Current Report Filing (8-k)

November 21 2019 - 4:06PM

Edgar (US Regulatory)

0001474432false00014744322019-11-192019-11-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 19, 2019

_____________________________________

Pure Storage, Inc.

(Exact name of Registrant as Specified in Its Charter)

_____________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-37570

|

|

|

27-1069557

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

650 Castro Street, Suite 400

|

|

Mountain View

|

California

|

|

94041

|

|

(Address of Principal Executive Offices)

|

|

|

|

|

(Zip Code)

|

(800) 379-7873

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

________________________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, $0.0001 par value per share

|

|

PSTG

|

|

New York Stock Exchange LLC

|

________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.02. Results of Operations and Financial Condition.

On November 21, 2019, Pure Storage, Inc. (“Pure”) issued a press release and will hold a conference call regarding its financial results for the quarter ended October 31, 2019. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

This information, including the exhibit(s) hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Pure is making reference to non-GAAP financial information in the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release. These non-GAAP financial measures are reported in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 19, 2019, Pure's Board of Directors (the “Board”) approved the appointment of Kevan Krysler, age 48, to become Pure’s Chief Financial Officer, effective on or before December 9, 2019.

Mr. Krysler currently serves as Senior Vice President of Finance, and Chief Accounting Officer of VMware, Inc., a provider of information infrastructure technology and solutions. Prior to joining VMware in August 2013, Mr. Krysler was a partner with KPMG, a multinational accounting organization, where he served both multi-national and emerging software and technology companies.

In connection with his appointment, Pure entered into an agreement with Mr. Krysler describing the terms of his employment (the “Employment Agreement”). Under the Employment Agreement, Mr. Krysler will receive an initial annual base salary of $450,000. In addition, Mr. Krysler will be eligible for an annual performance-based cash bonus, with a target amount equal to 80% of his base salary, based on performance measures set and being satisfied, as determined by the Compensation Committee of the Board. In addition, Mr. Krysler will receive a one-time signing bonus of $1,000,000; provided that if Mr. Krysler’s employment is terminated for any reason other than a layoff within the first 12 months of service, such amount must be repaid at a prorated rate based on months of service prior to his termination date.

Pursuant to the Employment Agreement and our 2015 Equity Incentive Plan, Pure will grant Mr. Krysler a restricted stock unit award to acquire a number of shares of Pure’s Class A common stock equal to $8,000,000 divided by the prior 30-calendar day average of the closing price of Pure’s Class A common stock, ending on the day prior to the date on which the grant is made and rounded down to the nearest whole share (the “RSU Award”), which will vest and settle as to 25% of the RSU Award in December 2020, with the remaining RSU Award to vest in equal quarterly installments over the subsequent 12 quarters, subject to Mr. Krysler’s continuous service. Mr. Krysler will be eligible to participate in Pure’s Change in Control Severance Benefit Plan, which was filed as Exhibit 10.13 to Pure’s Annual Report on Form 10-K (File No. 001-37570) filed with the Securities and Exchange Commission on March 26, 2019 (the “Annual Report”). The foregoing description is qualified in its entirety by reference to the Employment Agreement, which will be filed as an exhibit to Pure’s Quarterly Report on Form 10-Q for the period ending October 31, 2019.

Except for his Employment Agreement, there is no arrangement or understanding between Mr. Krysler and any other person pursuant to which Mr. Krysler was selected as an officer. Mr. Krysler is not a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. In connection with his appointment, Mr. Krysler will execute Pure’s standard form of indemnity agreement for officers, which was filed as Exhibit 10.9 to the Annual Report.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

|

|

|

|

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pure Storage, Inc.

|

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Charles Giancarlo

|

|

|

|

|

|

|

Charles Giancarlo

|

|

|

|

|

|

|

Chief Executive Officer

|

November 21, 2019

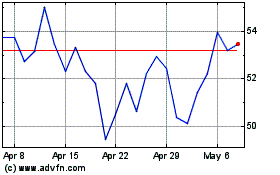

Pure Storage (NYSE:PSTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

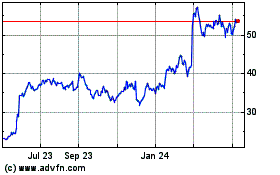

Pure Storage (NYSE:PSTG)

Historical Stock Chart

From Apr 2023 to Apr 2024