Current Report Filing (8-k)

December 05 2019 - 9:30AM

Edgar (US Regulatory)

0001320414

false

0001320414

2019-12-04

2019-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

current

report

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date

of Report (Date of earliest event reported): December 5, 2019

SELECT MEDICAL HOLDINGS CORPORATION

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

001-34465

|

|

20-1764048

|

(State or other jurisdiction of

Incorporation)

|

|

(Commission File

Number)

|

|

(I.R.S. Employer

Identification No.)

|

4714 Gettysburg Road, P.O. Box 2034

Mechanicsburg, PA 17055

(Address of principal executive offices) (Zip Code)

(717) 972-1100

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section

12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

SEM

|

New York Stock Exchange (NYSE)

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate by check mark whether either registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if either

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

Item 7.01

|

Regulation FD Disclosure

|

Select Medical Corporation (the

“Company”), a wholly owned subsidiary of Select Medical Holdings Corporation (“Holdings”), intends to

offer $625 million in aggregate principal amount of senior notes due 2026. It is anticipated that the notes will be issued as

additional notes under the same indenture as Select’s existing $550 million aggregate principal amount of 6.250% senior

notes due 2026 that were originally issued on August 1, 2019 and, as such, will form a single series and

trade interchangeably with such previously issued notes. The senior notes will be issued by the Company and will be

unconditionally guaranteed by certain of the Company’s subsidiaries.

The Company intends to use a portion

of the net proceeds of the offering, together with a portion of the proceeds from a proposed incremental term loan, to make

an intercompany loan to Concentra, Inc. (“Concentra”), a joint venture subsidiary of the Company, which will use

the proceeds from such intercompany loan to repay in full all of Concentra’s outstanding term loans, and to pay related fees and expenses. In connection with the intercompany loan, the Company intends to amend

its existing senior secured credit facilities in order to, among other things, establish a new incremental term loan under

the Company’s existing senior secured credit agreement in the aggregate principal amount of $615 million.

The terms of the amendments to its senior

secured credit facilities are under discussion. Accordingly, their definitive terms may vary from those described above.

The senior notes will be issued through

a private placement and resold by initial purchasers to qualified institutional buyers under Rule 144A of the Securities Act of

1933, as amended, and Regulation S. The senior notes will not be registered under the Securities Act and cannot be offered or sold

in the United States absent registration or an applicable exemption from the registration requirements. This does not constitute

an offer to sell or the solicitation of an offer to buy any security in any jurisdiction in which such offer or sale would be unlawful.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all other

information in this Form 8-K consists of forward-looking statements. These forward-looking statements involve a number of risks,

uncertainties and other factors, including the contemplated size of a note offering, possible completion of a note offering, the

prospective impact of a note offering, plans to repay certain indebtedness (including the terms and success of such repayment),

which may cause the actual results to be materially different from those expressed or implied in the forward-looking statements.

Other important factors that could cause the statements made in this Form 8-K or the actual results of operations or financial

condition of Holdings to differ include, without limitation, that the note offering is subject to market conditions and a number

of other conditions and approvals and the final terms may vary substantially as a result of market and other conditions. There

can be no assurance that the note offering will be completed as described herein or at all. Other important factors are discussed

under the caption “Forward-Looking Statements” in Holdings’ Form 10-Q Quarterly Report for the quarter ended

September 30, 2019 and in subsequent filings made prior to or after the date hereof. Holdings does not intend to review or revise

any particular forward-looking statement in light of future events.

Certain Information

Attached as Exhibit 99.1 to the report are

selected portions of information from an offering memorandum that the Company expects to disclose to investors in connection with

the proposed private placement. There can be no assurance that the placement will be completed as described in the offering memorandum

or at all.

The information in this report (including

Exhibit 99.1) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section,

nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

On December 5, 2019, Holdings issued a press

release announcing the Company had commenced an offering of $625 million aggregate principal amount of senior notes due 2026.

A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit Number

|

|

|

Description

|

|

|

|

|

|

|

99.1

|

|

|

Selected portions of information from an offering memorandum that the Company expects to disclose to investors in connection with its proposed private placement.

|

|

99.2

|

|

|

Press Release, dated December 5, 2019, announcing the offering of senior notes due 2026.

|

|

104

|

|

|

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL.

|

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly

authorized.

|

|

SELECT MEDICAL HOLDINGS CORPORATION

|

|

|

|

|

Date: December 5, 2019

|

By:

|

/s/ Michael E. Tarvin

|

|

|

|

Michael E. Tarvin

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

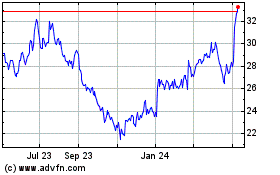

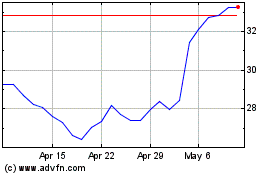

Select Medical (NYSE:SEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Select Medical (NYSE:SEM)

Historical Stock Chart

From Apr 2023 to Apr 2024