Current Report Filing (8-k)

December 19 2019 - 4:24PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 19, 2019 (December 15, 2019)

MARIZYME, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

000-27237

|

|

82-5464863

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

2950 E. Harmony Rd., Suite 255, Fort Collins, CO 80528

|

|

80528

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(925) 400-3123

|

|

(Registrant’s telephone number, including area code)

|

|

|

|

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging Growth Company [X]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Not applicable.

|

|

|

|

|

Item 1.01 Entry into a Material Definitive Agreement.

On December 15, 2019, Marizyme, Inc. (the “Company”) entered into an asset purchase agreement (the “Agreement”) with Somahlution, LLC, Somahlution, Inc. and Somaceutica, LLC, companies duly organized under the laws of Florida (collectively, “Somah”). Somah is engaged in developing products to prevent ischemic injury to organs and tissues and its products (the “Somah Products”) include DuraGraft, a one-time intraoperative vascular graft treatment for use in vascular and bypass surgeries that maintains endothelial function and structure, and other related properties. Pursuant to the terms of the Agreement, the Company has agreed to purchase (the “Acquisition”) all of the assets of Somah, including all of the intellectual property relating to the Somah Products. Under the Agreement, the Company will not acquire any of the liabilities of Somah. As consideration for the Acquisition, the Company has agreed to issue to Somah’s equity owners (the “Somah Designees”) 10 million restricted shares of Company common stock and five-year warrants to purchase an additional three million restricted shares of Marizyme common stock with an exercise price of $5.00 per share. The Company has also agreed to pay the Somah Designees royalties and issue additional warrants to them based on future sales, or FDA approval, of certain Somah Products. The Somah Designees will receive a liquidation preference on payouts relating to future Company sales of Somah related assets. Somah will also be entitled to appoint two members to the Company’s board of directors. As a condition to the closing of the Acquisition, in addition to satisfactory due diligence by each party to the Agreement, the Company will be required to raise at least $10 million in funding to be used as working capital to develop the Somah Products post-closing. The Agreement may be terminated at any time prior to the closing by mutual consent of the Company and Somah or by February 28, 2020, if the Company has not raised the required capital by that date.

The above discussion is only a partial description of the terms of the Agreement, a copy of which is attached hereto for review, as Exhibit 10.1.

Item 9.01. Financial Statement and Exhibits

(d) Exhibits

The following exhibits are filed herewith:

|

Exhibit

No.

|

|

Description of Exhibit

|

|

10.1

|

|

Asset Purchase Agreement dated December 15, 2019 by and between the Registrant and Somahlution, LLC et al.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, FC Global Realty Incorporated has duly caused this current report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 19, 2019

|

MARIZYME, INC.

|

|

|

|

|

|

|

By:

|

/s/ Nicholas P. DeVito

|

|

|

|

Nicholas P. DeVito

|

|

|

|

Interim Chief Executive Officer

|

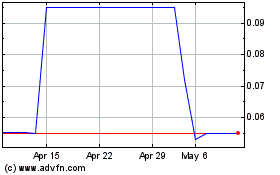

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

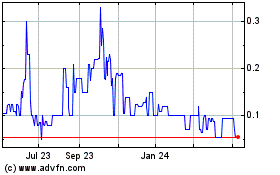

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2023 to Apr 2024