result of her positions at Symantec Corporation and Hewlett-Packard Company and her service on the Audit Committees of Synopsys, International Game Technology and Informatica. In 2015, Ms. Chaffin completed the requirements to become a NACD Fellow, the highest level of credentialing for corporate directors and corporate governance professionals by the National Association of Corporate Directors. To become a NACD Fellow, Ms. Chaffin demonstrated knowledge of the leading trends and practices that define exemplary corporate governance today and committed to developing professional insights through a comprehensive program of ongoing study.

Ms. Chaffin holds a Bachelor of Arts from the University of California, San Diego and a Master of Business Administration from the University of California, Los Angeles. |

2020 Proxy Statement 15

Table of Contents

Proposal 1: Election of Directors

|

Phillip Fernandez |

Director since: 2016 |

Age: 58 |

|

Board Committees: Audit |

|

Other Public Company Boards:

Yext, Inc.

Marketo, Inc.

(January 2006 – August 2016)

Tibco Software, Inc.

(June 2014 – December 2014)

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Marketing Marketing

Research and Development Research and Development |

Mr. Fernandez was a Venture Partner at Shasta Ventures, a venture capital firm, from January 2017 until January 2018. Mr. Fernandez was a founder of Marketo, Inc., a global digital marketing software company, and served as its Chief Executive Officer and President from January 2006 to August 2016. Before that, he was with Epiphany, Inc., a marketing software company acquired by SSA Global Technologies, Inc., from 1999 to 2005, including as President and Chief Operating Officer from July 2003 until September 2005.

Mr. Fernandez has demonstrated leadership experience as a result of his service at Marketo, Inc. and at Epiphany, Inc. He has also gained significant marketing experience through his role at Marketo, Inc. Mr. Fernandez is also a well-known writer and speaker on topics related to digital marketing, marketing automation, big data, and entrepreneurialism, and is the author of Revenue Disruption: Game-Changing Sales and Marketing Strategies to Accelerate Growth (Wiley, 2012).

Mr. Fernandez holds a Bachelor of Arts in History from Stanford University. |

16 www.ptc.com

Table of Contents

Proposal 1: Election of Directors

|

James Heppelmann |

Director since: 2008 |

Age: 55 |

|

Board Committees: None |

|

Other Public Company Boards:

Sensata Technologies Holding plc

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Manufacturing Manufacturing

Marketing Marketing

Research and Development Research and Development |

Mr. Heppelmann has served as the President and Chief Executive Officer of PTC since October 2010. He was President and Chief Operating Officer of PTC from March 2009 to September 2010, Executive Vice President and Chief Product Officer of PTC from February 2003 to February 2009, and Executive Vice President, Software Solutions and Chief Technology Officer of PTC from June 2001 to January 2003. Mr. Heppelmann joined PTC in 1998.

Mr. Heppelmann brings to the Board significant leadership experience in the enterprise software industry as a result of his positions at PTC Inc. and his position at Windchill Technology, Inc., where he was the founder and President before its acquisition by PTC. Through his tenure at PTC, he has developed extensive knowledge of PTC’s history, technologies and the markets in which PTC operates. Additionally, Mr. Heppelmann has financial and marketing expertise as a result of his positions as Chief Executive Officer, Chief Operating Officer and Chief Product Officer of PTC. His skills also include technology and research and development expertise as a result of his positions as Chief Product Officer and Chief Technology Officer, and at Windchill Technology, Inc.

Mr. Heppelmann holds a bachelor’s degree in Mechanical Engineering from the University of Minnesota.

|

2020 Proxy Statement 17

Table of Contents

Proposal 1: Election of Directors

|

Klaus Hoehn |

Director since: 2015 |

Age: 68 |

|

Board Committees: Corporate Governance, Nominating |

|

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Manufacturing Manufacturing

Research and Development Research and Development |

Mr. Hoehn serves as Senior Advisor, Innovation and Technology to the Office of the Chairman, Deere & Company, an agricultural, construction, commercial and consumer equipment manufacturer. Before that, he served as the Vice President, Advanced Technology and Engineering, at Deere & Company from January 2006 through November 2018. He joined Deere & Company in 1992 and has served in several engineering and product development roles at the company.

As a result of his positions at Deere & Company, Mr. Hoehn has extensive knowledge of manufacturing and the markets in which PTC operates, as well as extensive knowledge of PTC software, including as a user of PTC software. Mr. Hoehn’s experience at Deere, a customer of PTC, makes him uniquely qualified to serve as the “voice of the customer” on the Board. His skills also include technology and research and development expertise as a result of his positions at Deere, including his role that included corporate-level responsibility for directing advanced technology development and engineering services that support worldwide agricultural, construction, and commercial and consumer equipment design and manufacturing.

Mr. Hoehn holds a bachelor’s degree, a master’s degree, and a Doctorate degree in Mechanical and Agricultural Engineering from Rostock University in Germany. |

18 www.ptc.com

Table of Contents

Proposal 1: Election of Directors

|

Paul Lacy |

Director since: 2009 |

Age: 72 |

|

Board Committees: Audit (Chair), Compensation, Corporate Governance, Nominating |

|

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Manufacturing Manufacturing

|

Mr. Lacy served as President of Kronos Incorporated, a global enterprise software company, from May 2006 until his retirement in June 2008. He served as President, Chief Financial and Administrative Officer, of Kronos from November 2005 through April 2006, and as Executive Vice President and Chief Financial and Administrative Officer of Kronos from April 2002 through October 2005.

Mr. Lacy’s skills include extensive financial accounting and manufacturing expertise as a result of his positions at Kronos. During his tenure at Kronos, Kronos grew from a $26 million hardware company into a $662 million public global enterprise software company. Mr. Lacy also gained significant leadership and public company software experience as a result of his positions at Kronos Incorporated.

Mr. Lacy holds a Juris Doctor from Boston College Law School and Bachelor of Science in Accounting from Boston College.

|

2020 Proxy Statement 19

Table of Contents

Proposal 1: Election of Directors

|

Corinna Lathan |

Director since: 2017 |

Age: 52 |

|

Board Committees: Audit |

|

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Research and Development Research and Development

|

Dr. Corinna Lathan has been the Chief Executive Officer, Co-Founder and Chair of the Board of AnthroTronix, Inc., a biomedical engineering research and development company that creates diverse products in robotics, digital health, wearable technology, and augmented reality, since July 1999. Before that, Dr. Lathan was an Associate Professor of Biomedical Engineering at The Catholic University of America and an Adjunct Associate Professor of Aerospace Engineering at the University of Maryland, College Park.

Dr. Lathan has extensive experience as a leader and technology innovator as a result of her work at AnthroTronix and brings to the Board deep expertise in human-technology interfaces for robotics and mobile technology platforms. Her significant experience and expertise in augmented reality and other technologies enable her to help us advance our Internet of Things strategy.

Dr. Lathan holds a Bachelor of Arts degree in Biopsychology and Mathematics from Swarthmore College, and an S.M. in Aeronautics and Astronautics and Ph.D. in Neuroscience from MIT. |

20 www.ptc.com

Table of Contents

Proposal 1: Election of Directors

|

Blake Moret |

Director since: 2018 |

Age: 57 |

|

Board Committees: Corporate Governance, Strategic Partnerships Oversight |

|

Other Public Company Boards:

Rockwell Automation, Inc.

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Manufacturing Manufacturing

Marketing Marketing |

Mr. Moret has been the President and Chief Executive Officer of Rockwell Automation, Inc., a company focused on industrial automation and information, since July 2016, and Chairman of the Board since January 2018. He served as Senior Vice President, Control Products and Solutions, at Rockwell Automation from April 2011 until July 2016. Mr. Moret has been with Rockwell Automation for over 32 years, during which he served in various roles, including leadership roles in marketing, solutions, services and product groups.

Mr. Moret was appointed to the Board in connection with the formation of the strategic alliance between PTC and Rockwell Automation and Rockwell Automation’s purchase of $1 Billion of PTC stock in July 2018. In connection with those transactions, we agreed to appoint to the Board and to the Corporate Governance Committee an individual proposed by Rockwell Automation and reasonably acceptable to us. Rockwell Automation designated Mr. Moret as the initial designee. Although Mr. Moret met the objective Nasdaq independence standard when he joined the Board, we initially designated him as not independent due to the new strategic alliance and uncertainty about the types of issues that could potentially arise, particularly in the early days of the relationship. The parties now have over one year of experience operating under the strategic alliance, with transactions between the parties not constituting a significant portion of either PTC’s or Rockwell Automation’s annual revenue for 2019.

With the benefit of operating experience over the past year, in connection with Mr. Moret’s nomination for re-election in 2020, we have concluded that he qualifies as an independent director under the applicable Nasdaq rules. In reaching this conclusion, we considered the fact that Mr. Moret continued to meet the objective independence standard under the applicable Nasdaq rules, that Rockwell Automation’s interests are aligned with those of stockholders generally, that transactions between the parties under the strategic alliance are not expected to be a material percentage of annual revenue in 2020, that Mr. Moret does not have any other relationship with us that would compromise his independence, and that, as with all directors, if a matter arises that poses a potential conflict of interest, Mr. Moret would be excluded from consideration of that particular matter.

Mr. Moret brings significant leadership experience in factory automation and the factory automation market to the Board as a result of his experience at Rockwell Automation, an area that is a significant focus of our digital transformation for industrial enterprises strategy.

Mr. Moret holds a bachelor’s degree in Mechanical Engineering from the Georgia Institute of Technology. |

2020 Proxy Statement 21

Table of Contents

Proposal 1: Election of Directors

|

Robert Schechter Chairman of the Board |

Director since: 2009 |

Age: 71 |

|

Board Committees: Audit, Compensation, Strategic Partnerships Oversight |

|

Other Public Company Boards:

Mimecast Limited

Telaria, Inc.

EXA Corporation

(2012 – 2017)

Unica Corporation

(2005 - 2010)

Soapstone Networks, Inc.

(2003 - 2009)

Skills and Attributes

Leadership Leadership

Strategy Strategy

Global Global

Financial Financial

Software Industry Software Industry

Manufacturing Manufacturing

Marketing Marketing

Research and Development Research and Development |

Mr. Schechter served as the Chief Executive Officer of NMS Communications Corporation, a global provider of hardware and software solutions for the communications industry from 1995 until his retirement in 2008.

Mr. Schechter brings to the board significant financial and accounting expertise as a result of his positions at NMS Communications Corporation and at Lotus Development Corporation, where he was the Chief Financial Officer. He was also a partner at Coopers & Lybrand LLP, an independent audit firm, and served as Chairman of its North East Region High Tech Practice. Through his position at NMS Communications Corporation, he gained relevant knowledge of the manufacturing market and process. He also acquired marketing experience as well as technology and research and development expertise as a result of his position as Senior Vice President at Lotus Development Corporation, where he was responsible for all sales, marketing, customer service and product development outside North America.

Mr. Schechter holds a Bachelor of Science from Rensselaer Polytechnic Institute and a Master of Business Administration from the Wharton School of the University of Pennsylvania. |

22

www.ptc.com

Table of Contents

Corporate Governance

Board Leadership Structure

Our Board is led by an independent Chairman, Mr. Schechter. We believe this Board leadership structure serves the company and our stockholders well by providing independent leadership of the Board. If we were to decide that combining the Chairman and CEO positions would better serve the company and our stockholders, our policy is to have a Lead Independent Director.

Board and Committee Meetings; Attendance at the Annual Meeting

The Board and committees hold regularly scheduled meetings over the course of the year and hold additional meetings as necessary. The Board met four times in 2019. No director attended less than 75% of meetings of the Board and the committees on which he or she served in 2019.

We expect that each director will attend the Annual Meeting of Stockholders each year. All directors attended the 2019 Annual Meeting of Stockholders.

Board Evaluation Process

The Board conducts an annual evaluation process, which is facilitated by a third-party once every three years.

|

Years 1 and 2

Self-Evaluation

The Chairman of the Board meets with each director individually to discuss the Board’s performance and the Chair of the Corporate Governance Committee meets with each director individually to assess the Chairman of the Board’s performance.

The results of the assessment are discussed with the full Board. |

|

Year 3

Externally Facilitated Evaluation

The external facilitator works with the Board to develop a list of discussion topics and then meets with each of the directors individually to discuss these topics and the Board’s performance.

The results of the assessment are discussed with the full Board. |

2020 Proxy Statement 23

Table of Contents

Corporate Governance

Board Refreshment Process

The Nominating Committee is responsible for identifying and recommending to the Board candidates for Board membership. The Nominating Committee considers the Board’s composition, skills and attributes to determine whether they are aligned with our long-term strategy. The Nominating Committee evaluates candidates against the standards and qualifications set forth in our Corporate Governance Guidelines as well as other relevant factors, including the candidate’s potential contributions to the Board.

Our typical search process involves the steps described below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assess Board’s Current Skills and Attributes |

|

Identify Skills or Attributes that are needed or may be needed in the future |

|

Develop Candidate Profile |

|

Identify and Retain Search Firm to Lead the Process |

|

Screen Candidates |

|

Chairman of the Board, CEO, Chair of Nominating Committee and other directors meet with candidates |

|

Decision and Nomination |

Board Risk Oversight

The Board and the relevant committees review with PTC’s management the risk management practices for which they have oversight responsibility. Since overseeing risk is an ongoing process and inherent in PTC’s strategic decisions, the Board and the relevant committees do not view risk in isolation but discuss risk throughout the year in relation to ongoing operations and proposed actions and initiatives.

| Board of Directors |

| Ultimate responsibility for risk management oversight and oversees risk management of risks not addressed by a committee. |

|

Audit

●Financial Condition and Debt

●Accounting and Financial Reporting

●Cybersecurity and IT Programs

●Compliance Programs

●Taxes

●Related Party Transactions |

|

Compensation

Overall Compensation Policies, Programs and Practices |

|

Corporate Governance

●Corporate Governance Policies

●CEO Succession Planning

●Director Compensation |

|

Nominating

●Composition of the Board

●Director Evaluation and Nominations |

|

Strategic Partnerships Oversight

Implementation and Operation of Significant Strategic Relationships |

24 www.ptc.com

Table of Contents

Corporate Governance

The Committees of the Board

The Board has five standing committees: Audit, Compensation, Corporate Governance, Nominating and the Strategic Partnerships Oversight Committee. Each of the committees acts under a written charter, all of which are available on the Investor Relations page of our website at www.ptc.com. Mr. Heppelmann, our CEO, does not serve on any committee.

| 2019 Director |

|

Audit |

|

Compensation |

|

Corporate

Governance |

|

Nominating |

|

Strategic

Partnerships |

| Janice Chaffin, Independent |

|

|

|

✓ |

|

C |

|

C |

|

✓ |

| Phillip Fernandez, Independent |

|

✓ |

|

|

|

|

|

|

|

|

|

Donald Grierson, Independent(1) |

|

|

|

C |

|

✓ |

|

|

|

|

|

Klaus Hoehn, Independent |

|

|

|

|

|

✓ |

|

✓ |

|

|

|

Paul Lacy, Independent

|

|

C |

|

✓ |

|

✓ |

|

✓ |

|

|

|

Corinna Lathan, Independent |

|

✓ |

|

|

|

|

|

|

|

|

|

Blake Moret, Independent |

|

|

|

|

|

✓ |

|

|

|

✓ |

|

Robert Schechter, Independent  |

|

✓ |

|

✓ |

|

|

|

|

|

C |

| Total Meetings in 2019 |

|

8 |

|

5 |

|

4 |

|

—(2) |

|

3 |

| C Chair |

✓ Member |

Audit Committee Financial Expert Audit Committee Financial Expert |

| (1) |

Mr. Grierson will retire from the Board effective as of the end of his current term that ends on the date of the 2020 Annual Meeting of Stockholders. |

| (2) |

The Nominating Committee was formed in February 2019. It is expected that the Committee will hold one regular meeting a year in November, as it did in November 2019. The Committee will meet more often as necessary. |

2020 Proxy Statement 25

Table of Contents

Corporate Governance

|

Audit Committee |

|

|

Committee Chair:

Paul Lacy |

Committee Members:

Phillip Fernandez

Corinna Lathan

Robert Schechter |

|

Responsibilities

●Assists our Board in fulfilling its oversight responsibilities for accounting and financial reporting compliance and oversees our compliance programs.

●Reviews the financial information provided to stockholders and others, PTC’s accounting policies, disclosure controls and procedures, internal accounting and financial controls, and the audit process.

●Meets with management and with our independent auditor to discuss our financial reporting policies and procedures, our internal control over financial reporting, the results of the independent auditor’s examinations, PTC’s critical accounting policies and the overall quality of PTC’s financial reporting, and reports on such matters to the Board.

●Meets with the independent auditor, with and without PTC management present.

●Appoints (and, if appropriate, replaces), evaluates, and establishes the compensation of, the independent auditor.

●Reviews the independent auditor’s performance in conducting the annual financial statement audit and the audit of our internal control over financial reporting, assesses independence of the auditor, and reviews the auditor’s fees.

●Reviews and pre-approves audit and non-audit related services that may be performed by the independent auditor.

Independence and Financial Expertise

●All committee members are “independent directors” under both SEC rules and the Nasdaq Stock Market listing requirements. ●No member has ever been an employee of PTC or any of its subsidiaries. ●The Board of Directors has determined that Mr. Lacy and Mr. Schechter qualify as Audit Committee Financial Experts, as defined by the SEC.

|

26

www.ptc.com

Table of Contents

Corporate Governance

|

Compensation Committee |

|

|

Committee Chair:

Donald Grierson |

Committee Members:

Janice Chaffin

Paul Lacy

Robert Schechter |

|

Responsibilities

●Establishes the compensation levels for our executive officers.

●Oversees our employee compensation programs, including the corporate bonus programs.

●Sets performance goals for compensation of executive officers and evaluates performance against those goals.

●Oversees our equity compensation plans.

May engage compensation consultants or other advisors to provide information and advice to the Committee.

Independence

●All committee members are “independent directors” under The Nasdaq Stock Market listing requirements.

|

|

Corporate Governance Committee |

|

|

Committee Chair:

Janice Chaffin |

Committee Members:

Donald Grierson

Klaus Hoehn

Paul Lacy

Blake Moret |

|

Responsibilities

●Develops and recommends policies and processes regarding corporate governance.

●Reviews and makes recommendations to the Board with respect to director compensation.

●Maintains a CEO succession plan to ensure continuity of leadership for PTC.

Independence

●All Committee members are “independent directors” under The Nasdaq Stock Market listing rules.

|

2020 Proxy Statement 27

Table of Contents

Corporate Governance

|

Nominating Committee |

|

Committee Chair:

Janice Chaffin |

Committee Members:

Klaus Hoehn

Paul Lacy |

|

Responsibilities

●Oversees the director recruitment process, including the assessment of qualifications and skills sought in new directors and the retention of search firms to assist in the identification of potential candidates.

●Reviews the composition of the Board and makes recommendations regarding nominees for election to the Board.

●Makes recommendations to the Board about the composition of committees of the Board.

Independence

●All Committee members are “independent directors” under The Nasdaq Stock Market listing rules.

|

|

Strategic Partnerships Oversight Committee |

|

Committee Chair:

Robert Schechter |

Committee Members:

Janice Chaffin

Blake Moret |

|

Responsibilities

●Oversee the implementation and operation of significant strategic relationships entered into by the company.

Independence

●All Committee members are “independent directors” under The Nasdaq Stock Market listing rules.

|

28

www.ptc.com

Table of Contents

Corporate Governance

Director and Executive Officer Stock Ownership Requirements

Because we believe our directors’ and executives’ interests are more aligned with those of our stockholders if they are stockholders themselves, our directors and executive officers are required to hold a significant amount of our stock. Options and unvested equity are not counted toward the holding requirement.

|

Directors

5x

Annual Board

Cash Retainer |

Chief Executive

Officer

5x

Annual Salary |

Other Executive

Officers

3x

Annual Salary |

|

Our Director Stock Ownership Policy and our Executive Officer Stock Ownership Policy are available on the Investor Relations page of our website at www.ptc.com.

No Hedging or Pledging of PTC Equity

In order to ensure members of the Board of Directors and our executives and employees are aligned with the interests of our stockholders, our Trading in Company Securities Policy prohibits the hedging of PTC stock or equity by directors, executives and employees and transactions in derivative securities whose value is tied to that of PTC stock (including puts, calls and listed options). The Policy also prohibits the pledging of PTC stock or equity by directors, executives and employees and short sales of PTC stock.

Director Election Process and Voting Standard

All directors stand for election each year. Directors are elected by a plurality of votes received. However, we maintain a Majority Voting Policy for uncontested director elections that requires a director who does not receive a majority of the votes cast for his or her proposed election to promptly tender his or her resignation from the Board. The Corporate Governance Committee will consider the resignation and recommend to the Board whether to accept the resignation. The Board will use its best efforts to act on the resignation and publicly disclose its decision and its rationale within 90 days following certification of the election results. The director who tenders his or her resignation may not participate in the decisions of the Corporate Governance Committee or the Board that concern the resignation.

Director Nominations

The Nominating Committee is responsible for identifying and evaluating nominees for director and for recommending to the Board a slate of nominees for election at each Annual Meeting of Stockholders. Candidates may be suggested by directors, management, stockholders or a search firm retained by the Committee. Stockholders that wish to nominate a candidate may do so in accordance with the procedures described in STOCKHOLDER PROPOSALS AND NOMINATIONS. Candidates properly nominated by stockholders will be given the same consideration as other proposed candidates.

2020 Proxy Statement 29

Table of Contents

Corporate Governance

Director Qualifications and Diversity

The Nominating Committee’s mandate is to create and maintain a Board with a diversity of skills and attributes that is aligned with PTC’s current and anticipated future strategic needs. Beyond a few general requirements, the Nominating Committee does not rely on a fixed set of qualifications for director nominees but considers the composition of the Board and the experience and skills each director nominee brings to the Board.

PTC values diversity and believes that diversity among the directors as to personal and professional experiences, opinions, perspectives and backgrounds, as well as diversity with respect to race, ethnicity, gender, age and cultural backgrounds, is desirable. The Committee does not maintain a diversity policy but seeks to achieve diversity through its thoughtful selection of qualified candidates.

Qualifications Required of All Directors

The Nominating Committee considers each candidate’s character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, national and international experience and such other relevant skills and experience as may contribute to the Board’s effectiveness and PTC’s success. In addition, all candidates must be able to dedicate sufficient time and resources for the diligent performance of the duties required of a member of the Board of Directors and must not hold positions or interests that conflict with their responsibilities to PTC. Candidates must also comply with any other minimum qualifications for either individual directors or the Board under applicable laws or regulations. The Committee will also consider whether the candidate is independent of PTC as at least a majority of members of the Board of Directors must qualify as independent in accordance with Nasdaq independence rules.

Communications with the Board

Stockholders may send communications to the Board of Directors at: Board of Directors, PTC Inc., c/o General Counsel, 121 Seaport Boulevard, Boston, Massachusetts 02210.

30

www.ptc.com

Table of Contents

Director Compensation

We pay our non-employee directors a mix of cash and equity compensation. The amounts established for the annual Board and committee cash and equity retainers for the most recent year are shown in the table below. No fees are paid for service on the Strategic Partnerships Oversight Committee. The retainers are the only compensation paid for service as a director; we do not pay meeting fees for attendance at board or committee meetings.

|

|

Annual

Cash

Retainer |

|

Annual

Equity

Retainer |

|

Committee

Chair

Retainer |

|

Committee

Member

Retainer |

|

|

| Chairman of the Board |

|

$ |

125,000 |

|

$ |

300,000 |

|

|

|

|

|

|

|

|

| Other Directors |

|

$ |

60,000 |

|

$ |

250,000 |

|

|

|

|

|

|

|

| Audit Committee |

|

|

|

|

|

|

|

$ |

30,000 |

|

$ |

15,000 |

|

| Compensation Committee |

|

|

|

|

|

|

|

$ |

25,000 |

|

$ |

12,500 |

|

Corporate Governance

Committee |

|

|

|

|

|

|

|

$ |

15,000 |

|

$ |

7,500 |

|

| Nominating Committee |

|

|

|

|

|

|

|

$ |

5,000 |

|

$ |

2,500 |

|

Strategic Partnerships

Oversight Committee |

|

|

|

|

|

|

|

$ |

— |

|

$ |

— |

|

Director Compensation Process and Decisions

The Board establishes the annual compensation for the directors at the meeting of the Board of Directors held directly after the Annual Meeting of Stockholders. In setting such compensation, the Board considers the recommendation of the Corporate Governance Committee. In making its recommendation for 2019, the Corporate Governance Committee considered a competitive assessment of the directors’ compensation with that of our compensation peer group (described in COMPENSATION DISCUSSION AND ANALYSIS) and reviewed each element of compensation to determine whether the compensation is competitive and reasonable for the services provided by the directors. Based on that review, no changes were made to our directors’ compensation for 2019. For 2019 our directors’ compensation was positioned at approximately the 55th percentile of the compensation peer group.

We provide a higher annual retainer for service as the Chairman of the Board given the additional work required by that position, but do not pay a committee chair retainer to the Chairman of the Board for service as the Chair of any committee. We provide different retainers for the Chairs and members of the various committees based on the anticipated level of work required with respect to the position and the committee.

We also believe that providing a majority of our directors’ annual retainer compensation in the form of equity rather than cash serves to further align the interests of our directors with our stockholders as they become stockholders themselves.

2020 Proxy Statement 31

Table of Contents

Director Compensation

2019 Director Compensation

The amounts shown in the Fees Earned or Paid in Cash column of the table are each director’s annual board and committee retainer fees. The amounts shown in the Stock Awards column of the table are the value of the restricted stock unit (RSU) awards made to the directors during the year.

| Name(1) |

|

Fees Earned

or

Paid in Cash

($) |

|

Stock

Awards

($)(2)(3) |

|

Total

($) |

Robert Schechter

Chairman of the Board |

|

$ |

152,500 |

|

$ |

299,927 |

|

$ |

452,427 |

| Janice Chaffin |

|

$ |

87,500 |

|

$ |

249,999 |

|

$ |

337,499 |

| Phillip Fernandez |

|

$ |

75,000 |

|

$ |

249,999 |

|

$ |

324,999 |

| Donald Grierson |

|

$ |

92,500 |

|

$ |

249,999 |

|

$ |

342,499 |

| Klaus Hoehn |

|

$ |

67,500 |

|

$ |

249,999 |

|

$ |

317,499 |

| Paul Lacy |

|

$ |

115,000 |

|

$ |

249,999 |

|

$ |

364,999 |

| Corinna Lathan |

|

$ |

75,000 |

|

$ |

249,999 |

|

$ |

324,999 |

| Blake Moret |

|

$ |

67,500 |

|

$ |

249,999 |

|

$ |

317,499 |

| (1) |

As an employee of PTC, Mr. Heppelmann, our President and Chief Executive Officer, receives no compensation for his service as a director and, accordingly, is not shown in the Director Compensation table. |

| (2) |

Grant date fair value of restricted stock units granted on March 6, 2019, calculated by multiplying the number of RSUs granted by the closing price of our common stock on the NASDAQ Stock Market on the grant date, $89.96 per share. |

| (3) |

The number of outstanding RSUs held by each director as of September 30, 2019 is shown in the table below. No director held options. |

| |

Name |

|

Restricted

Stock Units |

|

Robert Schechter |

|

3,334 |

|

Janice Chaffin |

|

2,779 |

|

Phillip Fernandez |

|

2,779 |

|

Donald Grierson |

|

2,779 |

|

Klaus Hoehn |

|

2,779 |

|

Paul Lacy |

|

2,779 |

|

Corinna Lathan |

|

2,779 |

|

Blake Moret |

|

4,711 |

32 www.ptc.com

Table of Contents

Our Executive Officers

|

|

|

|

| |

James Heppelmann |

|

| |

|

|

| |

Information about Jim Heppelmann is provided in “Director Nominees” above. |

| |

|

|

|

|

|

|

| |

Kristian Talvitie |

Age 49 |

| |

|

|

| |

Executive Vice President, Chief Financial Officer |

| |

|

|

|

Kristian became our Chief Financial Officer in May 2019. Before that, Kristian was the Chief Financial Officer of Syncsort Incorporated, a private software company specializing in Big Data, high speed sorting products and data integration software and services from October 2018 through May 2019. He served as Chief Financial Officer of Sovos Compliance, LLC, a private SaaS software company specializing in tax compliance software from July 2016 to October 2018, and served as the Corporate Vice President, Finance of PTC from July 2013 to July 2016 and as the Senior Vice President, Financial Planning and Analysis and Investor Relations of PTC from November 2010 to July 2013. |

|

|

|

|

| |

Kathleen Mitford |

Age 47 |

| |

|

|

| |

Executive Vice President, Products |

| |

|

|

|

Kathleen became our Executive Vice President, Products in February 2018. Kathleen was our Executive Vice President, Products and Market Strategy from October 2017 to February 2018, Executive Vice President, Segments from February 2017 to October 2017, Corporate Vice President, Corporate Strategy from July 2014 to February 2017, and Senior Vice President, Corporate Strategy from October 2011 to July 2014. Before that, she served in various roles in our product, market and corporate strategy groups. Kathleen joined PTC in 2006. |

|

|

|

|

| |

Aaron Von Staats |

Age 54 |

| |

|

|

| |

Executive Vice President, General Counsel and Secretary |

| |

|

|

|

Aaron has served as our General Counsel and Secretary since 2003. Before that, he served in other roles in the company’s Legal group. Aaron joined PTC in 1997. |

2020 Proxy Statement 33

Table of Contents

| |

Proposal 2 |

|

| |

|

|

Advisory Vote on the Compensation of our Named Executive Officers |

This advisory vote on the compensation of our Chief Executive Officer and our other executive officers and former executive officers named in the Summary Compensation Table (our “named executive officers”) gives stockholders the opportunity to express their views on our named executive officers’ compensation. This “say-on-pay” vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers. Additional information about their compensation is discussed in COMPENSATION DISCUSSION AND ANALYSIS and in EXECUTIVE COMPENSATION.

| ✓ |

The Board of Directors recommends that you vote FOR the approval of the compensation of our named executive officers as disclosed in COMPENSATION DISCUSSION AND ANALYSIS and the tables and related disclosures contained in EXECUTIVE COMPENSATION. |

Summary of Our Compensation Practices

Our compensation programs are designed to pay for performance. A significant portion of the compensation of our named executive officers is comprised of performance-based pay. For 2019, 51% of our CEO’s target compensation was performance-based and 49% of our other named executive officers’ target compensation was performance-based.

Our performance-based pay is tied to strategic short-term and long-term objectives and requires substantial incremental performance over the prior period to be earned. For example, although our business performed well overall for the year and our executives earned 97.60% of their annual incentive, they earned only 59.33% of the target 2019 long-term performance-based equity eligible to be earned in 2019 due to underperformance against our free cash flow target and 0% of the annual upside performance-based RSUs due to underperformance against the aggressive new license and subscription bookings target.

As shown in the pay and performance alignment charts in COMPENSATION DISCUSSION AND ANALYSIS, our executives’ pay and the Company’s performance are strongly aligned.

Our compensation programs are designed to align our executives’ interests with our stockholders’ interests. In addition to weighting our executives’ compensation to performance-based pay, a substantial portion of their compensation is in the form of equity (RSUs) that vests over three years. Moreover, our executives are subject to substantial stock ownership requirements and to clawback of incentive compensation in certain circumstances. These elements serve to align our executives’ interests with those of our stockholders in the long-term value of PTC.

Our compensation programs are developed by independent directors advised by an independent consultant. Our Compensation Committee is comprised only of independent directors and retains an independent compensation consultant to advise it on appropriate compensation practices.

34 www.ptc.com

Table of Contents

Proposal 2: Advisory Vote on the Compensation of our Named Executive Officers

Effect of Say-on-Pay Vote

This say-on-pay vote, which is required by Section 14A of the Securities Exchange Act of 1934, is advisory only and is not binding on the company, the Compensation Committee or our Board of Directors. Although the vote is advisory, we, our Compensation Committee and our Board of Directors value the opinions of our stockholders and will consider the outcome of this vote when establishing future compensation for our executive officers. We hold such a vote each year.

2020 Proxy Statement 35

Table of Contents

Compensation Discussion and Analysis

The Compensation Committee of our Board of Directors determines the compensation for our executives. We discuss below our executive compensation program and the compensation decisions made for 2019 for our Chief Executive Officer, our Chief Financial Officer, and the other executive officers and former executive officers named in the Summary Compensation Table.

Our Compensation Philosophy & Practices

Our executive compensation programs are designed to attract, motivate and retain our executives.

We Pay for Performance

We have a pay-for-performance philosophy for executive compensation and emphasize performance-based compensation tied to strategic initiatives designed to create long-term stockholder value. We believe that equity incentives that vest over multiple years provide an important motivational and retentive aspect to the executives’ overall compensation and align our executives’ interest in the long-term performance of PTC with that of our stockholders. Accordingly, a substantial portion of our executives’ compensation consists of performance-based and service-based RSUs that vest over multiple years.

Our results for 2019 reflect the successful execution of our business transformation to a subscription company with expanding margins. Our Internet of Things business, which we view as a significant growth opportunity, continued to grow as we added new customers and existing customers expanded their implementations over the year.

Long-Term Pay and Performance Alignment

Our performance over the past several years reflects the success and efficacy of aligning executive compensation with our strategic plan. This pay-for-performance approach has resulted in strong pay and performance alignment and will continue to be the centerpiece of our executive compensation programs.

36 www.ptc.com

Table of Contents

Compensation Discussion and Analysis

5-Year CEO Total Realized Pay

vs Relative TSR |

|

5-Year NEO Total Realized Pay

vs Relative TSR |

|

|

|

We are Responsive to Stockholders

We have made significant changes to our executive compensation programs over recent years in response to say-on-pay votes, comments from stockholders and changes to perceived best practices. Those changes included:

| ● |

Adopting separate performance measures for our annual incentive bonus and our performance-based equity; |

| ● |

Introducing multiple performance periods for our long-term performance-based equity; |

| ● |

Adopting a clawback policy; and |

| ● |

Eliminating all single-trigger vesting and tax gross-ups in connection with a change in control. |

As a result, stockholders approved our say-on-pay proposals in 2017 and 2018 at the 90%+ level. However, in 2019, stockholder support for our say-on-pay proposal was significantly lower. After this disappointing result, we embarked on a stockholder engagement initiative to understand our stockholders’ views on our executive pay program and the reasons for their lack of support for our 2018 executive pay program.

2019 Stockholder Engagement on Executive Compensation

We contacted 26 of our largest stockholders representing 46% of our outstanding shares to seek their views on our executive pay programs and any governance or other matters they wished to discuss. Of those, 14 stockholders representing 27% of our outstanding shares spoke with us. Our Chairman of the Board, Robert Schechter, who is also a member of the Compensation Committee, participated in many of these discussions. Other participants from the company included our Vice President of Investor Relations and our General Counsel and/or our Senior Vice President, Corporate & Securities Counsel.

2020 Proxy Statement 37

Table of Contents

Compensation Discussion and Analysis

| What We Heard |

|

2018 CEO Long-Term Performance-Based Equity Grant

Most stockholders we met with focused on the special five-year performance-based equity grant made to our CEO in June 2018 and sought to further understand the rationale for the grant and the structure and value of the grant. Stockholders generally understood what the Compensation Committee was trying to achieve with that incentive grant, why we selected the performance measures for that grant and the rigor of the performance measures. Although a few investors indicated that they supported the grant and had supported our say-on-pay proposal, most commented about the fact that the grant was incremental to our established executive compensation program, the value of the grant, and the structure of the grant, and indicated that the grant was the reason they voted against our say-on-pay proposal in 2019.

Structure of Our Long-Term Performance-Based Equity

Investors asked us to consider using a relative performance measure and adding a second performance measure to our long-term performance-based equity.

Investors also commented on other features of our other long-term performance-based equity incentives, specifically the fact that portions of those awards can be earned for achieving performance milestones in years 1 and 2 of the 3-year performance period, and that amounts not earned in years 1 and 2 can be earned for year 3 (the “catch-up” opportunity). |

| |

|

|

| |

|

| Our Considerations and Actions |

|

2018 CEO Long-Term Performance-Based Equity Grant

We understand our stockholders’ concerns about the off-cycle grant. We do not, as a general practice, grant awards outside of the core elements of the executive compensation program but on occasion have used an additional grant for specific circumstances. In this case, our Compensation Committee felt it was appropriate to fully align our CEO incentives with a new, challenging 5-year financial target announced by the Company in 2018 and to retain him to drive that target.

No supplemental grants were made in 2019 and no similar grants are currently contemplated.

Structure of Long-Term Performance-Based Equity

We reviewed the structure of our long-term performance-based equity and addressed stockholders’ comments by adding a second performance measure to the long-term equity for 2020. As also suggested by stockholders, the second measure we added was a relative performance measure. The measure we chose was relative TSR. This structure enables us to incent a long-term strategic goal while further aligning our executives’ interests with stockholders’ interests.

We have retained the annual earning opportunities in years 1 and 2 of the 3-year performance period under our long-term performance-based equity and the catch-up opportunity. The Compensation Committee believes that retaining this design increases the likelihood that the final year 3 performance measure will be achieved by providing milestones along the way to the year 3 performance-target while also enabling executives to make decisions appropriate for the business that may cause performance to fall short of the year 1 or 2 milestones, but ultimately achieve the year 3 performance measure. The Committee believes that focusing executives on achieving a 3-year performance measure best aligns executives’ interests with those of stockholders and is more likely to create longer-term value for stockholders if the target performance measure is achieved. |

38 www.ptc.com

Table of Contents

Compensation Discussion and Analysis

|

The Committee also considered the fact that the annual earning opportunities and catch-up provision under our long-term performance-based equity existed before 2018 and stockholders had strongly supported our executive compensation programs with votes above the 90% level in those years. The Committee also considered the fact that many of the investors we engaged with in this process indicated that they would have supported our say-on-pay proposal notwithstanding these features but voted against our pay proposal in 2019 due to the incremental five-year grant to our CEO in 2018.