Current Report Filing (8-k)

December 06 2019 - 7:26AM

Edgar (US Regulatory)

0000217346

false

0000217346

2019-12-04

2019-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): December 5, 2019

TEXTRON INC.

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

1-5480

|

|

05-0315468

|

|

(State of

Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

40 Westminster Street, Providence, Rhode Island 02903

(Address of principal executive offices)

Registrant’s telephone number, including

area code: (401) 421-2800

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which registered

|

|

Common Stock – par value $0.125

|

|

TXT

|

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instructions A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c)) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

2.05 Costs Associated with Exit or Disposal Activities.

On December 3, 2019,

Textron’s Board of Directors approved a restructuring plan designed to reduce costs and improve overall operating efficiency

through headcount reductions, facility consolidations and other actions. The restructuring plan principally impacts the Textron

Aviation and Industrial segments. In the Textron Aviation segment, we conducted a review of our ongoing workforce requirements,

resulting in the initiation of targeted headcount reductions and other actions to realign our cost structure. In the Industrial

segment, in connection with the strategic review of our Kautex business in the fourth quarter of 2019, we are initiating cost reduction

and other measures to maximize its operating margin and are taking further cost cutting actions in our Textron Specialized Vehicles

business.

We expect to incur

pre-tax charges in the fourth quarter of 2019 in the range of $65 million to $80 million. Severance and related costs are estimated

to be in the range of $40 million to $45 million, with a total headcount reduction of approximately 875 positions. The headcount

reductions include business support and administrative functions within both segments. At Textron Aviation, the headcount reductions

are primarily related to engineering positions, reflecting completion of the Longitude certification activities and reduced requirements

for ongoing development programs. Impairment charges related to facility closures and tooling and other assets across both segments

are estimated to be in the range of $15 million to $20 million. Contract termination and other costs are estimated to be in the

range of $10 million to $15 million, which includes facility closure costs and cost associated with the strategic review of the

Kautex business.

Future cash expenditures

are expected to be in the range of $50 million to $60 million, which will be paid principally in the first half of 2020. We anticipate

that the restructuring plan will be substantially completed by the end of 2019.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

TEXTRON INC.

|

|

|

(Registrant)

|

|

|

|

|

|

By:

|

/s/ Mark S. Bamford

|

|

|

|

Mark S. Bamford

|

|

|

|

Vice President and Corporate Controller

|

|

|

|

|

Date: December 5, 2019

|

|

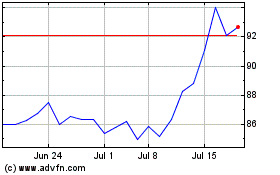

Textron (NYSE:TXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Textron (NYSE:TXT)

Historical Stock Chart

From Apr 2023 to Apr 2024