NYSE Ranks Once Again as the Global Leader in Capital Raised

December 13 2019 - 11:30AM

Business Wire

Leader in tech IPOs; continues to drive

innovation

The New York Stock Exchange (NYSE), a wholly-owned subsidiary of

Intercontinental Exchange (NYSE: ICE), ranked first once again as

the global leader in capital raising in 2019 with $111.6 billion in

proceeds raised in IPOs and follow-on offerings, which include some

of the world’s highest-profile new listings.

NYSE Group also maintained its leadership as the leading

exchange group for Exchange Traded Product (ETP) issuers, welcoming

153 ETPs with $7.1 billion in assets under management (AUM) for the

year to date. NYSE Group is home to $3.4 trillion of ETP AUM,

representing the largest ETP marketplace in the world.

“As the global leader in capital raising, the NYSE in 2019

proved once again the importance of our public markets, helping

some of the world’s largest and most disruptive companies raise

capital through IPOs and follow-on offerings, as well as advancing

innovative approaches like Direct Listings,” said Stacey

Cunningham, President, NYSE Group. “We are more committed than ever

to providing ways for companies to access the public markets

earlier in their lifecycles, allowing all investors an opportunity

to share in their performance.”

2019 Highlights

- Capital Raised. Once again, the NYSE ranked as the

global leader in total capital raised, with $111.6 billion in 300

transactions, comprising $28.9 billion raised in 57 IPOs and $82.7

billion in follow-on offerings.

- Largest U.S. IPO. The NYSE was home to the largest U.S.

IPO of the year for the 7th straight year, helping Uber

Technologies, Inc. (NYSE: UBER) raise $8.1 billion.

- Technology Leadership. The exchange raised 68 percent of

all U.S. tech IPO proceeds with $14.6 billion in 18

transactions.

- Market Capitalization. The exchange added $354 billion

in market capitalization to an industry-leading total of $29.0

trillion.

- Direct Listings. The NYSE executed its second-ever

Direct Listing with Slack Technologies, Inc. (NYSE: WORK) and

continued working to evolve the Direct Listings product.

- SPAC Innovation. The NYSE listed one of the

highest-profile SPAC mergers of all time, welcoming Virgin Galactic

(NYSE: SPCE) to the exchange.

For additional details, please see our 2019 highlight video.

“The NYSE extended its tech leadership in 2019, raising the

majority of technology proceeds, and is well-positioned to provide

innovative access to the public markets in 2020 with the evolution

of Direct Listings and the launch of our new pathway for biotech

and other emerging companies to list on the exchange,” said John

Tuttle, Vice Chairman and Chief Commercial Officer, NYSE Group.

“During the year, we continued to win the biggest transactions

while, at the same time, offering new and expanded services to our

listed companies.”

About NYSE Group

NYSE Group is a subsidiary of Intercontinental Exchange

(NYSE:ICE), a leading operator of global exchanges and clearing

houses, and a provider of data and listings services. NYSE Group’s

equity exchanges -- the New York Stock Exchange, NYSE American,

NYSE Arca, NYSE Chicago and NYSE National -- trade more U.S. equity

volume than any other exchange group. The NYSE is the premier

global venue for capital raising, including technology IPOs. NYSE

Arca Options and NYSE Amex Options are leading equity options

exchanges. To learn more, visit www.nyse.com/index.

About Intercontinental Exchange

Intercontinental Exchange (NYSE: ICE) is a Fortune 500 and

Fortune Future 50 company formed in the year 2000 to modernize

markets. ICE serves customers by operating in the exchanges,

clearing houses and information services they rely upon to invest,

trade and manage risk across global financial and commodity

markets. A leader in market data, ICE Data Services serves the

information and connectivity needs across virtually all asset

classes. As the parent company of the New York Stock Exchange, the

company raises more capital than any other exchange in the world,

driving economic growth and transforming markets.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located at

http://www.intercontinentalexchange.com/terms-of-use. Key

Information Documents for certain products covered by the EU

Packaged Retail and Insurance-based Investment Products Regulation

can be accessed on the relevant exchange website under the heading

“Key information Documents (KIDS).”

Safe Harbor Statement under the Private Securities Litigation

Reform Act of 1995 -- Statements in this press release regarding

ICE’s business that are not historical facts are “forward-looking

statements” that involve risks and uncertainties. For a discussion

of additional risks and uncertainties, which could cause actual

results to differ from those contained in the forward-looking

statements, see ICE’s Securities and Exchange Commission (SEC)

filings, including, but not limited to, the risk factors in ICE’s

Annual Report on Form 10-K for the year ended December 31, 2018, as

filed with the SEC on February 7, 2019.

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191213005329/en/

NYSE Media Contact: Farrell Kramer

Farrell.Kramer@nyse.com 212-656-2476

ICE Investor Contact: Warren Gardiner

Warren.Gardiner@theice.com 770-835-0114

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Mar 2024 to Apr 2024

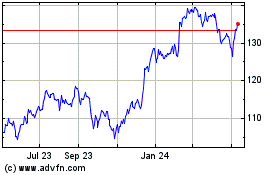

Intercontinental Exchange (NYSE:ICE)

Historical Stock Chart

From Apr 2023 to Apr 2024