|

|

|

OMB

APPROVAL

|

|

|

|

|

|

|

|

|

OMB Number: 32350016

|

|

|

|

Expires: September 30, 2007

|

|

|

|

Estimated burden

|

|

|

UNITED

STATES

|

hours per response ……5.43

|

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2019

Commission

File Number 001-34837

Luokung

Technology Corp.

(Translation

of registrant’s name into English)

B9-8,

Block B, SOHO Phase II, No. 9, Guanghua Road, Chaoyang District, Beijing

People’s Republic of China 100020

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F þ Form

40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6’-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note:

Regulation S-T Rule 101(6)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual

report to security holders.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule l01(b)(7): ____

Note:

Regulation S-T Rule 101(6)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other

document that the registrant foreign private issuer must furnish and make public’ under the laws of the jurisdiction in which

the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules

of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a

press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material

event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Luokung

Technology Corp.

Entry

into Share Subscription Agreement and Joint Venture Cooperation Agreement with Geely Technology Group Co., Ltd.

On

November 13, 2019, Luokung Technology Corp., a corporation organized under the laws of the British Virgin Islands (the “Company”),

entered into a Share Subscription Agreement (the “Agreement”), pursuant to which Geely Technology Group Co., Ltd.

(“Geely”) has subscribed to purchase from the Company 21,794,872 preferred shares (the “Preferred Shares”)

at a purchase price of $1.95 per share (the “Purchase Price”) for an aggregate purchase price of $42,500,000 (the

“Purchase”).

Pursuant to the Agreement,

Geely has the right to require the Company to repurchase all or part of the Preferred Shares in cash at a repurchase price defined

below upon the following events: (1) six (6) months after the closing date; (2) the proposed acquisition of eMapgo Technologies

(Beijing) Co., Ltd. (the “Proposed Acquisition”) is terminated; (3) the Company breaches the Agreement; or (4) within

six (6) months from the closing date provided that the Company has sufficient funds after completing the Proposed Acquisition.

The repurchase price per each Preferred Share shall be the higher of (i) $1.95 per share; or (ii) the US dollars equivalent to

RMB13.7648 per share (the “Repurchase Price”), where the exchange rate shall be the central parity rate between RMB

and USD published by the People’s Bank of China the day before Geely issues the repurchase notice, plus an eight percent

(8%) annual simple interest rate basis calculated from the date such Purchase Price was fully paid until the date of full payment

of the Repurchase Price, which shall be made in a lump sum on the date of the payment of the Repurchase Price, plus all declared

but unpaid dividends with respect to the Preferred Shares. The Company shall pay the corresponding Repurchase Price within sixty

(60) days following twelve (12) months after the Purchased Shares are issued. Geely has the right to convert the Preferred Shares

into the Company’s ordinary shares at the ratio of 1:1 at any time. The repurchase right discussed above will not apply to

the ordinary shares so converted.

Pursuant to the Agreement,

in addition to the Preferred Shares the Company issued to Geely a warrant to purchase 10,897,436 ordinary shares (the “Warrant”).

Each warrant entitles Geely to purchase one ordinary share at an exercise price (the “Warrant Exercise Price”), equal

to one hundred twenty percent (120%) of the Purchase Price of the Preferred Shares (i.e. USD 2.34). After Geely elects to convert

the Preferred Shares into ordinary shares, the Company shall have the right to require Geely to exercise the Warrant in the event

that the VWAP for any trailing 20-day period is in excess of one hundred twenty-five percent (125%) of the Warrant Exercise Price

(i.e. USD 2.925). Upon receipt of the notice of exercise of the Warrant, Geely shall decide whether to exercise the Warrant in

accordance with applicable Chinese governmental regulatory requirements (including but not limited to ODI procedures) and shall

promptly notify the Company in writing of the result of such decision. If Geely decides not to exercise the Warrant, the Warrant

shall become void.

Geely and the Company

also entered into a framework Joint Venture Cooperation Agreement (the “JV Agreement”), which provides that the newly

established joint venture company will engage in a ridesharing map service business.

The Agreement, the

Warrant and the JV Agreement contain customary representations and warranties, indemnification provisions, and conditions precedent

and post-closing conditions and covenants of each party. The description contained herein of the terms of the Agreement and the

JV Agreement does not purport to be complete and is qualified in its entirety by reference to the Agreement, a copy of which will

be attached to the Company’s Form 20-F upon the filing of such Form 20-F.

Entry into Securities Purchase Agreement

and Warrant with Acuitas Capital, LLC

On November 13, 2019,

the Company entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with ACUITAS CAPITAL,

LLC (the “Purchaser”) and a Warrant (the “Warrant”) to purchase the Company’s ordinary shares pursuant

to which the Purchaser subscribed to purchase up to $100,000,000 of units (the “Units”) with up to a $10,000,000 subscription

at each closing, with each Unit consisting of one ordinary share and one warrant, where each whole warrant entitles the holder

to purchase one ordinary share. The Units may be sold at an aggregate price of $10,000,000 at a purchase price per Unit equal to

(i) for the initial Closing, ninety two and five-tenths percent (92.5%) of the volume weighted average price (the “VWAP”)

for the five-trading day period starting on the date on which a Form 6-K is filed announcing this transaction; and (ii) for all

other closings the lesser of (A) ninety two and five-tenths percent (92.5%) of the VWAP for the trailing five-trading day period

prior to the applicable closing date; and (B) ninety two and five-tenths percent (92.5%) of the closing bid price of the Company’s

ordinary shares as of one (1) trading day prior to the applicable closing date. The Securities Purchase Agreement contemplates

closings to be held monthly provided, however, that, subject to all other terms and conditions of the Securities Purchase Agreement

being met, in the event that (i) the VWAP for any trailing three-day period is in excess of 110 percent of the purchase price for

the closing date immediately preceding such time period, or (ii) the cumulative trading volume is fifty-five million dollars ($55,000,000),

then the Company shall have the right, but not the obligation, to accelerate the next closing date upon two (2) business days’

written notice to the Purchasers shall be obligated to comply with such acceleration request.

Each Warrant allows

for the purchase of one ordinary share for every Unit issued to Purchaser pursuant to the Securities Purchase Agreement at an exercise

price equal to one hundred twenty percent (120%) of the closing bid price of the ordinary shares as of one (1) trading day prior

to the applicable closing date (the “Exercise Price”).

The Warrants may be

exercised for cash if the Exercise Price is lower than the closing bid price of the ordinary shares at the time of the exercise.

If the Exercise Price is greater than the closing bid price of the ordinary shares at the time of the exercise, then the Purchaser

may elect to redeem the Warrants pursuant to the following formula:

Net Number = (A x B)/C

For purposes of

the foregoing formula:

A= the total number

of ordinary shares with respect to which the applicable Warrant is then being exercised.

B= Black Scholes Value

(as defined in the applicable Warrant).

C= the closing bid

price of the ordinary shares as of two (2) trading days prior to the time of such exercise (as such closing bid price is defined

in the applicable Warrant).

;provided, however,

that, with respect to each such election by Purchaser, Purchaser cannot elect to redeem Warrants on a “cashless” basis

if (i) Purchaser holds 25% or more of the Purchase Shares received under this Agreement, or (ii) Purchaser has terminated the

Securities Purchase Agreement pursuant to Section 9(a)(ii).

In the event that (i)

the VWAP for any trailing 20-day period is in excess of 125 percent of the Exercise Price and (ii) the average daily trading volume

is greater than three million dollars ($3,000,000), then the Company shall have the right, but not the obligation, to require the

Purchaser to exercise its Warrants pursuant to the terms of the applicable Warrant.

The Purchasers have

weighted average anti-dilution rights.

The Agreement contains

customary representations and warranties, indemnification provisions, and pre- and post-closing conditions and covenants of each

party including without limitation:

|

|

(i)

|

a covenant which restricts the Company from filing a registration statement within 90 days of any

closing held pursuant to the Securities Purchase Agreement;

|

|

|

(ii)

|

a covenant which prevents the Company from issuing any equity securities within 90 days of any

closing held pursuant to the Securities Purchase Agreement;

|

|

|

(iii)

|

payment of any Purchase Price will be transmitted by Purchaser to an escrow agent not to the Company;

|

|

|

(iv)

|

the release of the Purchase Price for any Closing by the Escrow Agent to the Company is subject

to the satisfaction of certain conditions; including without limitation (a) the Company’s ordinary shares cumulative trading

volume exceed $55,000,000 since the execution of the Securities Purchase Agreement or last closing held pursuant to the Securities

Purchase Agreement; (b) the Company shall have received $42,500,000 investment from an existing shareholder and publicly announce

such investment; (c) the Company shall have acquired 51% of the equity interests of EMG; and the closing bid price of the ordinary

shares as of 1 trading day prior to the date of release of the Purchase Price shall not be below $1.00,

|

The Company has the right to

terminate the Securities Purchase Agreement upon 30 days written notice.

The description contained

herein of the terms of the Securities Purchase Agreement and the Warrant, respectively, does not purport to be complete and is

qualified in its entirety by reference to the Securities Purchase Agreement and the Warrant, respectively, attached hereto as Exhibit

99.1 and Exhibit 99.2, respectively, and incorporated by reference herein.

In connection with

the Securities Purchase Agreement, the Company is hereby furnishing under the cover of Form 6-K:

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

Luokung Technology Corp.

|

|

|

|

|

|

Date December 3, 2019

|

By

|

/s/ Xuesong Song

|

|

|

|

Xuesong Song

|

|

|

|

Chief Executive Officer

|

|

|

|

(Principal Executive Officer) and

|

|

|

|

Duly Authorized Officer

|

4

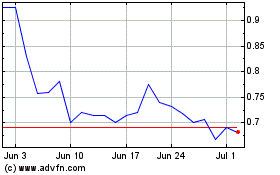

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Luokung Technology (NASDAQ:LKCO)

Historical Stock Chart

From Apr 2023 to Apr 2024